Key Insights

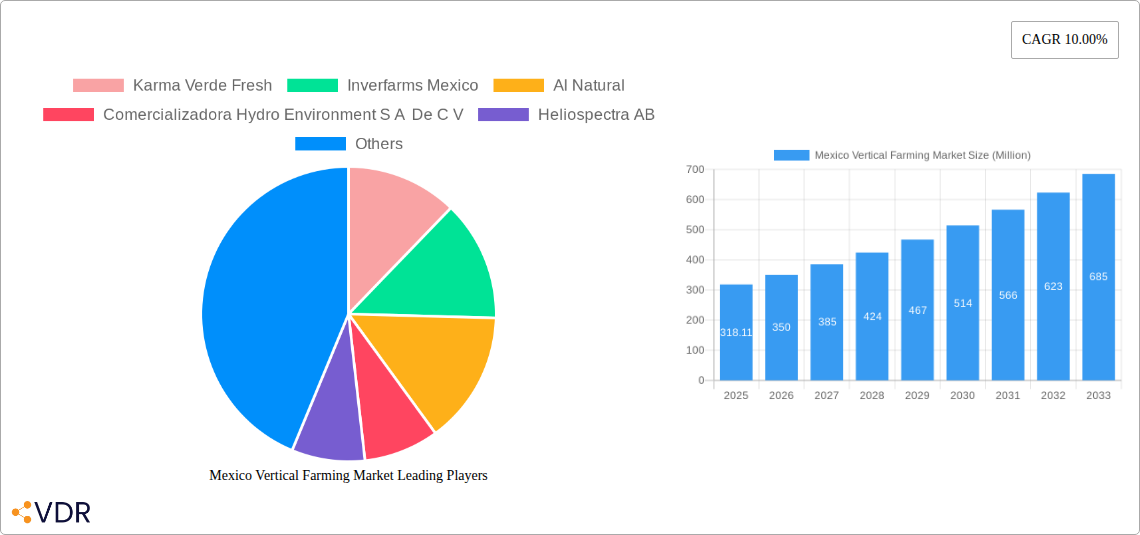

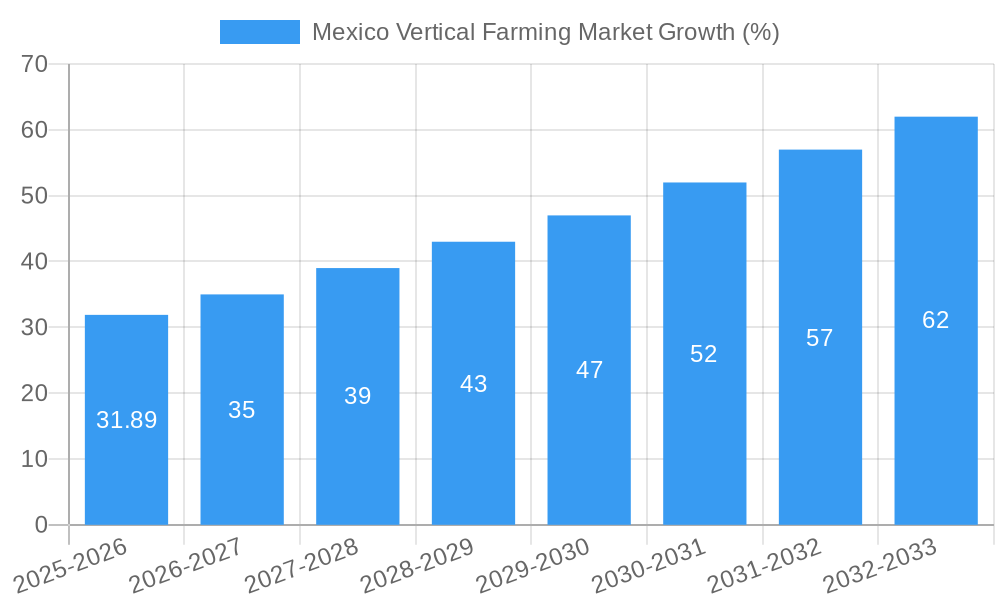

The Mexico vertical farming market, valued at $318.11 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization in Mexico leads to land scarcity and rising demand for fresh produce, making vertical farming a compelling solution for sustainable and efficient food production. Furthermore, the growing consumer preference for locally sourced, organic produce fuels the market's growth. Technological advancements in hydroponics, aeroponics, and aquaponics systems are also contributing, offering improved yields and reduced resource consumption compared to traditional agriculture. The market is segmented by crop type (tomatoes, berries, lettuce, peppers, cucumbers, microgreens, and others), growth mechanism (aeroponics, hydroponics, aquaponics), and structure (building-based and shipping container-based vertical farms). Key players like Karma Verde Fresh, Inverfarms Mexico, and Al Natural are driving innovation and market penetration. While challenges like high initial investment costs and energy consumption exist, government initiatives promoting sustainable agriculture and food security are expected to mitigate these restraints and further accelerate market growth.

The market's segmentation reveals diverse opportunities. Hydroponics currently dominates, but aeroponics and aquaponics are experiencing significant growth due to their potential for higher yields and reduced water usage. Building-based vertical farms hold the largest market share, but shipping container-based farms are gaining traction due to their mobility and scalability. The demand for advanced components like LED lighting, climate control systems, and sensors is also increasing, creating opportunities for technology providers. The forecast period (2025-2033) is expected to witness a significant surge in market value, driven by continued technological innovation, supportive government policies, and increasing consumer awareness of sustainable food production practices. The Mexican government's emphasis on food security and the growing middle class with increased purchasing power are pivotal factors influencing the market's trajectory.

Mexico Vertical Farming Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Mexico Vertical Farming Market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report segments the market by crop type (tomato, berries, lettuce and leafy vegetables, pepper, cucumber, microgreens, other), growth mechanism (aeroponics, hydroponics, aquaponics), and structure (building-based, shipping container-based), offering a granular understanding of this rapidly evolving sector. The market size in 2025 is estimated at xx Million and is projected to reach xx Million by 2033.

Mexico Vertical Farming Market Dynamics & Structure

The Mexico vertical farming market is characterized by a relatively fragmented landscape, with a mix of established players and emerging startups. Market concentration is low, with no single dominant player controlling a significant market share. Technological innovation, particularly in areas like LED lighting, climate control, and automation, is a key driver of growth. However, high initial investment costs and a lack of awareness among consumers present barriers to wider adoption. The regulatory environment is gradually evolving, with supportive policies promoting sustainable agriculture and food security. The market is also seeing increased interest from foreign investors and multinational companies. M&A activity is expected to increase in the coming years as larger players consolidate their position and expand their market reach.

- Market Concentration: Low, with no single dominant player.

- Technological Innovation: Significant driver, focusing on efficiency and yield optimization.

- Regulatory Framework: Gradually evolving, with supportive policies emerging.

- Competitive Substitutes: Traditional farming methods, but vertical farming offers advantages in terms of yield and sustainability.

- End-User Demographics: Growing urban population and increasing demand for fresh produce are driving market growth.

- M&A Trends: Expected to increase, driven by consolidation and expansion efforts. Estimated M&A deal volume in 2024: xx deals.

Mexico Vertical Farming Market Growth Trends & Insights

The Mexico vertical farming market is experiencing robust growth, driven by several factors. Increasing urbanization, rising demand for fresh produce, and growing concerns about food security and sustainability are fueling the adoption of vertical farming technologies. The market is witnessing significant technological disruptions, with the introduction of advanced sensors, automation systems, and data analytics improving efficiency and yields. Consumer behavior is also shifting towards healthier and more sustainably produced food, further bolstering market demand. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is estimated at xx%. Market penetration in 2025 is projected at xx%, expected to increase significantly by 2033. The shift towards locally sourced produce and reduced transportation costs also plays a vital role in market expansion. The adoption of vertical farming is particularly high in urban areas, where land scarcity is a major constraint for traditional agriculture.

Dominant Regions, Countries, or Segments in Mexico Vertical Farming Market

The Mexico City metropolitan area is currently the dominant region for vertical farming, driven by high population density, strong consumer demand, and relatively better infrastructure. Within crop types, Lettuce and Leafy Vegetables hold the largest market share, followed by tomatoes and berries. Hydroponics is the most prevalent growth mechanism due to its relatively lower initial investment and simpler operational requirements. Building-based vertical farms are more common due to scalability and ease of integration into existing infrastructure. Key drivers include supportive government initiatives promoting sustainable agriculture, increasing investments in technology and infrastructure, and growing consumer awareness of the benefits of locally sourced produce.

- Leading Region: Mexico City metropolitan area.

- Dominant Crop Type: Lettuce and Leafy Vegetables.

- Most Prevalent Growth Mechanism: Hydroponics.

- Predominant Structure: Building-based Vertical Farms.

- Key Growth Drivers: Government initiatives, technological advancements, consumer demand.

Mexico Vertical Farming Market Product Landscape

Product innovations are focused on enhancing efficiency and optimizing yields through advanced technologies such as AI-powered climate control systems, automated harvesting robots, and improved LED lighting solutions. The focus is shifting towards modular and scalable systems to cater to a wider range of applications and market segments. Unique selling propositions include reduced water consumption, improved crop quality, and year-round production capability. Technological advancements are leading to significant improvements in resource efficiency and overall productivity, resulting in enhanced profitability for vertical farms.

Key Drivers, Barriers & Challenges in Mexico Vertical Farming Market

Key Drivers:

- Growing urban population and rising demand for fresh produce.

- Increasing concerns about food security and sustainability.

- Government support for sustainable agriculture and technological innovation.

- Technological advancements leading to increased efficiency and yield.

Key Challenges:

- High initial investment costs for setting up vertical farms.

- Limited access to financing and investment for smaller players.

- Lack of skilled labor and technical expertise.

- Competition from traditional farming methods. (Estimated impact on market growth: xx% reduction)

Emerging Opportunities in Mexico Vertical Farming Market

Emerging opportunities include expanding into underserved regions beyond major metropolitan areas, exploring innovative applications like medicinal plants and herbs cultivation, and tapping into the demand for organic and specialty produce. The development of sustainable and energy-efficient vertical farming solutions will also be a key growth area.

Growth Accelerators in the Mexico Vertical Farming Market Industry

Strategic partnerships between technology providers, investors, and agricultural businesses will be crucial in accelerating market growth. The development of standardized operating procedures and best practices can help to overcome some of the challenges associated with vertical farming. Continued technological innovation, particularly in areas like automation and AI, will further enhance the efficiency and profitability of vertical farms, driving market expansion.

Key Players Shaping the Mexico Vertical Farming Market Market

- Karma Verde Fresh

- Inverfarms Mexico

- Al Natural

- Comercializadora Hydro Environment S A De C V

- Heliospectra AB

- Aeroponia Mexican

- Verde Compacto

- Oasis Grower Solutions

- Signify Holding (Philips)

Notable Milestones in Mexico Vertical Farming Market Sector

- February 2023: Rising Farms expands its indoor farming space from 12 to 62 acres, significantly increasing its production capacity.

- October 2022: 30MHz launches affordable vertical farming solutions in partnership with Mexican growers.

In-Depth Mexico Vertical Farming Market Market Outlook

The future of the Mexico vertical farming market is bright, with significant growth potential driven by technological advancements, increasing consumer demand, and supportive government policies. Strategic investments in research and development, coupled with public-private partnerships, will be instrumental in unlocking the full potential of this sector. The market is expected to witness a significant increase in the number of vertical farms, expansion into new regions, and the development of innovative applications, resulting in substantial market growth over the forecast period.

Mexico Vertical Farming Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Mexico Vertical Farming Market Segmentation By Geography

- 1. Mexico

Mexico Vertical Farming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Growth in Organic Cultivation Practices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Vertical Farming Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Karma Verde Fresh

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Inverfarms Mexico

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Natural

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Comercializadora Hydro Environment S A De C V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Heliospectra AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aeroponia Mexican

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Verde Compacto

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oasis Grower Solutions

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Signify Holding (Philips)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Karma Verde Fresh

List of Figures

- Figure 1: Mexico Vertical Farming Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Vertical Farming Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Vertical Farming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Vertical Farming Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Mexico Vertical Farming Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Mexico Vertical Farming Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Mexico Vertical Farming Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Mexico Vertical Farming Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Mexico Vertical Farming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Mexico Vertical Farming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Mexico Vertical Farming Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Mexico Vertical Farming Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Mexico Vertical Farming Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Mexico Vertical Farming Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Mexico Vertical Farming Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Mexico Vertical Farming Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Vertical Farming Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the Mexico Vertical Farming Market?

Key companies in the market include Karma Verde Fresh, Inverfarms Mexico, Al Natural, Comercializadora Hydro Environment S A De C V, Heliospectra AB, Aeroponia Mexican, Verde Compacto, Oasis Grower Solutions, Signify Holding (Philips).

3. What are the main segments of the Mexico Vertical Farming Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 318.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Growth in Organic Cultivation Practices.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

February 2023: Rising Farms, a high-tech indoor farming firm based in Mexico, announced the extension of its indoor farming space from 12 to 62 acres, increasing its capacity 5 fold to grow hydroponic crops and providing the market with a more comprehensive choice of high-quality produce.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Vertical Farming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Vertical Farming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Vertical Farming Market?

To stay informed about further developments, trends, and reports in the Mexico Vertical Farming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence