Key Insights

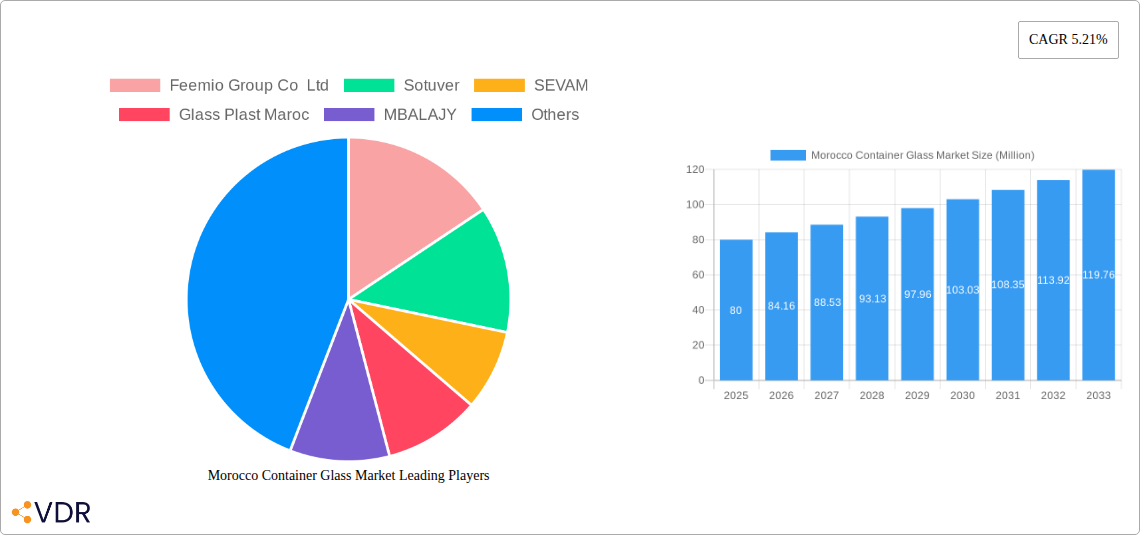

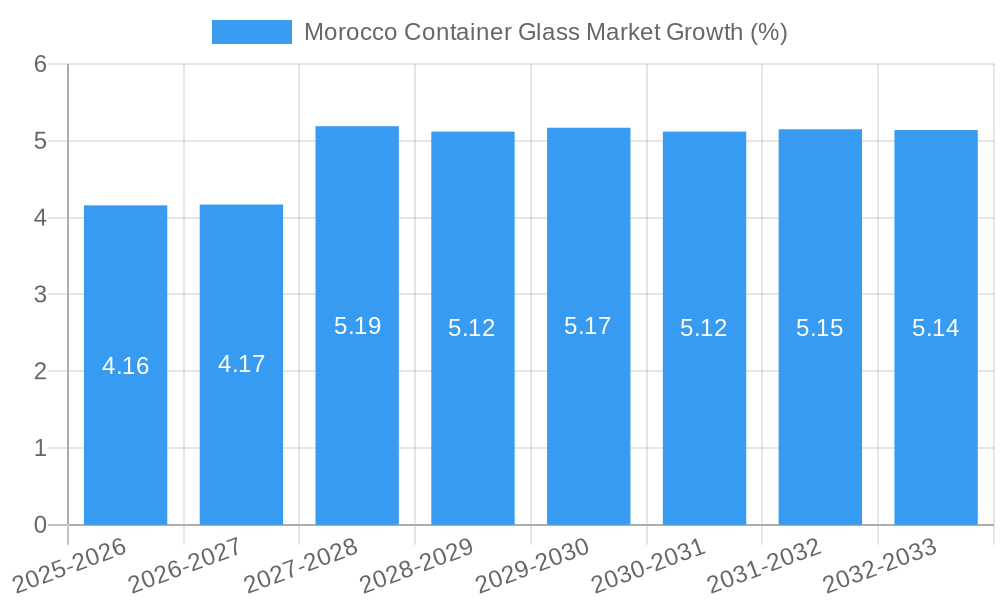

The Morocco container glass market, valued at approximately $80 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.21% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning food and beverage industry within Morocco is a primary catalyst, demanding increased packaging solutions. Simultaneously, a rising consumer preference for glass packaging, due to its perceived health and environmental benefits, fuels market demand. Government initiatives promoting sustainable packaging practices further contribute to market growth. While a lack of advanced manufacturing technologies in some segments and potential price fluctuations in raw materials (like silica sand) pose challenges, the overall market outlook remains positive. The market is segmented by various factors, including product type (bottles, jars, etc.), end-use industry (food and beverage, pharmaceutical etc.), and distribution channels. Companies like Feemio Group Co Ltd, Sotuver, SEVAM, Glass Plast Maroc, MBALAJY, Le Verre Beldi, and GRASSE SENTEURS are key players, contributing to the competitive dynamics within the market.

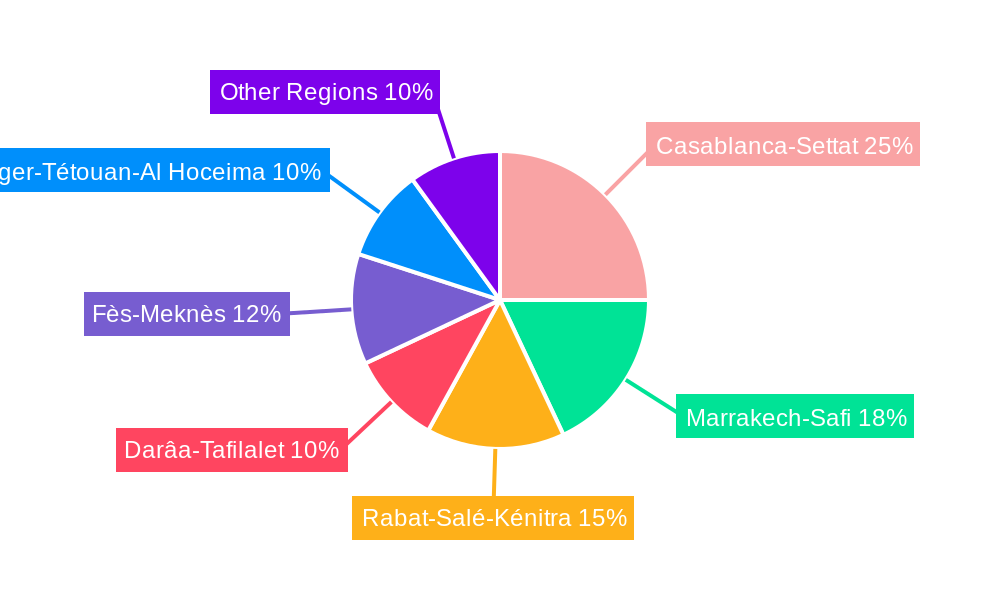

Further analysis reveals that the regional distribution of the market is likely skewed towards urban centers, reflecting higher consumption rates and better infrastructure. The historical period (2019-2024) likely saw a more moderate growth rate, given the global economic fluctuations during that time. The forecast period (2025-2033) presents a more optimistic trajectory, underpinned by the factors mentioned earlier. Future growth will be influenced by the ongoing expansion of the food and beverage sector, as well as the success of government-led initiatives promoting sustainable packaging. The competitive landscape will continue to evolve, with existing players investing in capacity expansion and innovation to cater to the growing demand. The potential entry of new players cannot be discounted, potentially increasing market competition and accelerating innovation.

Morocco Container Glass Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Morocco container glass market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and stakeholders. The market is segmented into various categories (specific segments will be detailed within the full report), providing a granular understanding of this dynamic sector. The total market size in 2025 is estimated at xx Million units.

Morocco Container Glass Market Dynamics & Structure

The Moroccan container glass market exhibits a moderately concentrated structure, with key players such as Feemio Group Co Ltd, Sotuver, SEVAM, Glass Plast Maroc, MBALAJY, Le Verre Beldi, and GRASSE SENTEURS (list not exhaustive) vying for market share. Technological innovation, primarily in furnace technology and production efficiency, plays a crucial role, alongside government regulations regarding environmental sustainability and product safety. Competitive pressures stem from alternative packaging materials, such as plastic and aluminum, impacting the market's overall growth trajectory.

- Market Concentration: xx% held by top 5 players in 2025.

- Technological Innovation: Focus on energy efficiency and automation.

- Regulatory Framework: Stringent environmental standards impacting production processes.

- Competitive Substitutes: Growing competition from plastic and aluminum containers.

- End-User Demographics: Strong demand from the food and beverage, cosmetics, and pharmaceutical sectors.

- M&A Activity: xx M&A deals recorded between 2019-2024, with a focus on expansion and technological upgrades.

Morocco Container Glass Market Growth Trends & Insights

The Moroccan container glass market is projected to experience substantial growth during the forecast period (2025-2033), driven by factors such as rising domestic consumption, infrastructure development, and increasing demand from various end-use sectors. The market size is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements, particularly in automation and energy efficiency, are further enhancing market growth. Changes in consumer preferences, towards eco-friendly packaging and premium products are influencing packaging choices.

Dominant Regions, Countries, or Segments in Morocco Container Glass Market

The analysis reveals that the [Specific Region/City in Morocco - needs data to fill this in] region/segment is currently the dominant force in the Moroccan container glass market. This dominance is primarily attributed to:

- Strong Industrial Base: High concentration of food and beverage processing facilities.

- Favorable Economic Policies: Government initiatives supporting manufacturing and industrial growth.

- Developed Infrastructure: Efficient transportation networks facilitating ease of distribution.

- Growing Population: Increased consumption and demand for packaged goods.

This region's market share is projected to remain significant throughout the forecast period, although other regions are expected to witness growth due to increased investment and development.

Morocco Container Glass Market Product Landscape

The Moroccan container glass market offers a diverse range of products, encompassing various sizes, shapes, colors, and functionalities to cater to diverse end-user needs. Innovations focus on enhancing product durability, improving aesthetic appeal, and optimizing the use of recycled glass. The unique selling propositions frequently highlight eco-friendly production methods and customized packaging solutions.

Key Drivers, Barriers & Challenges in Morocco Container Glass Market

Key Drivers:

- Growing Food & Beverage Sector: Expanding domestic consumption and export demand.

- Rising Demand for Cosmetics & Pharmaceuticals: Increased use of glass packaging for premium products.

- Government Support for Manufacturing: Policies encouraging industrial growth and investment.

Key Challenges:

- Fluctuations in Raw Material Prices: Impacting production costs and profitability.

- Competition from Alternative Packaging Materials: Pressure from sustainable and cost-effective alternatives.

- Energy Costs: Significant impact on production costs.

Emerging Opportunities in Morocco Container Glass Market

- Sustainable Packaging Solutions: Increasing consumer demand for eco-friendly glass packaging.

- Customized Packaging Designs: Tailored solutions for specific product needs and branding.

- Growth of the E-commerce Sector: Increased demand for packaging for online retail.

Growth Accelerators in the Morocco Container Glass Market Industry

The long-term growth of the Moroccan container glass market is driven by factors such as technological advancements in glass production, strategic partnerships between manufacturers and end-users, and expansion into new market segments like cosmetics and pharmaceuticals. Further market consolidation through mergers and acquisitions could also accelerate growth.

Key Players Shaping the Morocco Container Glass Market Market

- Feemio Group Co Ltd

- Sotuver

- SEVAM

- Glass Plast Maroc

- MBALAJY

- Le Verre Beldi

- GRASSE SENTEURS

- List Not Exhaustive

Notable Milestones in Morocco Container Glass Market Sector

- October 2023: Furnotherm Glass completes the reconstruction of SEVAM's 210 tonnes-per-day container glass furnace, boosting production capacity.

- July 2024: SoPharma's partnership with L’OCCITANE Group for the Erborian brand creates new opportunities for container glass in the cosmetics sector.

In-Depth Morocco Container Glass Market Market Outlook

The future of the Moroccan container glass market looks promising, driven by continued economic growth, increasing consumer demand, and technological innovations in sustainable packaging solutions. Strategic partnerships and investments in capacity expansion will further shape the market landscape, presenting significant opportunities for both established players and new entrants. The market is expected to maintain a steady growth trajectory throughout the forecast period, positioning it as a key player in the broader North African packaging industry.

Morocco Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

-

1.1.1. Alcoholi

- 1.1.1.1. Beer

- 1.1.1.2. Wine

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alco

- 1.1.2.1. Carbonated Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Other Non-Alcoholic Beverages

-

1.1.1. Alcoholi

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End user verticals

-

1.1. Beverage

Morocco Container Glass Market Segmentation By Geography

- 1. Morocco

Morocco Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Urbanization and Sustainability Trends to Drive the Market; End-User Industries to Drive the Demand for Container Glass Market

- 3.3. Market Restrains

- 3.3.1. Rise in Urbanization and Sustainability Trends to Drive the Market; End-User Industries to Drive the Demand for Container Glass Market

- 3.4. Market Trends

- 3.4.1. Rise in Urbanization to Drive the Demand for Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholi

- 5.1.1.1.1. Beer

- 5.1.1.1.2. Wine

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alco

- 5.1.1.2.1. Carbonated Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Other Non-Alcoholic Beverages

- 5.1.1.1. Alcoholi

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End user verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Feemio Group Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sotuver

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SEVAM

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Glass Plast Maroc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MBALAJY

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Le Verre Beldi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GRASSE SENTEURS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Feemio Group Co Ltd

List of Figures

- Figure 1: Morocco Container Glass Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Morocco Container Glass Market Share (%) by Company 2024

List of Tables

- Table 1: Morocco Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Morocco Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: Morocco Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Morocco Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Morocco Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Container Glass Market?

The projected CAGR is approximately 5.21%.

2. Which companies are prominent players in the Morocco Container Glass Market?

Key companies in the market include Feemio Group Co Ltd, Sotuver, SEVAM, Glass Plast Maroc, MBALAJY, Le Verre Beldi, GRASSE SENTEURS:*List Not Exhaustive.

3. What are the main segments of the Morocco Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Urbanization and Sustainability Trends to Drive the Market; End-User Industries to Drive the Demand for Container Glass Market.

6. What are the notable trends driving market growth?

Rise in Urbanization to Drive the Demand for Beverage Industry.

7. Are there any restraints impacting market growth?

Rise in Urbanization and Sustainability Trends to Drive the Market; End-User Industries to Drive the Demand for Container Glass Market.

8. Can you provide examples of recent developments in the market?

July 2024: SoPharma has entered into an exclusive distribution partnership with L’OCCITANE Group for the Erborian brand in Morocco. Erborian, translating to “Herbes d'Orient,” is a French-Korean brand owned by the L'Occitane Group. The brand artfully merges traditional Korean medicine with modern technology, resulting in hybrid products, including the celebrated BB and CC crèmes. This collaboration highlights our commitment to offering premium skincare products and bolsters our dermo-cosmetic skincare range. Such strategic moves could pave the way for container glass opportunities within the cosmetics market.October 2023: Furnotherm Glass has wrapped up a project with SEVAM, Morocco's leading container and tableware glass manufacturer. Furnotherm undertook the challenge of reconstructing SEVAM's 210 tonnes-per-day container glass furnace. The project was completed 10 days before the deadline and ended in October 2023. Furnotherm sincerely appreciated the SEVAM group, BDF, and all stakeholders for their pivotal role in this swift achievement. Such furnace expansions drive the demand for container glass in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Container Glass Market?

To stay informed about further developments, trends, and reports in the Morocco Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence