Key Insights

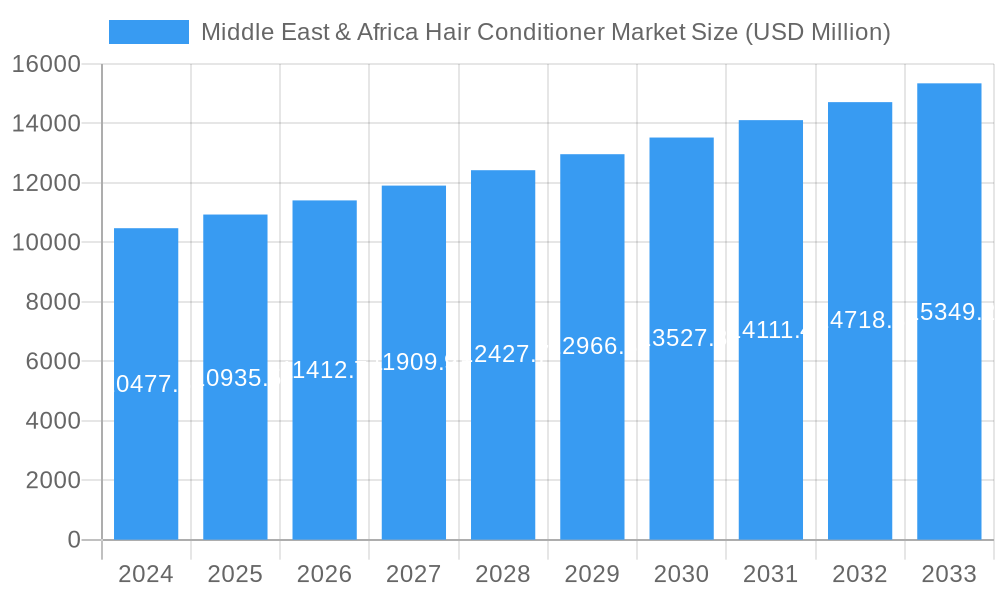

The Middle East & Africa hair conditioner market is poised for significant growth, with a projected market size of USD 10,477.6 million in 2024, expanding at a healthy Compound Annual Growth Rate (CAGR) of 4.4% through 2033. This robust expansion is fueled by a confluence of evolving consumer preferences, increasing disposable incomes, and a growing awareness of hair health and grooming. Consumers are increasingly seeking premium and specialized hair conditioning products that cater to specific concerns such as damage repair, color protection, and scalp health. The rising influence of social media and beauty influencers also plays a crucial role in driving demand for innovative and effective hair care solutions. Furthermore, a burgeoning middle class across many African nations is contributing to increased spending on personal care products, including hair conditioners, thereby bolstering market penetration and revenue generation.

Middle East & Africa Hair Conditioner Market Market Size (In Billion)

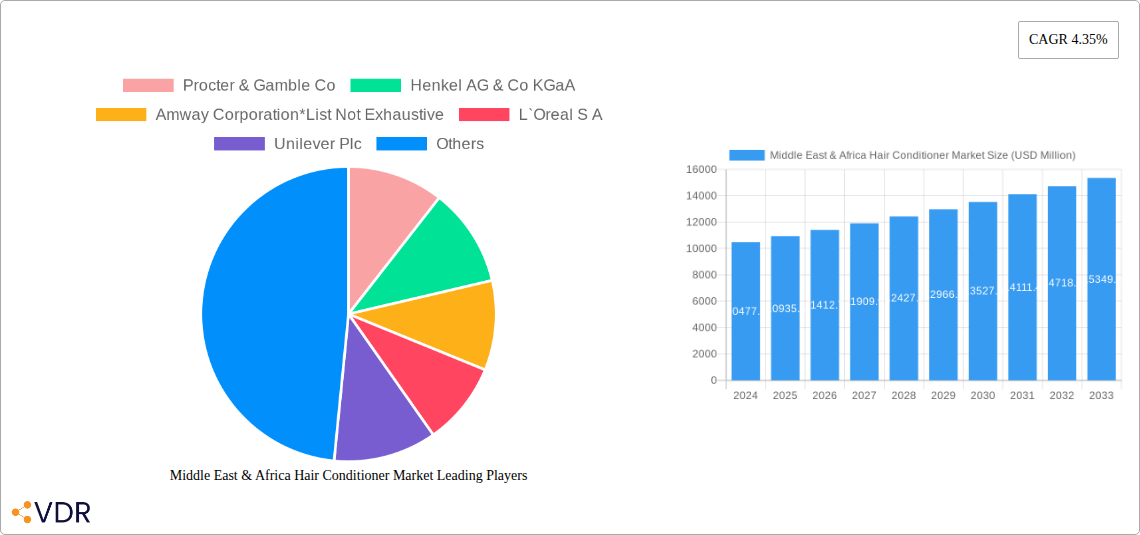

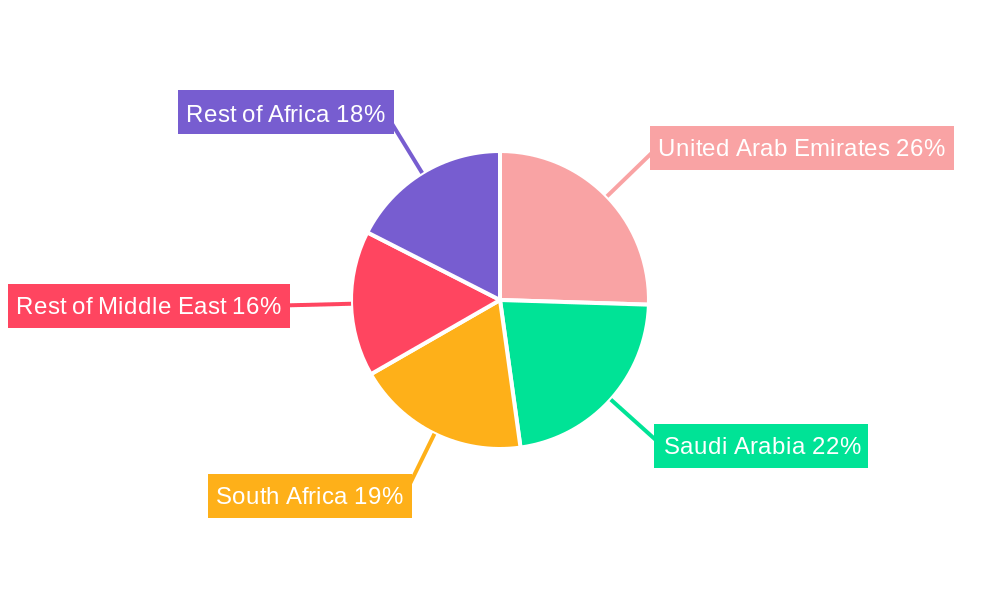

The market is characterized by a dynamic competitive landscape and diverse distribution strategies. Key players like Procter & Gamble, L'Oréal, and Unilever are actively innovating and expanding their product portfolios to capture market share. The growing prominence of e-commerce channels presents a significant opportunity for both established and emerging brands to reach a wider consumer base. Supermarkets and hypermarkets remain strong distribution pillars, while pharmacies and drugstores are gaining traction for specialized and therapeutic hair conditioning products. Geographically, the United Arab Emirates and Saudi Arabia are leading the market in terms of value, driven by higher disposable incomes and a strong demand for premium beauty products. South Africa and the rest of the Middle East & Africa region are also exhibiting substantial growth potential, underscoring the vast opportunities within this evolving market.

Middle East & Africa Hair Conditioner Market Company Market Share

Middle East & Africa Hair Conditioner Market: Comprehensive Report

This in-depth report provides a detailed analysis of the Middle East & Africa Hair Conditioner Market, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and major players. With a study period spanning 2019–2033, including a base year of 2025 and a forecast period from 2025–2033, this report offers critical insights for stakeholders seeking to navigate this dynamic and expanding market. We present all values in million units.

Middle East & Africa Hair Conditioner Market Market Dynamics & Structure

The Middle East & Africa hair conditioner market exhibits a moderate to high level of concentration, with key global players like Procter & Gamble Co, L'Oréal S.A., and Unilever Plc holding significant market shares. Technological innovation is primarily driven by advancements in formulation, leading to products with enhanced benefits such as damage repair, color protection, and scalp health. These innovations are crucial for capturing consumer interest in a market increasingly focused on specialized hair care solutions. Regulatory frameworks, while generally supportive of consumer product safety, can vary across individual countries, impacting product registration and market entry strategies. Competitive product substitutes include DIY hair masks and other hair treatments, though the convenience and efficacy of commercial conditioners maintain their dominance. End-user demographics are diverse, with a growing middle class and increasing disposable income driving demand. M&A trends are observed as companies seek to expand their product portfolios, gain access to new markets, or acquire innovative technologies.

- Market Concentration: Dominated by a few global leaders, with increasing participation from regional and specialized brands.

- Technological Innovation: Focus on natural ingredients, sustainable packaging, and advanced formulations for specific hair concerns.

- Regulatory Landscape: Varied across countries, requiring strategic market entry planning and compliance.

- Competitive Substitutes: DIY remedies and professional salon treatments, but commercial conditioners retain strong consumer preference.

- End-User Demographics: Growing middle-income population, increasing awareness of hair health, and demand for premium products.

- M&A Activity: Driven by portfolio expansion, market access, and technology acquisition.

Middle East & Africa Hair Conditioner Market Growth Trends & Insights

The Middle East & Africa hair conditioner market is poised for robust growth, driven by a confluence of factors including rising disposable incomes, increasing urbanization, and a burgeoning awareness of personal grooming and hair health. The market size is projected to experience a healthy Compound Annual Growth Rate (CAGR) during the forecast period. Adoption rates for hair conditioners are steadily increasing, particularly in emerging economies within the region, as consumers move away from basic hair care to more specialized products. Technological disruptions are manifesting in the form of innovative product formulations, such as sulfate-free, paraben-free, and silicon-free conditioners, catering to the growing demand for natural and organic ingredients. Furthermore, the surge in e-commerce platforms has significantly improved accessibility to a wider range of hair conditioner products across the region, even in remote areas. Consumer behavior shifts are evident in the growing preference for premium and performance-driven conditioners, with consumers actively seeking solutions for specific hair concerns like dryness, damage, and frizz. The demand for hair conditioners tailored to diverse hair types, including curly and coily textures prevalent in certain African populations, is also a significant growth driver.

- Market Size Evolution: Steady and significant growth anticipated due to economic development and increased consumer spending.

- Adoption Rates: Increasing penetration as consumers prioritize specialized hair care.

- Technological Disruptions: Innovations in natural formulations, efficacy-driven products, and sustainable practices.

- Consumer Behavior Shifts: Growing demand for premium, specialized, and ethically sourced hair conditioners.

- Market Penetration: Expected to rise across all sub-regions as accessibility improves.

- CAGR: Projected to be robust throughout the forecast period.

Dominant Regions, Countries, or Segments in Middle East & Africa Hair Conditioner Market

The Middle East & Africa hair conditioner market is characterized by dynamic regional performance and segment preferences. Within the Geography segment, the United Arab Emirates and Saudi Arabia are anticipated to emerge as dominant regions. This is attributed to their strong economic standing, high disposable incomes, and a deeply ingrained culture of personal grooming and aesthetic consciousness among consumers. These countries exhibit a high adoption rate for premium and specialized hair care products, including intensive hair conditioners, driven by a sophisticated retail infrastructure and a significant expatriate population with diverse hair care needs.

In terms of Product Type, Intensive Hair Conditioner is expected to witness substantial growth and likely lead the market. This dominance stems from the region's predominantly dry and hot climate, which necessitates more potent hair conditioning treatments to combat dryness, damage, and frizz. Consumers are increasingly seeking products that offer deep nourishment and repair, making intensive formulations a preferred choice.

Analyzing the Distribution Channel segment, Supermarkets/Hypermarkets are expected to maintain their stronghold due to their widespread accessibility and the convenience they offer to a broad consumer base. However, E-Commerce is rapidly gaining traction and is projected to be a significant growth driver, especially in countries with developing retail infrastructure. The online channel provides consumers with access to a wider variety of brands and product types, including niche and international offerings, and facilitates direct-to-consumer sales for brands.

- Dominant Geography: United Arab Emirates and Saudi Arabia, driven by high disposable income and consumer focus on grooming.

- Leading Product Type: Intensive Hair Conditioner, addressing prevalent hair concerns related to climate and styling.

- Key Distribution Channel: Supermarkets/Hypermarkets for broad accessibility, with E-Commerce as a rapidly growing channel for wider product reach and consumer choice.

- Growth Drivers in Dominant Regions: Economic stability, urbanization, and high per capita spending on beauty and personal care.

- Market Share Potential: UAE and Saudi Arabia are expected to hold a significant share of the regional market.

- E-Commerce Impact: Facilitating market penetration in underserved areas and offering diverse product selection.

Middle East & Africa Hair Conditioner Market Product Landscape

The Middle East & Africa hair conditioner market product landscape is characterized by a steady influx of innovative formulations designed to address a diverse range of hair concerns. Manufacturers are focusing on the development of conditioners featuring natural and organic ingredients, such as argan oil, shea butter, and keratin, appealing to the growing consumer preference for clean beauty. Advanced formulations often include UV filters to protect hair from sun damage, a critical factor in the region's climate. Performance metrics are increasingly scrutinized, with products promising deep hydration, damage repair, frizz control, and enhanced shine gaining market traction. Unique selling propositions often revolve around specialized treatments for color-treated hair, chemically processed hair, or hair prone to breakage. Technological advancements are enabling the creation of lighter, non-greasy formulas that are suitable for frequent use and cater to various hair types, including the region's diverse ethnic hair textures.

Key Drivers, Barriers & Challenges in Middle East & Africa Hair Conditioner Market

Key Drivers: The Middle East & Africa hair conditioner market is propelled by several key drivers. Rising disposable incomes and a growing middle class are increasing consumer spending power on personal care products. Increasing awareness regarding hair health and grooming, fueled by social media and beauty influencers, is driving demand for specialized conditioners. The expansion of retail infrastructure, including supermarkets, hypermarkets, and e-commerce platforms, is enhancing product accessibility across urban and semi-urban areas. Furthermore, product innovation, with a focus on natural ingredients and solutions for specific hair concerns like damage and dryness, is a significant catalyst.

Barriers & Challenges: Despite the growth, the market faces several barriers and challenges. Price sensitivity in some emerging economies can limit the adoption of premium products. Intense competition from both global and local brands, coupled with the threat of counterfeit products, poses a significant challenge. Logistical complexities and underdeveloped supply chains in certain African nations can lead to distribution inefficiencies and increased costs. Navigating diverse regulatory frameworks across different countries adds to market entry complexity. Economic volatility and currency fluctuations in some regions can impact consumer purchasing power and import costs.

Emerging Opportunities in Middle East & Africa Hair Conditioner Market

Emerging opportunities within the Middle East & Africa hair conditioner market are abundant. There is a significant untapped potential for brands focusing on natural and organic ingredients, catering to the growing consumer demand for clean beauty and sustainability. The burgeoning e-commerce sector presents a prime opportunity for online-first brands and for established players to expand their digital footprint, reaching consumers in remote areas. Tailoring products for specific hair types, particularly for the diverse range of curly and textured hair prevalent in Africa, represents a significant niche with high growth potential. Furthermore, the development of affordable yet effective hair conditioning solutions for lower-income segments could unlock substantial market share. The increasing awareness of scalp health also opens avenues for conditioners with added scalp-benefiting ingredients.

Growth Accelerators in the Middle East & Africa Hair Conditioner Market Industry

Long-term growth in the Middle East & Africa hair conditioner market is being significantly accelerated by several key factors. Technological breakthroughs in ingredient sourcing and formulation science are enabling the creation of more efficacious and targeted hair care solutions. Strategic partnerships between global manufacturers and local distributors are crucial for navigating complex market terrains and ensuring wider product availability. Market expansion strategies, including the introduction of region-specific product lines and the establishment of local manufacturing facilities, are vital for long-term success. The increasing trend of premiumization, where consumers are willing to spend more on high-quality, performance-driven products, acts as a powerful accelerator. Furthermore, the growing influence of digital marketing and social media is effectively creating consumer demand and shaping purchasing decisions.

Key Players Shaping the Middle East & Africa Hair Conditioner Market Market

- Procter & Gamble Co

- Henkel AG & Co KGaA

- Amway Corporation

- L'Oréal S A

- Unilever Plc

- Hask

- Johnson & Johnson Services Inc

- Kao Corporation

Notable Milestones in Middle East & Africa Hair Conditioner Market Sector

- 2021: Procter & Gamble Co. launched a new range of Pantene Pro-V conditioners with advanced repair technology targeting damage in the UAE market.

- 2022: Unilever Plc introduced a sustainably sourced shea butter intensive conditioner under its Dove brand in South Africa.

- 2022: L'Oréal S.A. expanded its Kérastase line with specialized conditioners for color-treated hair in Saudi Arabia.

- 2023: Henkel AG & Co KGaA acquired a stake in a regional organic beauty brand, enhancing its natural product portfolio in the MEA.

- 2024: Amway Corporation intensified its e-commerce distribution strategy for its Nutrilite hair care range across key African markets.

- 2024: Johnson & Johnson Services Inc. launched a new line of gentle, everyday conditioners under its Neutrogena brand, focusing on sensitive scalps in Egypt.

In-Depth Middle East & Africa Hair Conditioner Market Market Outlook

The outlook for the Middle East & Africa hair conditioner market remains exceptionally positive, driven by a robust combination of economic development, evolving consumer preferences, and ongoing technological advancements. Growth accelerators such as the increasing adoption of premium and specialized hair care products, the expanding reach of e-commerce channels, and the growing demand for natural and sustainable formulations will continue to propel market expansion. Strategic opportunities lie in tapping into the underserved markets, particularly in the African continent, by offering affordable yet effective solutions. Furthermore, continuous innovation in product development, focusing on addressing specific regional hair concerns and leveraging digital marketing to connect with consumers, will be crucial for capitalizing on the market's full potential. The region represents a significant growth frontier for the global hair conditioner industry.

Middle East & Africa Hair Conditioner Market Segmentation

-

1. Product Type

- 1.1. Intensive Hair Conditioner

- 1.2. Traditional Hair Conditioner

- 1.3. Other Hair Conditioner

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Speciality Stores

- 2.3. E-Commerce

- 2.4. Pharmacies/Drugstore

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. South Africa

- 3.4. Rest of Middle East & Africa

Middle East & Africa Hair Conditioner Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East

Middle East & Africa Hair Conditioner Market Regional Market Share

Geographic Coverage of Middle East & Africa Hair Conditioner Market

Middle East & Africa Hair Conditioner Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for certified jewelry; Increasing product development in terms of designs

- 3.3. Market Restrains

- 3.3.1. Extensive availability of imitation jewelry

- 3.4. Market Trends

- 3.4.1. Growing Inclination towards Premium Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Hair Conditioner Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Intensive Hair Conditioner

- 5.1.2. Traditional Hair Conditioner

- 5.1.3. Other Hair Conditioner

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Speciality Stores

- 5.2.3. E-Commerce

- 5.2.4. Pharmacies/Drugstore

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Arab Emirates Middle East & Africa Hair Conditioner Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Intensive Hair Conditioner

- 6.1.2. Traditional Hair Conditioner

- 6.1.3. Other Hair Conditioner

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Speciality Stores

- 6.2.3. E-Commerce

- 6.2.4. Pharmacies/Drugstore

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. South Africa

- 6.3.4. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia Middle East & Africa Hair Conditioner Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Intensive Hair Conditioner

- 7.1.2. Traditional Hair Conditioner

- 7.1.3. Other Hair Conditioner

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Speciality Stores

- 7.2.3. E-Commerce

- 7.2.4. Pharmacies/Drugstore

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. South Africa

- 7.3.4. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. South Africa Middle East & Africa Hair Conditioner Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Intensive Hair Conditioner

- 8.1.2. Traditional Hair Conditioner

- 8.1.3. Other Hair Conditioner

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Speciality Stores

- 8.2.3. E-Commerce

- 8.2.4. Pharmacies/Drugstore

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. South Africa

- 8.3.4. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East Middle East & Africa Hair Conditioner Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Intensive Hair Conditioner

- 9.1.2. Traditional Hair Conditioner

- 9.1.3. Other Hair Conditioner

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Speciality Stores

- 9.2.3. E-Commerce

- 9.2.4. Pharmacies/Drugstore

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. South Africa

- 9.3.4. Rest of Middle East & Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Procter & Gamble Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Henkel AG & Co KGaA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amway Corporation*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 L`Oreal S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Unilever Plc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hask

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Johnson & Johnson Services Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kao Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Procter & Gamble Co

List of Figures

- Figure 1: Middle East & Africa Hair Conditioner Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa Hair Conditioner Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 7: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 11: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 15: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 19: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Middle East & Africa Hair Conditioner Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Hair Conditioner Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Middle East & Africa Hair Conditioner Market?

Key companies in the market include Procter & Gamble Co, Henkel AG & Co KGaA, Amway Corporation*List Not Exhaustive, L`Oreal S A, Unilever Plc, Hask, Johnson & Johnson Services Inc, Kao Corporation.

3. What are the main segments of the Middle East & Africa Hair Conditioner Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for certified jewelry; Increasing product development in terms of designs.

6. What are the notable trends driving market growth?

Growing Inclination towards Premium Hair Care Products.

7. Are there any restraints impacting market growth?

Extensive availability of imitation jewelry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Hair Conditioner Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Hair Conditioner Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Hair Conditioner Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Hair Conditioner Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence