Key Insights

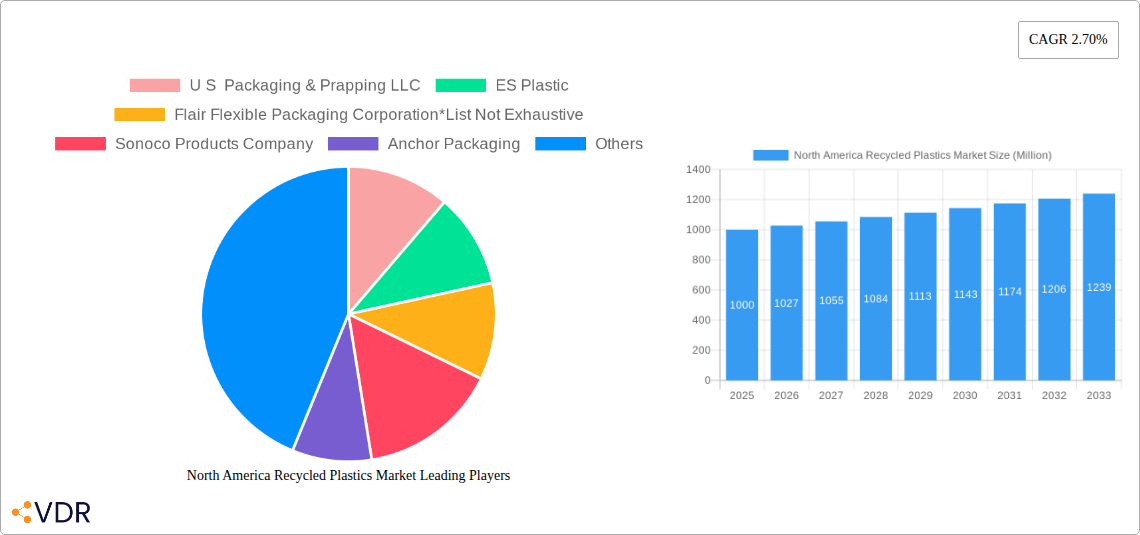

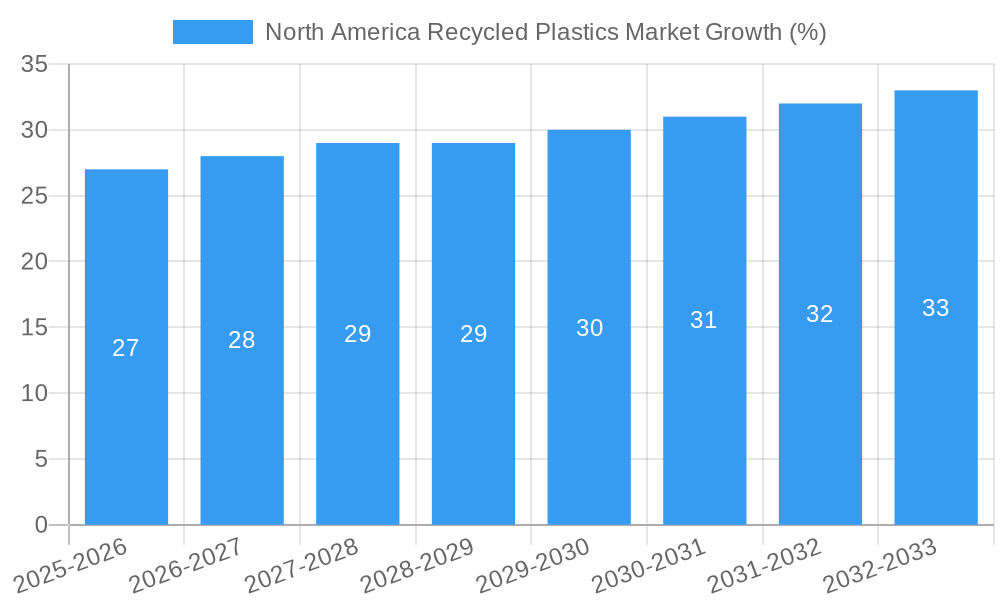

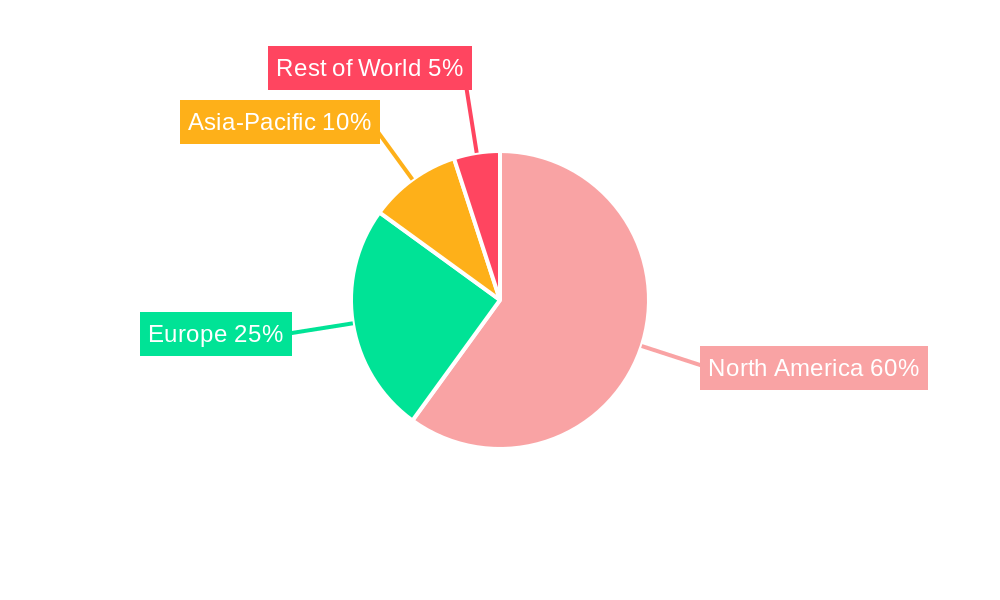

The North American recycled plastics market, valued at approximately $XX million in 2025, is projected to experience steady growth with a CAGR of 2.70% from 2025 to 2033. This growth is fueled by several key drivers. Increasing environmental concerns and stricter regulations regarding plastic waste are pushing manufacturers and consumers towards more sustainable packaging solutions. The rising demand for eco-friendly products across various end-use sectors, including food and beverage, consumer goods, and industrial applications, further boosts market expansion. Technological advancements in recycling processes, leading to higher-quality recycled plastics, are also contributing to the market's positive trajectory. However, challenges remain. The inconsistent quality of recycled plastics, limitations in the types of plastics that can be effectively recycled, and the fluctuating prices of virgin plastics pose restraints to wider adoption. The market segmentation reveals a strong demand for recycled rigid plastic packaging, driven primarily by the food and beverage industry's commitment to sustainability. Meanwhile, the flexible plastic packaging segment is also experiencing growth, albeit at a slower pace, indicating evolving market preferences and technological capabilities. Major players, including Amcor PLC, Berry Global Inc., and Sonoco Products Company, are actively investing in research and development to improve recycling technologies and expand their product offerings, solidifying their market positions. The North American region dominates the market, owing to stringent environmental regulations, heightened consumer awareness, and the presence of significant players.

The forecast for the North American recycled plastics market suggests continued, albeit moderate, expansion through 2033. The market will likely see increased focus on material innovation, particularly in developing new recycling methods for challenging plastic types. Strategic collaborations between recycling companies, packaging producers, and brand owners are expected to accelerate the growth and address the challenges concerning the inconsistent quality of recycled materials and scaling up of recycling infrastructure. Government initiatives promoting circular economy models and incentivizing the use of recycled plastics are predicted to further stimulate market demand. Competition among established players and new entrants will likely intensify, leading to innovation in product offerings, pricing strategies, and sustainability initiatives. This dynamic interplay of drivers, restraints, and competitive landscape will shape the future trajectory of the North American recycled plastics market.

North America Recycled Plastics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America recycled plastics market, encompassing market dynamics, growth trends, key players, and future outlook. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The report segments the market by material type (rigid and flexible plastic packaging), product type, end-user, and geography (US and Canada). It's an essential resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this rapidly evolving market. Market values are presented in million units.

North America Recycled Plastics Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the North American recycled plastics market. Market concentration is assessed, revealing the presence of both large multinational corporations and smaller specialized players. The report delves into the role of technological innovation, particularly in recycling processes and material conversion, in shaping market growth. Regulatory frameworks, including policies promoting recycled content and reducing plastic waste, are examined for their impact on market dynamics. The influence of substitute materials and evolving end-user preferences is also explored. The section concludes by analyzing mergers and acquisitions (M&A) activity, quantifying deal volumes and evaluating their impact on market structure. The analysis includes:

- Market Concentration: xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on advanced sorting and recycling technologies, chemical recycling gaining traction.

- Regulatory Landscape: Stringent regulations driving increased recycled content mandates across various packaging applications.

- Competitive Substitutes: Bioplastics and alternative packaging materials present a moderate competitive threat.

- M&A Activity: xx M&A deals recorded between 2019 and 2024, indicating consolidation trends.

North America Recycled Plastics Market Growth Trends & Insights

This section provides a detailed analysis of the North America recycled plastics market's growth trajectory using various analytical tools. Market size evolution is tracked from 2019 to 2024, showcasing the significant growth achieved and offering projections through 2033. Adoption rates of recycled plastics across different segments are assessed, emphasizing the increasing demand for sustainable packaging solutions. Technological disruptions, particularly advancements in recycling technologies and the emergence of new applications for recycled plastics, are identified and analyzed for their impact on market growth. Further, shifts in consumer behavior and preferences towards eco-friendly products drive market demand. The section features key metrics:

- Historical Market Size (2019-2024): Growth from xx million units to xx million units, with a CAGR of xx%.

- Forecast Market Size (2025-2033): Projected to reach xx million units by 2033, with a CAGR of xx%.

- Market Penetration: xx% penetration of recycled plastics in specific packaging segments by 2024.

Dominant Regions, Countries, or Segments in North America Recycled Plastics Market

This section identifies the leading regions, countries, and market segments within the North American recycled plastics market. Among the segments – Rigid Plastic Packaging (by material), Other Materials (by product), Other Products (by end-user), and Flexible Plastic Packaging (by material) – the report determines which exhibit the highest growth and market share. Dominance is analyzed in terms of market size, growth potential, and influencing factors including economic policies, infrastructure development, and consumer demand. The analysis focuses on the US and Canada, detailing their respective market positions and growth drivers:

- US Market: Dominated by xx segment, driven by strong regulatory frameworks and high demand.

- Canada Market: Shows strong growth potential in xx segment due to favorable government initiatives.

- Key Drivers: Increased demand for sustainable packaging, stringent regulations, and growing consumer awareness.

North America Recycled Plastics Market Product Landscape

This section details the diverse range of recycled plastic products available, highlighting innovation in materials and applications. The report analyzes product performance metrics, including durability, recyclability, and cost-effectiveness. Unique selling propositions (USPs) and technological advancements in recycled plastic manufacturing are highlighted, showcasing innovative approaches to material processing and product design.

Key Drivers, Barriers & Challenges in North America Recycled Plastics Market

This section outlines the key drivers and barriers that influence the growth of the North America recycled plastics market. Drivers include technological advancements, economic incentives, and supportive government policies fostering circular economy initiatives. Challenges encompass issues within the supply chain, such as the availability of consistent feedstock quality, and the need for regulatory clarity, coupled with competitive pressures from alternative materials. Quantitative impact assessments are provided where possible.

- Key Drivers: Government regulations, increasing consumer demand for sustainable packaging.

- Key Challenges: Inconsistency in recycled material quality, high costs associated with recycling infrastructure.

Emerging Opportunities in North America Recycled Plastics Market

This section identifies emerging opportunities within the North America recycled plastics market. These opportunities include exploring untapped market segments (e.g., specific packaging applications), developing innovative applications of recycled plastics (e.g., in construction or textiles), and adapting to evolving consumer preferences (e.g., preference for compostable and biodegradable materials).

Growth Accelerators in the North America Recycled Plastics Market Industry

This section pinpoints catalysts expected to fuel long-term growth in the North America recycled plastics market. Technological advancements and efficient recycling processes are emphasized, alongside strategic partnerships fostering industry collaborations and innovation. Market expansion strategies focusing on under-penetrated regions and applications are highlighted.

Key Players Shaping the North America Recycled Plastics Market Market

- U S Packaging & Prapping LLC

- ES Plastic

- Flair Flexible Packaging Corporation

- Sonoco Products Company

- Anchor Packaging

- St Johns Packaging

- Transcontinental Inc

- American Packaging Corporation

- Guycan Plastics Limited

- Crown Holdings Inc

- DS Smith PLC

- Owens Illinois Inc

- Winpak Ltd

- Emmerson Packaging

- Amcor PLC

- Mondi PLC

- Packaging Corporation of America

- Tetra Pak International SA

- Berry Global Inc

Notable Milestones in North America Recycled Plastics Market Sector

- AUG 2020: Amcor joined the U.S. Plastics Pact, signifying a commitment to circular economy initiatives.

- APR 2020: Amcor launched e-commerce-ready PET bottles, demonstrating innovation in sustainable packaging design.

In-Depth North America Recycled Plastics Market Market Outlook

This section summarizes the growth accelerators, forecasting future market potential and highlighting strategic opportunities for businesses in the North America recycled plastics market. It emphasizes the growing demand for sustainable packaging solutions and the technological advancements that will continue to shape market growth in the coming years. The long-term outlook is positive, driven by sustainable practices and environmental awareness.

North America Recycled Plastics Market Segmentation

-

1. Rigid Plastic Packaging

-

1.1. By Material

- 1.1.1. PE

- 1.1.2. PP

- 1.1.3. PET

- 1.1.4. PS and EPS

- 1.1.5. Other Materials

-

1.2. By Product

- 1.2.1. Bottles and Jars

- 1.2.2. Trays and Containers

- 1.2.3. Caps and Closures

- 1.2.4. Other Products

-

1.3. By End User

- 1.3.1. Food

- 1.3.2. Beverage

- 1.3.3. Personal Care

- 1.3.4. Pharmaceuticals

- 1.3.5. Other End Users

-

1.1. By Material

-

2. Flexible Plastic Packaging

-

2.1. By Material

- 2.1.1. PE

- 2.1.2. BOPP

- 2.1.3. CPP

- 2.1.4. Other Materials

-

2.2. By Product

- 2.2.1. Pouches and Bags

- 2.2.2. Films and Wraps

- 2.2.3. Other Products

-

2.3. By End User

- 2.3.1. Food

- 2.3.2. Beverage

- 2.3.3. Personal Care

- 2.3.4. Other End Users

-

2.1. By Material

North America Recycled Plastics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Recycled Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Stringent Regulation on Manufacturers Pertaining to Environmental Degradation

- 3.4. Market Trends

- 3.4.1. Food from end-user – flexible plastic packaging is expected to hold lagest share during the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Recycled Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rigid Plastic Packaging

- 5.1.1. By Material

- 5.1.1.1. PE

- 5.1.1.2. PP

- 5.1.1.3. PET

- 5.1.1.4. PS and EPS

- 5.1.1.5. Other Materials

- 5.1.2. By Product

- 5.1.2.1. Bottles and Jars

- 5.1.2.2. Trays and Containers

- 5.1.2.3. Caps and Closures

- 5.1.2.4. Other Products

- 5.1.3. By End User

- 5.1.3.1. Food

- 5.1.3.2. Beverage

- 5.1.3.3. Personal Care

- 5.1.3.4. Pharmaceuticals

- 5.1.3.5. Other End Users

- 5.1.1. By Material

- 5.2. Market Analysis, Insights and Forecast - by Flexible Plastic Packaging

- 5.2.1. By Material

- 5.2.1.1. PE

- 5.2.1.2. BOPP

- 5.2.1.3. CPP

- 5.2.1.4. Other Materials

- 5.2.2. By Product

- 5.2.2.1. Pouches and Bags

- 5.2.2.2. Films and Wraps

- 5.2.2.3. Other Products

- 5.2.3. By End User

- 5.2.3.1. Food

- 5.2.3.2. Beverage

- 5.2.3.3. Personal Care

- 5.2.3.4. Other End Users

- 5.2.1. By Material

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Rigid Plastic Packaging

- 6. United States North America Recycled Plastics Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Recycled Plastics Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Recycled Plastics Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Recycled Plastics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 U S Packaging & Prapping LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ES Plastic

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Flair Flexible Packaging Corporation*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sonoco Products Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Anchor Packaging

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 St Johns Packaging

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Transcontinental Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 American Packaging Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Guycan Plastics Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Crown Holdings Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 DS Smith PLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Owens Illinois Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Winpak Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Emmerson Packaging

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Amcor PLC

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Mondi PLC

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Packaging Corporation of America

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Tetra Pak International SA

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Berry Global Inc

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.1 U S Packaging & Prapping LLC

List of Figures

- Figure 1: North America Recycled Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Recycled Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: North America Recycled Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Recycled Plastics Market Revenue Million Forecast, by Rigid Plastic Packaging 2019 & 2032

- Table 3: North America Recycled Plastics Market Revenue Million Forecast, by Flexible Plastic Packaging 2019 & 2032

- Table 4: North America Recycled Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Recycled Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Recycled Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Recycled Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Recycled Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Recycled Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Recycled Plastics Market Revenue Million Forecast, by Rigid Plastic Packaging 2019 & 2032

- Table 11: North America Recycled Plastics Market Revenue Million Forecast, by Flexible Plastic Packaging 2019 & 2032

- Table 12: North America Recycled Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Recycled Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Recycled Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Recycled Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Recycled Plastics Market?

The projected CAGR is approximately 2.70%.

2. Which companies are prominent players in the North America Recycled Plastics Market?

Key companies in the market include U S Packaging & Prapping LLC, ES Plastic, Flair Flexible Packaging Corporation*List Not Exhaustive, Sonoco Products Company, Anchor Packaging, St Johns Packaging, Transcontinental Inc, American Packaging Corporation, Guycan Plastics Limited, Crown Holdings Inc, DS Smith PLC, Owens Illinois Inc, Winpak Ltd, Emmerson Packaging, Amcor PLC, Mondi PLC, Packaging Corporation of America, Tetra Pak International SA, Berry Global Inc.

3. What are the main segments of the North America Recycled Plastics Market?

The market segments include Rigid Plastic Packaging, Flexible Plastic Packaging.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

Food from end-user – flexible plastic packaging is expected to hold lagest share during the forecast period.

7. Are there any restraints impacting market growth?

Stringent Regulation on Manufacturers Pertaining to Environmental Degradation.

8. Can you provide examples of recent developments in the market?

AUG 2020- Amcor joined the U.S. Plastics Pact, a collaborative, solutions-driven initiative to create a path forward to a circular economy for plastics in the United States by 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Recycled Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Recycled Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Recycled Plastics Market?

To stay informed about further developments, trends, and reports in the North America Recycled Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence