Key Insights

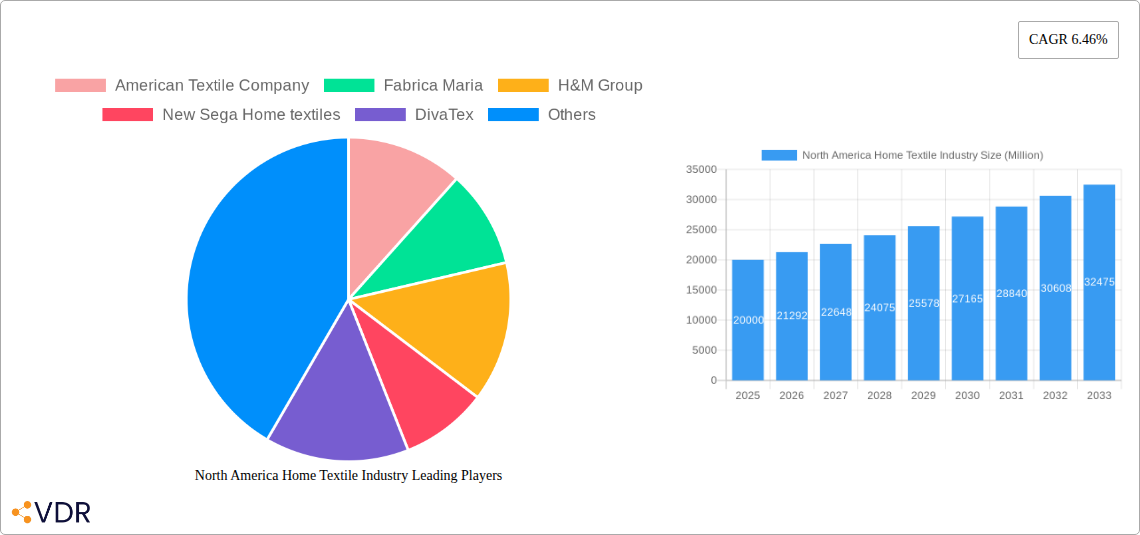

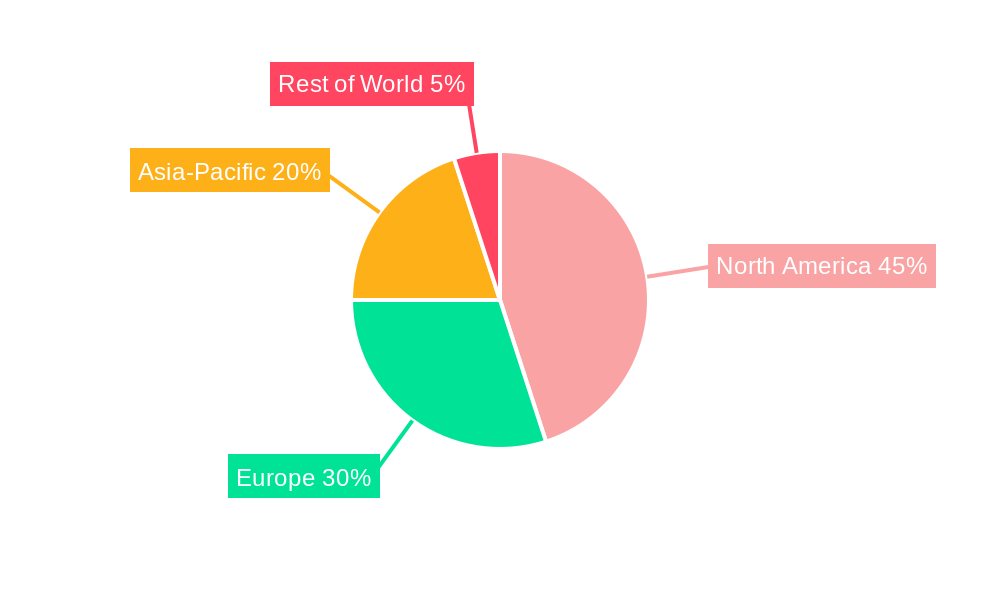

The North American home textile market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. A rising disposable income, coupled with a growing preference for comfortable and aesthetically pleasing home environments, fuels demand for high-quality bed linen, bath linen, kitchen textiles, and upholstery. The increasing popularity of online shopping provides convenient access to a wider range of products and competitive pricing, further boosting market expansion. Furthermore, the shift towards eco-friendly and sustainable materials is creating new opportunities for manufacturers committed to ethical and environmentally conscious production. The market segmentation reveals a strong presence across various distribution channels, including specialty stores, supermarkets, hypermarkets, and online retailers, catering to both residential and commercial end-users. Major players like American Textile Company, Fabrica Maria, and H&M Group are vying for market share, indicating a competitive landscape characterized by both established brands and emerging players.

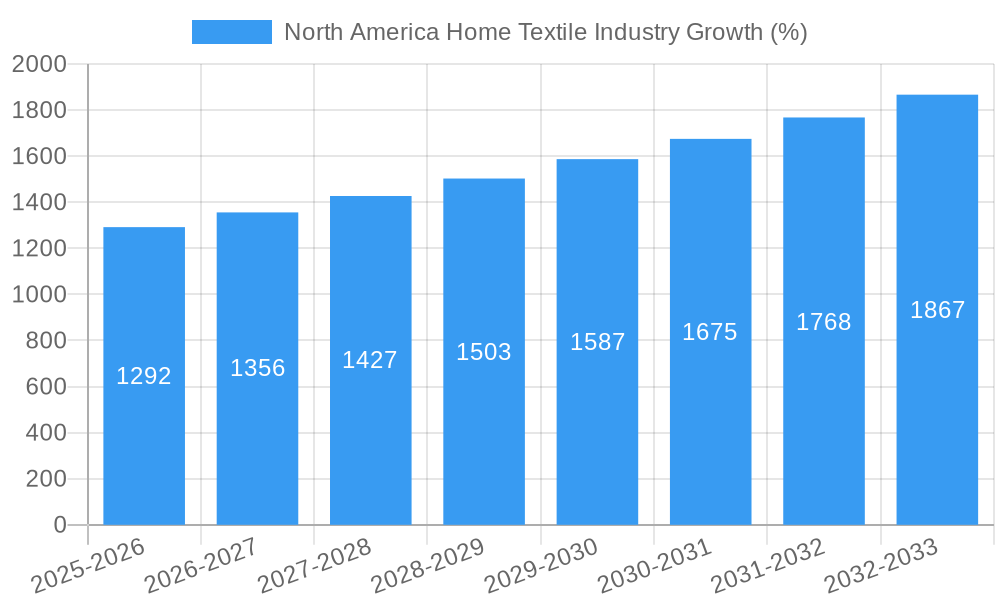

The 6.46% CAGR projected through 2033 suggests sustained market growth, though certain restraints might influence the trajectory. Fluctuations in raw material prices, particularly cotton, pose a significant challenge. Additionally, the increasing competition from international manufacturers necessitates continuous innovation and strategic pricing to maintain market competitiveness. The market’s evolution is also shaped by emerging trends such as personalized home décor, increasing demand for smart textiles, and the integration of technology in home furnishings. These trends indicate a shift towards customized experiences and the incorporation of smart features in home textiles, creating opportunities for innovative product development and market differentiation. North America, with its established retail infrastructure and high consumer spending power, remains a dominant region within the global home textile market.

This comprehensive report provides an in-depth analysis of the North America home textile industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by distribution channel (specialty stores, supermarkets/hypermarkets, online, others), end-user (residential, commercial), and product type (bed linen, bath linen, kitchen linen, upholstery, others). The report's detailed analysis uses data in Million units.

North America Home Textile Industry Market Dynamics & Structure

The North American home textile market is characterized by moderate concentration, with a few large players and numerous smaller companies. Technological innovation, particularly in materials science and manufacturing processes, is a key driver. Regulatory frameworks concerning product safety and sustainability are increasingly influential. The market faces competition from substitute products like synthetic alternatives and imported goods. End-user demographics, shifting towards smaller households and increased preference for sustainable products, significantly impact demand. Mergers and acquisitions (M&A) activity remains moderate but is expected to increase as companies consolidate to improve efficiency and expand their product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on sustainable materials (organic cotton, recycled fibers), smart textiles, and improved manufacturing efficiency.

- Regulatory Landscape: Increasing focus on product safety standards and environmental regulations.

- Competitive Substitutes: Synthetic materials, imported textiles, and alternative home décor options.

- End-User Demographics: Growing demand for smaller, multifunctional home textiles reflects changing lifestyle preferences.

- M&A Activity: xx M&A deals recorded between 2019-2024, with an estimated xx deals projected for 2025-2033.

North America Home Textile Industry Growth Trends & Insights

The North American home textile market exhibited steady growth from 2019 to 2024, driven by factors such as rising disposable incomes, increasing housing starts, and a growing preference for home improvement and comfort. The market experienced a temporary slowdown in 2020 due to the COVID-19 pandemic but recovered quickly due to increased demand for home furnishings and comfortable living spaces. Technological advancements, such as the introduction of smart textiles and sustainable materials, are influencing market trends. Consumer behavior shifts towards online shopping and preference for personalized home décor also contribute to growth. The market is projected to expand significantly over the forecast period (2025-2033), with a projected CAGR of xx%. Market penetration of sustainable and technologically advanced products is expected to increase steadily.

Dominant Regions, Countries, or Segments in North America Home Textile Industry

The residential segment dominates the North American home textile market, driven by a growing population and rising household incomes. Within distribution channels, online sales are exhibiting the fastest growth, surpassing specialty stores in market share. The southwestern and northeastern regions of the US demonstrate strong growth potential due to their population density and robust construction sectors. Canada shows comparatively slower growth, partially attributed to its smaller population base.

- By Distribution Channel: Online sales are experiencing the fastest growth.

- By End-User: The residential segment maintains the largest market share.

- By Product: Bed linen continues to be a significant segment, followed by bath linen and kitchen linen.

- Regional Dominance: The southwestern and northeastern regions of the US exhibit the strongest growth.

North America Home Textile Industry Product Landscape

Product innovation in the North American home textile industry focuses on enhancing comfort, durability, and sustainability. New materials, such as antimicrobial fabrics and temperature-regulating textiles, are gaining traction. Smart textiles integrated with technology are emerging, offering features like automated temperature control or embedded sensors. The emphasis on sustainability drives the development of eco-friendly materials and production processes. Unique selling propositions often center on comfort, performance features, and sustainable sourcing.

Key Drivers, Barriers & Challenges in North America Home Textile Industry

Key Drivers: Rising disposable incomes, increased consumer spending on home improvement, technological advancements (smart textiles, sustainable materials), and favorable government policies supporting domestic manufacturing.

Key Challenges: Supply chain disruptions, increasing raw material costs, intense competition from imports, and fluctuating consumer demand. These challenges can impact profitability and necessitate strategic adjustments by market participants. For instance, raw material cost increases from 2020 to 2024 impacted margins by an estimated xx%.

Emerging Opportunities in North America Home Textile Industry

Emerging opportunities include the growth of the smart home market, demand for personalized and customizable home textiles, and increasing interest in sustainable and ethically sourced products. Untapped markets lie in niche segments, such as luxury home textiles and specialized products for specific needs (e.g., allergy-friendly bedding). The focus on wellness and home comfort further fuels the demand for innovative product features.

Growth Accelerators in the North America Home Textile Industry

Technological breakthroughs in materials science and manufacturing processes, strategic partnerships between textile manufacturers and home décor brands, and expansion into new market segments (e.g., hospitality, healthcare) will accelerate industry growth. Sustainable initiatives and improved supply chain resilience will further enhance long-term prospects.

Key Players Shaping the North America Home Textile Industry Market

- American Textile Company

- Fabrica Maria

- H&M Group

- New Sega Home textiles

- DivaTex

- Ralph Lauren

- Marvic Textiles

- Standard Textile

- Welspun Group

- Calvin Klein Home

Notable Milestones in North America Home Textile Industry Sector

- 2020, Q2: Significant disruption in the supply chain due to the COVID-19 pandemic.

- 2021, Q4: Increased investment in sustainable and eco-friendly manufacturing practices.

- 2022, Q1: Several mergers and acquisitions in the industry, consolidating market share.

- 2023, Q3: Launch of several innovative products featuring smart textiles and advanced materials.

In-Depth North America Home Textile Industry Market Outlook

The North American home textile market is poised for continued growth over the forecast period, driven by robust demand and technological advancements. Strategic opportunities lie in developing sustainable products, embracing e-commerce channels, and focusing on niche markets. Companies that invest in innovation and build resilient supply chains will be best positioned to capitalize on future growth. The market's steady expansion, coupled with consumer preference shifts, presents significant opportunities for both established and emerging players.

North America Home Textile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Home Textile Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Home Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 India

- 3.2.2 Australia and China Leading textile export globally; China leading the bedding industry globally supporting its bed linen market growth

- 3.3. Market Restrains

- 3.3.1. Negative impact of covid on small bed and bath linen industries in Asia Pacific; Increasing rent of bedroom apartments in Asia Pacific

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Kitchen Linen Products in North American Countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Textile Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Home Textile Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Home Textile Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Home Textile Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Home Textile Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 American Textile Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fabrica Maria

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 H&M Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 New Sega Home textiles

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DivaTex

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ralph Lauren

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Marvic Textiles*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Standard Textile

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Welspun Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Calvin Klein Home

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 American Textile Company

List of Figures

- Figure 1: North America Home Textile Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Home Textile Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Home Textile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Home Textile Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Home Textile Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Home Textile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Home Textile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Home Textile Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Home Textile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Home Textile Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Home Textile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Home Textile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Home Textile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Home Textile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Home Textile Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Home Textile Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Home Textile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Home Textile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Home Textile Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Home Textile Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Home Textile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Home Textile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Home Textile Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Textile Industry?

The projected CAGR is approximately 6.46%.

2. Which companies are prominent players in the North America Home Textile Industry?

Key companies in the market include American Textile Company, Fabrica Maria, H&M Group, New Sega Home textiles, DivaTex, Ralph Lauren, Marvic Textiles*List Not Exhaustive, Standard Textile, Welspun Group, Calvin Klein Home.

3. What are the main segments of the North America Home Textile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

India. Australia and China Leading textile export globally; China leading the bedding industry globally supporting its bed linen market growth.

6. What are the notable trends driving market growth?

Increasing Demand for Kitchen Linen Products in North American Countries.

7. Are there any restraints impacting market growth?

Negative impact of covid on small bed and bath linen industries in Asia Pacific; Increasing rent of bedroom apartments in Asia Pacific.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Textile Industry?

To stay informed about further developments, trends, and reports in the North America Home Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence