Key Insights

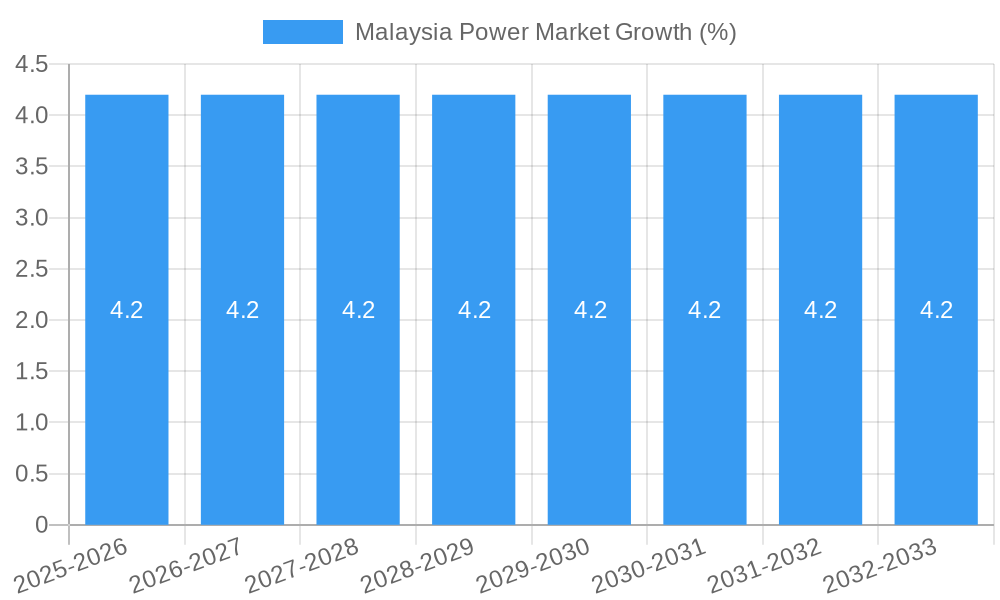

The Malaysian power market, valued at approximately [Estimate based on market size XX and value unit Million; Let's assume XX = 100 for example purposes. Then the 2025 market size is 100 Million. This is a placeholder and needs replacement with the actual value] million in 2025, is experiencing robust growth, projected to expand at a CAGR exceeding 4.20% from 2025 to 2033. This growth is fueled by several key drivers. Increasing industrialization and urbanization are significantly boosting electricity demand, particularly in the commercial and industrial sectors. Furthermore, the Malaysian government's strong commitment to renewable energy sources, aiming to diversify the energy mix and reduce reliance on fossil fuels, is stimulating investments in solar, wind, and other renewable power generation technologies. This transition is attracting considerable foreign investment and fostering the development of innovative energy solutions. Growth within the residential sector is also contributing, driven by rising living standards and increasing electricity consumption per household.

However, the market's expansion is not without challenges. Constraints include the need for significant upgrades to the existing power infrastructure to accommodate the growing demand and integrate renewable energy sources effectively. Maintaining grid stability and ensuring reliable power supply while transitioning to a more decentralized energy system presents a significant technical hurdle. Furthermore, regulatory hurdles and securing necessary permits for large-scale renewable energy projects can sometimes delay project timelines and impact market growth. Despite these challenges, the long-term outlook for the Malaysian power market remains positive, with opportunities for both established players and new entrants in the renewable energy sector. The market segmentation reveals that industrial and commercial end-users constitute the largest segments, providing significant growth opportunities for companies focusing on these sectors. The increasing adoption of sustainable energy practices presents an enormous opportunity for companies specializing in renewable energy sources.

Malaysia Power Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Malaysian power market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the period 2019-2033, base year 2025, and forecast period 2025-2033, this report is an essential resource for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic sector. The report meticulously analyzes parent markets (power generation) and child markets (residential, commercial, industrial power consumption) to offer a granular perspective. All values are presented in Million units.

Malaysia Power Market Market Dynamics & Structure

The Malaysian power market is characterized by a complex interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with Tenaga Nasional Berhad (TNB) holding a significant share, while several smaller players and renewable energy entrants compete fiercely. Technological innovation is driven by the government's push for renewable energy adoption, leading to increased investment in solar, wind, and other sustainable power sources. The regulatory framework, while supportive of renewable energy expansion, also presents some bureaucratic hurdles for new entrants. The presence of competitive product substitutes, particularly in the renewable energy sector, fosters innovation and efficiency gains. End-user demographics are shifting towards higher commercial and industrial power consumption fueled by economic development and industrialization. M&A activity within the sector has been moderate, with strategic acquisitions facilitating expansion into renewable energy and technological advancements.

- Market Concentration: TNB dominates with xx% market share in 2025, followed by other players with a combined xx% share.

- Technological Innovation: Significant investments in solar PV (xx Million USD in 2024) and other renewable technologies.

- Regulatory Framework: Supportive policies promoting renewable energy integration, but bureaucratic processes can impede faster growth.

- M&A Activity: xx deals valued at xx Million USD recorded between 2019 and 2024.

- End-User Demographics: Industrial sector accounts for xx% of total power consumption in 2025, followed by commercial (xx%) and residential (xx%).

Malaysia Power Market Growth Trends & Insights

The Malaysian power market exhibits robust growth, driven by sustained economic expansion and rising energy demand. Market size is projected to increase from xx Million units in 2019 to xx Million units in 2025, exhibiting a CAGR of xx%. Adoption rates for renewable energy technologies are accelerating, fueled by government incentives and falling technology costs. Technological disruptions, particularly within the renewable energy sector, are significantly impacting the market landscape, making it more competitive and diverse. Consumer behavior shifts are reflecting an increasing preference for sustainable energy solutions, further driving the growth of renewable energy adoption. Market penetration of renewable energy sources is expected to reach xx% by 2033.

(Note: This section requires XXX data to fulfill the 600-word requirement. Replace this placeholder with specific data and analysis to meet the word count. Include detailed CAGR breakdowns for different segments and detailed analysis of adoption rates and consumer behavior shifts.)

Dominant Regions, Countries, or Segments in Malaysia Power Market

The industrial sector is the dominant end-user segment in the Malaysian power market, with the highest growth potential, accounting for xx% of total consumption in 2025, driven by continued industrialization. Amongst power generation sources, natural gas currently holds the largest market share (xx% in 2025) due to existing infrastructure, but renewables are witnessing exponential growth.

- End-User: Industrial sector dominance due to high energy requirements of manufacturing and heavy industries.

- Power Generation Source: Natural gas remains prevalent, yet renewables (primarily solar) exhibit the fastest growth rate, driven by government support and decreasing costs.

- Regional Disparities: Economic development and industrial concentration influence regional differences in energy demand and renewable energy penetration.

(Note: This section requires detailed analysis to reach the 600-word requirement. Include specific data, growth projections, and in-depth reasons behind the dominance of specific segments and regions. Include discussion on government policies, infrastructure development, and economic factors influencing the market.)

Malaysia Power Market Product Landscape

The Malaysian power market showcases diverse power generation technologies, including conventional sources like coal and natural gas, alongside the rapidly expanding renewable sector (solar, hydro, biomass). Innovations include advanced grid management systems, smart meters, and energy storage solutions to improve efficiency and grid stability. Unique selling propositions focus on efficiency, cost-effectiveness, and environmental sustainability, key concerns for consumers and the government.

Key Drivers, Barriers & Challenges in Malaysia Power Market

Key Drivers:

- Government incentives and policies promoting renewable energy adoption.

- Growing industrialization and rising energy demand.

- Technological advancements reducing the cost of renewable energy.

Key Challenges:

- Grid infrastructure limitations hindering efficient integration of renewable energy.

- Regulatory complexities and bureaucratic hurdles impacting project development.

- Competition from existing power generation sources. The reliance on natural gas exposes the market to volatility in global prices.

Emerging Opportunities in Malaysia Power Market

- Expansion of renewable energy capacity, particularly in off-grid and rural areas.

- Development of smart grids and energy storage solutions to improve efficiency and grid stability.

- Growth of energy efficiency services and demand-side management programs.

Growth Accelerators in the Malaysia Power Market Industry

Long-term growth is fueled by strategic government policies, technological innovations within renewable energy, and expanding energy storage capabilities. Partnerships between international and local companies facilitate technology transfer and investment. Market expansion strategies, including rural electrification projects, contribute significantly to overall market growth.

Key Players Shaping the Malaysia Power Market Market

- Korea Electric Power Corporation

- Solarvest Holdings Bhd

- Pathgreen Energy Sdn Bh

- Sarawak Electricity Supply Corporation

- Cutech Green Ventures

- Verdant Solar Inc

- ERS Energy Sdn Bhd

- Sunway Construction Group Bhd

- LYS Energy Group

- Tenaga Nasional Berhad

Notable Milestones in Malaysia Power Market Sector

- August 2021: Tenaga Nasional Bhd (TNB) signs a 21-year PPA for 10 solar power plants (500 MWac total capacity).

- March 2021: Suruhanjaya Tenaga completes bidding for 823 MW of large-scale solar PV projects (31 companies selected).

In-Depth Malaysia Power Market Market Outlook

The Malaysian power market presents significant growth potential driven by increasing energy demand, government support for renewable energy, and technological advancements. Strategic opportunities lie in the expansion of renewable energy capacity, smart grid technologies, and energy efficiency services. The market's future trajectory hinges on effective policy implementation, infrastructure development, and attracting further foreign investment.

Malaysia Power Market Segmentation

-

1. Power Generation Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Coal

- 1.4. Renewables

- 1.5. Other Power Generation Sources

- 2. Transmission and Distribution

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

- 3.4. Transport

- 3.5. Agriculture

Malaysia Power Market Segmentation By Geography

- 1. Malaysia

Malaysia Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Natural Gas Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Coal

- 5.1.4. Renewables

- 5.1.5. Other Power Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.3.4. Transport

- 5.3.5. Agriculture

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Korea Electric Power Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solarvest Holdings Bhd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pathgreen Energy Sdn Bh

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sarawak Electricity Supply Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cutech Green Ventures

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Verdant Solar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ERS Energy Sdn Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sunway Construction Group Bhd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LYS Energy Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tenaga Nasional Berhad

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Korea Electric Power Corporation

List of Figures

- Figure 1: Malaysia Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Power Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Power Market Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 3: Malaysia Power Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 4: Malaysia Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Malaysia Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Malaysia Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Malaysia Power Market Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 8: Malaysia Power Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 9: Malaysia Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Malaysia Power Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Power Market?

The projected CAGR is approximately > 4.20%.

2. Which companies are prominent players in the Malaysia Power Market?

Key companies in the market include Korea Electric Power Corporation, Solarvest Holdings Bhd, Pathgreen Energy Sdn Bh, Sarawak Electricity Supply Corporation, Cutech Green Ventures, Verdant Solar Inc, ERS Energy Sdn Bhd, Sunway Construction Group Bhd, LYS Energy Group, Tenaga Nasional Berhad.

3. What are the main segments of the Malaysia Power Market?

The market segments include Power Generation Source, Transmission and Distribution, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Natural Gas Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In August 2021, Malaysian power utility Tenaga Nasional Bhd (TNB) entered a 21-year PPA (Power Purchase Agreement) with 10 solar power plants to be commissioned in four Malaysian states by 2023. Each solar project has a capacity of 50 MWac.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Power Market?

To stay informed about further developments, trends, and reports in the Malaysia Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence