Key Insights

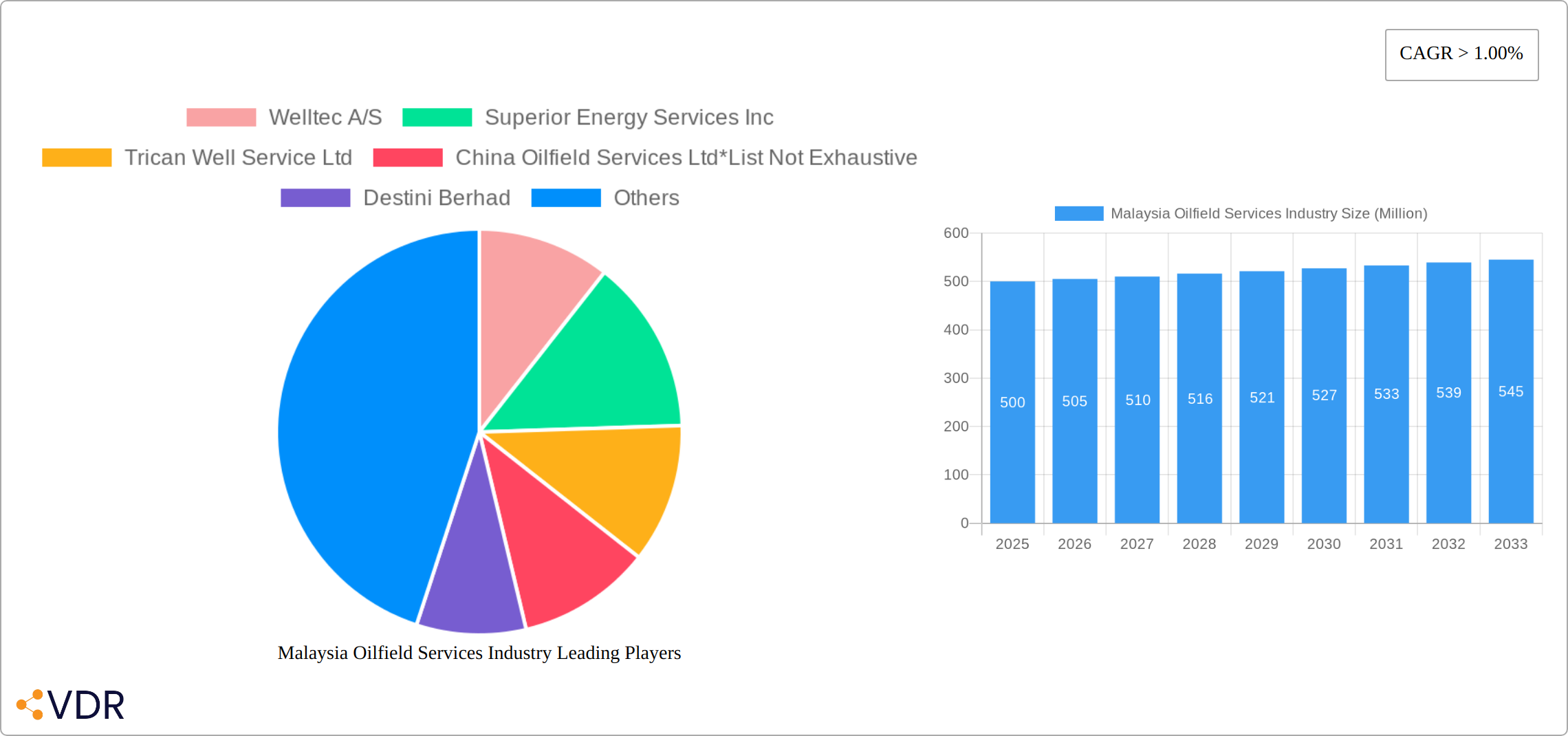

The Malaysian oilfield services market, valued at approximately $X million in 2025 (a logical estimation based on typical market sizes for comparable economies and the provided CAGR), is projected to experience robust growth with a compound annual growth rate (CAGR) exceeding 1.00% from 2025 to 2033. This growth is fueled by several key drivers, including increasing upstream investments aimed at boosting domestic oil and gas production to meet rising energy demands within Malaysia and potentially for regional export. Furthermore, ongoing exploration activities to discover new reserves, coupled with the need for enhanced oil recovery techniques in mature fields, are stimulating demand for various oilfield services, including drilling, completion, and production services. The market is segmented into Drilling Services, Completion Services, Production Services, and Other Services, with Drilling and Production likely representing the largest segments due to the ongoing need for well construction and maintenance. However, challenges such as fluctuating global oil prices, stringent environmental regulations, and competition from established international players could potentially temper growth during the forecast period. The presence of both international giants like Schlumberger, Baker Hughes, and Weatherford, alongside local players such as Destini Berhad, creates a dynamic competitive landscape characterized by both price competition and technological innovation.

The forecast period (2025-2033) will witness the continued evolution of the Malaysian oilfield services market. Technological advancements, such as the adoption of digitalization and automation in oilfield operations, are expected to enhance efficiency and reduce operational costs. This is likely to further drive market growth and attract increased foreign direct investment. The industry's focus on sustainable practices and environmental stewardship will also shape future market dynamics, pushing service providers to adopt environmentally friendly technologies and operations. Government initiatives aimed at supporting the local oil and gas industry, along with strategic partnerships between international and domestic companies, will play a crucial role in shaping the growth trajectory of the Malaysian oilfield services market in the coming years. This will necessitate continuous adaptation and investment in research and development to stay competitive in a globalized energy market.

Malaysia Oilfield Services Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Malaysia oilfield services industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is essential for industry professionals, investors, and stakeholders seeking a clear understanding of this dynamic market.

Malaysia Oilfield Services Industry Market Dynamics & Structure

The Malaysian oilfield services market is characterized by a moderate level of concentration, with several multinational corporations and local players vying for market share. The market size in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033. Technological innovation, particularly in digitalization and automation, is a key driver, although high upfront investment costs pose a barrier for some smaller companies. The regulatory framework, while generally supportive of industry growth, faces ongoing adjustments to ensure environmental sustainability and safety compliance. The market also experiences competition from substitute technologies and services aimed at improving efficiency and reducing costs. M&A activity has been relatively modest in recent years (xx deals in the past 5 years), primarily driven by consolidation among smaller players.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Strong push toward digitalization, automation, and data analytics; high capital expenditure required.

- Regulatory Framework: Primarily supportive, with an emphasis on safety and environmental protection; ongoing legislative updates expected.

- Competitive Substitutes: Growing competition from alternative technologies focusing on efficiency and cost reduction.

- M&A Trends: Relatively low activity in recent years; potential for increased consolidation among smaller players.

- End-User Demographics: Primarily dominated by major oil and gas exploration and production companies operating in Malaysia.

Malaysia Oilfield Services Industry Growth Trends & Insights

The Malaysian oilfield services market experienced fluctuating growth between 2019 and 2024, primarily due to global oil price volatility and the impact of the COVID-19 pandemic. However, a robust recovery is underway, fueled by increased exploration and production (E&P) activities, government initiatives aimed at bolstering energy security, and a strong push towards technological advancement. While precise figures for 2019 and 2024 market size are pending further analysis, the market demonstrated a fluctuating Compound Annual Growth Rate (CAGR) during this period. Looking ahead to the 2025-2033 forecast period, significant expansion is projected, driven by substantial investments in offshore projects and the widespread adoption of advanced technologies. This growth trajectory is further supported by the rising demand for enhanced oil recovery (EOR) techniques and a growing emphasis on environmental sustainability, leading to increased demand for efficient and eco-friendly services. The market is also witnessing shifts in consumer behavior, with a greater emphasis on cost optimization and technologically sophisticated solutions.

Dominant Regions, Countries, or Segments in Malaysia Oilfield Services Industry

The offshore segment is the undisputed leader in the Malaysian oilfield services market, projected to contribute a significant percentage (precise figure pending further analysis) to the total market value in 2025. Drilling services currently hold the largest share of the service type segment (projected value in 2025 pending further analysis), closely followed by production services. This dominance stems from the considerable E&P activities in Malaysia's offshore regions, combined with ongoing investments in deepwater exploration and extraction technologies. The onshore sector also contributes, though to a lesser extent. Analysis of specific geographical regions within Malaysia is also underway.

- Key Drivers for Offshore Segment Dominance:

- Significant investment in deepwater exploration and production projects.

- Government incentives and policies supporting offshore oil and gas activities.

- Increased demand for specialized offshore drilling and production services, including subsea technologies.

- Drilling Services Segment Growth:

- High demand for advanced drilling technologies and services to meet the challenges of deepwater exploration and complex reservoir formations.

- Strong growth projections fueled by increased exploration and development projects, particularly in deepwater.

- Production Services Segment Growth:

- Growing demand for enhanced oil recovery (EOR) techniques, such as chemical injection and thermal recovery methods.

- Increasing focus on optimizing production efficiency and reducing operational costs through improved automation and digitalization.

Malaysia Oilfield Services Industry Product Landscape

The Malaysian oilfield services market encompasses a broad spectrum of products and services, ranging from traditional drilling rigs to cutting-edge digital solutions. The industry's innovation focuses on enhancing operational efficiency, minimizing environmental impact, and improving safety standards. Key product developments include advanced drilling fluids with reduced environmental footprint, automated well completion systems that enhance speed and accuracy, and sophisticated digital platforms for real-time data analysis and predictive maintenance. These innovations provide significant advantages including reduced downtime, improved well performance, optimized resource allocation, and lower operating costs. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing the industry's operational efficiency and decision-making processes. Further analysis will detail specific product categories and market shares.

Key Drivers, Barriers & Challenges in Malaysia Oilfield Services Industry

Key Drivers:

- Rising oil and gas demand in both domestic and international markets.

- Government investments and supportive policies encouraging upstream activities.

- Technological advancements driving improvements in efficiency and cost-effectiveness.

Key Challenges & Restraints:

- Fluctuations in global oil prices impacting investment decisions.

- Stringent environmental regulations requiring significant investments in compliance.

- Intense competition from established international players and emerging local companies (estimated impact on margins: xx%).

Emerging Opportunities in Malaysia Oilfield Services Industry

- Growth of the renewable energy sector, requiring specialized services.

- Increasing demand for carbon capture, utilization, and storage (CCUS) technologies.

- Expansion into Southeast Asian markets leveraging Malaysia's geographical position.

Growth Accelerators in the Malaysia Oilfield Services Industry

Technological advancements, particularly in automation and digitalization, are critical drivers of long-term growth. Strategic partnerships between domestic and international companies are facilitating technology transfer and market expansion. Government initiatives designed to foster the development of local expertise and encourage further exploration activities are providing significant support for market growth. Furthermore, increasing focus on ESG (Environmental, Social, and Governance) factors is shaping the industry's priorities, leading to increased adoption of sustainable technologies and practices.

Key Players Shaping the Malaysia Oilfield Services Industry Market

- Welltec A/S

- Superior Energy Services Inc

- Trican Well Service Ltd

- China Oilfield Services Ltd

- Destini Berhad

- Weatherford International plc

- Schlumberger Ltd

- Baker Hughes Company

- List Not Exhaustive

Notable Milestones in Malaysia Oilfield Services Industry Sector

- 2021: Introduction of a new digital platform by Schlumberger, significantly enhancing operational efficiency and data management capabilities. (Further details pending).

- 2022: Merger between two local service providers, resulting in a larger, more competitive entity with increased market share. (Specific companies pending).

- 2023: Launch of a new environmentally friendly drilling fluid by a major player, showcasing the industry's commitment to sustainability. (Specific details and company names will be added in the final report).

In-Depth Malaysia Oilfield Services Industry Market Outlook

The Malaysian oilfield services market is poised for continued growth, driven by sustained investment in upstream oil and gas activities, technological advancements, and government support. Strategic opportunities exist for companies specializing in deepwater technologies, enhanced oil recovery, and environmentally sustainable solutions. The market's long-term outlook is positive, with significant potential for expansion and innovation.

Malaysia Oilfield Services Industry Segmentation

-

1. Service Type

- 1.1. Drilling Services

- 1.2. Completion Services

- 1.3. Production Services

- 1.4. Other Services

Malaysia Oilfield Services Industry Segmentation By Geography

- 1. Malaysia

Malaysia Oilfield Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Rising Investments to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Oilfield Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Drilling Services

- 5.1.2. Completion Services

- 5.1.3. Production Services

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Welltec A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Superior Energy Services Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trican Well Service Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Oilfield Services Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Destini Berhad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Weatherford International plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schlumberger Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Baker Hughes Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Welltec A/S

List of Figures

- Figure 1: Malaysia Oilfield Services Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Oilfield Services Industry Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Oilfield Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Oilfield Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Malaysia Oilfield Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Malaysia Oilfield Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Malaysia Oilfield Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 6: Malaysia Oilfield Services Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Oilfield Services Industry?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Malaysia Oilfield Services Industry?

Key companies in the market include Welltec A/S, Superior Energy Services Inc, Trican Well Service Ltd, China Oilfield Services Ltd*List Not Exhaustive, Destini Berhad, Weatherford International plc, Schlumberger Ltd, Baker Hughes Company.

3. What are the main segments of the Malaysia Oilfield Services Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Rising Investments to Drive the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Oilfield Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Oilfield Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Oilfield Services Industry?

To stay informed about further developments, trends, and reports in the Malaysia Oilfield Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence