Key Insights

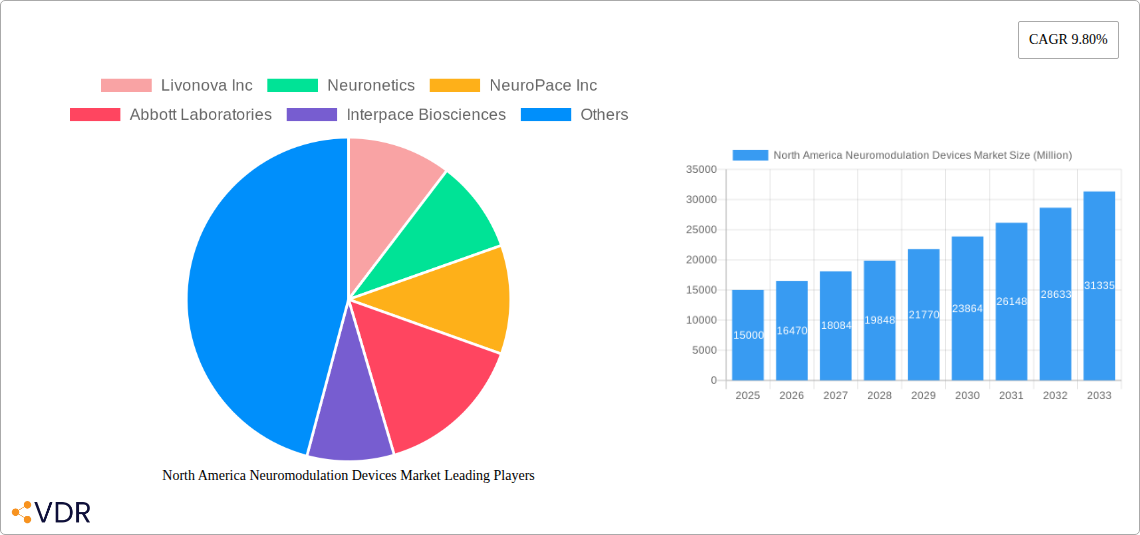

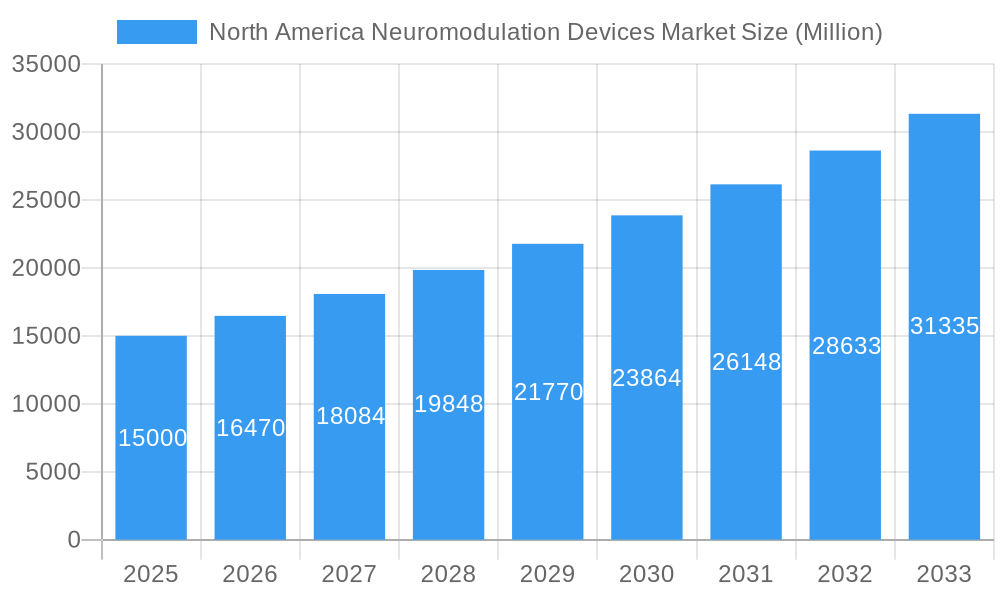

The North American neuromodulation devices market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 9.80% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of neurological disorders like Parkinson's disease, epilepsy, and chronic pain, coupled with advancements in minimally invasive surgical techniques and improved device efficacy, are major contributors. Growing awareness among patients and healthcare professionals regarding the benefits of neuromodulation therapies, including reduced reliance on pharmaceuticals and improved quality of life, fuels market demand. Furthermore, technological innovations leading to smaller, more sophisticated devices with enhanced features are contributing to market expansion. The market is segmented by device type (implantable and external) and application (Parkinson's disease, epilepsy, depression, dystonia, pain management, and others). Implantable devices currently dominate the market share, but external devices are witnessing significant growth due to their less invasive nature and ease of use. Significant investment in research and development by key players like Medtronic, Boston Scientific, and Abbott Laboratories further reinforces the positive market outlook.

North America Neuromodulation Devices Market Market Size (In Billion)

The North American region, particularly the United States, holds the largest market share due to factors like high healthcare expenditure, advanced medical infrastructure, and a larger patient pool. Canada and Mexico are also contributing to the market growth, albeit at a slower pace compared to the US. However, high costs associated with neuromodulation devices, stringent regulatory approvals, and potential risks associated with implantation procedures pose challenges to market growth. Nevertheless, the ongoing research into new applications and improvements in device technology are expected to mitigate these restraints, resulting in sustained market expansion throughout the forecast period. Competitive landscape analysis reveals a mix of established multinational corporations and emerging specialized companies, fostering innovation and driving down costs, ultimately benefitting patients and contributing to market expansion.

North America Neuromodulation Devices Market Company Market Share

North America Neuromodulation Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America neuromodulation devices market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and researchers seeking a detailed understanding of this rapidly evolving sector. The market is segmented by device type (Implantable Devices, External Devices) and application (Parkinson's Disease, Epilepsy, Depression, Dystonia, Pain Management, Other Applications). The report provides valuable insights into the parent market (Medical Devices) and its child market (Neuromodulation Devices) in North America.

North America Neuromodulation Devices Market Dynamics & Structure

The North American neuromodulation devices market exhibits a moderately consolidated structure, with key players like Medtronic PLC, Boston Scientific Corporation, and Abbott Laboratories holding significant market share. The market is characterized by intense competition driven by technological advancements, regulatory changes, and a growing patient population. Technological innovations, such as minimally invasive procedures and advanced stimulation techniques, are major drivers. Stringent regulatory frameworks, including FDA approvals, pose challenges but also ensure product safety and efficacy. The market also witnesses substantial mergers and acquisitions (M&A) activity, reflecting the strategic importance of this sector. Competitive substitutes, including pharmaceutical therapies, also impact market dynamics.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on minimally invasive procedures, advanced stimulation techniques, and improved device longevity.

- Regulatory Framework: Stringent FDA approvals drive product safety and efficacy, but also increase time to market.

- Competitive Substitutes: Pharmaceutical therapies provide alternative treatment options, impacting market share.

- End-User Demographics: Aging population and increasing prevalence of neurological disorders drive market growth.

- M&A Trends: Significant M&A activity observed in recent years, with xx major deals completed between 2019-2024.

North America Neuromodulation Devices Market Growth Trends & Insights

The North America neuromodulation devices market is experiencing robust growth, driven by increasing prevalence of neurological and chronic pain disorders, technological advancements, and rising healthcare expenditure. The market size is projected to reach xx million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is steadily increasing, particularly in applications like Parkinson's disease and epilepsy. Technological disruptions, such as the development of closed-loop systems and personalized therapies, are reshaping market dynamics. Consumer behavior is shifting towards minimally invasive procedures and improved quality of life, further fueling market expansion. This growth is supported by factors like increased awareness, improved diagnostics, and technological advancements. However, high treatment costs, reimbursement challenges and access limitations continue to pose some challenges.

Dominant Regions, Countries, or Segments in North America Neuromodulation Devices Market

The United States dominates the North American neuromodulation devices market, driven by high healthcare expenditure, robust infrastructure, and a large patient pool. Within the application segments, Parkinson's disease and epilepsy represent the largest market shares, owing to higher prevalence rates and established treatment protocols. Implantable devices constitute the largest segment by device type, reflecting the efficacy and long-term benefits of these solutions.

- United States: Highest market share due to advanced healthcare infrastructure, high healthcare expenditure, and significant patient population.

- Canada: Experiencing steady growth, driven by increasing government initiatives and healthcare investments.

- Implantable Devices: Largest segment by device type due to longer lifespan and superior treatment efficacy.

- Parkinson's Disease & Epilepsy: Largest application segments due to higher prevalence and established treatment protocols.

- Key Drivers: High healthcare expenditure, aging population, increased awareness, and technological advancements.

North America Neuromodulation Devices Market Product Landscape

The market is characterized by a diverse range of implantable and external neuromodulation devices, each designed to target specific neurological conditions. Recent innovations focus on minimizing invasiveness, enhancing precision, and improving patient outcomes. Closed-loop systems, personalized therapies, and advanced stimulation techniques are key differentiators, providing superior treatment outcomes and enhanced patient experience. Features such as improved battery life, smaller device size, and remote monitoring capabilities are also major selling points.

Key Drivers, Barriers & Challenges in North America Neuromodulation Devices Market

Key Drivers:

- Rising prevalence of neurological disorders.

- Technological advancements leading to improved device efficacy and patient outcomes.

- Increasing healthcare expenditure and insurance coverage.

Challenges & Restraints:

- High cost of devices and procedures limiting accessibility.

- Stringent regulatory approval processes prolonging time to market.

- Competition from pharmaceutical alternatives.

- Supply chain disruptions impacting device availability. The impact of these disruptions is estimated to be a xx% reduction in market growth in 2024.

Emerging Opportunities in North America Neuromodulation Devices Market

- Expanding applications into new therapeutic areas, such as obesity and depression.

- Development of more sophisticated closed-loop systems and personalized therapies.

- Growing adoption of minimally invasive surgical techniques.

- Growing focus on digital therapeutics and remote patient monitoring.

Growth Accelerators in the North America Neuromodulation Devices Market Industry

Strategic partnerships between device manufacturers and healthcare providers are facilitating market penetration. Investment in research and development is fueling technological innovation, driving the development of advanced devices and therapies. Expansion into emerging markets and untapped patient populations presents significant opportunities for growth. Government initiatives supporting medical technology development also contribute to overall market expansion.

Key Players Shaping the North America Neuromodulation Devices Market Market

Notable Milestones in North America Neuromodulation Devices Market Sector

- July 2022: DyAnsys received U.S. FDA approval for its First Relief PENS device for diabetic neuropathic pain. This expands treatment options and market potential for PENS technology.

- February 2022: Precisis GmbH received FDA Breakthrough Device Designation for its EASEE brain stimulator. This accelerates development and commercialization of a potentially transformative technology.

In-Depth North America Neuromodulation Devices Market Market Outlook

The North America neuromodulation devices market is poised for continued robust growth, driven by several factors including increasing prevalence of neurological disorders, ongoing technological innovations, and expanding applications. The market presents significant opportunities for established players and new entrants alike, particularly in developing advanced closed-loop systems, personalized therapies, and minimally invasive procedures. Strategic partnerships and investments in R&D are crucial for driving long-term success in this dynamic sector.

North America Neuromodulation Devices Market Segmentation

-

1. Device Type

-

1.1. Implantable Devices

- 1.1.1. Vagus Nerve Stimulators

- 1.1.2. Spinal Cord Stimulators

- 1.1.3. Deep Brain Stimulators

- 1.1.4. Gastric Electric Stimulators

- 1.1.5. Other Implantable Devices

-

1.2. External Devices

- 1.2.1. Transcranial Magnetic Stimulation (TMS)

- 1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 1.2.3. Other External Devices

-

1.1. Implantable Devices

-

2. Application

- 2.1. Parkinson's Disease

- 2.2. Epilepsy

- 2.3. Depression

- 2.4. Dystonia

- 2.5. Pain Management

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Neuromodulation Devices Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Neuromodulation Devices Market Regional Market Share

Geographic Coverage of North America Neuromodulation Devices Market

North America Neuromodulation Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Neurological Diseases; Rising Demand for Minimally Invasive Technologies

- 3.3. Market Restrains

- 3.3.1. High Cost of Neurological Disease Treatments; Shortage of Skilled Healthcare Professionals

- 3.4. Market Trends

- 3.4.1. Pain Management Segment is Expected to Witness Considerable Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Implantable Devices

- 5.1.1.1. Vagus Nerve Stimulators

- 5.1.1.2. Spinal Cord Stimulators

- 5.1.1.3. Deep Brain Stimulators

- 5.1.1.4. Gastric Electric Stimulators

- 5.1.1.5. Other Implantable Devices

- 5.1.2. External Devices

- 5.1.2.1. Transcranial Magnetic Stimulation (TMS)

- 5.1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 5.1.2.3. Other External Devices

- 5.1.1. Implantable Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Parkinson's Disease

- 5.2.2. Epilepsy

- 5.2.3. Depression

- 5.2.4. Dystonia

- 5.2.5. Pain Management

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Implantable Devices

- 6.1.1.1. Vagus Nerve Stimulators

- 6.1.1.2. Spinal Cord Stimulators

- 6.1.1.3. Deep Brain Stimulators

- 6.1.1.4. Gastric Electric Stimulators

- 6.1.1.5. Other Implantable Devices

- 6.1.2. External Devices

- 6.1.2.1. Transcranial Magnetic Stimulation (TMS)

- 6.1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 6.1.2.3. Other External Devices

- 6.1.1. Implantable Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Parkinson's Disease

- 6.2.2. Epilepsy

- 6.2.3. Depression

- 6.2.4. Dystonia

- 6.2.5. Pain Management

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Canada North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Implantable Devices

- 7.1.1.1. Vagus Nerve Stimulators

- 7.1.1.2. Spinal Cord Stimulators

- 7.1.1.3. Deep Brain Stimulators

- 7.1.1.4. Gastric Electric Stimulators

- 7.1.1.5. Other Implantable Devices

- 7.1.2. External Devices

- 7.1.2.1. Transcranial Magnetic Stimulation (TMS)

- 7.1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 7.1.2.3. Other External Devices

- 7.1.1. Implantable Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Parkinson's Disease

- 7.2.2. Epilepsy

- 7.2.3. Depression

- 7.2.4. Dystonia

- 7.2.5. Pain Management

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Mexico North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Implantable Devices

- 8.1.1.1. Vagus Nerve Stimulators

- 8.1.1.2. Spinal Cord Stimulators

- 8.1.1.3. Deep Brain Stimulators

- 8.1.1.4. Gastric Electric Stimulators

- 8.1.1.5. Other Implantable Devices

- 8.1.2. External Devices

- 8.1.2.1. Transcranial Magnetic Stimulation (TMS)

- 8.1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 8.1.2.3. Other External Devices

- 8.1.1. Implantable Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Parkinson's Disease

- 8.2.2. Epilepsy

- 8.2.3. Depression

- 8.2.4. Dystonia

- 8.2.5. Pain Management

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Livonova Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Neuronetics

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 NeuroPace Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Abbott Laboratories

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Interpace Biosciences

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Nevro Corp

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 NeuroSigma Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Medtronic PLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Synapse Biomedical Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Boston Scientific Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 EndoStim Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Livonova Inc

List of Figures

- Figure 1: North America Neuromodulation Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Neuromodulation Devices Market Share (%) by Company 2025

List of Tables

- Table 1: North America Neuromodulation Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: North America Neuromodulation Devices Market Volume K Tons Forecast, by Device Type 2020 & 2033

- Table 3: North America Neuromodulation Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Neuromodulation Devices Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: North America Neuromodulation Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Neuromodulation Devices Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: North America Neuromodulation Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Neuromodulation Devices Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: North America Neuromodulation Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 10: North America Neuromodulation Devices Market Volume K Tons Forecast, by Device Type 2020 & 2033

- Table 11: North America Neuromodulation Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: North America Neuromodulation Devices Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: North America Neuromodulation Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: North America Neuromodulation Devices Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: North America Neuromodulation Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Neuromodulation Devices Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: North America Neuromodulation Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 18: North America Neuromodulation Devices Market Volume K Tons Forecast, by Device Type 2020 & 2033

- Table 19: North America Neuromodulation Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: North America Neuromodulation Devices Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: North America Neuromodulation Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North America Neuromodulation Devices Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: North America Neuromodulation Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Neuromodulation Devices Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: North America Neuromodulation Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 26: North America Neuromodulation Devices Market Volume K Tons Forecast, by Device Type 2020 & 2033

- Table 27: North America Neuromodulation Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: North America Neuromodulation Devices Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: North America Neuromodulation Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: North America Neuromodulation Devices Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: North America Neuromodulation Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: North America Neuromodulation Devices Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Neuromodulation Devices Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the North America Neuromodulation Devices Market?

Key companies in the market include Livonova Inc, Neuronetics, NeuroPace Inc, Abbott Laboratories, Interpace Biosciences, Nevro Corp, NeuroSigma Inc, Medtronic PLC, Synapse Biomedical Inc, Boston Scientific Corporation, EndoStim Inc.

3. What are the main segments of the North America Neuromodulation Devices Market?

The market segments include Device Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Neurological Diseases; Rising Demand for Minimally Invasive Technologies.

6. What are the notable trends driving market growth?

Pain Management Segment is Expected to Witness Considerable Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Neurological Disease Treatments; Shortage of Skilled Healthcare Professionals.

8. Can you provide examples of recent developments in the market?

July 2022: DyAnsys received U.S. FDA approval for its percutaneous electrical neurostimulation (PENS) device, called First Relief, to treat diabetic neuropathic pain. First Relief is intended for symptomatic Relief of chronic, intractable pain related to diabetic peripheral neuropathy through multiple treatments for up to 56 days.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Neuromodulation Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Neuromodulation Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Neuromodulation Devices Market?

To stay informed about further developments, trends, and reports in the North America Neuromodulation Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence