Key Insights

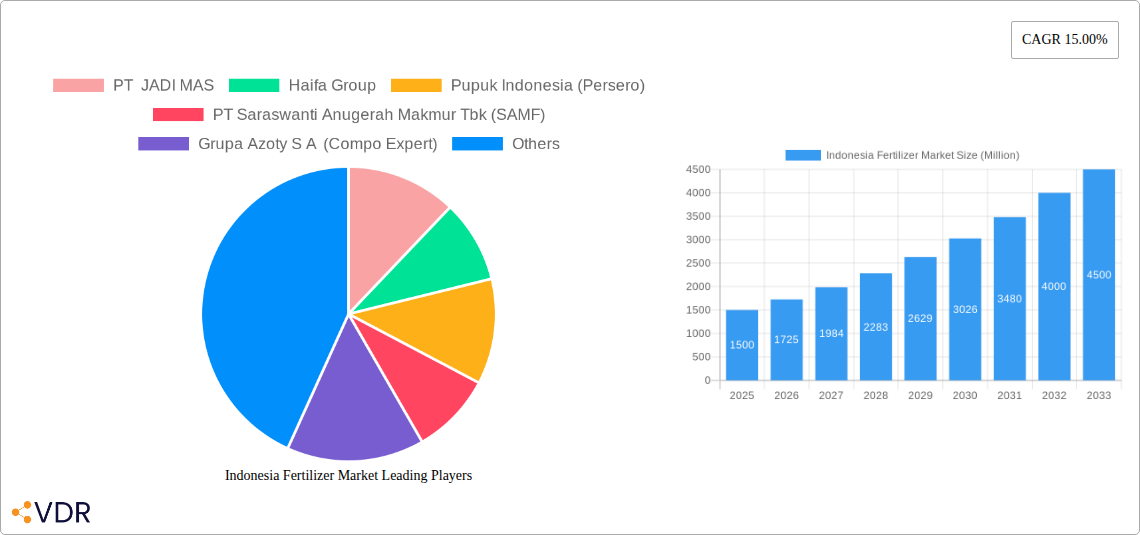

The Indonesian fertilizer market presents a robust growth opportunity, projected to reach a significant market size with a Compound Annual Growth Rate (CAGR) of 15% between 2025 and 2033. This expansion is driven by several key factors. Firstly, Indonesia's burgeoning agricultural sector, particularly in field crops and horticultural products, necessitates increased fertilizer usage to enhance crop yields and meet the demands of a growing population. Secondly, government initiatives promoting agricultural modernization and improved farming practices are further stimulating fertilizer consumption. Increased adoption of advanced application methods like fertigation is also contributing to market growth. However, challenges remain, including fluctuating raw material prices, potential supply chain disruptions, and the need for sustainable fertilizer practices to minimize environmental impact. The market is segmented by form (conventional and specialty), type (complex and straight), application mode (fertigation, foliar, and soil), and crop type (field crops, horticultural crops, and turf & ornamental). Key players such as PT JADI MAS, Haifa Group, Pupuk Indonesia (Persero), PT Saraswanti Anugerah Makmur Tbk (SAMF), Grupa Azoty S A (Compo Expert), Yara International AS, and Asia Kimindo Prima are actively competing in this dynamic market.

The competitive landscape is characterized by a blend of domestic and international players. Local companies benefit from established distribution networks and strong understanding of local agricultural needs, while multinational corporations bring advanced technologies and global best practices. The future growth of the Indonesian fertilizer market hinges on maintaining a balance between supporting agricultural productivity, ensuring affordability, and mitigating environmental concerns associated with fertilizer use. Strategies focusing on promoting efficient fertilizer application, developing sustainable products, and investing in research and development will be crucial for long-term success in this sector. The forecast period indicates substantial opportunities for market expansion, but players must remain agile and adapt to evolving market dynamics to capitalize fully on this potential.

Indonesia Fertilizer Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia fertilizer market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

Indonesia Fertilizer Market Dynamics & Structure

The Indonesian fertilizer market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is moderate, with several major players alongside numerous smaller, regional companies. Technological innovation is a key driver, with ongoing advancements in fertilizer formulations (e.g., slow-release, micronutrient-enhanced products) impacting efficiency and crop yields. Stringent government regulations concerning fertilizer quality and environmental impact shape the competitive landscape. Substitutes, such as organic fertilizers and improved soil management techniques, exert competitive pressure but represent a smaller market segment currently. The end-user demographic comprises primarily smallholder farmers and larger agricultural businesses, with differing needs and purchasing power. M&A activity, while not at a high frequency, has the potential to reshape the market landscape, as demonstrated by recent acquisitions.

- Market Concentration: Moderate, with a few dominant players and many smaller competitors. Pupuk Indonesia (Persero) holds a significant market share, estimated at xx%.

- Technological Innovation: Driving factors include improved efficiency, targeted nutrient delivery, and sustainable production methods. Barriers include high R&D costs and access to advanced technologies.

- Regulatory Framework: Government regulations pertaining to fertilizer quality, safety, and environmental impact are becoming increasingly stringent.

- Competitive Product Substitutes: Organic fertilizers and improved agricultural practices are emerging as alternatives, currently holding xx% of the market.

- End-User Demographics: Predominantly smallholder farmers (xx million) and larger commercial farms (xx thousand).

- M&A Trends: Recent years have witnessed a few significant acquisitions, reflecting consolidation and expansion efforts within the sector (xx deals in the last 5 years).

Indonesia Fertilizer Market Growth Trends & Insights

The Indonesian fertilizer market has experienced robust growth over the historical period (2019-2024), driven by factors including rising agricultural output, increasing government investment in agricultural development, and growing awareness of the importance of fertilizer use for crop productivity. The market size has expanded significantly from xx million units in 2019 to xx million units in 2024. This translates to a CAGR of xx%. Technological disruptions, such as the introduction of precision farming techniques and digital agriculture solutions, are influencing adoption rates and creating new market segments. Shifting consumer behavior towards higher-quality, more sustainable fertilizer products is also reshaping the market. Market penetration of specialty fertilizers is expected to increase due to the growing demand for higher yields and improved crop quality.

Dominant Regions, Countries, or Segments in Indonesia Fertilizer Market

The Indonesian fertilizer market exhibits regional variations in growth and consumption patterns. Java, as the most densely populated and agriculturally productive island, demonstrates the highest consumption of fertilizers. The dominant segment within the market is currently Field Crops, driven by its large-scale cultivation, government support, and importance to national food security. Within the types of fertilizers, Complex fertilizers are the leading segment, due to their balanced nutrient composition meeting the diverse needs of Indonesian soils. Conventional fertilizers still hold the largest market share but Specialty fertilizer market is growing rapidly.

- Key Drivers for Field Crops: High demand for staple crops like rice, corn, and palm oil; government subsidies and support programs; extensive arable land.

- Factors Contributing to Complex Fertilizer Dominance: Wide applicability, balanced nutrient profiles, improved crop yields, and convenience for farmers.

- Growth Potential: The horticultural crops and turf & ornamental segments offer promising growth opportunities, fueled by increasing urbanization and rising disposable incomes.

Indonesia Fertilizer Market Product Landscape

The Indonesian fertilizer market features a diverse range of products, from conventional NPK blends to specialty fertilizers formulated for specific crops and soil conditions. Recent innovations focus on improving nutrient use efficiency, reducing environmental impact, and enhancing crop quality. Slow-release fertilizers and coated urea are gaining traction due to their enhanced efficiency and reduced nitrogen loss. Technological advancements, including the use of nanotechnology and biofertilizers, are creating opportunities for new product development and improved fertilizer performance. Unique selling propositions often center on nutrient optimization, ease of application, and sustainability.

Key Drivers, Barriers & Challenges in Indonesia Fertilizer Market

Key Drivers: Rising demand for food and agricultural products, government support for the agricultural sector, and increasing adoption of modern farming practices. Economic growth, coupled with expanding agricultural output, fuels fertilizer demand. Investments in infrastructure, such as improved irrigation systems, further enhance the market.

Key Challenges: Fluctuations in global commodity prices, supply chain disruptions, and the increasing costs of raw materials pose significant challenges. Regulatory hurdles and environmental concerns associated with fertilizer use, along with competition from substitute products, further impede market growth.

Emerging Opportunities in Indonesia Fertilizer Market

Untapped market potential exists in horticultural crops and turf & ornamental segments, where demand for specialty fertilizers is rising. Organic fertilizers and biofertilizers represent a growing market segment for environmentally conscious farmers. Evolving consumer preferences are driving demand for sustainably produced, high-quality fertilizers. The adoption of precision farming techniques offers opportunities for targeted fertilizer application and improved resource efficiency.

Growth Accelerators in the Indonesia Fertilizer Market Industry

Technological breakthroughs in fertilizer formulation, such as nano-fertilizers and bio-fertilizers, are driving growth. Strategic partnerships between fertilizer producers and agricultural technology companies are facilitating the development of integrated solutions. Market expansion strategies focusing on less-developed regions and underserved farming communities are creating new growth opportunities.

Key Players Shaping the Indonesia Fertilizer Market Market

- Pupuk Indonesia (Persero)

- Haifa Group

- PT JADI MAS

- PT Saraswanti Anugerah Makmur Tbk (SAMF)

- Grupa Azoty S A (Compo Expert)

- Yara International AS

- Asia Kimindo Prima

Notable Milestones in Indonesia Fertilizer Market Sector

- May 2023: Pupuk Kaltim announces a USD 1 billion+ investment in new factories to increase urea production by 1.1 million metric tons and ammonia by 825,000 tonnes annually. This significantly boosts domestic supply and potential for export.

- April 2022: Petrokimia Gresik launches Petro ZA Plus and Phosgreen, improving crop yields and enhancing its product portfolio. This strengthens its market position and addresses specific farmer needs.

- March 2022: Haifa Group acquires Horticoop Andina, expanding its Latin American presence and global brand recognition. This highlights strategic acquisitions to enhance market share and geographic reach.

In-Depth Indonesia Fertilizer Market Market Outlook

The Indonesian fertilizer market is poised for continued growth, driven by factors such as rising agricultural production, increased government support, and technological advancements. Strategic opportunities lie in the development of sustainable and efficient fertilizer solutions, catering to the evolving needs of farmers and addressing environmental concerns. Further expansion into high-growth segments, like horticultural crops, and leveraging technological advancements in precision agriculture will shape the future market landscape. Increased investment in research and development, coupled with strategic partnerships, will be crucial for realizing this potential.

Indonesia Fertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Fertilizer Market Segmentation By Geography

- 1. Indonesia

Indonesia Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 PT JADI MAS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haifa Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pupuk Indonesia (Persero)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Saraswanti Anugerah Makmur Tbk (SAMF)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grupa Azoty S A (Compo Expert)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yara International AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Asia Kimindo Prima

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 PT JADI MAS

List of Figures

- Figure 1: Indonesia Fertilizer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Fertilizer Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Indonesia Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Indonesia Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Indonesia Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Indonesia Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Indonesia Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Indonesia Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Indonesia Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Indonesia Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Indonesia Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Indonesia Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Indonesia Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Fertilizer Market?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the Indonesia Fertilizer Market?

Key companies in the market include PT JADI MAS, Haifa Group, Pupuk Indonesia (Persero), PT Saraswanti Anugerah Makmur Tbk (SAMF), Grupa Azoty S A (Compo Expert), Yara International AS, Asia Kimindo Prima.

3. What are the main segments of the Indonesia Fertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

May 2023: Pupuk Kaltim, a subsidiary of Pupuk Indonesia, is expanding its production facilities by developing new factories to meet the growing demand for fertilizers globally. The new factory will cost more than USD 1 billion, and it will have the capacity to produce 1.1 million metric ton of urea and 825,000 tonnes of ammonia annually.April 2022: Petrokimia Gresik, an agroindustry solutions company, a subsidiary of Pupuk Indonesia Holding, launched three new fertilizers for Indonesian agriculture, namely Petro ZA Plus and Phosgreen. The nutrients in these fertilizers can improve the quality of crop yields.March 2022: The Haifa Group entered a purchase agreement with HORTICOOP BV to acquire Horticoop Andina, the distributor of nutritional products for agriculture. Through this acquisition of the brand, Haifa intends to expand its market presence in the Latin American market and strengthen its position as a global superbrand in advanced plant nutrition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Fertilizer Market?

To stay informed about further developments, trends, and reports in the Indonesia Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence