Key Insights

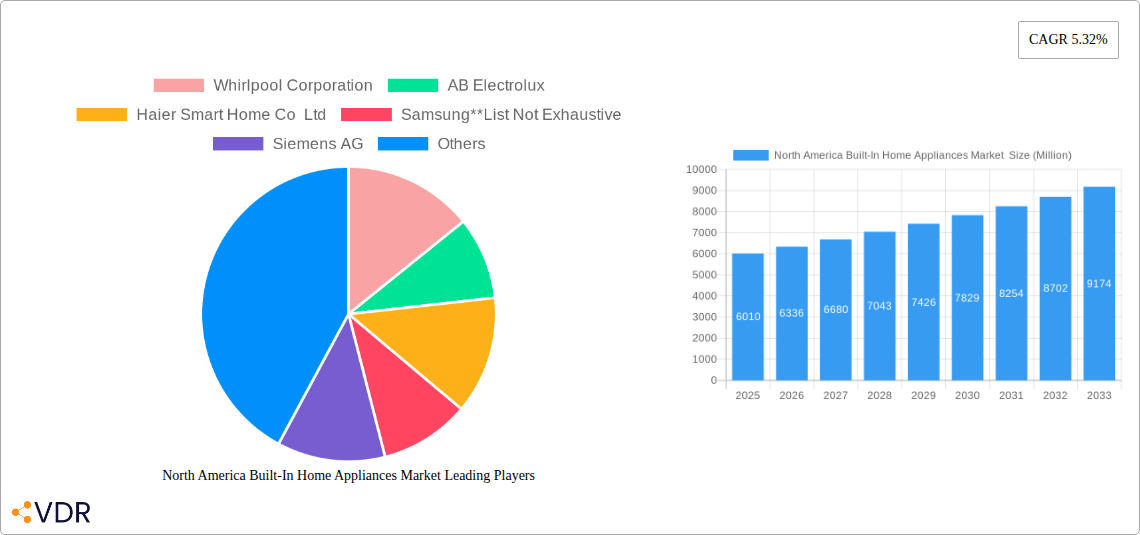

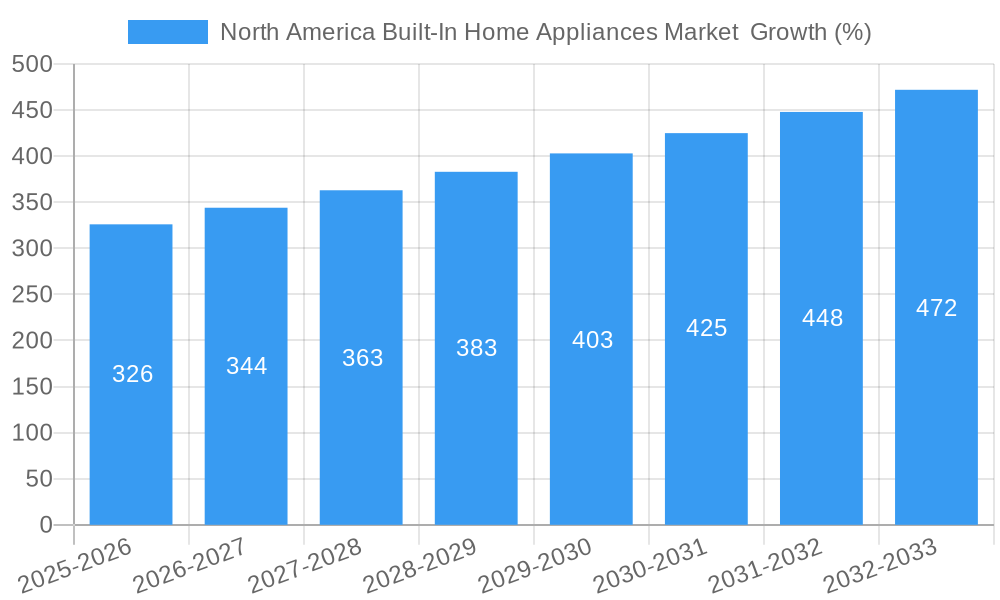

The North America built-in home appliances market, valued at $6.01 billion in 2025, is projected to experience robust growth, driven by increasing disposable incomes, a preference for modern, space-saving kitchen designs, and a rising demand for sophisticated, technologically advanced appliances. The market's Compound Annual Growth Rate (CAGR) of 5.32% from 2025 to 2033 indicates a significant expansion, with key segments like built-in refrigerators and ovens leading the charge. Consumers are increasingly prioritizing convenience, energy efficiency, and smart home integration, fueling the adoption of premium built-in appliances. The growth is further propelled by the expanding e-commerce sector, offering greater accessibility and choice to consumers. While supply chain disruptions and potential inflationary pressures could pose challenges, the long-term outlook remains positive, particularly given the ongoing trend towards kitchen renovations and new home construction.

The market segmentation reveals strong performance across product types, with built-in refrigerators consistently demonstrating high demand due to their space-saving design and integration capabilities. Built-in ovens and microwaves also constitute significant market shares, reflecting the increasing popularity of combination units and smart cooking technology. The end-user segment is primarily driven by homeowners, with a notable contribution from the rental and hospitality sectors. Distribution channels show a healthy mix, with supermarkets/hypermarkets retaining a substantial market share, alongside the rapidly expanding e-commerce segment which provides consumers with a broader selection and convenient purchasing experience. Key players like Whirlpool, Electrolux, Haier, Samsung, and Bosch are actively competing through innovation and brand recognition, influencing market trends and consumer preferences. The continued focus on sustainability and energy-efficient designs will further shape the market trajectory in the coming years.

This in-depth report provides a comprehensive analysis of the North America built-in home appliances market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, regional segmentation (by product type, end-user, and distribution channel), competitive landscape, and future outlook. This report is an essential resource for industry professionals, investors, and anyone seeking a thorough understanding of this dynamic sector. The report utilizes data in Million units.

North America Built-In Home Appliances Market Dynamics & Structure

The North American built-in home appliance market is characterized by a moderately concentrated landscape, with key players like Whirlpool Corporation, AB Electrolux, Haier Smart Home Co Ltd, Samsung, Siemens AG, and others vying for market share. Technological innovations, particularly in smart home integration and energy efficiency, are significant drivers. Stringent energy efficiency regulations are shaping product development and consumer choices. The market witnesses continuous technological advancements and competition from other kitchen appliances. The growing popularity of smart homes and the increasing demand for high-end home appliances are also key drivers. The market experienced xx M&A deals in the historical period (2019-2024), with xx% of deals focusing on technological advancements and strengthening market position.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Smart home integration, energy-efficient designs, and advanced cooking features are key drivers.

- Regulatory Framework: Stringent energy efficiency standards influence product development and consumer choices.

- Competitive Substitutes: Standalone appliances and other kitchen solutions present competitive pressure.

- End-User Demographics: Growing affluent households and rising disposable incomes fuel market growth.

- M&A Trends: Focus on technological advancements and strategic market expansion.

North America Built-In Home Appliances Market Growth Trends & Insights

The North America built-in home appliances market witnessed substantial growth during the historical period (2019-2024), expanding from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. This growth is attributed to several factors, including rising disposable incomes, increasing urbanization, and a shift towards modern and convenient kitchen solutions. The market is expected to continue its growth trajectory during the forecast period (2025-2033), driven by technological advancements like smart appliances and the increasing adoption of smart home technology. Consumer preferences are shifting towards energy-efficient and aesthetically pleasing built-in appliances. Market penetration is expected to reach xx% by 2033.

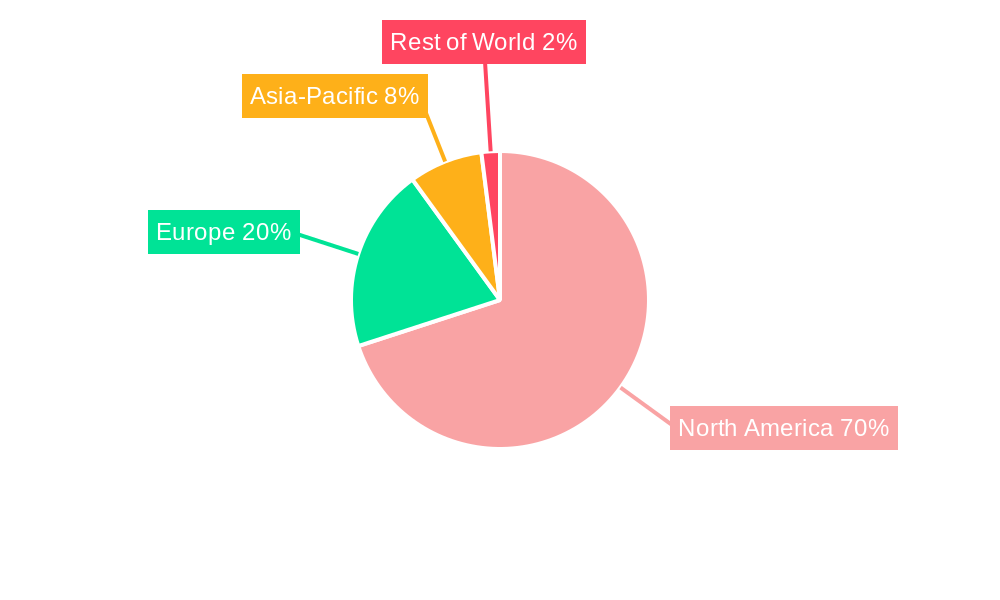

Dominant Regions, Countries, or Segments in North America Built-In Home Appliances Market

The United States remains the dominant market within North America, accounting for approximately xx% of the total market share in 2024. The Built-in Refrigerators segment holds the largest share within the product type category, driven by increasing demand for space-saving and energy-efficient solutions. Supermarkets/Hypermarkets remain the leading distribution channel due to their extensive reach and brand visibility. High-end residential construction is a key driver within the end-user segment. Canada is showing promising growth potential due to rising disposable incomes and a growing preference for modern kitchens.

- By Product Type: Built-in Refrigerators (xx million units in 2024), Built-in Ovens and Microwaves (xx million units in 2024), Built-in Hob (xx million units in 2024), Built-in Hoods (xx million units in 2024)

- By End-User: High-end residential construction (xx million units in 2024) and renovations are key drivers.

- By Distribution Channel: Supermarkets/Hypermarkets (xx million units in 2024) maintain dominance.

North America Built-In Home Appliances Market Product Landscape

The market showcases a wide range of built-in appliances, incorporating smart features like Wi-Fi connectivity, voice control, and precise temperature monitoring. Product innovations focus on improved energy efficiency, enhanced cooking performance, and seamless integration with other smart home devices. Unique selling propositions include sleek designs, customizable options, and advanced cooking functionalities. Technological advancements continue to drive market innovation, focusing on convenience, improved performance, and enhanced user experience.

Key Drivers, Barriers & Challenges in North America Built-In Home Appliances Market

Key Drivers:

- Rising disposable incomes and consumer spending on home improvements.

- Increasing demand for smart home integration and advanced functionalities.

- Growing preference for aesthetically pleasing and space-saving kitchen appliances.

Challenges & Restraints:

- Supply chain disruptions and increased raw material costs impacting production and pricing.

- Intense competition among established players and emerging brands.

- Stringent regulatory requirements for energy efficiency and safety standards. These factors may increase production costs by approximately xx%.

Emerging Opportunities in North America Built-In Home Appliances Market

- Expansion into smaller kitchen spaces with compact and efficient appliances.

- Growing demand for customizable and personalized built-in appliances.

- Increasing adoption of eco-friendly and sustainable materials and manufacturing processes.

Growth Accelerators in the North America Built-In Home Appliances Market Industry

Technological advancements, particularly in smart home technology and energy efficiency, are significant long-term growth catalysts. Strategic partnerships between appliance manufacturers and smart home technology providers are fostering innovation and market expansion. Furthermore, focused marketing strategies targeting specific consumer demographics are driving market growth and brand loyalty.

Key Players Shaping the North America Built-In Home Appliances Market Market

- Whirlpool Corporation

- AB Electrolux

- Haier Smart Home Co Ltd

- Samsung

- Siemens AG

- Danby

- Robert Bosch GmbH

- IFB Appliances

- LG Electronics

- Panasonic Holdings Corporation

Notable Milestones in North America Built-In Home Appliances Market Sector

- September 2023: Samsung launched a new oven with internal temperature monitoring and customizable notifications.

- August 2023: LG Electronics introduced a new built-in kitchen package at IFA 2023, strengthening its premium product lineup.

In-Depth North America Built-In Home Appliances Market Market Outlook

The North America built-in home appliances market is poised for continued growth, driven by sustained technological advancements, increasing consumer demand for smart and energy-efficient appliances, and the expanding smart home ecosystem. Strategic partnerships, product diversification, and targeted marketing initiatives will play a crucial role in shaping the market's future. Opportunities exist for companies to capitalize on evolving consumer preferences for sustainable and customizable solutions, further driving market expansion and innovation.

North America Built-In Home Appliances Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Built-In Home Appliances Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Built-In Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Household Disposable Income Drives the Market; Changing Lifestyles Drives the Market

- 3.3. Market Restrains

- 3.3.1. Repairing Challenges; Infrastructure and Space Limitations

- 3.4. Market Trends

- 3.4.1. United States Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Whirlpool Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 AB Electrolux

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Haier Smart Home Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samsung**List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Danby

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 IFB Appliances

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 LG Electronics

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Holdings Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Whirlpool Corporation

List of Figures

- Figure 1: North America Built-In Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Built-In Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: North America Built-In Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Built-In Home Appliances Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Built-In Home Appliances Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Built-In Home Appliances Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Built-In Home Appliances Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Built-In Home Appliances Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Built-In Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Built-In Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Built-In Home Appliances Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Built-In Home Appliances Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Built-In Home Appliances Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Built-In Home Appliances Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Built-In Home Appliances Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Built-In Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Built-In Home Appliances Market ?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the North America Built-In Home Appliances Market ?

Key companies in the market include Whirlpool Corporation, AB Electrolux, Haier Smart Home Co Ltd, Samsung**List Not Exhaustive, Siemens AG, Danby, Robert Bosch GmbH, IFB Appliances, LG Electronics, Panasonic Holdings Corporation.

3. What are the main segments of the North America Built-In Home Appliances Market ?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Household Disposable Income Drives the Market; Changing Lifestyles Drives the Market.

6. What are the notable trends driving market growth?

United States Dominates the Market.

7. Are there any restraints impacting market growth?

Repairing Challenges; Infrastructure and Space Limitations.

8. Can you provide examples of recent developments in the market?

September 2023: Samsung launched a new oven that enables consumers to monitor internal temperature and set notifications at various cooking stages, which provides convenience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Built-In Home Appliances Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Built-In Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Built-In Home Appliances Market ?

To stay informed about further developments, trends, and reports in the North America Built-In Home Appliances Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence