Key Insights

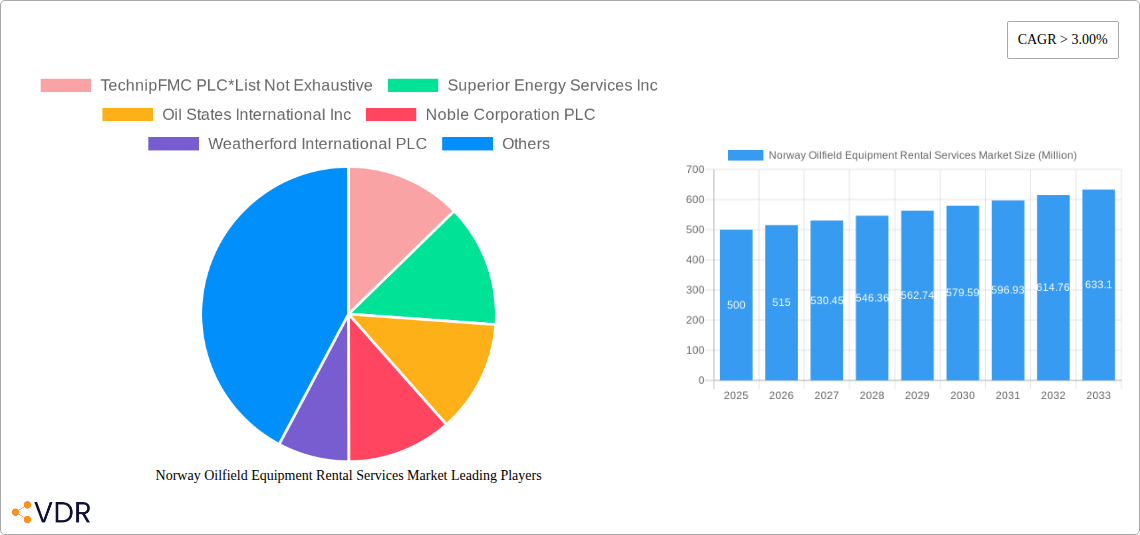

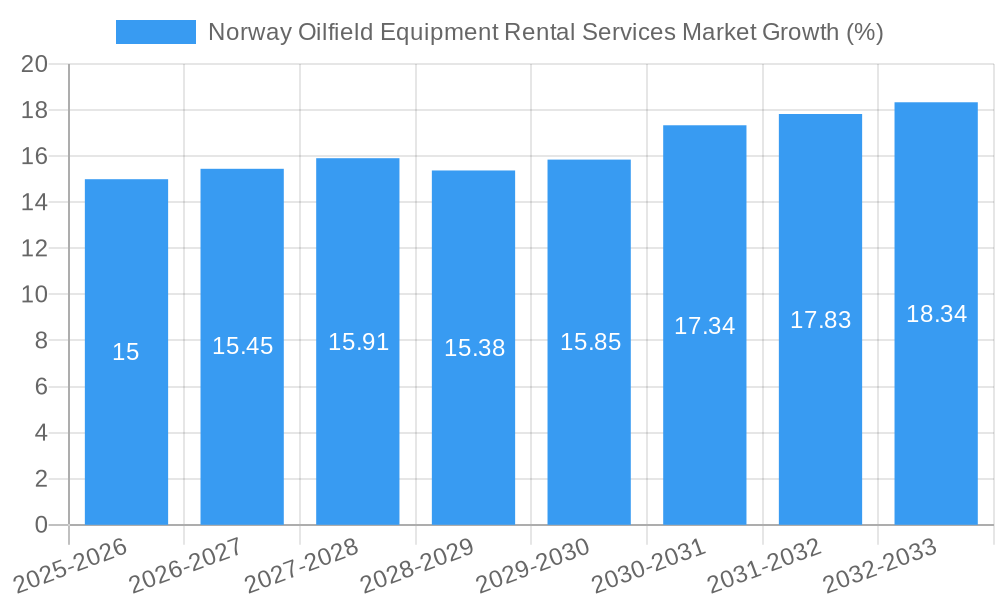

The Norway oilfield equipment rental services market exhibits robust growth potential, driven by increasing offshore oil and gas exploration and production activities in the Norwegian Continental Shelf (NCS). A CAGR exceeding 3% from 2019 to 2033 indicates a steadily expanding market. The market's value in 2025 is estimated to be around $500 million, considering the significant investments in NCS infrastructure and the ongoing need for specialized equipment. Key drivers include stringent safety regulations, which necessitate the use of well-maintained rental equipment, and the preference for outsourcing to specialized rental service providers. This reduces capital expenditure for operators while ensuring access to cutting-edge technology. Growing demand for advanced drilling equipment, completion and workover rigs, and sophisticated logging equipment further fuels this market. The market is segmented by equipment type, with drilling rigs, completion and workover rigs, and drilling equipment representing the largest segments. While potential restraints include fluctuating oil prices and evolving environmental regulations, the long-term outlook remains positive due to the strategic importance of the NCS as a major oil and gas producing region and ongoing investments in renewable energy infrastructure which indirectly boosts the market through expertise and equipment reuse.

Major players such as TechnipFMC, Superior Energy Services, Oil States International, Noble Corporation, Weatherford International, Transocean, Baker Hughes, Halliburton, Seadrill, Schlumberger, and Valaris contribute significantly to the market's dynamics. These companies compete based on equipment quality, service offerings, and technological advancements. The competitive landscape is characterized by both established multinational corporations and smaller specialized providers catering to niche needs. Future growth will likely be shaped by technological innovations such as automation and digitalization in oilfield operations, as well as increased focus on sustainable practices in the oil and gas industry. The Norwegian government's initiatives to support the energy sector, particularly through investment in new exploration and production, will likely contribute positively to the growth trajectory of the oilfield equipment rental services market.

Norway Oilfield Equipment Rental Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Norway oilfield equipment rental services market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast period extending to 2033. The parent market is the broader Norway Oil & Gas Industry, and the child market is specifically Oilfield Equipment Rental Services. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking a deep understanding of this dynamic market. Market values are presented in Million units.

Norway Oilfield Equipment Rental Services Market Dynamics & Structure

The Norwegian oilfield equipment rental services market exhibits a moderately concentrated structure, with several major international players and a number of smaller, specialized rental companies. Market concentration is estimated at xx% in 2025, with the top 5 players holding approximately yy% of the market share. Technological innovation, driven by increasing demand for efficiency and safety, is a key driver. Stringent regulatory frameworks enforced by the Norwegian Petroleum Directorate significantly influence operations and safety standards. Competitive substitutes include purchasing equipment outright, however, renting offers flexibility and cost-effectiveness. The end-user demographics primarily comprise oil and gas exploration and production companies operating on the Norwegian Continental Shelf. M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, driven primarily by consolidation efforts among smaller players.

- Market Concentration: xx% in 2025 (Top 5 players: yy%)

- Key Drivers: Technological innovation, efficiency demands, safety regulations.

- Key Restraints: Stringent regulatory environment, cyclical nature of the oil & gas industry.

- M&A Activity: xx deals (2019-2024)

Norway Oilfield Equipment Rental Services Market Growth Trends & Insights

The Norwegian oilfield equipment rental services market experienced a CAGR of xx% during the historical period (2019-2024), driven by increased exploration and production activities on the Norwegian Continental Shelf. This growth is expected to continue, albeit at a moderated pace, with a projected CAGR of yy% during the forecast period (2025-2033). Adoption rates of advanced drilling technologies, such as automated drilling systems and remote operations, are increasing, enhancing efficiency and reducing operational costs. The market is witnessing technological disruptions, including the rise of digitalization and data analytics in equipment management and maintenance. Consumer behavior is shifting towards a preference for flexible rental agreements and value-added services, like preventative maintenance and technical support. Market penetration of advanced rental models such as performance-based contracts is expected to grow from xx% in 2025 to yy% by 2033.

Dominant Regions, Countries, or Segments in Norway Oilfield Equipment Rental Services Market

The North Sea region, particularly areas with significant oil and gas reserves, dominates the Norwegian oilfield equipment rental services market. Within this region, the areas surrounding the major oil and gas fields in the North Sea are the most active. The segment showing the most significant growth is Drilling Rigs, driven by the continuous need for new exploration and development activities. Other significant segments include Completion and Workover Rigs and Drilling Equipment, closely tied to the exploration and production lifecycles.

- Key Drivers: High oil and gas production, significant investments in exploration, favorable government policies supporting energy exploration.

- Dominant Segment: Drilling Rigs (market share: xx% in 2025)

- Growth Potential: High growth potential anticipated in the subsea equipment rental segment driven by deepwater exploration initiatives.

Norway Oilfield Equipment Rental Services Market Product Landscape

The market offers a diverse range of equipment, from traditional drilling rigs and completion equipment to advanced drilling and logging technologies. Recent product innovations focus on enhanced safety features, automation, remote operation capabilities, and improved efficiency through data analytics and real-time monitoring. Unique selling propositions include tailored rental packages, specialized equipment for challenging environments (like Arctic conditions), and comprehensive maintenance services. Technological advancements are continually improving equipment performance, extending lifespan, and reducing operational downtime.

Key Drivers, Barriers & Challenges in Norway Oilfield Equipment Rental Services Market

Key Drivers:

- Increased oil and gas exploration and production activities on the Norwegian Continental Shelf.

- Technological advancements leading to greater efficiency and safety.

- Government support for the energy sector and investment in infrastructure.

Key Challenges:

- Fluctuations in oil prices affecting investment decisions.

- Stringent safety regulations and environmental concerns impacting operational costs.

- Intense competition from international and domestic players. This competition is estimated to reduce average rental margins by xx% by 2033.

Emerging Opportunities in Norway Oilfield Equipment Rental Services Market

- Expansion into offshore wind energy projects, capitalizing on Norway's growing renewable energy sector.

- Development of specialized equipment for unconventional oil and gas resources.

- Adoption of digital technologies for remote equipment monitoring and predictive maintenance, creating new service opportunities.

Growth Accelerators in the Norway Oilfield Equipment Rental Services Market Industry

Long-term growth will be fueled by technological breakthroughs in automation and digitalization, creating more efficient and safer operations. Strategic partnerships between equipment rental companies and oil and gas operators, creating integrated solutions and optimized operational workflows, will enhance growth. Market expansion strategies focusing on emerging offshore wind energy sectors will further accelerate growth.

Key Players Shaping the Norway Oilfield Equipment Rental Services Market Market

- TechnipFMC PLC

- Superior Energy Services Inc

- Oil States International Inc

- Noble Corporation PLC

- Weatherford International PLC

- Transocean Ltd

- Baker Hughes Company

- Halliburton Company

- Seadrill Ltd

- Schlumberger Limited

- Valaris PLC

Notable Milestones in Norway Oilfield Equipment Rental Services Market Sector

- August 2022: Aker BP announces plans for up to 15 exploration wells in 2023 and a USD 15 billion investment over 5-6 years in NCS projects. This signifies a significant boost to demand for rental equipment.

In-Depth Norway Oilfield Equipment Rental Services Market Market Outlook

The Norwegian oilfield equipment rental services market is poised for sustained growth, driven by ongoing investments in oil and gas exploration and production, coupled with the expansion of renewable energy projects. Strategic opportunities exist for companies that can leverage technological advancements, forge strong partnerships, and offer innovative solutions catering to the evolving needs of the industry. The long-term outlook is positive, with significant potential for market expansion and increased profitability.

Norway Oilfield Equipment Rental Services Market Segmentation

-

1. Equipment

- 1.1. Drilling Rigs

- 1.2. Completion and Workover Rigs

- 1.3. Drilling Equipment

- 1.4. Logging Equipment

- 1.5. Other Equipment

Norway Oilfield Equipment Rental Services Market Segmentation By Geography

- 1. Norway

Norway Oilfield Equipment Rental Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Drilling Rigs to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Oilfield Equipment Rental Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Drilling Rigs

- 5.1.2. Completion and Workover Rigs

- 5.1.3. Drilling Equipment

- 5.1.4. Logging Equipment

- 5.1.5. Other Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TechnipFMC PLC*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Superior Energy Services Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oil States International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Noble Corporation PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Weatherford International PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Transocean Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Baker Hughes Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Halliburton Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Seadrill Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Schlumberger Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Valaris PLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 TechnipFMC PLC*List Not Exhaustive

List of Figures

- Figure 1: Norway Oilfield Equipment Rental Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Oilfield Equipment Rental Services Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Oilfield Equipment Rental Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Oilfield Equipment Rental Services Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Norway Oilfield Equipment Rental Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Norway Oilfield Equipment Rental Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Norway Oilfield Equipment Rental Services Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 6: Norway Oilfield Equipment Rental Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Oilfield Equipment Rental Services Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Norway Oilfield Equipment Rental Services Market?

Key companies in the market include TechnipFMC PLC*List Not Exhaustive, Superior Energy Services Inc, Oil States International Inc, Noble Corporation PLC, Weatherford International PLC, Transocean Ltd, Baker Hughes Company, Halliburton Company, Seadrill Ltd, Schlumberger Limited, Valaris PLC.

3. What are the main segments of the Norway Oilfield Equipment Rental Services Market?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Drilling Rigs to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

In August 2022, Norwegian oil and gas company Aker BP announced its plans to undertake exploration drilling of up to 15 oil and gas wells, including in the Arctic Barents Sea, in 2023. The company also plans to invest USD 15 billion over the next 5-6 years to develop projects on the Norwegian continental shelf.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Oilfield Equipment Rental Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Oilfield Equipment Rental Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Oilfield Equipment Rental Services Market?

To stay informed about further developments, trends, and reports in the Norway Oilfield Equipment Rental Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence