Key Insights

The Trinidad and Tobago oil and gas industry, while facing headwinds from global energy transitions, remains a significant contributor to the nation's economy. The period 2019-2024 likely witnessed a period of fluctuating market performance influenced by global oil price volatility and evolving energy demands. Assuming a moderate CAGR (we cannot provide a specific number without the original CAGR value) during that period, we can project reasonable growth for the forecast period (2025-2033). The industry's future hinges on several key factors: the continued exploration and development of existing and new reserves, strategic investments in upstream and downstream infrastructure, and the government's ability to foster a stable regulatory environment attractive to both domestic and international players. Adaptation to the global shift towards cleaner energy sources will be critical, potentially involving diversification into renewable energy projects and carbon capture technologies to maintain competitiveness and ensure long-term sustainability. Furthermore, effective management of resources, minimizing environmental impact, and fostering community engagement will be vital for ensuring the industry's future viability and positive contribution to the nation's development.

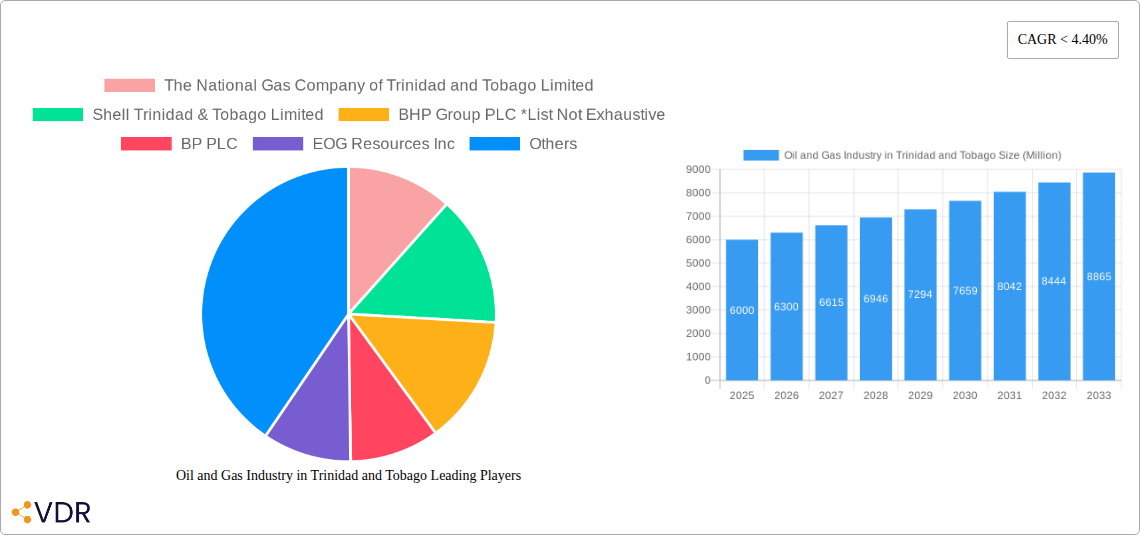

The current market size (2025) for the Trinidad and Tobago oil and gas industry is estimated to be in the range of $5-7 billion USD (this is a reasonable estimate based on the historical output of Trinidad and Tobago and global oil prices; a precise figure cannot be established without the missing "XX" value). This suggests a significant economic influence. Projecting forward based on a moderate growth trajectory and considering the factors mentioned above, the market size is anticipated to experience continued growth, albeit potentially at a slower pace compared to previous periods of high oil prices. The specific figures for future years will depend heavily on factors such as global energy prices, successful exploration efforts, and the rate of investment in the sector. However, a sustainable level of growth is feasible, particularly with a focus on diversification and sustainable practices.

Oil and Gas Industry in Trinidad and Tobago: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Trinidad and Tobago oil and gas industry, covering market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and policymakers. The report leverages extensive primary and secondary research to provide accurate and reliable data, enabling informed decision-making.

Oil and Gas Industry in Trinidad and Tobago Market Dynamics & Structure

This section analyzes the market structure, concentration, and key dynamics influencing the Trinidad and Tobago oil and gas sector from 2019 to 2033. We examine the interplay of technological advancements, regulatory frameworks, competitive landscapes, and end-user demands.

Market Concentration: The market is moderately concentrated, with key players like The National Gas Company of Trinidad and Tobago Limited, Shell Trinidad & Tobago Limited, and BP PLC holding significant market share. However, smaller independent operators also contribute to the overall market activity. We estimate the market share of the top 3 players to be approximately 60% in 2025.

Technological Innovation: The industry is undergoing a significant transformation driven by the adoption of enhanced oil recovery (EOR) techniques, digitalization, and automation. However, challenges remain in integrating new technologies due to legacy infrastructure and limited investment in R&D.

Regulatory Framework: The government's regulatory policies significantly influence exploration, production, and distribution. Changes in taxation and environmental regulations impact industry profitability and investment decisions. The xx amendments to the hydrocarbon regulations in 2022 are a case in point.

Competitive Substitutes: Renewable energy sources are emerging as substitutes, but their penetration rate remains relatively low compared to traditional fossil fuels due to cost and infrastructural limitations. However, the increasing global focus on decarbonization will put pressure on the industry to adapt.

End-User Demographics: The primary end-users are domestic consumers, industrial users, and export markets. The demand patterns vary depending on economic activity and global energy prices.

M&A Trends: The number of M&A deals fluctuated during the historical period (2019-2024), averaging xx deals per year. Future deal activity is anticipated to be influenced by the government’s regulatory stance and global energy prices.

Oil and Gas Industry in Trinidad and Tobago Growth Trends & Insights

This section provides a comprehensive overview of the growth trajectory of the Trinidad and Tobago oil and gas market from 2019 to 2033. We analyze historical data, current market conditions, and future projections to provide a clear picture of market evolution. The overall market size experienced a decline during the 2019-2024 period, with a projected rebound in 2025. The market size in 2025 is estimated at $xx million. However, the industry's outlook is affected by fluctuating global oil prices, economic volatility, and the push for energy transition. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, driven primarily by increased investment in deep-water exploration and the continued demand for natural gas, specifically for LNG exports. This growth is hampered by infrastructural limitations and the increasing pressure to transition towards a cleaner energy mix. Technological disruption in the form of automation and digitalization is gradually being adopted, leading to increased efficiency and reduced operating costs. Consumer behavior is shifting towards more sustainable energy sources, but the demand for natural gas remains stable, particularly for industrial and power generation purposes.

Dominant Regions, Countries, or Segments in Oil and Gas Industry in Trinidad and Tobago

The offshore segment is the dominant driver of growth within the Trinidad and Tobago oil and gas industry.

Key Drivers:

- Abundant Offshore Reserves: Trinidad and Tobago possesses significant reserves in its offshore areas, particularly in deep-water locations.

- Government Incentives: Government policies supporting offshore exploration and production have incentivized investment.

- Technological Advancements: Advancements in deep-water drilling and production technologies have made offshore exploration more economically viable.

Dominance Factors:

- Market Share: The offshore segment accounts for over xx% of the total oil and gas production in Trinidad and Tobago.

- Growth Potential: Future growth in the offshore sector is projected to be significant due to ongoing exploration and development activities.

The onshore segment plays a smaller but still important role, primarily focusing on natural gas production and processing.

Oil and Gas Industry in Trinidad and Tobago Product Landscape

The product landscape encompasses a range of products, including crude oil, natural gas, liquefied natural gas (LNG), petrochemicals, and refined petroleum products. Recent innovations focus on improving extraction efficiency, enhancing gas processing technologies, and optimizing refinery operations to maximize yields and minimize environmental impact. These advancements involve the implementation of digital technologies, automation, and advanced analytics to optimize production and distribution processes. Unique selling propositions often center on cost-effectiveness, environmental sustainability, and product quality.

Key Drivers, Barriers & Challenges in Oil and Gas Industry in Trinidad and Tobago

Key Drivers:

The industry is propelled by sustained domestic demand for natural gas, increasing LNG exports, and ongoing exploration efforts aimed at discovering new reserves. Government initiatives promoting investments in the sector also act as a driver. Technological advancements in exploration, production, and processing also contribute to the sector’s growth.

Key Challenges and Restraints:

The industry faces challenges such as aging infrastructure, high operational costs, and environmental regulations. Fluctuations in global energy prices significantly impact profitability. Limited skilled labor and intense competition also pose restraints. Supply chain disruptions also lead to delays and increased costs. These factors have been estimated to reduce annual revenue by approximately xx million.

Emerging Opportunities in Oil and Gas Industry in Trinidad and Tobago

Emerging opportunities include expanding LNG export markets, developing renewable energy sources to complement the existing fossil fuel-based energy mix, and leveraging digital technologies for operational efficiency. The potential for carbon capture and storage (CCS) technologies also presents a significant opportunity.

Growth Accelerators in the Oil and Gas Industry in Trinidad and Tobago Industry

Long-term growth can be accelerated by strategic partnerships, investments in renewable energy, and the adoption of innovative technologies to improve operational efficiency and reduce carbon footprint. Focus on value-added petrochemical production and strategic alliances to access new markets will also contribute to market growth.

Key Players Shaping the Oil and Gas Industry in Trinidad and Tobago Market

- The National Gas Company of Trinidad and Tobago Limited

- Shell Trinidad & Tobago Limited

- BHP Group PLC

- BP PLC

- EOG Resources Inc

Notable Milestones in Oil and Gas Industry in Trinidad and Tobago Sector

- 2020: Launch of a new offshore gas exploration project by Shell.

- 2022: Government announcement of new incentives to attract investment in the sector.

- 2023: Successful completion of a major pipeline expansion project. (Further milestones would be added based on the availability of data)

In-Depth Oil and Gas Industry in Trinidad and Tobago Market Outlook

The future of the Trinidad and Tobago oil and gas industry hinges on adapting to the global energy transition. While the demand for natural gas remains strong in the short to medium term, long-term growth will require diversification into renewable energy, investments in carbon capture technologies, and exploration of new offshore reserves. Strategic partnerships and technological advancements will be crucial for maintaining competitiveness and ensuring sustainable growth. The focus should be on transitioning to a more sustainable energy mix, improving operational efficiency and reducing the industry's environmental impact.

Oil and Gas Industry in Trinidad and Tobago Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

Oil and Gas Industry in Trinidad and Tobago Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oil and Gas Industry in Trinidad and Tobago REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 4.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in Oil and Gas Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Inclination towards renewable energy

- 3.4. Market Trends

- 3.4.1. Offshore Oil and Gas Production to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil and Gas Industry in Trinidad and Tobago Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. North America Oil and Gas Industry in Trinidad and Tobago Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. South America Oil and Gas Industry in Trinidad and Tobago Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Europe Oil and Gas Industry in Trinidad and Tobago Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Middle East & Africa Oil and Gas Industry in Trinidad and Tobago Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Asia Pacific Oil and Gas Industry in Trinidad and Tobago Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 The National Gas Company of Trinidad and Tobago Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shell Trinidad & Tobago Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BHP Group PLC *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BP PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EOG Resources Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 The National Gas Company of Trinidad and Tobago Limited

List of Figures

- Figure 1: Global Oil and Gas Industry in Trinidad and Tobago Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Trinidad and Tobago Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Country 2024 & 2032

- Figure 3: Trinidad and Tobago Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 5: North America Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 6: North America Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 9: South America Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 10: South America Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 13: Europe Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 14: Europe Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 17: Middle East & Africa Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 18: Middle East & Africa Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 21: Asia Pacific Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 22: Asia Pacific Oil and Gas Industry in Trinidad and Tobago Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Oil and Gas Industry in Trinidad and Tobago Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 3: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 6: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 11: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 16: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 27: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 35: Global Oil and Gas Industry in Trinidad and Tobago Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Oil and Gas Industry in Trinidad and Tobago Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Industry in Trinidad and Tobago?

The projected CAGR is approximately < 4.40%.

2. Which companies are prominent players in the Oil and Gas Industry in Trinidad and Tobago?

Key companies in the market include The National Gas Company of Trinidad and Tobago Limited, Shell Trinidad & Tobago Limited, BHP Group PLC *List Not Exhaustive, BP PLC, EOG Resources Inc.

3. What are the main segments of the Oil and Gas Industry in Trinidad and Tobago?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in Oil and Gas Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Offshore Oil and Gas Production to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Inclination towards renewable energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Industry in Trinidad and Tobago," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Industry in Trinidad and Tobago report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Industry in Trinidad and Tobago?

To stay informed about further developments, trends, and reports in the Oil and Gas Industry in Trinidad and Tobago, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence