Key Insights

The Middle East and Africa (MEA) Biopesticide Industry is poised for substantial growth, driven by an increasing demand for sustainable agricultural practices and a growing awareness of the environmental and health risks associated with conventional chemical pesticides. The market, valued at an estimated $300 million in 2024, is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 11.8% through 2033. This significant expansion is fueled by several key drivers. Growing government initiatives promoting organic farming and integrated pest management (IPM) are creating a favorable regulatory environment. Furthermore, the rising prevalence of crop diseases and pest infestations, exacerbated by climate change, necessitates more effective and eco-friendly solutions. Consumers are also increasingly demanding residues-free produce, pushing agricultural producers towards biopesticides.

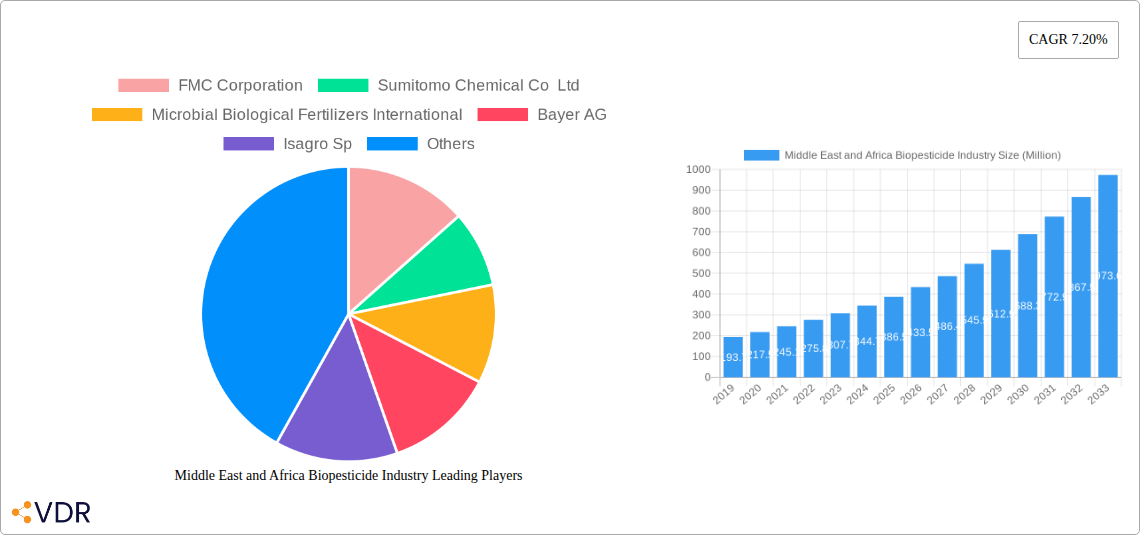

Middle East and Africa Biopesticide Industry Market Size (In Million)

The MEA biopesticide market is experiencing a dynamic shift with several emerging trends. Innovation in formulation technologies is leading to more potent and stable biopesticide products. The integration of biopesticides with digital farming solutions, such as precision agriculture, is optimizing their application and efficacy. However, the market faces certain restraints, including the higher initial cost compared to conventional pesticides, limited shelf life for some biological products, and the need for greater farmer education and adoption of these novel solutions. Despite these challenges, the strong underlying demand for sustainable agriculture and the continuous development of advanced biopesticide solutions are expected to propel the MEA Biopesticide Industry to new heights, with significant opportunities in segments such as bioinsecticides, biofungicides, and bioherbicides.

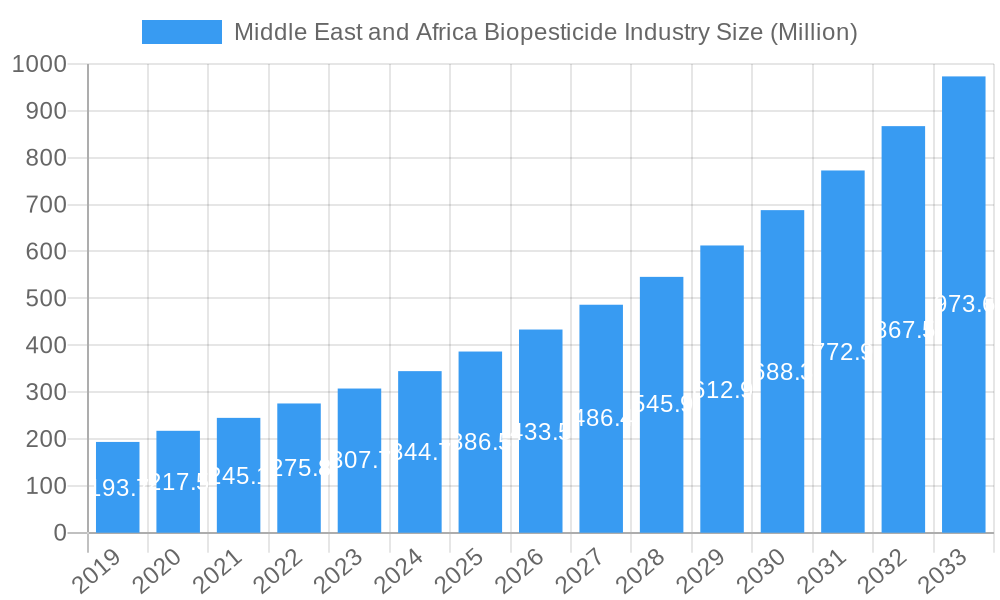

Middle East and Africa Biopesticide Industry Company Market Share

Middle East and Africa Biopesticide Industry Market Dynamics & Structure

The Middle East and Africa (MEA) biopesticide industry is characterized by a dynamic and evolving market structure. Market concentration is currently moderate, with a growing number of regional and global players vying for market share. Technological innovation drivers are primarily centered around the development of novel microbial strains, botanical extracts, and pheromones with enhanced efficacy and specificity. The regulatory frameworks across MEA countries are gradually becoming more supportive of biopesticides, with some nations implementing policies to promote their adoption. However, fragmented and sometimes stringent registration processes remain a barrier. Competitive product substitutes for conventional chemical pesticides are gaining traction due to increasing awareness of environmental sustainability and health concerns. End-user demographics are shifting, with a growing segment of farmers and agricultural cooperatives seeking safer and more sustainable crop protection solutions. M&A trends are on the rise, as larger companies seek to acquire innovative biopesticide technologies and expand their product portfolios.

- Market Share Evolution: While specific figures for MEA are still emerging, global biopesticide market leaders are actively investing in regional expansion.

- Regulatory Harmonization: Efforts towards harmonizing biopesticide registration across different MEA nations could significantly boost market growth.

- Farmer Adoption: Education and demonstration programs are crucial for overcoming farmer skepticism and driving adoption of biopesticides.

- Investment Landscape: Increasing venture capital and private equity interest in agricultural technology is fueling innovation and M&A activities.

Middle East and Africa Biopesticide Industry Growth Trends & Insights

The Middle East and Africa biopesticide industry is poised for substantial growth, driven by a confluence of factors including increasing agricultural output demands, a heightened focus on sustainable farming practices, and a growing awareness of the detrimental effects of chemical pesticides. This market is expected to witness a significant market size evolution over the forecast period of 2025-2033. The adoption rates of biopesticides are projected to accelerate, moving from niche applications to mainstream agricultural practices, particularly in countries with large agricultural sectors and growing environmental consciousness.

Technological disruptions are a key enabler of this growth. Advancements in fermentation technology, genetic engineering of beneficial microorganisms, and the identification of novel bioactive compounds from natural sources are leading to the development of more potent and cost-effective biopesticides. This influx of innovation addresses some of the historical limitations of biopesticides, such as shelf-life and efficacy under diverse environmental conditions. Furthermore, consumer behavior shifts are playing a crucial role. Consumers are increasingly demanding sustainably produced food with minimal chemical residues, putting pressure on agricultural producers to adopt greener crop protection methods. This demand translates into a direct incentive for farmers to invest in biopesticides.

The market penetration of biopesticides in MEA is anticipated to rise considerably, spurred by government initiatives promoting organic farming and reducing reliance on synthetic chemicals. The CAGR for the MEA biopesticide market is estimated to be robust, reflecting this upward trajectory. The development of integrated pest management (IPM) strategies, where biopesticides form a cornerstone, is also gaining momentum. This holistic approach to pest control is proving more sustainable and economically viable in the long run.

The availability of diverse biopesticide formulations, including microbial biopesticides (bacteria, fungi, viruses), biochemical biopesticides (plant extracts, pheromones), and insecticidal natural compounds, caters to a wide range of pest and disease challenges faced by the region's agriculture. The rising incidence of pest resistance to conventional chemicals is further compelling farmers to explore and adopt biopesticide alternatives. The forecast period (2025-2033) will likely see a significant shift in the agricultural input landscape of MEA, with biopesticides emerging as a critical component of modern, sustainable agriculture. The base year of 2025 marks a pivotal point where initial growth trends are expected to gain significant momentum.

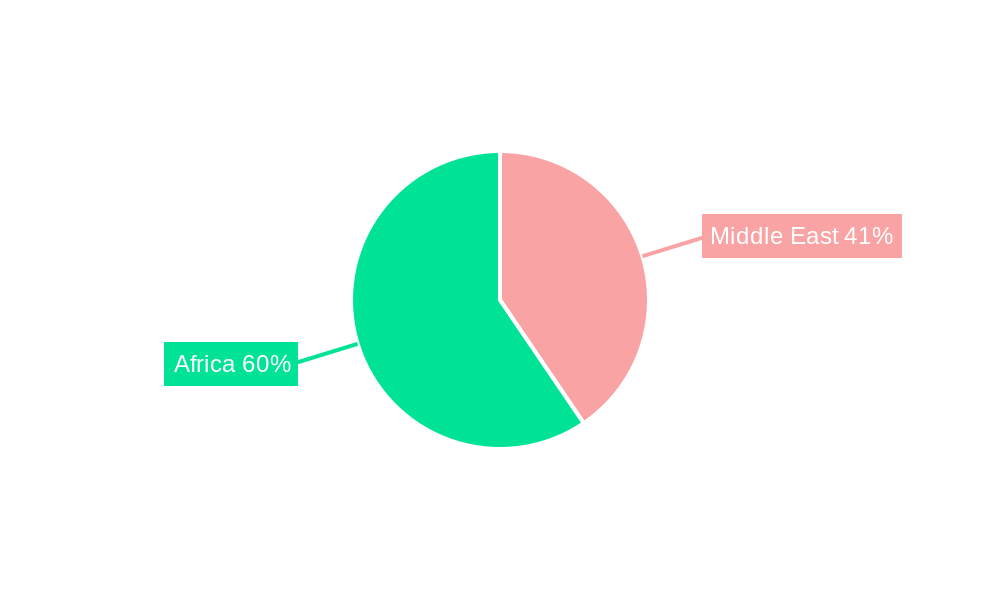

Dominant Regions, Countries, or Segments in Middle East and Africa Biopesticide Industry

The Middle East and Africa (MEA) biopesticide industry's dominance is multifaceted, with several regions, countries, and segments exhibiting significant growth potential and influence. From a Production Analysis: perspective, North African countries like Egypt and Morocco are emerging as key production hubs due to their established agricultural sectors and government support for agricultural innovation. These nations possess the infrastructure and expertise to scale up biopesticide manufacturing.

In terms of Consumption Analysis:, South Africa stands out as a dominant consumer. Its well-developed agricultural industry, coupled with stringent environmental regulations and a mature market for organic produce, drives high demand for biopesticides. Other significant consuming nations include Kenya, driven by its large horticultural export sector, and Saudi Arabia, with its focus on food security and sustainable agriculture in arid regions.

The Import Market Analysis (Value & Volume): is heavily influenced by countries that may not have significant local production capabilities but possess substantial agricultural needs. Nigeria, with its vast agricultural land and growing population, presents a significant import market for biopesticides. Similarly, countries in the Horn of Africa and the Levant also contribute significantly to import volumes as they seek to enhance crop yields and reduce reliance on chemical imports.

Conversely, the Export Market Analysis (Value & Volume): is currently led by a few established players who have successfully developed and scaled their production. While not solely MEA-based, companies with manufacturing facilities within the region, or those exporting from developed markets into MEA, contribute to the export landscape. Future growth in MEA exports will likely be driven by local companies that can meet international quality standards and develop unique biopesticide solutions tailored to regional pest pressures.

The Price Trend Analysis: in the MEA biopesticide market is influenced by a combination of factors. Initially, biopesticides were often priced higher than conventional chemical pesticides, acting as a barrier to adoption. However, with advancements in production technologies and increasing economies of scale, price parity or even competitive pricing is becoming more common, especially for high-volume applications. Fluctuations in raw material costs and currency exchange rates also play a role.

The Industry Developments: segment showing the most dominance is the increasing focus on biological fungicides and insecticides. These categories are witnessing higher adoption rates due to their broad-spectrum efficacy against common agricultural pests and diseases prevalent in the MEA region. Government incentives, such as subsidies for organic farming and tax breaks for biopesticide manufacturers, are critical economic policies driving dominance in specific countries. Furthermore, the development of localized biopesticide formulations, adapted to the specific soil types, climates, and pest profiles of different MEA sub-regions, is a key market share driver. Infrastructure development, particularly in cold chain logistics for biological products, is also crucial for market expansion and dominance in areas with challenging logistics.

Middle East and Africa Biopesticide Industry Product Landscape

The MEA biopesticide industry is characterized by a growing array of innovative products designed to address diverse pest and disease challenges within the region's varied agricultural ecosystems. Key product types include microbial biopesticides, such as those derived from Bacillus thuringiensis (Bt) for insect control, and beneficial fungi like Trichoderma for soil-borne disease management. Botanical biopesticides, leveraging extracts from plants like Neem and Pyrethrum, are gaining traction for their broad-spectrum activity and relatively low environmental impact. Performance metrics are increasingly focusing on efficacy against specific pests, reduced re-entry intervals, and compatibility with integrated pest management (IPM) programs. Unique selling propositions often revolve around reduced environmental footprint, enhanced crop quality, and compliance with organic certification standards. Technological advancements are leading to improved formulation stability, shelf-life extension, and targeted delivery mechanisms, enhancing the overall performance and competitiveness of biopesticides in the MEA market.

Key Drivers, Barriers & Challenges in Middle East and Africa Biopesticide Industry

The MEA biopesticide market is propelled by several key drivers. A significant catalyst is the growing global and regional demand for sustainably produced food, coupled with increasing consumer awareness regarding the health and environmental risks associated with conventional chemical pesticides. Government initiatives promoting organic farming and integrated pest management (IPM) further bolster this trend. Technological advancements in biopesticide development, leading to more effective and cost-efficient products, also act as a strong driver. The rising incidence of pest resistance to chemical treatments compels farmers to seek alternative solutions.

However, the industry faces notable barriers and challenges. Regulatory hurdles, including lengthy and complex registration processes for biopesticides in many MEA countries, can stifle market entry and product availability. Limited farmer awareness and education regarding the benefits and proper application of biopesticides remain a significant restraint, often leading to skepticism and underutilization. The high initial cost of some biopesticides compared to conventional alternatives, though decreasing, can also be a barrier, particularly for smallholder farmers. Supply chain and cold chain logistics for biological products can be challenging in some parts of the region, impacting product viability and efficacy.

Emerging Opportunities in Middle East and Africa Biopesticide Industry

Emerging opportunities in the MEA biopesticide industry are substantial, particularly in the development of region-specific formulations tailored to the unique pest pressures and climatic conditions of countries like Egypt, South Africa, and Kenya. The growing demand for organic and naturally grown produce presents a significant untapped market for certified biopesticides. Furthermore, the potential for integrating biopesticides with digital agriculture platforms for precision application and monitoring offers a pathway for enhanced efficacy and farmer engagement. There is also an opportunity in promoting biocontrol agents for neglected tropical diseases affecting crops and in developing biopesticides for the burgeoning urban agriculture sector across the region.

Growth Accelerators in the Middle East and Africa Biopesticide Industry Industry

Long-term growth in the MEA biopesticide industry is expected to be accelerated by several key factors. Technological breakthroughs in areas like synthetic biology and advanced fermentation techniques will lead to the development of more potent and diversified biopesticide products. Strategic partnerships between international biopesticide innovators and local agricultural entities in MEA can facilitate market access, technology transfer, and localized product development. Government support and policy reforms, aimed at streamlining registration processes and providing financial incentives for biopesticide adoption, will be critical growth accelerators. Increased investment in research and development for novel biopesticide solutions, as well as the expansion of distribution networks to reach remote agricultural communities, will further propel market expansion.

Key Players Shaping the Middle East and Africa Biopesticide Industry Market

- FMC Corporation

- Sumitomo Chemical Co Ltd

- Microbial Biological Fertilizers International

- Bayer AG

- Isagro Sp

- Marrone Bio Innovations

- Omnia Holdings Limited

- Novozymes AS

- Koppert Biological Systems

- BASF SE

Notable Milestones in Middle East and Africa Biopesticide Industry Sector

- 2021: Marrone Bio Innovations partners with a South African distributor to expand its biopesticide portfolio in the African market.

- 2022: Bayer AG launches a new biological fungicide in select MENA countries, focusing on grape and vegetable cultivation.

- 2023: Novozymes AS announces increased investment in its bioprotection research and development hub in the Middle East.

- 2023: The Kenyan government introduces new policies to encourage the adoption of organic farming inputs, including biopesticides.

- 2024: FMC Corporation acquires a significant stake in an Egyptian biopesticide manufacturing startup.

- 2024: Koppert Biological Systems expands its technical support and training programs for farmers in North Africa.

- 2025 (Estimated): Introduction of novel microbial biopesticides with enhanced heat tolerance, specifically developed for arid MEA climates.

- 2025 (Estimated): Significant increase in M&A activity, with larger chemical companies acquiring smaller biopesticide firms to strengthen their portfolios.

In-Depth Middle East and Africa Biopesticide Industry Market Outlook

The outlook for the MEA biopesticide industry is exceptionally promising, characterized by robust growth fueled by an intensifying commitment to sustainable agriculture and increasing demand for safer food production. Technological advancements in bio-innovation, coupled with supportive government policies and a growing farmer consciousness, are poised to significantly expand market penetration. Strategic collaborations and investments in local manufacturing and distribution will further accelerate market expansion. The forecast period is set to witness a substantial shift towards biological crop protection, positioning biopesticides as an integral component of the agricultural landscape across the Middle East and Africa.

Middle East and Africa Biopesticide Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle East and Africa Biopesticide Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Biopesticide Industry Regional Market Share

Geographic Coverage of Middle East and Africa Biopesticide Industry

Middle East and Africa Biopesticide Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players

- 3.3. Market Restrains

- 3.3.1. High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming

- 3.4. Market Trends

- 3.4.1. Increase in Organic Farm Practises is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Biopesticide Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microbial Biological Fertilizers International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Isagro Sp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marrone Bio Innovations

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Omnia Holdings Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novozymes AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koppert Biological Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: Middle East and Africa Biopesticide Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Biopesticide Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Biopesticide Industry?

The projected CAGR is approximately 11.8%.

2. Which companies are prominent players in the Middle East and Africa Biopesticide Industry?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, Microbial Biological Fertilizers International, Bayer AG, Isagro Sp, Marrone Bio Innovations, Omnia Holdings Limited, Novozymes AS, Koppert Biological Systems, BASF SE.

3. What are the main segments of the Middle East and Africa Biopesticide Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players.

6. What are the notable trends driving market growth?

Increase in Organic Farm Practises is Driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Biopesticide Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Biopesticide Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Biopesticide Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Biopesticide Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence