Key Insights

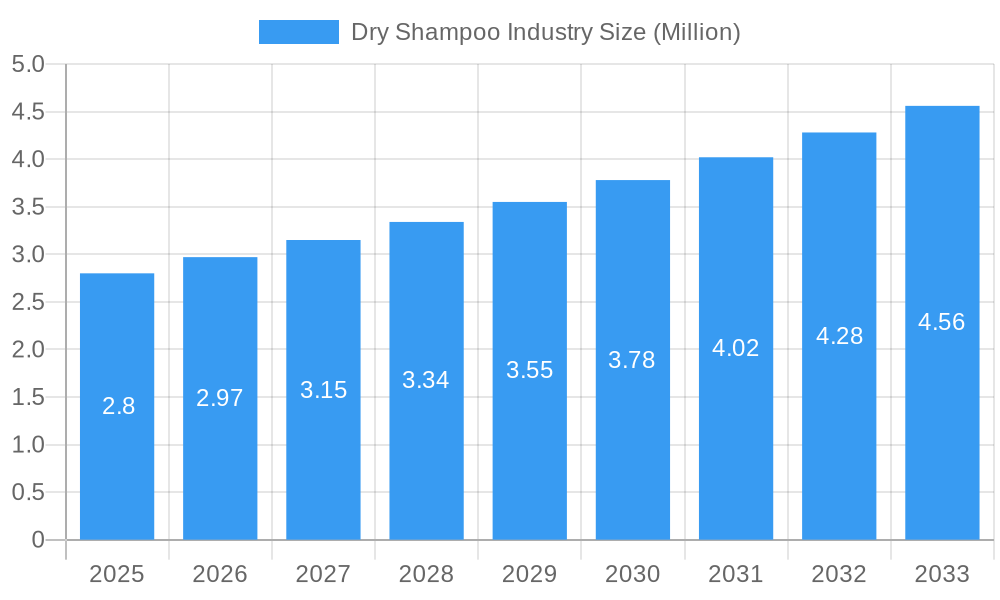

The global Dry Shampoo market is experiencing robust growth, projected to reach $2.80 Million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.72% expected through 2033. This expansion is driven by a confluence of factors, primarily the increasing demand for convenient and time-saving personal care solutions, especially among urban consumers and busy professionals. The product's ability to refresh hair between washes, absorb excess oil, and add volume without water appeals to a growing demographic prioritizing efficiency. Furthermore, evolving lifestyle trends, including frequent travel and a focus on maintaining a polished appearance with minimal effort, are significant contributors. The market is also witnessing innovation in product formulations, with brands introducing dry shampoos catering to specific hair types, concerns (like scalp health and color protection), and offering various fragrances, further broadening consumer appeal. The convenience factor is particularly amplified by the rise of e-commerce, making these products readily accessible.

Dry Shampoo Industry Market Size (In Million)

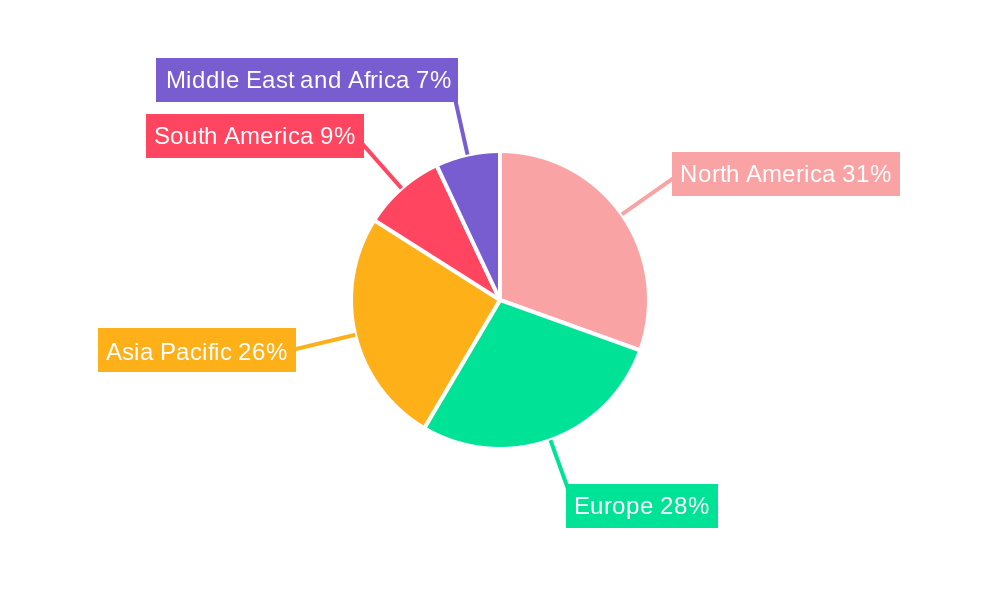

The market's trajectory is further shaped by the dynamic interplay of distribution channels and regional preferences. Supermarkets/hypermarkets and online retail stores are emerging as dominant channels, reflecting consumer purchasing habits and the ease of online access to a wide array of brands. Specialty stores also play a crucial role in catering to niche markets and premium product segments. Geographically, North America and Europe are established markets, but the Asia Pacific region, driven by rising disposable incomes and increasing awareness of personal grooming products, presents substantial growth opportunities. While the market is largely propelled by convenience and product innovation, potential restraints could include growing consumer concerns regarding the long-term effects of certain ingredients and the increasing availability of waterless hair-cleansing alternatives or advanced rinse-free hair treatments. However, the overall outlook remains positive due to the product's inherent versatility and its alignment with modern consumer needs.

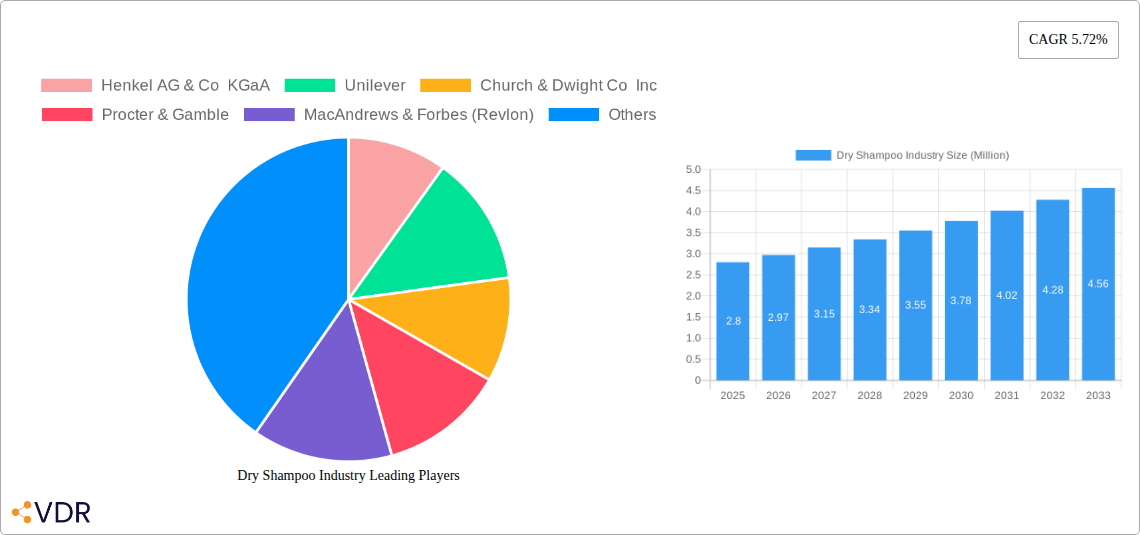

Dry Shampoo Industry Company Market Share

Here's an SEO-optimized report description for the Dry Shampoo Industry, meticulously crafted to maximize visibility and engagement with industry professionals.

Dry Shampoo Industry Market Dynamics & Structure

The global dry shampoo industry is characterized by a moderate market concentration, with a few key players like Unilever, Procter & Gamble, and L'Oreal S.A. holding significant market share. Technological innovation is primarily driven by the demand for natural ingredients, sustainable packaging, and advanced formulations that offer improved scalp benefits and efficacy. Regulatory frameworks, particularly concerning ingredient safety and labeling, play a crucial role in shaping product development and market entry. Competitive product substitutes include traditional shampoos and conditioners, although the convenience and on-the-go application of dry shampoo offer a distinct advantage. End-user demographics are increasingly diverse, with a growing adoption among younger generations and busy professionals seeking time-saving beauty solutions. Mergers and acquisitions (M&A) trends are moderate, with companies strategically acquiring smaller, innovative brands to expand their product portfolios and market reach.

- Market Concentration: Moderate, with key players dominating market share.

- Innovation Drivers: Natural ingredients, sustainable packaging, scalp-friendly formulations.

- Regulatory Impact: Ingredient safety and labeling compliance are critical.

- End-User Demographics: Broadening appeal across age groups and lifestyles.

- M&A Trends: Strategic acquisitions of niche brands are prevalent.

Dry Shampoo Industry Growth Trends & Insights

The global dry shampoo market is poised for robust expansion, projected to reach a valuation of approximately $4,500 million units by 2025, and forecast to climb to over $8,000 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of roughly 6.5% during the forecast period of 2025–2033. This growth trajectory is underpinned by increasing consumer awareness of the product's benefits, including its ability to extend the life of hairstyles, reduce water consumption, and offer a quick refresh between washes. The adoption rates are significantly higher in urban and developed economies, but emerging markets are showing considerable potential as disposable incomes rise and beauty consciousness grows. Technological disruptions are manifesting in the form of advanced aerosol technologies, waterless formulations, and the integration of beneficial ingredients like vitamins and antioxidants directly into dry shampoo products. Consumer behavior shifts are evident, with a strong preference for travel-friendly sizes and multi-functional products that cater to an active and on-the-go lifestyle. The market penetration is currently estimated at around 45% in key developed regions, with substantial room for growth globally. This evolving landscape necessitates continuous innovation and strategic marketing to capture the expanding consumer base and capitalize on emerging trends.

Dominant Regions, Countries, or Segments in Dry Shampoo Industry

The Online Retail Stores distribution channel is currently the most dominant segment driving growth in the global dry shampoo industry, projected to account for over 35% of the total market share by 2025. This dominance is fueled by the increasing digitalization of retail, the convenience of home delivery, and the vast product selection available online, catering to a global consumer base seeking accessibility and variety. Major e-commerce platforms and dedicated beauty retailers are actively expanding their dry shampoo offerings, making it easier for consumers to discover and purchase their preferred brands.

- Online Retail Stores:

- Key Drivers: Convenience, wide product selection, competitive pricing, direct-to-consumer (DTC) brand growth.

- Market Share: Anticipated to hold a leading position with significant growth potential.

- Consumer Behavior: Preference for research and comparison before purchase, leading to higher online conversion rates.

- Supermarkets/Hypermarkets:

- Key Drivers: High foot traffic, impulse purchase opportunities, accessibility for a broad consumer base.

- Market Share: A substantial segment, particularly in traditional retail markets.

- Growth Potential: Steady, driven by impulse buys and routine shopping.

- Specialty Stores:

- Key Drivers: Curated selections, premium product offerings, expert advice, brand loyalty.

- Market Share: Niche but influential, especially for premium and professional brands.

- Growth Potential: Tied to the success of premiumization trends and personalized beauty experiences.

- Convenience Stores:

- Key Drivers: Impulse purchases, grab-and-go convenience for immediate needs.

- Market Share: Smaller share, but important for immediate availability.

- Growth Potential: Dependent on urban density and consumer immediacy.

Dry Shampoo Industry Product Landscape

The product landscape of the dry shampoo industry is continuously evolving with a focus on innovative formulations and enhanced performance. Brands are increasingly introducing dry shampoos infused with natural ingredients such as rice starch, tapioca starch, and botanical extracts to absorb excess oil and improve scalp health. Innovations also include waterless formulations, color-depositing dry shampoos for root touch-ups, and scalp-soothing variants enriched with ingredients like chamomile and aloe vera. The trend towards sustainable packaging, including recyclable aerosol cans and refillable options, is gaining traction. Performance metrics emphasize long-lasting oil absorption, weightless feel, and pleasant, often natural, fragrances, differentiating products in a competitive market.

Key Drivers, Barriers & Challenges in Dry Shampoo Industry

Key Drivers:

- Time-Saving Convenience: Essential for busy lifestyles and extending wash days.

- Water Conservation: Growing consumer awareness of environmental impact drives demand for waterless solutions.

- Product Innovation: Development of natural, scalp-beneficial, and multi-functional formulas.

- Social Media Influence: Amplification of usage trends and product efficacy through influencers and user-generated content.

Barriers & Challenges:

- Perception of Hair Health: Some consumers remain concerned about potential build-up or scalp irritation.

- Residue Issues: Overuse or improper application can lead to visible residue.

- Competition from Traditional Products: Established shampoo and conditioner market dominance.

- Regulatory Scrutiny: Evolving ingredient regulations and safety standards.

- Supply Chain Disruptions: Potential for raw material shortages or increased logistics costs.

Emerging Opportunities in Dry Shampoo Industry

Emerging opportunities in the dry shampoo industry lie in the development of specialized formulations catering to diverse hair types and scalp concerns, such as dry shampoos for colored hair, fine hair, or sensitive scalps. The growing demand for all-natural and organic dry shampoos presents a significant avenue for brands focused on clean beauty. Furthermore, the expansion into emerging markets with rising disposable incomes and increasing beauty consciousness offers substantial untapped potential. Innovative product formats, such as dry shampoo powders in sustainable dispensers or dissolvable shampoo sheets, also represent exciting opportunities for market differentiation and capturing new consumer segments.

Growth Accelerators in the Dry Shampoo Industry Industry

The dry shampoo industry's long-term growth is being accelerated by several key catalysts. Technological breakthroughs in aerosol propellant systems and powder formulations are enabling more efficient and aesthetically pleasing product delivery. Strategic partnerships between established beauty conglomerates and niche, ingredient-focused brands are fostering innovation and expanding market reach. Furthermore, aggressive market expansion strategies targeting emerging economies, coupled with targeted marketing campaigns highlighting the product's environmental benefits and convenience, are crucial growth accelerators. The increasing emphasis on personalized beauty solutions also opens doors for customized dry shampoo offerings.

Key Players Shaping the Dry Shampoo Industry Market

- Henkel AG & Co KGaA

- Unilever

- Church & Dwight Co Inc

- Procter & Gamble

- MacAndrews & Forbes (Revlon)

- Philosophy Inc

- BBLUNT

- L'Oreal S A

- Coty Inc

- Kao Corporation

Notable Milestones in Dry Shampoo Industry Sector

- November 2022: Part of Rodan+Fields' launched a hair care collection including citrus-scented dry shampoo, which employs rice starch to sop up excess oil and chamomile extract to soothe the scalp.

- April 2022: Japanese personal care major Kao Corporation launched a pair of dry shampoos under the hair care brand Merit in response to the growing demand for dry shampoos that can be used on the go, including a shampoo sheet concept first developed for use in the spa.

- January 2021: Batiste, America's Dry Shampoo brand, announced a partnership with six Batiste brand ambassadors, a diverse group of females including professional athletes, an entrepreneur, and standout content creators. These fans of Batiste will serve as brand advocates, sharing their different beauty routines and tips on getting an instant refresh between washes.

In-Depth Dry Shampoo Industry Market Outlook

The future outlook for the dry shampoo industry remains exceptionally bright, driven by an confluence of evolving consumer preferences and continuous product innovation. Growth accelerators, including the increasing demand for sustainable and natural ingredients, coupled with advancements in product formulations offering superior scalp care, will further propel market expansion. Strategic market penetration into underserved regions and the development of personalized dry shampoo solutions tailored to specific hair needs will unlock significant untapped potential. The industry is well-positioned to capitalize on the ongoing trend of time-saving beauty routines and water-conscious consumption, ensuring sustained growth and increased market value in the coming years.

Dry Shampoo Industry Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Specialty Stores

- 1.4. Online Retail Stores

- 1.5. Other Distribution Channels

Dry Shampoo Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Dry Shampoo Industry Regional Market Share

Geographic Coverage of Dry Shampoo Industry

Dry Shampoo Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Organic/Natural formulations are Becoming Mainstream

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dry Shampoo Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Specialty Stores

- 5.1.4. Online Retail Stores

- 5.1.5. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Dry Shampoo Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarkets/Hypermarkets

- 6.1.2. Convenience Stores

- 6.1.3. Specialty Stores

- 6.1.4. Online Retail Stores

- 6.1.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. Europe Dry Shampoo Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarkets/Hypermarkets

- 7.1.2. Convenience Stores

- 7.1.3. Specialty Stores

- 7.1.4. Online Retail Stores

- 7.1.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Asia Pacific Dry Shampoo Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarkets/Hypermarkets

- 8.1.2. Convenience Stores

- 8.1.3. Specialty Stores

- 8.1.4. Online Retail Stores

- 8.1.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. South America Dry Shampoo Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarkets/Hypermarkets

- 9.1.2. Convenience Stores

- 9.1.3. Specialty Stores

- 9.1.4. Online Retail Stores

- 9.1.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Middle East and Africa Dry Shampoo Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Supermarkets/Hypermarkets

- 10.1.2. Convenience Stores

- 10.1.3. Specialty Stores

- 10.1.4. Online Retail Stores

- 10.1.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unilever

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Church & Dwight Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Procter & Gamble

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MacAndrews & Forbes (Revlon)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Philosophy Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BBLUNT

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 L'Oreal S A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Coty Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kao Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Dry Shampoo Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Dry Shampoo Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 3: North America Dry Shampoo Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 4: North America Dry Shampoo Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Dry Shampoo Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Dry Shampoo Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: Europe Dry Shampoo Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Europe Dry Shampoo Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Dry Shampoo Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Dry Shampoo Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Asia Pacific Dry Shampoo Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Asia Pacific Dry Shampoo Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Dry Shampoo Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Dry Shampoo Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America Dry Shampoo Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Dry Shampoo Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Dry Shampoo Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Dry Shampoo Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 19: Middle East and Africa Dry Shampoo Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Middle East and Africa Dry Shampoo Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Dry Shampoo Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dry Shampoo Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Dry Shampoo Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Dry Shampoo Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Dry Shampoo Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Dry Shampoo Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Dry Shampoo Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Spain Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Russia Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Dry Shampoo Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Dry Shampoo Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Australia Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Dry Shampoo Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Dry Shampoo Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Dry Shampoo Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Dry Shampoo Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: South Africa Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Dry Shampoo Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dry Shampoo Industry?

The projected CAGR is approximately 5.72%.

2. Which companies are prominent players in the Dry Shampoo Industry?

Key companies in the market include Henkel AG & Co KGaA, Unilever, Church & Dwight Co Inc, Procter & Gamble, MacAndrews & Forbes (Revlon), Philosophy Inc *List Not Exhaustive, BBLUNT, L'Oreal S A, Coty Inc, Kao Corporation.

3. What are the main segments of the Dry Shampoo Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Organic/Natural formulations are Becoming Mainstream.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In November 2022, Part of Rodan+Fields' launched a hair care collection including citrus-scented dry shampoo, which employs rice starch to sop up excess oil and chamomile extract to soothe the scalp.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dry Shampoo Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dry Shampoo Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dry Shampoo Industry?

To stay informed about further developments, trends, and reports in the Dry Shampoo Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence