Key Insights

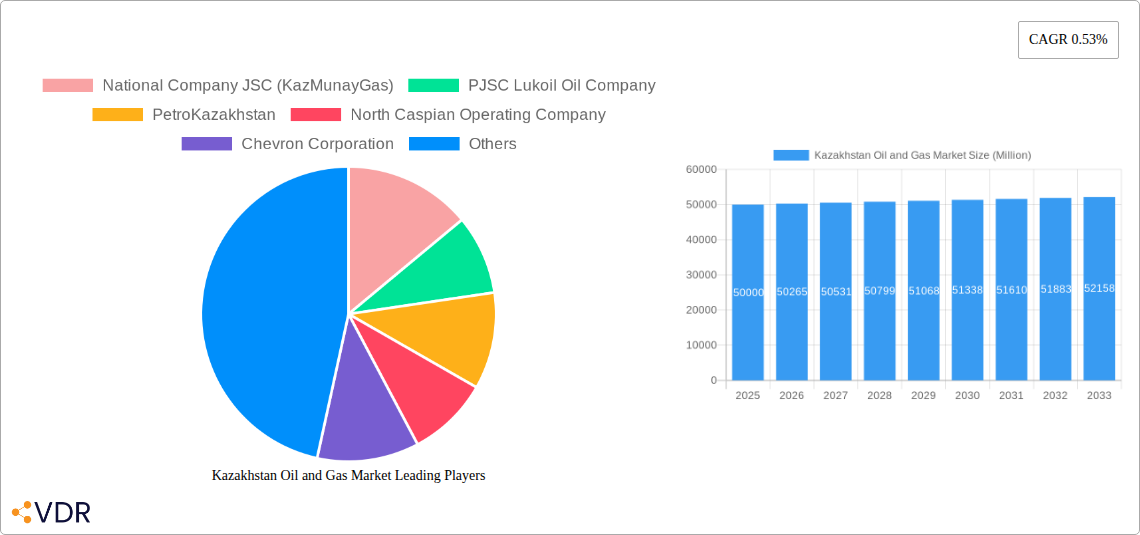

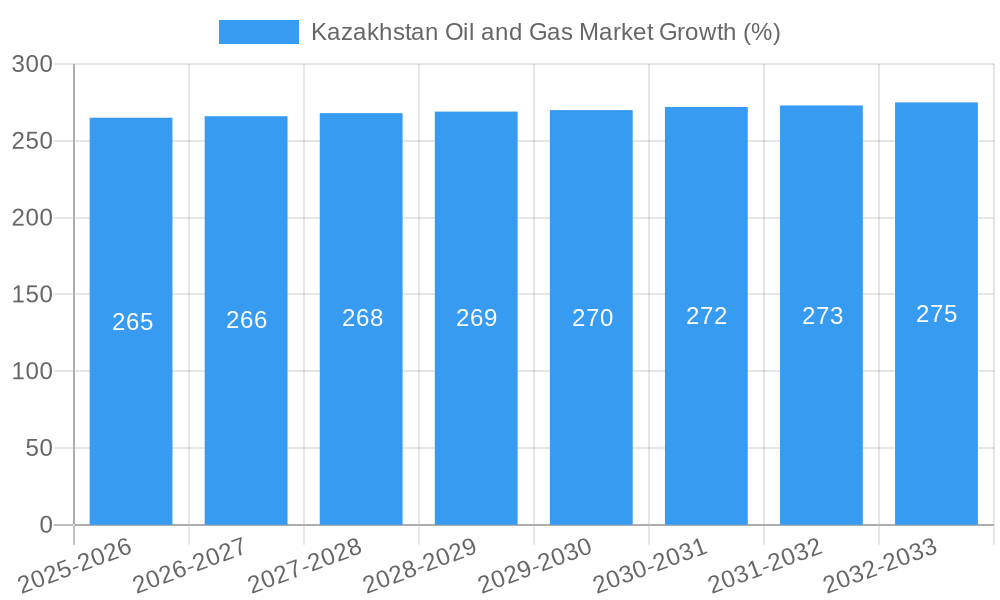

The Kazakhstan oil and gas market, while exhibiting a relatively modest CAGR of 0.53%, presents a complex landscape shaped by both significant existing infrastructure and ongoing geopolitical considerations. The market's size in 2025 is estimated at $XX million (replace XX with a realistic estimate based on available market data for similar regions or industries; this requires external research). This relatively slow growth rate is likely influenced by several factors. Upstream activities, dominated by major international and national players like KazMunayGas, Lukoil, and Chevron, are crucial, focusing on established fields and exploring new opportunities. The downstream sector, encompassing refineries and distribution networks, faces challenges related to refining capacity and infrastructure upgrades to meet evolving fuel standards. Midstream activities, encompassing transportation and storage, particularly pipeline infrastructure connecting key routes, are vital to efficient oil and gas export. The onshore segment likely holds a larger market share than offshore due to established infrastructure and lower exploration costs, though offshore exploration remains a significant area of potential growth. LNG terminal development and expansion could unlock further export opportunities, particularly to Asian markets, contributing to future market expansion.

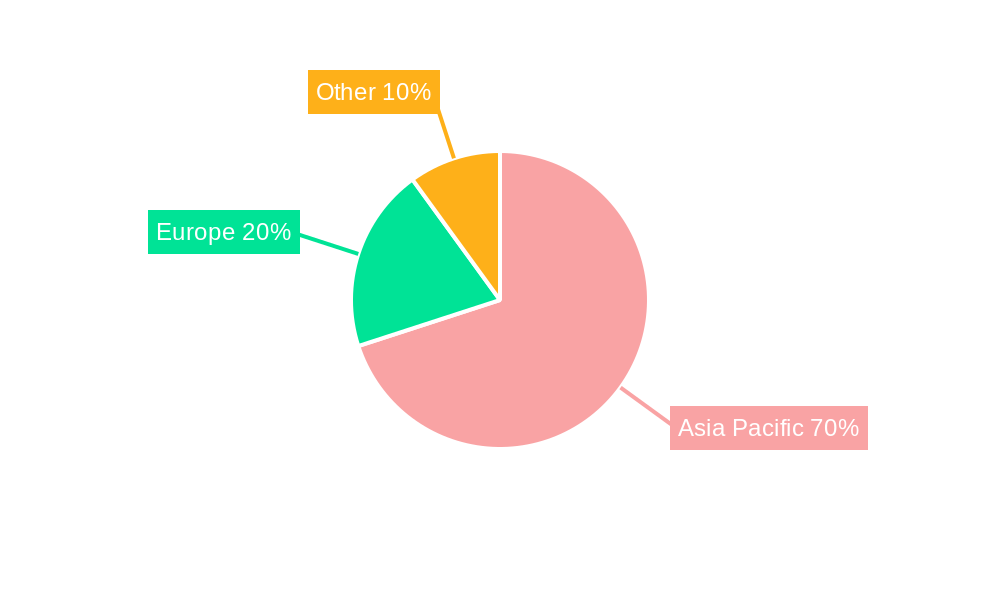

The market segmentation reveals specific growth opportunities. Investment in pipeline infrastructure modernization and expansion, particularly those servicing key export routes, will be critical. Similarly, upgrading refining capacity and adapting to cleaner fuel demands will drive growth in the downstream sector. The geographical distribution of oil and gas reserves within Kazakhstan, alongside the nation's geopolitical positioning, greatly influence the sector’s strategic direction. Strong government support and foreign investment remain essential drivers, although regulatory changes and environmental concerns could act as potential restraints. Growth in the Asia-Pacific region, specifically China, Japan, and India, presents a key opportunity for Kazakhstan's oil and gas exports, driving further investment and expansion within the sector. Analyzing the interplay between these drivers and restraints is key to understanding the future trajectory of the Kazakhstan oil and gas market.

Kazakhstan Oil and Gas Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Kazakhstan oil and gas market, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It delves into market dynamics, growth trends, dominant segments, key players, and future opportunities, offering invaluable insights for industry professionals, investors, and policymakers. The report examines both upstream and downstream segments, including refineries, pipeline infrastructure, and LNG terminals, across onshore and offshore operations. This analysis utilizes a robust methodology, incorporating both qualitative and quantitative data to provide a complete picture of this vital energy market. Market values are presented in millions of units.

Kazakhstan Oil and Gas Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and key industry trends. The Kazakhstan oil and gas market is characterized by a mix of state-owned and international players, with KazMunayGas playing a dominant role.

- Market Concentration: KazMunayGas holds a significant market share (xx%), followed by Lukoil (xx%), Chevron (xx%), and other international and domestic players. The market exhibits moderate concentration, with potential for consolidation through mergers and acquisitions (M&A).

- Technological Innovation: The sector is witnessing increased adoption of enhanced oil recovery (EOR) techniques and digitalization efforts to improve efficiency and reduce costs. However, challenges remain in technology transfer and infrastructure upgrades.

- Regulatory Framework: The government's policies and regulations play a crucial role in shaping the market, including licensing procedures, environmental regulations, and tax incentives. Recent regulatory changes have aimed at attracting foreign investment and increasing production efficiency.

- Competitive Substitutes: While oil and gas remain dominant, the emergence of renewable energy sources is presenting a growing competitive pressure, particularly in the long term.

- End-User Demographics: The primary end-users include domestic industries, power generation, and export markets, with export markets playing a significant role in revenue generation.

- M&A Trends: The past five years have seen xx M&A deals, totaling an estimated xx million USD, indicating a moderate level of consolidation within the industry. Further consolidation is anticipated as companies strive for economies of scale and enhanced efficiency.

Kazakhstan Oil and Gas Market Growth Trends & Insights

The Kazakhstan oil and gas market has experienced fluctuating growth in recent years, influenced by global oil prices, geopolitical factors, and production levels. The market size in 2024 was estimated at xx million USD, exhibiting a CAGR of xx% during the 2019-2024 period. The forecast period (2025-2033) projects a CAGR of xx%, reaching xx million USD by 2033, driven by increasing demand, both domestically and internationally, alongside investments in new exploration and production activities. The report provides detailed analysis of fluctuating global oil prices, geopolitical uncertainty, technological disruptions, and shifts in energy demand and supply which further impact the growth.

Dominant Regions, Countries, or Segments in Kazakhstan Oil and Gas Market

The Western Kazakhstan region, rich in oil and gas reserves, dominates the upstream segment, contributing the largest share of production. The onshore segment accounts for the majority of operations due to established infrastructure and easier access. The downstream segment is concentrated around major refineries in Atyrau and Pavlodar.

- Upstream: The West Kazakhstan region dominates upstream production due to prolific oil and gas fields. Investment in exploration and production technologies is driving significant growth in this segment.

- Midstream: Pipeline infrastructure plays a vital role in transporting oil and gas, with key routes connecting production sites to refineries and export terminals. Further investment in pipeline capacity expansion is expected.

- Downstream: Refineries in Atyrau and Pavlodar account for a significant portion of downstream activity. Growth is driven by increasing domestic demand and exports of refined products.

- Onshore: Onshore activities dominate due to readily available infrastructure, contributing to a larger share of overall production.

- Offshore: Although relatively less developed, offshore exploration and production are expected to contribute incrementally to the country's oil and gas output in the coming years.

- Pipeline Infrastructure: Existing pipeline infrastructure plays a critical role, linking production sites to domestic and international markets. Capacity expansion is vital for accommodating future production increases.

- LNG Terminals: The potential development of LNG terminals will open up new export opportunities for Kazakhstan, although current capacity is limited.

Kazakhstan Oil and Gas Market Product Landscape

The product landscape primarily consists of crude oil, natural gas, and refined petroleum products. Technological advancements are focused on improving extraction techniques, optimizing refining processes, and enhancing pipeline efficiency. This involves the implementation of advanced analytics and automation.

Key Drivers, Barriers & Challenges in Kazakhstan Oil and Gas Market

Key Drivers:

- Abundant oil and gas reserves.

- Growing domestic demand for energy.

- Favorable government policies supporting the industry.

- Investments in infrastructure development.

Key Challenges:

- Geopolitical risks.

- Fluctuations in global oil prices.

- Environmental regulations and concerns.

- Dependence on aging infrastructure in certain areas. Estimated investment needs in infrastructure modernization reach xx million USD in the forecast period.

Emerging Opportunities in Kazakhstan Oil and Gas Market

- Expansion into new exploration areas, including deeper offshore exploration.

- Increased investment in gas processing and petrochemical projects.

- Development of renewable energy sources alongside oil and gas production.

- Growth in the downstream sector with value-added product development.

Growth Accelerators in the Kazakhstan Oil and Gas Market Industry

Long-term growth will be driven by strategic partnerships with international companies, technological advancements, and diversification into petrochemical projects. Further development of pipeline infrastructure and the potential development of LNG terminals will also contribute significantly.

Key Players Shaping the Kazakhstan Oil and Gas Market Market

- National Company JSC (KazMunayGas)

- PJSC Lukoil Oil Company

- PetroKazakhstan

- North Caspian Operating Company

- Chevron Corporation

- PJSC Gazprom

- Karachaganak Petroleum Operating BV

- Nostrum Oil & Gas PLC

Notable Milestones in Kazakhstan Oil and Gas Market Sector

- June 2023: The Ministry of Energy announced maintaining oil production reduction by 78,000 barrels per day until the end of 2024, aligning with OPEC's agreement. This impacts overall production levels and potentially export volumes.

- May 2023: Sinopec and KazMunayGaz reached agreements for a gas-based petrochemical complex in Atyrau. This signifies significant investment in downstream expansion and diversification.

In-Depth Kazakhstan Oil and Gas Market Market Outlook

The Kazakhstan oil and gas market presents significant opportunities for long-term growth, driven by increasing demand, technological advancements, and strategic investments. Successful navigation of geopolitical uncertainties and efficient infrastructure development will be crucial to realizing this potential. The market is projected to witness substantial growth in the coming years, supported by ongoing exploration activities and downstream expansion.

Kazakhstan Oil and Gas Market Segmentation

-

1. Upstream

-

1.1. Location of Deployment

-

1.1.1. Onshore

-

1.1.1.1. Overview

- 1.1.1.1.1. Existing Projects

- 1.1.1.1.2. Projects in Pipeline

- 1.1.1.1.3. Upcoming Projects

-

1.1.1.1. Overview

- 1.1.2. Offshore

-

1.1.1. Onshore

-

1.1. Location of Deployment

-

2. Midstream

-

2.1. Transportation

-

2.1.1. Overview

- 2.1.1.1. Existing Infrastructure

- 2.1.1.2. Projects in Pipeline

- 2.1.1.3. Upcoming Projects

-

2.1.1. Overview

- 2.2. Storage

- 2.3. LNG Terminals

-

2.1. Transportation

-

3. Downstream

-

3.1. Refineries

-

3.1.1. Overview

- 3.1.1.1. Existing Infrastructure

- 3.1.1.2. Projects in Pipeline

- 3.1.1.3. Upcoming Projects

-

3.1.1. Overview

- 3.2. Petrochemicals Plants

-

3.1. Refineries

Kazakhstan Oil and Gas Market Segmentation By Geography

- 1. Kazakhstan

Kazakhstan Oil and Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.1.1. Location of Deployment

- 5.1.1.1. Onshore

- 5.1.1.1.1. Overview

- 5.1.1.1.1.1. Existing Projects

- 5.1.1.1.1.2. Projects in Pipeline

- 5.1.1.1.1.3. Upcoming Projects

- 5.1.1.1.1. Overview

- 5.1.1.2. Offshore

- 5.1.1.1. Onshore

- 5.1.1. Location of Deployment

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.2.1. Transportation

- 5.2.1.1. Overview

- 5.2.1.1.1. Existing Infrastructure

- 5.2.1.1.2. Projects in Pipeline

- 5.2.1.1.3. Upcoming Projects

- 5.2.1.1. Overview

- 5.2.2. Storage

- 5.2.3. LNG Terminals

- 5.2.1. Transportation

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.3.1. Refineries

- 5.3.1.1. Overview

- 5.3.1.1.1. Existing Infrastructure

- 5.3.1.1.2. Projects in Pipeline

- 5.3.1.1.3. Upcoming Projects

- 5.3.1.1. Overview

- 5.3.2. Petrochemicals Plants

- 5.3.1. Refineries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kazakhstan

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. China Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 8. India Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 10. Southeast Asia Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 12. Indonesia Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 13. Phillipes Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 14. Singapore Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 15. Thailandc Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia Pacific Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 National Company JSC (KazMunayGas)

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 PJSC Lukoil Oil Company

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 PetroKazakhstan

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 North Caspian Operating Company

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Chevron Corporation

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 PJSC Gazprom

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Karachaganak Petroleum Operating BV

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Nostrum Oil & Gas PLC

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.1 National Company JSC (KazMunayGas)

List of Figures

- Figure 1: Kazakhstan Oil and Gas Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kazakhstan Oil and Gas Market Share (%) by Company 2024

List of Tables

- Table 1: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kazakhstan Oil and Gas Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 4: Kazakhstan Oil and Gas Market Volume Million Forecast, by Upstream 2019 & 2032

- Table 5: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 6: Kazakhstan Oil and Gas Market Volume Million Forecast, by Midstream 2019 & 2032

- Table 7: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 8: Kazakhstan Oil and Gas Market Volume Million Forecast, by Downstream 2019 & 2032

- Table 9: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Kazakhstan Oil and Gas Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Kazakhstan Oil and Gas Market Volume Million Forecast, by Country 2019 & 2032

- Table 13: China Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: India Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Southeast Asia Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Southeast Asia Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Indonesia Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Phillipes Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Thailandc Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Asia Pacific Kazakhstan Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Asia Pacific Kazakhstan Oil and Gas Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 35: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 36: Kazakhstan Oil and Gas Market Volume Million Forecast, by Upstream 2019 & 2032

- Table 37: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 38: Kazakhstan Oil and Gas Market Volume Million Forecast, by Midstream 2019 & 2032

- Table 39: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 40: Kazakhstan Oil and Gas Market Volume Million Forecast, by Downstream 2019 & 2032

- Table 41: Kazakhstan Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Kazakhstan Oil and Gas Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kazakhstan Oil and Gas Market?

The projected CAGR is approximately 0.53%.

2. Which companies are prominent players in the Kazakhstan Oil and Gas Market?

Key companies in the market include National Company JSC (KazMunayGas), PJSC Lukoil Oil Company, PetroKazakhstan, North Caspian Operating Company, Chevron Corporation, PJSC Gazprom, Karachaganak Petroleum Operating BV, Nostrum Oil & Gas PLC.

3. What are the main segments of the Kazakhstan Oil and Gas Market?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector.

6. What are the notable trends driving market growth?

Upstream Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

June 2023: The Ministry of Energy in Kazakhstan has announced that the country will maintain its reduction of oil production by 78,000 barrels per day until the end of 2024. This decision aligns with the agreement reached by the Organization of the Petroleum Exporting Countries (OPEC) in June 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kazakhstan Oil and Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kazakhstan Oil and Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kazakhstan Oil and Gas Market?

To stay informed about further developments, trends, and reports in the Kazakhstan Oil and Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence