Key Insights

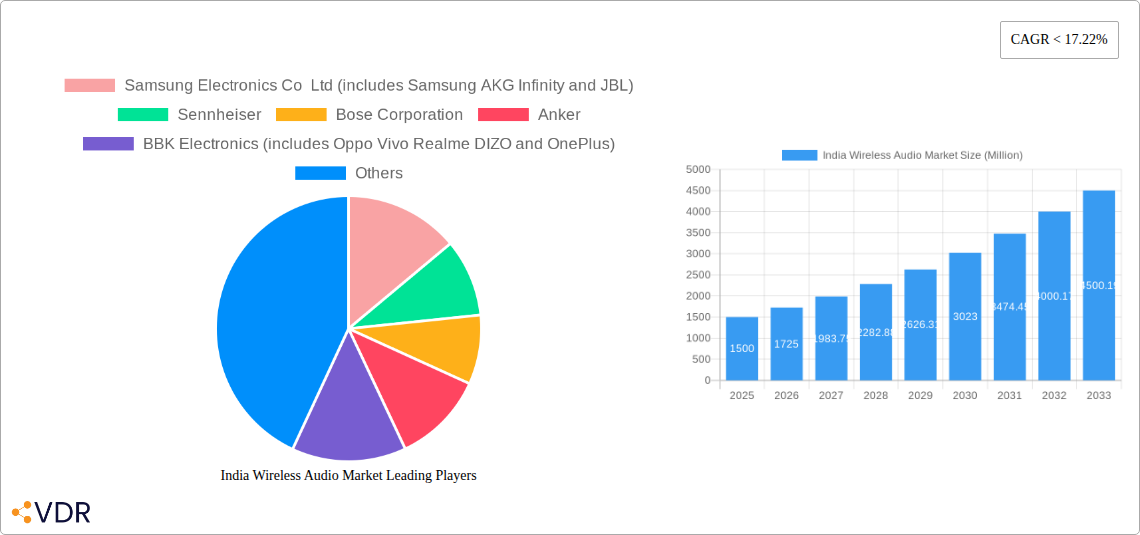

The India wireless audio market is experiencing robust growth, driven by increasing smartphone penetration, rising disposable incomes, and a burgeoning young population with a penchant for entertainment and technology. The market's historical period (2019-2024) showcased significant expansion, with a considerable increase in sales of wireless earphones, headphones, and speakers. The base year of 2025 serves as a strong foundation, indicating a mature yet dynamic market. While precise figures for market size aren't provided, considering global trends and India's unique market dynamics, a reasonable estimate for the 2025 market size would be around $1.5 billion USD. This projection takes into account factors such as the competitive landscape (with both established international brands and emerging domestic players) and the increasing preference for premium audio experiences among Indian consumers.

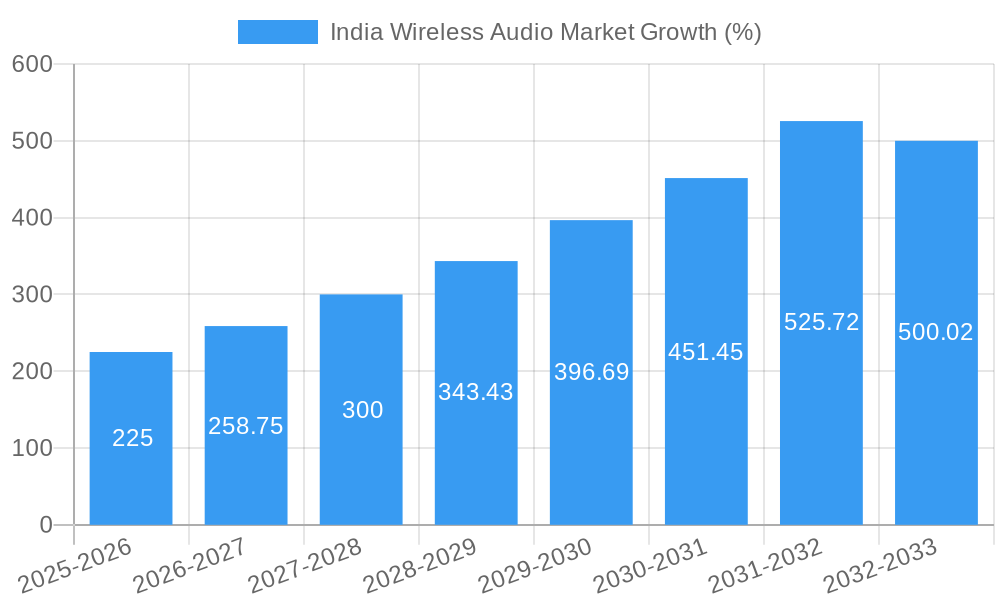

Looking ahead to the forecast period (2025-2033), the market is poised for continued expansion, fueled by advancements in technology (like noise cancellation and improved battery life), increasing affordability of wireless audio products, and the growing popularity of streaming services and online gaming. The Compound Annual Growth Rate (CAGR) will likely remain substantial, possibly within the range of 15-20%, depending on macroeconomic conditions and competitive intensity. This growth will be witnessed across various segments, including truly wireless earbuds, over-ear headphones, and portable Bluetooth speakers, with earbuds likely dominating the market share due to their convenience and affordability. The market's evolution will be significantly influenced by consumer preferences towards features, branding, and pricing strategies employed by various players.

India Wireless Audio Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India wireless audio market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (Wireless Audio) and child markets (Wireless Earphones, Wireless Headphones, Truly Wireless Earbuds), this report is essential for industry professionals seeking to understand and capitalize on opportunities within this rapidly expanding sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. Market size is presented in Million units.

India Wireless Audio Market Market Dynamics & Structure

The Indian wireless audio market is characterized by intense competition, rapid technological advancements, and evolving consumer preferences. Market concentration is relatively high, with a few dominant players holding significant market share. However, the presence of numerous smaller brands and startups contributes to a dynamic competitive landscape. Technological innovation, particularly in noise cancellation, sound quality, and battery life, is a key driver of market growth. Regulatory frameworks, while generally supportive of the electronics industry, may influence import/export dynamics. The increasing affordability of wireless audio products and the rise of e-commerce have fueled market expansion. The market experiences significant substitution from wired audio products.

- Market Concentration: Top 5 players hold xx% market share in 2025 (estimated).

- Technological Innovation: Focus on improved sound quality, noise cancellation, longer battery life, and integration with smart devices.

- Regulatory Framework: Generally favorable, with potential impact from import duties and standards compliance.

- Competitive Substitutes: Wired earphones and headphones.

- End-User Demographics: Predominantly young adults and professionals, with growing adoption across age groups.

- M&A Trends: A moderate number of M&A deals have been observed in the recent past (xx deals in the last 5 years). Consolidation is likely to continue as larger players seek to expand their market share. Barriers to innovation include high R&D costs and the need to cater to diverse consumer preferences.

India Wireless Audio Market Growth Trends & Insights

The Indian wireless audio market has witnessed phenomenal growth over the past few years, driven by factors such as increasing smartphone penetration, rising disposable incomes, and a growing preference for convenient and portable audio solutions. The market size has expanded significantly, with a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth trajectory is expected to continue during the forecast period (2025-2033), with a projected CAGR of xx%. The adoption rate of wireless audio products is rapidly increasing, particularly among younger demographics. Technological disruptions, such as the introduction of advanced features like active noise cancellation and improved battery life, have further stimulated market demand. Shifts in consumer behavior, including a preference for premium audio experiences and personalized sound profiles, are shaping the market landscape. Market penetration is estimated at xx% in 2025, with significant room for future growth.

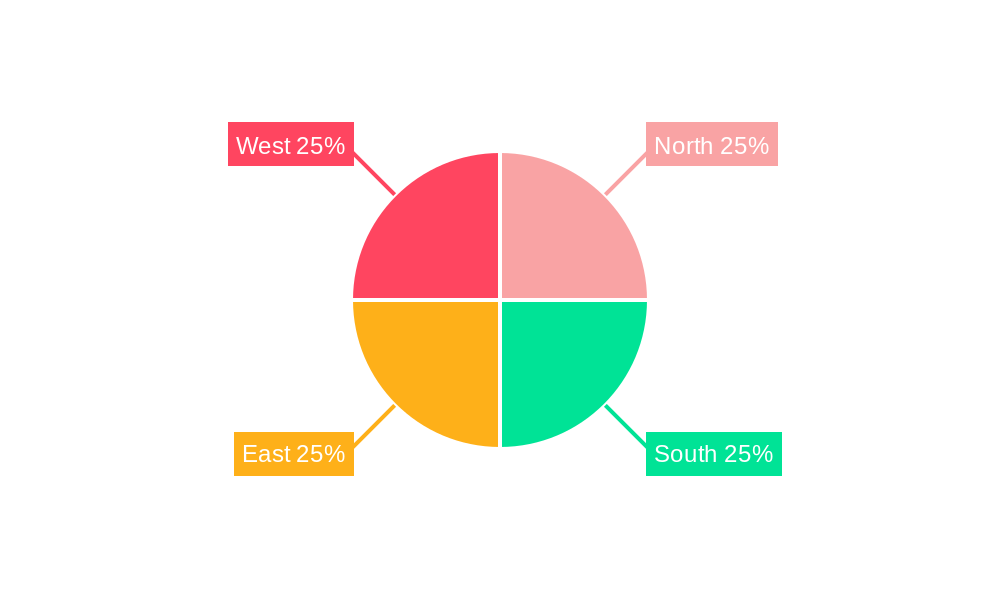

Dominant Regions, Countries, or Segments in India Wireless Audio Market

The urban centers of India, specifically metropolitan areas like Mumbai, Delhi, Bengaluru, and Chennai, are leading the market growth in the wireless audio sector. Within product types, Truly Wireless Earbuds (TWS) are experiencing the fastest growth, driven by their convenience and portability. Online distribution channels are exhibiting faster growth compared to offline channels, facilitated by the increasing reach of e-commerce platforms and the convenience of online shopping.

- Key Drivers for Urban Centers: Higher disposable incomes, greater awareness of technology, and better access to online shopping.

- Key Drivers for TWS: Convenience, portability, and advanced features like noise cancellation.

- Key Drivers for Online Channels: Wider product selection, competitive pricing, convenient delivery, and digital marketing strategies.

Regional Variations: Growth rates vary across regions, with Tier-1 cities showing the highest adoption rates, followed by Tier-2 and Tier-3 cities.

India Wireless Audio Market Product Landscape

The Indian wireless audio market offers a diverse range of products, including wireless earphones, wireless headphones, and truly wireless earbuds (TWS). Product innovation is focused on enhancing sound quality, battery life, comfort, and integration with smart devices. Many products incorporate features like active noise cancellation, ambient sound modes, and customizable EQ settings. Key performance metrics include battery life, sound quality, comfort, and water resistance. Unique selling propositions often center around design, features, and brand reputation. Technological advancements are driving the market towards more sophisticated and user-friendly devices.

Key Drivers, Barriers & Challenges in India Wireless Audio Market

Key Drivers:

- Increasing smartphone penetration

- Rising disposable incomes

- Growing preference for convenient and portable audio solutions

- Technological advancements such as improved sound quality, noise cancellation and longer battery life

- E-commerce growth

Challenges:

- Intense competition among numerous players, leading to price wars

- Counterfeit products impacting brand reputation and market integrity

- Supply chain disruptions (xx% impact estimated in 2024 due to global issues)

- Fluctuations in raw material prices

- Dependence on imports for certain components.

Emerging Opportunities in India Wireless Audio Market

- Expansion into Tier 2 & 3 cities: Untapped market potential exists in smaller cities and towns.

- Growth of premium segment: Higher disposable incomes are driving demand for higher-quality products.

- Integration with fitness wearables: Wireless audio products can be integrated with fitness trackers and smartwatches.

- Development of personalized audio experiences: Tailored sound profiles and AI-powered features.

Growth Accelerators in the India Wireless Audio Market Industry

Technological breakthroughs, including advancements in battery technology and audio processing, are fueling market expansion. Strategic partnerships between audio brands and smartphone manufacturers are creating synergistic growth opportunities. Aggressive marketing campaigns and increased brand awareness are driving market penetration. Expansion into new market segments and the development of innovative products are vital for long-term growth.

Key Players Shaping the India Wireless Audio Market Market

- Samsung Electronics Co Ltd (includes Samsung AKG Infinity and JBL)

- Sennheiser

- Bose Corporation

- Anker

- BBK Electronics (includes Oppo Vivo Realme DIZO and OnePlus)

- Sony India

- Xiaomi Corporation

- Imagine Marketing Limited (boat LIFESTYLE)

- Skullcandy

- Apple Inc

Notable Milestones in India Wireless Audio Market Sector

- September 2022: Sennheiser launched the Momentum 4 wireless headphones.

- September 2022: JBL introduced the JBL Quantum 350 wireless headphones.

- November 2022: Sony released the WF-LS900N noise-canceling TWS earphones.

In-Depth India Wireless Audio Market Market Outlook

The future of the Indian wireless audio market appears bright, with continued growth driven by technological innovation, evolving consumer preferences, and increasing market penetration. Strategic opportunities exist in developing tailored products for specific market segments, expanding distribution channels, and fostering strategic partnerships. The market’s growth is projected to remain robust throughout the forecast period, presenting significant opportunities for both established players and new entrants.

India Wireless Audio Market Segmentation

-

1. Product Type

- 1.1. Wireless Earphones

- 1.2. Wireless Headphones

- 1.3. Truly Wireless Earbuds

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

India Wireless Audio Market Segmentation By Geography

- 1. India

India Wireless Audio Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 17.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing E-Commerce Industry Will Boost Market Growth

- 3.3. Market Restrains

- 3.3.1. Health Problems Caused by Continuous Usage of Audio Devices

- 3.4. Market Trends

- 3.4.1. Growing E-Commerce Industry Will Boost Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Wireless Audio Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Wireless Earphones

- 5.1.2. Wireless Headphones

- 5.1.3. Truly Wireless Earbuds

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North India India Wireless Audio Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Wireless Audio Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Wireless Audio Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Wireless Audio Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Samsung Electronics Co Ltd (includes Samsung AKG Infinity and JBL)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sennheiser

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bose Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Anker

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BBK Electronics (includes Oppo Vivo Realme DIZO and OnePlus)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sony India

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Xiaomi Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Imagine Marketing Limited (boat LIFESTYLE)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Skullcandy*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Apple Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Samsung Electronics Co Ltd (includes Samsung AKG Infinity and JBL)

List of Figures

- Figure 1: India Wireless Audio Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Wireless Audio Market Share (%) by Company 2024

List of Tables

- Table 1: India Wireless Audio Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Wireless Audio Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: India Wireless Audio Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: India Wireless Audio Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Wireless Audio Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Wireless Audio Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Wireless Audio Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Wireless Audio Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Wireless Audio Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Wireless Audio Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: India Wireless Audio Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: India Wireless Audio Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Wireless Audio Market?

The projected CAGR is approximately < 17.22%.

2. Which companies are prominent players in the India Wireless Audio Market?

Key companies in the market include Samsung Electronics Co Ltd (includes Samsung AKG Infinity and JBL), Sennheiser, Bose Corporation, Anker, BBK Electronics (includes Oppo Vivo Realme DIZO and OnePlus), Sony India, Xiaomi Corporation, Imagine Marketing Limited (boat LIFESTYLE), Skullcandy*List Not Exhaustive, Apple Inc.

3. What are the main segments of the India Wireless Audio Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing E-Commerce Industry Will Boost Market Growth.

6. What are the notable trends driving market growth?

Growing E-Commerce Industry Will Boost Market Growth.

7. Are there any restraints impacting market growth?

Health Problems Caused by Continuous Usage of Audio Devices.

8. Can you provide examples of recent developments in the market?

November 2022: Sony's TWS product selection in India was enhanced with the release of the WF-LS900N noise-canceling earphones. Sony's newest TWS earbuds aim to give consumers an entirely new audio experience. These earphones provide realistic sound in AR gaming by utilizing an assortment of sensors and multidimensional sound technologies. The WF-LS900N is also ideal for the continuous streaming of material.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Wireless Audio Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Wireless Audio Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Wireless Audio Market?

To stay informed about further developments, trends, and reports in the India Wireless Audio Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence