Key Insights

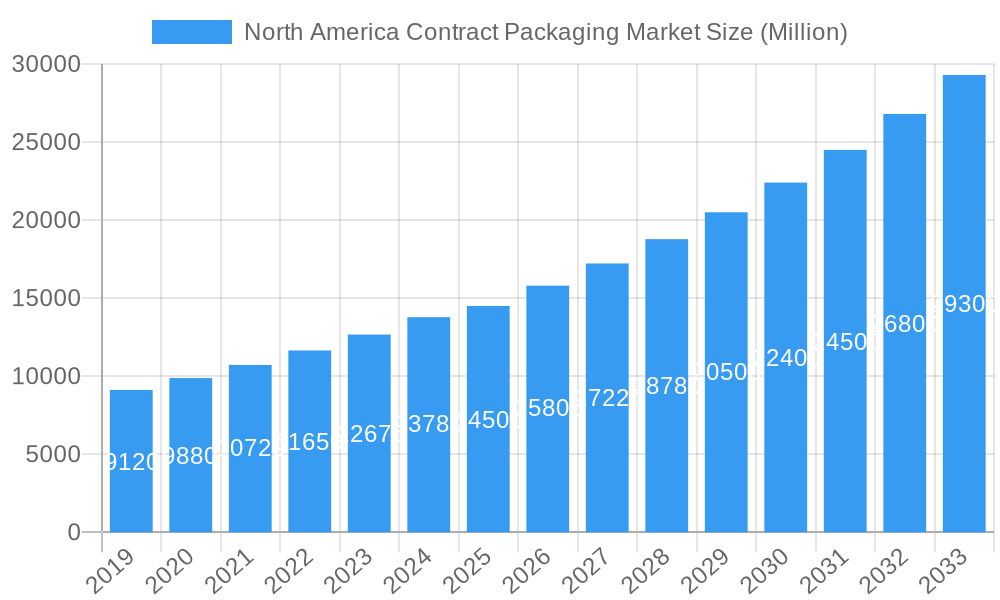

The North American contract packaging market is poised for robust expansion, projected to reach an estimated market size of $14,500 million in 2025 and sustain a compound annual growth rate (CAGR) of 9.70% through 2033. This significant growth is primarily fueled by an increasing demand for specialized packaging solutions across diverse end-user verticals. The food and beverage industry, a cornerstone of the North American economy, continues to drive demand for efficient and innovative packaging that ensures product integrity, extends shelf life, and meets evolving consumer preferences for convenience and sustainability. Simultaneously, the pharmaceutical sector's stringent regulatory requirements and the growing complexity of drug delivery systems necessitate sophisticated contract packaging services, including serialization and track-and-trace capabilities. E-commerce proliferation further acts as a potent growth catalyst, compelling businesses to adopt specialized secondary and tertiary packaging designed for direct-to-consumer shipping, emphasizing protection and branding.

North America Contract Packaging Market Market Size (In Billion)

Several key trends are shaping the North American contract packaging landscape. The escalating focus on sustainability is prompting a significant shift towards eco-friendly packaging materials, including recyclable, biodegradable, and compostable options, which contract packagers are increasingly integrating into their offerings. Automation and advanced manufacturing technologies are also playing a crucial role, enhancing operational efficiency, reducing costs, and improving the precision of packaging processes. Furthermore, the demand for customized and value-added services, such as kitting, assembly, and supply chain management integration, is on the rise as companies seek to outsource more aspects of their product fulfillment. While the market is generally strong, potential restraints include escalating raw material costs, particularly for plastics and paperboard, and a shortage of skilled labor in manufacturing. However, the inherent advantages of contract packaging – including cost savings, scalability, and access to specialized expertise and technology – are expected to outweigh these challenges, ensuring continued market momentum.

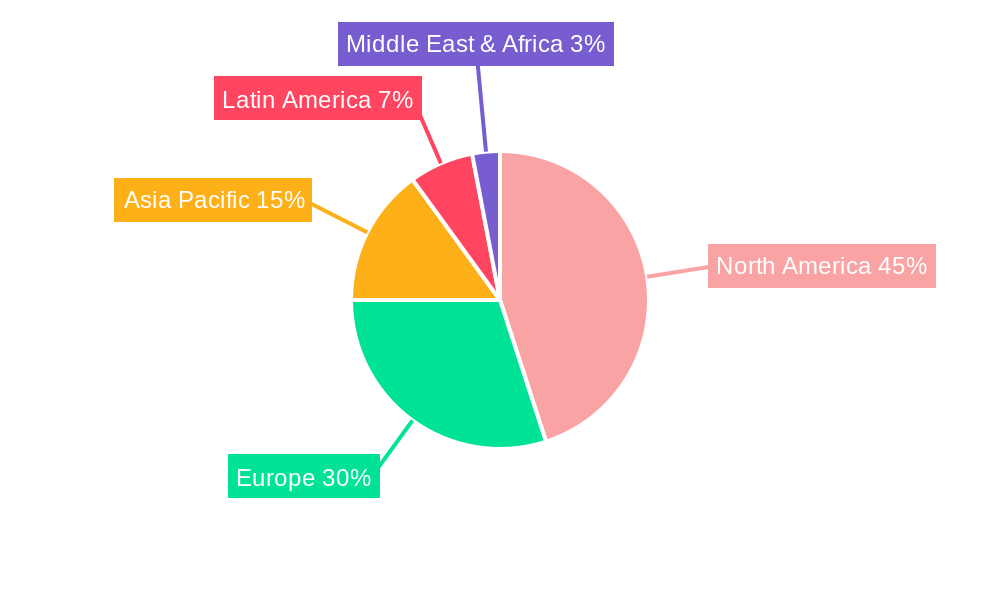

North America Contract Packaging Market Company Market Share

This in-depth market research report provides a definitive analysis of the North America Contract Packaging Market, a rapidly evolving sector essential to the success of diverse industries. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, and emerging opportunities. Our analysis offers unparalleled insights for stakeholders seeking to navigate the complexities of contract packaging solutions.

North America Contract Packaging Market Market Dynamics & Structure

The North America contract packaging market is characterized by a moderate to high level of concentration, with a few key players holding significant market share. However, the presence of numerous smaller, specialized contract packagers fosters a dynamic competitive environment. Technological innovation is a primary driver, with advancements in automation, serialization, and sustainable packaging materials constantly reshaping service offerings. Stringent regulatory frameworks, particularly within the pharmaceutical and food & beverage sectors, dictate quality standards and compliance requirements, creating both barriers to entry and opportunities for specialized expertise. Competitive product substitutes, such as in-house packaging operations and alternative supply chain models, are present but often prove less cost-effective or agile than outsourcing to contract packagers. End-user demographics are shifting, with increasing demand for customized solutions, faster turnaround times, and environmentally conscious packaging. Mergers and acquisitions (M&A) activity remains a significant trend, as larger players seek to expand their capabilities, geographic reach, and client portfolios, consolidating market influence. For instance, in 2021, Sharp invested USD17 million in its Conshohocken, PA facility, a strategic move to enhance its pharmaceutical packaging capabilities and demonstrate capacity expansion within the sector. This indicates a strong drive for growth through strategic investment and infrastructure development.

- Market Concentration: Moderate to high, with a mix of large, established players and specialized niche providers.

- Technological Innovation: Driven by automation, serialization, intelligent packaging, and sustainable materials.

- Regulatory Frameworks: Stringent regulations in pharmaceuticals and food & beverage demand high compliance and quality standards.

- Competitive Substitutes: In-house packaging, alternative supply chain models.

- End-User Demographics: Growing demand for customization, speed, and sustainability.

- M&A Trends: Active consolidation and strategic acquisitions to gain market share and capabilities.

North America Contract Packaging Market Growth Trends & Insights

The North America contract packaging market is projected for robust growth, driven by an increasing reliance on specialized outsourcing by manufacturers across key industries. The market size is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.8% during the forecast period (2025–2033). This expansion is fueled by several factors. Firstly, the growing complexity of product portfolios and the need for specialized packaging expertise, particularly in areas like pharmaceutical serialization and cold chain logistics, are pushing companies to partner with contract packagers. Secondly, the adoption rate of contract packaging services is escalating as businesses seek to optimize their supply chains, reduce operational costs, and focus on core competencies. Technological disruptions, such as the integration of AI for demand forecasting and advanced robotics for high-speed filling and packaging, are enhancing efficiency and offering greater flexibility to contract packagers. Consumer behavior shifts, including a heightened awareness of sustainability and the demand for convenience-oriented packaging formats, are also influencing market trends. For example, the increasing popularity of ready-to-drink (RTD) beverages necessitates specialized filling and packaging solutions, a service that contract packagers are well-positioned to provide. The pharmaceutical sector's stringent requirements for compliance, patient safety, and product integrity further cement the indispensable role of contract packaging. The historical period (2019-2024) has laid the groundwork for this accelerated growth, marked by increasing investments in capacity and technology. The base year 2025 is pivotal, signifying a mature yet dynamic market poised for significant expansion.

Dominant Regions, Countries, or Segments in North America Contract Packaging Market

Within the North America contract packaging market, the United States stands out as the dominant country, accounting for a substantial share of market revenue due to its large manufacturing base, advanced technological adoption, and the presence of major end-user industries. Among the packaging segments, Secondary Packaging is a key driver of market growth. This segment encompasses the immediate packaging that holds primary packages, offering branding, protection, and unitization for retail display and distribution. The demand for innovative secondary packaging solutions, such as customized folding cartons, blister packs, and shelf-ready packaging, is particularly high in the food and beverage, and pharmaceutical sectors.

The Pharmaceutical end-user vertical represents another dominant force in the contract packaging market. The stringent regulatory environment, complex product requirements (e.g., cold chain, sterile packaging), and the need for absolute precision and traceability make pharmaceutical companies heavily reliant on specialized contract packaging services. The increasing prevalence of biologics and personalized medicine further amplifies this dependence.

- Dominant Country: United States, driven by a robust manufacturing ecosystem and high demand from key industries.

- Dominant Packaging Segment: Secondary Packaging, crucial for product protection, branding, and retail readiness.

- Key drivers include demand for customized folding cartons, blister packs, and shelf-ready packaging.

- Dominant End-User Vertical: Pharmaceuticals, owing to strict regulatory demands, product complexity, and safety requirements.

- Growth is further propelled by advancements in biologics and personalized medicine.

- Market Share & Growth Potential: The U.S. market, coupled with the pharmaceutical sector and secondary packaging, exhibits the highest market share and substantial growth potential due to continuous innovation and evolving industry needs.

North America Contract Packaging Market Product Landscape

The product landscape of the North America contract packaging market is characterized by a wide array of solutions tailored to specific industry needs. Innovations focus on enhancing product protection, shelf-life extension, consumer convenience, and regulatory compliance. This includes advanced materials for primary packaging, such as high-barrier films and specialized blister packaging for pharmaceuticals, ensuring product integrity and safety. Secondary packaging innovations include intelligent design for improved retail display and sustainable material options for reduced environmental impact. Tertiary packaging solutions are optimized for efficient logistics and handling, with a focus on durability and ease of deployment. Performance metrics are critical, with contract packagers demonstrating capabilities in high-speed filling, precise dosing, tamper-evident sealing, and serialization for track-and-trace requirements, particularly vital for pharmaceuticals.

Key Drivers, Barriers & Challenges in North America Contract Packaging Market

Key Drivers: The North America contract packaging market is propelled by several key drivers. The increasing demand for specialized packaging expertise, particularly in regulated industries like pharmaceuticals and food, is a significant growth catalyst. Manufacturers are outsourcing to leverage the advanced capabilities and economies of scale offered by contract packagers, reducing their own capital expenditure and operational complexity. Technological advancements in automation, serialization, and sustainable packaging are creating new service opportunities and enhancing efficiency. The growing trend of product customization and smaller batch sizes also favors flexible contract packaging solutions. Economic factors, such as the need for cost optimization and supply chain efficiency, further encourage outsourcing.

Barriers & Challenges: Despite strong growth, the market faces several barriers and challenges. Stringent regulatory compliance, especially in the pharmaceutical sector, can be a hurdle, requiring significant investment in quality control and adherence to evolving standards. Supply chain disruptions, such as raw material shortages and logistics bottlenecks, can impact service delivery and lead times. Intense competition among contract packagers can lead to price pressures and reduced profit margins. Furthermore, the need for continuous investment in new technologies and infrastructure to keep pace with industry demands presents a capital expenditure challenge for many players. Maintaining data security and intellectual property protection for clients is also a critical concern.

Emerging Opportunities in North America Contract Packaging Market

Emerging opportunities in the North America contract packaging market lie in the growing demand for sustainable and eco-friendly packaging solutions, including biodegradable materials and recyclable packaging formats. The expansion of the e-commerce sector presents a significant opportunity for contract packagers specializing in customized shipping and fulfillment packaging. The increasing prevalence of personalized medicine and specialty pharmaceuticals is driving demand for highly specialized, small-batch contract packaging services. Furthermore, the rise of functional foods and beverages, requiring specific preservation and delivery methods, opens avenues for innovation. Contract packagers that can offer integrated services, from primary packaging to kitting and distribution, will be well-positioned to capitalize on these evolving market needs.

Growth Accelerators in the North America Contract Packaging Market Industry

The long-term growth of the North America contract packaging market is being accelerated by several key factors. Technological breakthroughs in areas like advanced robotics, artificial intelligence for supply chain optimization, and high-speed, precision filling equipment are enhancing operational efficiency and enabling contract packagers to handle more complex projects. Strategic partnerships between contract packagers and raw material suppliers, as well as collaborations with technology providers, are fostering innovation and expanding service portfolios. Market expansion strategies, including acquisitions to broaden capabilities and geographic reach, are also crucial growth accelerators. The increasing focus on supply chain resilience and nearshoring manufacturing trends further position contract packagers as essential partners for businesses seeking reliable and efficient packaging solutions.

Key Players Shaping the North America Contract Packaging Market Market

- AmeriPac

- Genco (FedEx Supply Chain)

- Jones Healthcare Group

- UNICEP Packaging LLC

- Aaron Thomas Company

- Complete Co-Packing Services Ltd

- Pharma Tech Industries Inc

- Co-Pak Packaging Group

- Reed Lane Inc

- WG-Pro Manufacturing Inc

- Multipack Solutions LLC

- Anderson Packaging LLC

- Stamar Packaging Inc

- Green Packaging Asia

- MJS Packaging

- Sharp Corporation (UDG)

Notable Milestones in North America Contract Packaging Market Sector

- May 2021: Sharp, a subsidiary of UDG Healthcare plc, invested USD17 million in its Conshohocken, PA location. This expansion, adding a 4-acre plot adjacent to existing facilities, bolsters their Blistering Centre of Excellence and signifies a major capacity development project within pharmaceutical contract packaging.

- December 2020: Complete Co-Packing Services Limited announced a partnership with Brewdog, a carbon-negative company, for the filling, packing, and distribution of their 2020 Craft Beer Advent Calendars and 12 LoneWolf Gins of Christmas. This highlights successful collaborations in the beverage sector.

In-Depth North America Contract Packaging Market Market Outlook

The North America contract packaging market is poised for sustained and significant growth, driven by the increasing demand for specialized outsourcing and the continuous evolution of consumer preferences and regulatory landscapes. Growth accelerators such as technological innovation in automation and sustainable packaging will empower contract packagers to offer more sophisticated and efficient solutions. Strategic partnerships and market consolidation will continue to shape the competitive environment, leading to a more integrated and capable industry. The market's future potential is immense, particularly in serving the pharmaceutical, food, and beverage sectors, where precision, compliance, and agility are paramount. Businesses seeking to optimize their supply chains and enhance their product offerings will increasingly rely on the expertise and capabilities of contract packaging providers, making this a critical and dynamic market segment for years to come.

North America Contract Packaging Market Segmentation

-

1. Packaging

- 1.1. Primary Packaging

- 1.2. Secondary Packaging

- 1.3. Tertiary Packaging

-

2. End-User Vertical

- 2.1. Beverages

- 2.2. Pharmaceuticals

- 2.3. Food

North America Contract Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Contract Packaging Market Regional Market Share

Geographic Coverage of North America Contract Packaging Market

North America Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Steady rise in demand from the food industry; Recent trend of outsourcing non-core operations; Ongoing efforts towards serialization in the pharmaceutical sector

- 3.3. Market Restrains

- 3.3.1. In-house Packaging; Increasing Lead Time and Logistics Cost

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is one of the Significant Factor for Growth of Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging

- 5.1.1. Primary Packaging

- 5.1.2. Secondary Packaging

- 5.1.3. Tertiary Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Beverages

- 5.2.2. Pharmaceuticals

- 5.2.3. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Packaging

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AmeriPac

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Genco (FedEx Supply Chain)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jones Healthcare Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UNICEP Packaging LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aaron Thomas Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Complete Co-Packing Services Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pharma Tech Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Co-Pak Packaging Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Reed Lane Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WG-Pro Manufacturing Inc*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Multipack Solutions LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Anderson Packaging LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Stamar Packaging Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Green Packaging Asia

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 MJS Packaging

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Sharp Corporation (UDG)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 AmeriPac

List of Figures

- Figure 1: North America Contract Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 2: North America Contract Packaging Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 3: North America Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 5: North America Contract Packaging Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 6: North America Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Contract Packaging Market?

The projected CAGR is approximately 9.70%.

2. Which companies are prominent players in the North America Contract Packaging Market?

Key companies in the market include AmeriPac, Genco (FedEx Supply Chain), Jones Healthcare Group, UNICEP Packaging LLC, Aaron Thomas Company, Complete Co-Packing Services Ltd, Pharma Tech Industries Inc, Co-Pak Packaging Group, Reed Lane Inc, WG-Pro Manufacturing Inc*List Not Exhaustive, Multipack Solutions LLC, Anderson Packaging LLC, Stamar Packaging Inc, Green Packaging Asia, MJS Packaging, Sharp Corporation (UDG).

3. What are the main segments of the North America Contract Packaging Market?

The market segments include Packaging, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Steady rise in demand from the food industry; Recent trend of outsourcing non-core operations; Ongoing efforts towards serialization in the pharmaceutical sector.

6. What are the notable trends driving market growth?

Food and Beverage Industry is one of the Significant Factor for Growth of Market.

7. Are there any restraints impacting market growth?

In-house Packaging; Increasing Lead Time and Logistics Cost.

8. Can you provide examples of recent developments in the market?

May 2021 - Sharp, a subsidiary of UDG Healthcare plc, a global leader in contract packaging and clinical supply services, has invested USD17 million in its Conshohocken, PA location. The new 4-acre plot is directly adjacent to Sharp's two enduring commercial pharmaceutical packaging buildings, which collectively form the organization's Blistering Centre of Excellence and is the most developed addition to an ongoing capacity development project at the Conshohocken campus.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Contract Packaging Market?

To stay informed about further developments, trends, and reports in the North America Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence