Key Insights

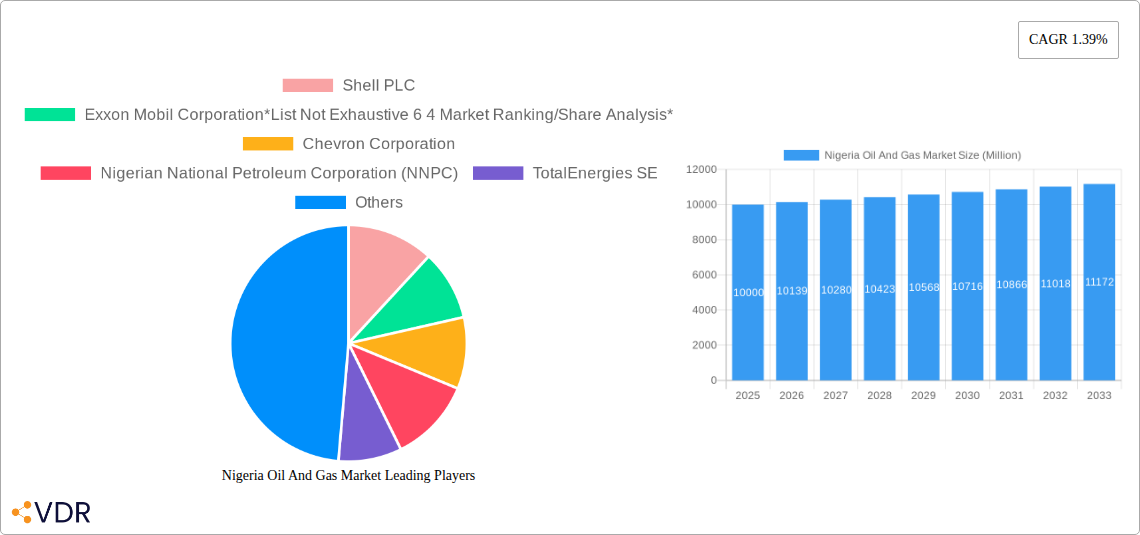

The Nigerian oil and gas market, while facing significant challenges, presents a complex landscape of opportunities and risks. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 1.39% and a known 2019-2024 historical period), is projected to experience moderate growth throughout the forecast period (2025-2033). Key drivers include ongoing domestic demand for energy, substantial oil reserves, and the potential for increased gas production and utilization, particularly for power generation and industrial applications. However, significant restraints exist, notably security concerns in the Niger Delta region affecting production and investment, aging infrastructure requiring substantial upgrades, and the global push towards renewable energy sources, potentially impacting long-term demand for fossil fuels. The market is segmented into upstream (exploration and production), midstream (processing and transportation), and downstream (refining and marketing) sectors, with each facing unique challenges and growth opportunities. Major players like Shell PLC, ExxonMobil, Chevron, NNPC, and TotalEnergies SE are actively navigating these complexities, influencing market dynamics through their investments and operational strategies. The forecast period will likely witness a shift towards greater gas monetization and improved infrastructure development.

Growth in the Nigerian oil and gas sector will hinge on addressing the significant infrastructure deficit and security challenges. Successful government initiatives aimed at fostering a stable investment climate, promoting local content development, and diversifying the energy mix will play a critical role in shaping the market's trajectory. While global trends toward renewable energy pose a long-term challenge, the sustained domestic need for energy and the potential for export growth in liquefied natural gas (LNG) could provide resilience for the sector. This balanced perspective highlights both the potential for sustained growth and the significant headwinds the market must overcome. Detailed strategic analysis considering these factors is crucial for investors and stakeholders in the Nigerian energy sector.

Nigeria Oil & Gas Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Nigeria Oil & Gas market, covering market dynamics, growth trends, key players, and future outlook. With a focus on the upstream, midstream, and downstream sectors, this study offers invaluable insights for industry professionals, investors, and policymakers seeking to understand and navigate this dynamic market. The report utilizes data from 2019-2024 (historical period), with a base year of 2025 and forecasts extending to 2033. The market size is presented in million units.

Nigeria Oil & Gas Market Market Dynamics & Structure

The Nigerian oil and gas market is characterized by a complex interplay of factors influencing its structure and growth. Market concentration is relatively high, with a few major international and national players dominating the upstream sector. Technological innovation is crucial, driven by the need to enhance efficiency, improve recovery rates, and explore new resources. The regulatory framework, often undergoing changes, significantly impacts investment decisions and operational strategies. Competitive product substitutes, such as renewable energy sources, are gradually emerging, posing a long-term challenge. End-user demographics, primarily focused on domestic consumption and export markets, play a key role in shaping demand patterns. Mergers and acquisitions (M&A) activity remains a significant aspect of market consolidation.

- Market Concentration: High, with major players holding significant market share (xx%).

- Technological Innovation: Driven by enhanced oil recovery (EOR) techniques and gas monetization projects.

- Regulatory Framework: Subject to frequent changes impacting investment decisions.

- Competitive Substitutes: Renewable energy sources pose a long-term threat.

- M&A Activity: xx deals valued at xx million units recorded between 2019 and 2024.

Nigeria Oil & Gas Market Growth Trends & Insights

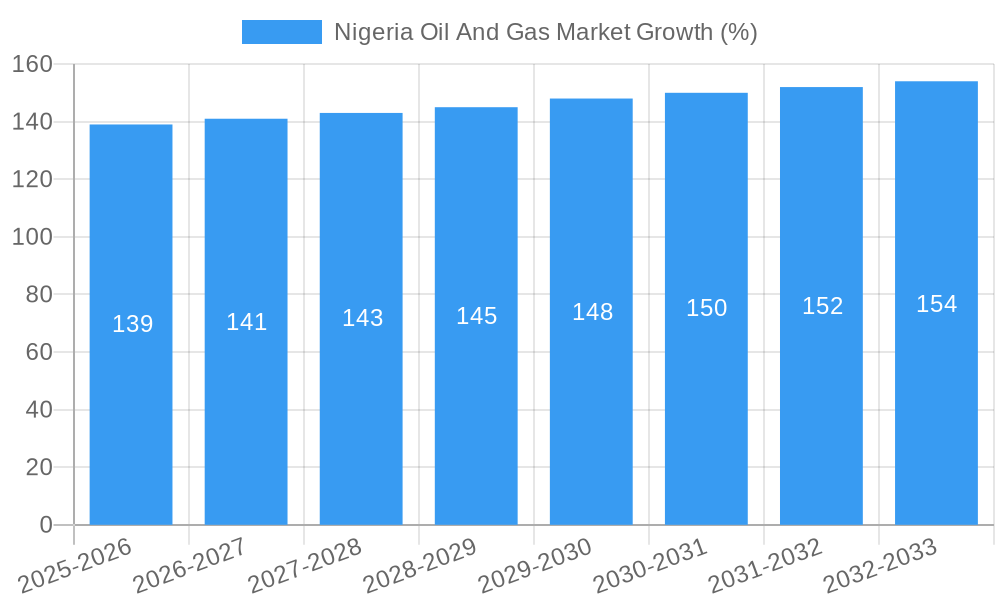

The Nigerian oil and gas market exhibits a fluctuating growth trajectory, influenced by global oil price volatility, domestic policy shifts, and investment levels. Historical growth (2019-2024) showed a CAGR of xx%, with significant variations year-on-year. Adoption rates for new technologies have been moderate due to high upfront investment costs and regulatory hurdles. Technological disruptions, like the increasing adoption of digital oilfield technologies, are steadily improving efficiency and productivity. Shifts in consumer behavior, primarily driven by changing energy consumption patterns, require strategic adaptation by market players. The market size in 2025 is estimated at xx million units, and is projected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in Nigeria Oil And Gas Market

The Upstream sector currently dominates the Nigerian oil and gas market, driven by significant reserves and ongoing exploration activities. The Niger Delta region is a key hub for oil production, contributing a substantial share of the national output. Several factors underpin the dominance of this sector:

- Abundant Reserves: Nigeria holds significant proven oil and gas reserves.

- Government Policies: The government has historically prioritized oil and gas exploration and production.

- Infrastructure Investments: Significant investment in pipelines, processing facilities and other infrastructure.

- Export Markets: Nigeria exports a significant portion of its oil and gas production, contributing to export revenues.

The midstream and downstream sectors are also significant but exhibit slower growth compared to the upstream segment due to infrastructure limitations and regulatory challenges.

Nigeria Oil & Gas Market Product Landscape

The Nigerian oil and gas market encompasses a range of products, including crude oil, natural gas, refined petroleum products, and petrochemicals. Recent product innovations focus on improving efficiency in exploration and production, enhancing gas processing and distribution, and optimizing refining processes. Technological advancements in areas like EOR and digital oilfields are enhancing production and optimizing resource utilization. The emphasis is on creating products that meet evolving environmental regulations and market demands for cleaner energy solutions.

Key Drivers, Barriers & Challenges in Nigeria Oil And Gas Market

Key Drivers:

- Abundant Reserves: Nigeria possesses significant oil and gas reserves.

- Growing Domestic Demand: Increasing energy needs are driving domestic consumption.

- Government Initiatives: Focus on gas monetization and infrastructure development.

Key Challenges:

- Security Concerns: Operational challenges and insecurity in the Niger Delta hinder production and operations, impacting the market by approximately xx million units per year.

- Regulatory Uncertainty: Frequent changes in regulations create investment uncertainty.

- Infrastructure Gaps: Limited midstream and downstream infrastructure constrains growth.

- Funding Constraints: securing required funding for exploration and production is challenging.

Emerging Opportunities in Nigeria Oil & Gas Market

- Gas Monetization: Significant potential for gas exploration and utilization as a cleaner fuel source.

- Renewable Energy Integration: Opportunities for integrating renewable energy sources into the energy mix.

- Deepwater Exploration: Exploration and production in deepwater areas offer significant potential.

- Investment in Refining Capacity: Developing domestic refining capacity will reduce reliance on imports.

Growth Accelerators in the Nigeria Oil & Gas Market Industry

Long-term growth hinges on overcoming the challenges outlined above. Technological breakthroughs in EOR and gas processing are crucial. Strategic partnerships between international and domestic players can attract investment and expertise. Aggressive expansion strategies, particularly in the gas sector, can unlock significant growth potential. Government initiatives to streamline regulations and enhance security will be vital for driving sustainable development.

Key Players Shaping the Nigeria Oil And Gas Market Market

- Shell PLC

- Exxon Mobil Corporation

- Chevron Corporation

- Nigerian National Petroleum Corporation (NNPC)

- TotalEnergies SE

Notable Milestones in Nigeria Oil And Gas Market Sector

- August 2022: NNPC renewed oil production sharing agreements with Shell, Equinox, Chevron, ExxonMobil, Sinopec, and South Atlantic Petroleum for five deep-water blocks, aiming for 10 billion barrels of oil production over 20 years.

- June 2022: Nigerian government approved the Nigeria-Morocco gas pipeline project, spanning 6,000 kilometers across 13 African countries, with over 5,000 billion cubic meters of gas projected for delivery to Morocco.

In-Depth Nigeria Oil & Gas Market Market Outlook

The future of the Nigerian oil and gas market is promising, despite challenges. Addressing security issues, regulatory uncertainty, and infrastructure gaps will be critical for unlocking the market's full potential. Increased investment in gas infrastructure and exploration, coupled with strategic partnerships and technological advancements, will drive substantial long-term growth. Focus on gas monetization and exploring renewable energy integration will offer new strategic opportunities and contribute to a more sustainable energy future for Nigeria.

Nigeria Oil And Gas Market Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Nigeria Oil And Gas Market Segmentation By Geography

- 1. Niger

Nigeria Oil And Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Growing Investments in Natural Gas Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Vandalization and Threats By Militants On Oil And Gas Infrastructures

- 3.4. Market Trends

- 3.4.1. The Upstream Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Oil And Gas Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Exxon Mobil Corporation*List Not Exhaustive 6 4 Market Ranking/Share Analysis*

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nigerian National Petroleum Corporation (NNPC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TotalEnergies SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Nigeria Oil And Gas Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Oil And Gas Market Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Oil And Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Oil And Gas Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Nigeria Oil And Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: Nigeria Oil And Gas Market Volume Billion Forecast, by Sector 2019 & 2032

- Table 5: Nigeria Oil And Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Nigeria Oil And Gas Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Nigeria Oil And Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Nigeria Oil And Gas Market Volume Billion Forecast, by Country 2019 & 2032

- Table 9: Nigeria Oil And Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 10: Nigeria Oil And Gas Market Volume Billion Forecast, by Sector 2019 & 2032

- Table 11: Nigeria Oil And Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Nigeria Oil And Gas Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Oil And Gas Market?

The projected CAGR is approximately 1.39%.

2. Which companies are prominent players in the Nigeria Oil And Gas Market?

Key companies in the market include Shell PLC, Exxon Mobil Corporation*List Not Exhaustive 6 4 Market Ranking/Share Analysis*, Chevron Corporation, Nigerian National Petroleum Corporation (NNPC), TotalEnergies SE.

3. What are the main segments of the Nigeria Oil And Gas Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Growing Investments in Natural Gas Infrastructure.

6. What are the notable trends driving market growth?

The Upstream Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Vandalization and Threats By Militants On Oil And Gas Infrastructures.

8. Can you provide examples of recent developments in the market?

August 2022: NNPC, Nigeria's state-owned oil firm, renewed its oil production sharing agreements with international oil companies Shell, Equinox, Chevron, ExxonMobil, China's Sinopec, and Nigerian firm South Atlantic Petroleum for five deep-water blocks. The company aims to produce up to 10 billion barrels of oil over the next 20 years. NNPC jointly and separately owns the OML 128, 130, 132, 133, and 138 blocks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Oil And Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Oil And Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Oil And Gas Market?

To stay informed about further developments, trends, and reports in the Nigeria Oil And Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence