Key Insights

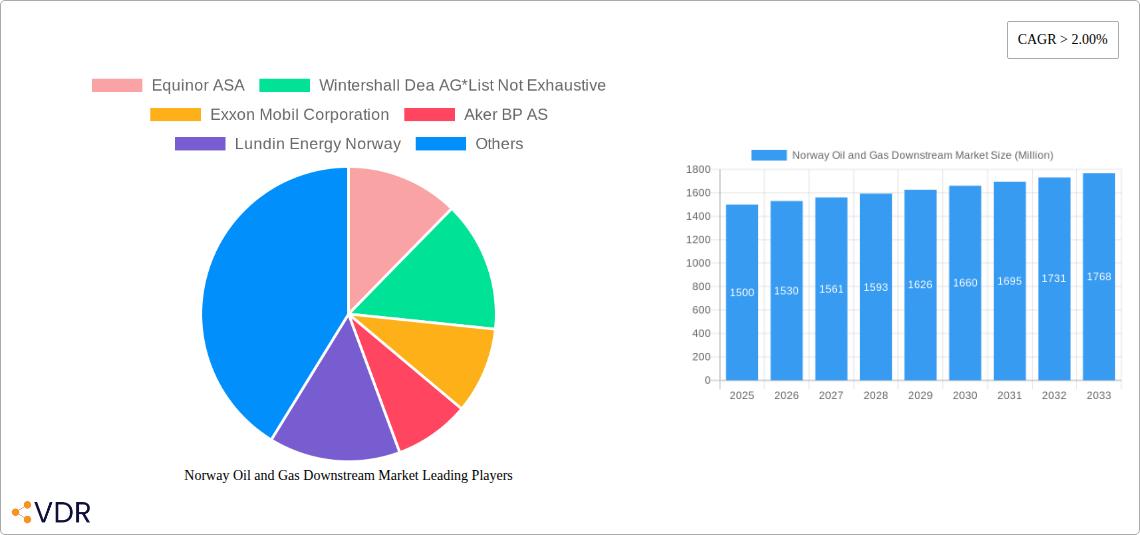

The Norway oil and gas downstream market, encompassing refineries and petrochemical plants, presents a robust growth trajectory. While the precise market size for 2025 isn't specified, considering a CAGR exceeding 2.00% and a value unit in millions, we can reasonably infer a significant market value. The market's expansion is propelled by several factors. Firstly, Norway's substantial oil and gas production necessitates robust downstream infrastructure for processing and refining. Secondly, increasing domestic demand for refined products, coupled with potential export opportunities to neighboring European countries, fuels market growth. Furthermore, technological advancements in refining processes, focusing on efficiency and environmental sustainability, contribute positively. However, the market also faces challenges. Fluctuations in global oil prices pose a significant risk, impacting profitability. Additionally, stringent environmental regulations and the global push towards renewable energy sources create headwinds. Major players like Equinor ASA, Wintershall Dea AG, Exxon Mobil Corporation, and others are actively shaping the market through strategic investments, technological innovation, and mergers & acquisitions. The market's segmentation into refineries and petrochemical plants allows for a nuanced understanding of specific growth drivers and challenges within each segment. Norway's strategic location and established energy sector infrastructure provide a strong foundation for continued growth in the downstream oil and gas sector in the forecast period (2025-2033).

The competitive landscape is characterized by the presence of both international energy giants and smaller, specialized companies. These firms are continually adapting their strategies to navigate the evolving energy landscape. This includes investments in renewable energy sources and carbon capture technologies to mitigate environmental concerns while maintaining profitability. The long-term outlook remains positive, contingent on the continued demand for refined products, technological advancements, and the successful management of environmental and economic uncertainties. Regional focus on Norway positions this market analysis as highly specific and valuable to stakeholders interested in this particular geographic sector of the downstream oil and gas industry.

Norway Oil and Gas Downstream Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Norway oil and gas downstream market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, regional performance, key players, and future opportunities within the parent market of Energy and the child market of Oil & Gas Downstream. This detailed analysis is essential for industry professionals, investors, and strategists seeking to understand and capitalize on the evolving landscape of Norway's oil and gas downstream sector. The report utilizes data from 2019-2024 as the historical period, 2025 as the base year and estimated year, and projects the market from 2025 to 2033.

Norway Oil and Gas Downstream Market Market Dynamics & Structure

This section analyzes the intricate structure of the Norwegian oil and gas downstream market, encompassing market concentration, technological advancements, regulatory influence, competitive dynamics, and end-user trends. The analysis incorporates quantitative data such as market share percentages and M&A deal volumes (in Million units), complemented by qualitative assessments of innovation barriers and market trends. The market is characterized by a moderate level of concentration with key players holding significant market share.

- Market Concentration: Equinor ASA holds approximately xx% market share, followed by Wintershall Dea AG with xx% and Exxon Mobil Corporation with xx%. The remaining share is distributed among several other players, indicating a moderately concentrated market.

- Technological Innovation: The sector is witnessing a shift towards greener technologies, driven by stringent environmental regulations and the growing demand for sustainable energy solutions. The Electra project by INOVYN exemplifies this trend.

- Regulatory Framework: Stringent environmental regulations and safety standards significantly influence the operations and investments within this market. This results in a complex regulatory landscape impacting operational costs and expansion strategies. Changes in policies and regulations are continuously monitored.

- Competitive Landscape: Intense competition prevails among existing players, spurring innovation and efficiency improvements. The market witnesses strategic alliances and mergers and acquisitions (M&A) to improve market standing. Over the study period (2019-2024), the total value of M&A deals was estimated at xx Million.

- End-User Demographics: The primary end-users include transportation, industrial sectors, and power generation. Changes in consumption patterns and energy mix influence demand fluctuations. The industrial sector constitutes roughly xx% of the downstream market demand.

Norway Oil and Gas Downstream Market Growth Trends & Insights

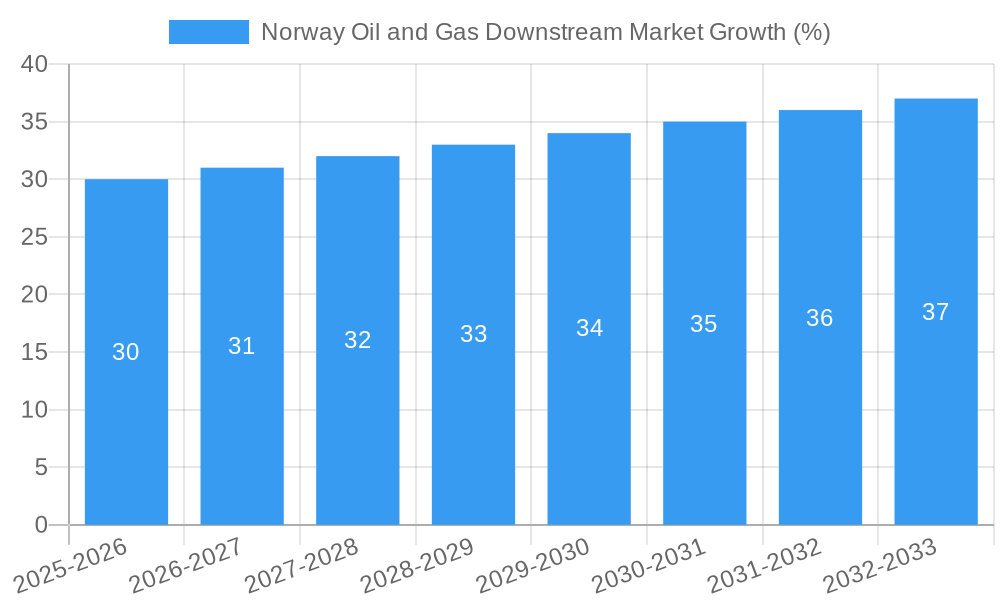

This section provides a comprehensive analysis of the Norway oil and gas downstream market's growth trajectory, integrating various factors such as market size evolution, adoption rates of new technologies, and shifts in consumer behavior. This in-depth analysis is complemented by key performance indicators like CAGR (Compound Annual Growth Rate) and market penetration rates, offering invaluable insights into the market's dynamic evolution. The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Factors contributing to growth include increasing energy demands, strategic investments in infrastructure, and government initiatives promoting energy security. However, the market is facing headwinds from fluctuating oil prices, stringent environmental policies, and concerns surrounding climate change.

Dominant Regions, Countries, or Segments in Norway Oil and Gas Downstream Market

This section pinpoints the leading regions, countries, or market segments within Norway's oil and gas downstream sector that are driving the market's growth. It meticulously examines the factors responsible for this dominance, such as economic policies, infrastructure development, and market share analysis. The report also evaluates the growth potential of each dominant segment, offering valuable insights into the future development of this dynamic market. The refineries segment currently holds the largest market share (approximately xx%), driven by consistent demand for refined petroleum products. This is followed by the Petrochemical Plants segment, which is projected to witness significant growth, driven by increasing demand for petrochemicals in various industries.

- Key Drivers for Refineries Segment: Strong domestic demand for refined fuels, proximity to major shipping lanes, and government incentives for refinery upgrades.

- Key Drivers for Petrochemical Plants Segment: Growth of downstream industries like plastics, fertilizers, and construction materials, coupled with investments in new capacities and technological upgrades.

Norway Oil and Gas Downstream Market Product Landscape

This section offers a concise overview of the product innovations, applications, and key performance indicators (KPIs) within the Norwegian oil and gas downstream market. It highlights the unique selling propositions (USPs) and advanced technological aspects of various products, providing a comprehensive understanding of the market's product offerings. The market offers a wide range of refined petroleum products like gasoline, diesel, jet fuel, and petrochemicals, such as ethylene, propylene, and benzene. Technological advancements focus on improving efficiency, reducing emissions, and enhancing product quality. The trend is toward producing cleaner fuels and developing bio-based alternatives.

Key Drivers, Barriers & Challenges in Norway Oil and Gas Downstream Market

This section identifies the major catalysts propelling the market's growth and the significant obstacles hindering its expansion. This comprehensive assessment includes technological, economic, and policy-related factors, along with a quantitative analysis of challenges like supply chain disruptions and competitive pressures.

Key Drivers: Growing energy demand, government initiatives to enhance energy security, and investments in infrastructure development are key drivers.

Key Barriers and Challenges: Fluctuating crude oil prices, stringent environmental regulations, and competition from renewable energy sources pose significant challenges. Supply chain disruptions can lead to production losses estimated at xx Million annually.

Emerging Opportunities in Norway Oil and Gas Downstream Market

This section illuminates emerging trends and untapped possibilities within Norway's oil and gas downstream sector. It explores potential market expansions, innovative applications, and shifts in consumer preferences, providing valuable insights into future growth opportunities. Emerging opportunities include the development of biofuels and sustainable petrochemical production, investment in carbon capture technologies, and exploring new export markets.

Growth Accelerators in the Norway Oil and Gas Downstream Market Industry

This section underscores the pivotal factors driving long-term growth within the Norwegian oil and gas downstream market. It emphasizes technological breakthroughs, strategic partnerships, and market expansion plans to enhance market understanding and guide strategic decision-making. Growth is fueled by strategic investments in refinery modernization, enhanced efficiency, and technological advancements, particularly in carbon capture and storage technologies.

Key Players Shaping the Norway Oil and Gas Downstream Market Market

- Equinor ASA

- Wintershall Dea AG

- Exxon Mobil Corporation

- Aker BP AS

- Lundin Energy Norway

- Royal Dutch Shell PLC

- Total S A

Notable Milestones in Norway Oil and Gas Downstream Market Sector

- October 2022: INOVYN's Electra project receives USD 1.41 Million in funding from Enova to electrify vinyl chloride production at its Rafnes site, marking a significant step towards greener technologies.

- July 2022: A fire at the Mongstad refinery temporarily impacted operations, highlighting the importance of safety and risk management in the sector.

In-Depth Norway Oil and Gas Downstream Market Market Outlook

The Norwegian oil and gas downstream market is poised for continued growth, albeit at a moderated pace, driven by sustained domestic demand and strategic investments in infrastructure and technology upgrades. Opportunities abound in the development of sustainable fuels and the deployment of carbon capture and storage solutions. Strategic partnerships and mergers & acquisitions are likely to reshape the competitive landscape. The market's long-term growth is contingent on global energy dynamics, environmental policies, and technological advancements in the energy sector.

Norway Oil and Gas Downstream Market Segmentation

-

1. Process Type

- 1.1. Refineries

- 1.2. Petrochemical Plants

Norway Oil and Gas Downstream Market Segmentation By Geography

- 1. Norway

Norway Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Refining Capacity to Remain Stagnant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Refineries

- 5.1.2. Petrochemical Plants

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wintershall Dea AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aker BP AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lundin Energy Norway

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Total S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Norway Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 3: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 6: Norway Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Oil and Gas Downstream Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Norway Oil and Gas Downstream Market?

Key companies in the market include Equinor ASA, Wintershall Dea AG*List Not Exhaustive, Exxon Mobil Corporation, Aker BP AS, Lundin Energy Norway, Royal Dutch Shell PLC, Total S A.

3. What are the main segments of the Norway Oil and Gas Downstream Market?

The market segments include Process Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems.

6. What are the notable trends driving market growth?

Refining Capacity to Remain Stagnant.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

October 2022: INOVYN's petrochemical site in Rafnes, Norway, takes the next step in developing and implementing green technology. As a subsidiary of INEOS, INOVYN will develop and install a new world-leading technology to electrify the production of vinyl chloride on the Rafnes site, replacing fossil fuel with renewable electricity. The project is called "Electra." A decision was made on 23 August 2022 by Enova to support Electra with an investment of USD 1.41 Million, subject to the decision by INEOS to proceed with the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Norway Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence