Key Insights

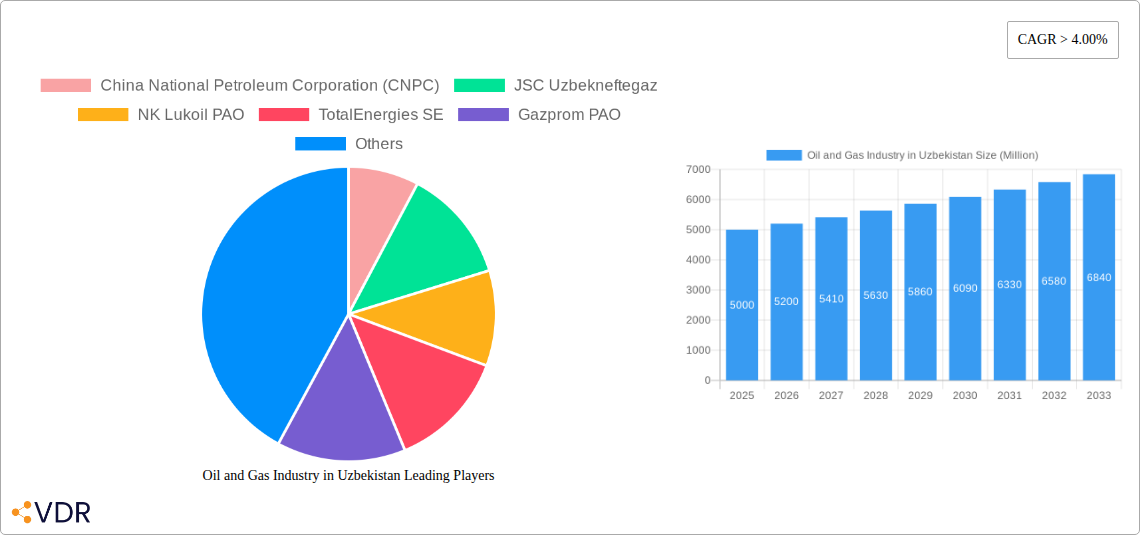

The Uzbekistani oil and gas industry, while relatively smaller compared to global giants, presents a dynamic market with significant growth potential. Driven by increasing domestic energy demand fueled by a growing population and industrialization, the sector is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. Upstream activities, primarily focused on natural gas production, are the backbone of the industry, contributing a significant portion of the overall market value. Midstream operations, encompassing processing, transportation, and storage, are undergoing modernization and expansion to support growing production and refining capacities. The downstream segment, encompassing refining and distribution of petroleum products, is also seeing investment, driven by the need to meet domestic fuel requirements and potentially export refined products in the future. Key players like JSC Uzbekneftegaz, alongside international partners such as Lukoil and TotalEnergies, are instrumental in driving this growth, implementing modern technologies and exploring new reserves to enhance production efficiency and output. Challenges such as aging infrastructure, the need for technological upgrades, and geopolitical factors influence the pace of development. However, the government’s focus on attracting foreign investment and improving the regulatory environment is expected to mitigate some of these restraints and stimulate further growth.

The forecast period of 2025-2033 suggests a substantial increase in the overall market value, with significant contributions anticipated from all three sectors – upstream, midstream, and downstream. While specific market size figures for 2025 are unavailable, estimations based on the provided CAGR and considering the industry's current trajectory indicate substantial growth. The sector's value is likely influenced by fluctuating global oil and gas prices, impacting both investment decisions and profitability. Government initiatives promoting energy security and diversification, along with the exploration of new reserves, will be pivotal in shaping the market’s future trajectory. Competition among existing players and the potential entry of new firms will further contribute to the dynamic landscape of Uzbekistan’s oil and gas sector.

Oil and Gas Industry in Uzbekistan: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Uzbekistan oil and gas industry, offering invaluable insights for industry professionals, investors, and policymakers. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study delves into market dynamics, growth trends, dominant segments, and key players, ultimately projecting the future potential of this dynamic sector. High-traffic keywords like "Uzbekistan oil and gas market," "Uzbekneftegaz," "Lukoil Uzbekistan," "Central Asia energy," and "upstream, midstream, downstream Uzbekistan" are strategically integrated for optimal search engine optimization.

Oil and Gas Industry in Uzbekistan Market Dynamics & Structure

The Uzbekistani oil and gas market, characterized by a complex interplay of state-owned enterprises and international players, presents a unique investment landscape. Market concentration is relatively high, with JSC Uzbekneftegaz dominating the upstream sector. However, significant participation from international oil companies like Lukoil and CNPC introduces competitive dynamics. Technological innovation is hampered by limited access to advanced technologies and expertise, despite efforts to modernize infrastructure.

- Market Concentration: JSC Uzbekneftegaz holds a dominant market share in upstream, estimated at 60% in 2025. Lukoil and CNPC collectively hold approximately 30%.

- Technological Innovation: Slow adoption of advanced drilling and extraction technologies; focus shifting towards improving existing infrastructure.

- Regulatory Framework: Government regulations heavily influence the sector, impacting investment decisions and production levels. Recent policy shifts focus on export diversification and energy security.

- Competitive Product Substitutes: Limited substitutes for natural gas in the domestic market. Renewables are emerging as a long-term alternative, but penetration is currently low (less than 5% in 2025).

- End-User Demographics: Primarily focused on domestic consumption with a growing emphasis on exports to neighboring countries and China.

- M&A Trends: Limited M&A activity in recent years; government oversight and approvals often create hurdles for larger transactions. Forecast suggests xx Million USD in M&A activity during 2025-2033.

Oil and Gas Industry in Uzbekistan Growth Trends & Insights

The Uzbekistani oil and gas market exhibits moderate growth, driven by increasing domestic demand and export opportunities. The historical period (2019-2024) showcased a CAGR of approximately 3%, with fluctuating production levels due to infrastructure limitations and global energy price volatility. The forecast period (2025-2033) anticipates a CAGR of 4%, fueled by infrastructure improvements and increased investment in exploration and production. Consumer behavior reveals a high reliance on natural gas for heating and power generation, with limited penetration of renewable energy sources. Technological disruptions are gradual, with a focus on efficiency gains within existing infrastructure rather than radical transformation. Market size is projected to reach xx Million USD by 2033, up from xx Million USD in 2025. Market penetration of natural gas in the domestic energy mix remains high, exceeding 85% in 2025.

Dominant Regions, Countries, or Segments in Oil and Gas Industry in Uzbekistan

The upstream sector is the most significant driver of growth within the Uzbekistan oil and gas industry. The dominant regions are concentrated in the western and southern parts of the country, known for their proven reserves. While the midstream and downstream sectors are comparatively smaller, they are experiencing gradual expansion fueled by the government’s focus on value addition.

- Upstream Dominance: Driven by significant gas reserves and the presence of major players like Uzbekneftegaz and Lukoil. Government support for exploration and production activities.

- Midstream Growth: Focused on pipeline expansion and infrastructure modernization to facilitate efficient gas transportation. Limited private sector involvement currently.

- Downstream Development: Emphasis on refining capacity enhancements and export diversification through strategic partnerships, as seen in the July 2022 agreement between Sanoat Energetika Guruhi and AD Ports Group.

- Key Drivers: Government investment in infrastructure, foreign direct investment, and increasing domestic demand drive the growth of all segments, although upstream retains dominance due to the size of its reserves and existing infrastructure.

Oil and Gas Industry in Uzbekistan Product Landscape

The product landscape is primarily focused on natural gas production and processing, with a smaller but growing refining segment. Innovation is gradual, focusing on improving extraction techniques and refining efficiency. Recent technological advancements concentrate on enhancing pipeline safety and reducing methane emissions. Unique selling propositions often revolve around the region's strategic location and access to key energy markets.

Key Drivers, Barriers & Challenges in Oil and Gas Industry in Uzbekistan

Key Drivers: Abundant natural gas reserves, government support for exploration and production, and growing regional demand for energy.

Key Challenges: Aging infrastructure, limited access to advanced technologies, bureaucratic hurdles for investment, and price volatility in the global energy market. Supply chain disruptions related to sanctions and geopolitical instability may also affect investment.

Emerging Opportunities in Oil and Gas Industry in Uzbekistan

Opportunities exist in enhancing gas processing and refining capacity, developing petrochemical industries, and increasing exports to regional and international markets. Investment in renewable energy integration alongside natural gas is also an emerging area of interest. The development of gas-based fertilizer production could further stimulate economic growth and job creation.

Growth Accelerators in the Oil and Gas Industry in Uzbekistan Industry

Strategic partnerships with international players, coupled with investments in modernization and expansion of existing infrastructure, will drive long-term growth. A focus on attracting foreign investment and technology transfer will be crucial in unlocking the full potential of the sector. Sustainable practices and environmental considerations are increasing in importance and represent both a challenge and an opportunity for growth.

Key Players Shaping the Oil and Gas Industry in Uzbekistan Market

- China National Petroleum Corporation (CNPC)

- JSC Uzbekneftegaz

- NK Lukoil PAO

- TotalEnergies SE

- Gazprom PAO

Notable Milestones in Oil and Gas Industry in Uzbekistan Sector

- December 2022: Temporary halt of natural gas exports to China by Uzbekneftegaz and Lukoil due to domestic energy shortages. This highlights the vulnerability of the Uzbekistani energy sector to domestic demand fluctuations.

- July 2022: Sanoat Energetika Guruhi's agreement with AD Ports Group signifies a push towards enhancing export capabilities and accessing global markets for refined products. This marks a strategic move to diversify Uzbekistan's energy exports.

In-Depth Oil and Gas Industry in Uzbekistan Market Outlook

The Uzbekistani oil and gas market presents significant growth potential, driven by abundant reserves, strategic location, and government efforts to modernize the sector. Strategic partnerships with international players, focused investments in infrastructure, and a commitment to sustainable practices are essential to realizing this potential. Long-term opportunities exist in developing downstream industries, improving energy efficiency, and exploring innovative solutions to address climate change concerns.

Oil and Gas Industry in Uzbekistan Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Oil and Gas Industry in Uzbekistan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oil and Gas Industry in Uzbekistan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Sector is Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Upstream

- 10.1.2. Midstream

- 10.1.3. Downstream

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 China National Petroleum Corporation (CNPC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 JSC Uzbekneftegaz

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NK Lukoil PAO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TotalEnergies SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gazprom PAO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 China National Petroleum Corporation (CNPC)

List of Figures

- Figure 1: Global Oil and Gas Industry in Uzbekistan Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Uzbekistan Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 3: Uzbekistan Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 27: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 35: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Industry in Uzbekistan?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Oil and Gas Industry in Uzbekistan?

Key companies in the market include China National Petroleum Corporation (CNPC), JSC Uzbekneftegaz, NK Lukoil PAO, TotalEnergies SE, Gazprom PAO.

3. What are the main segments of the Oil and Gas Industry in Uzbekistan?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Upstream Sector is Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

December 2022: Uzbekistan ordered state-run gas producer Uzbekneftegaz and Russia's Lukoil, the second-largest gas producer in the country, to temporarily halt natural gas exports to China as the country deals with a wave of blackouts and disruptions to local gas networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Industry in Uzbekistan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Industry in Uzbekistan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Industry in Uzbekistan?

To stay informed about further developments, trends, and reports in the Oil and Gas Industry in Uzbekistan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence