Key Insights

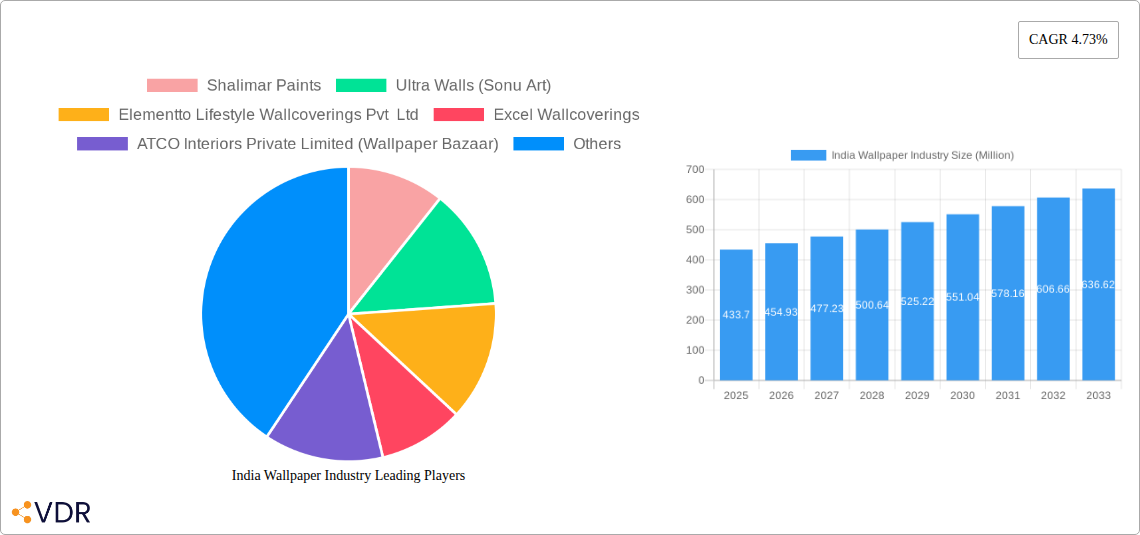

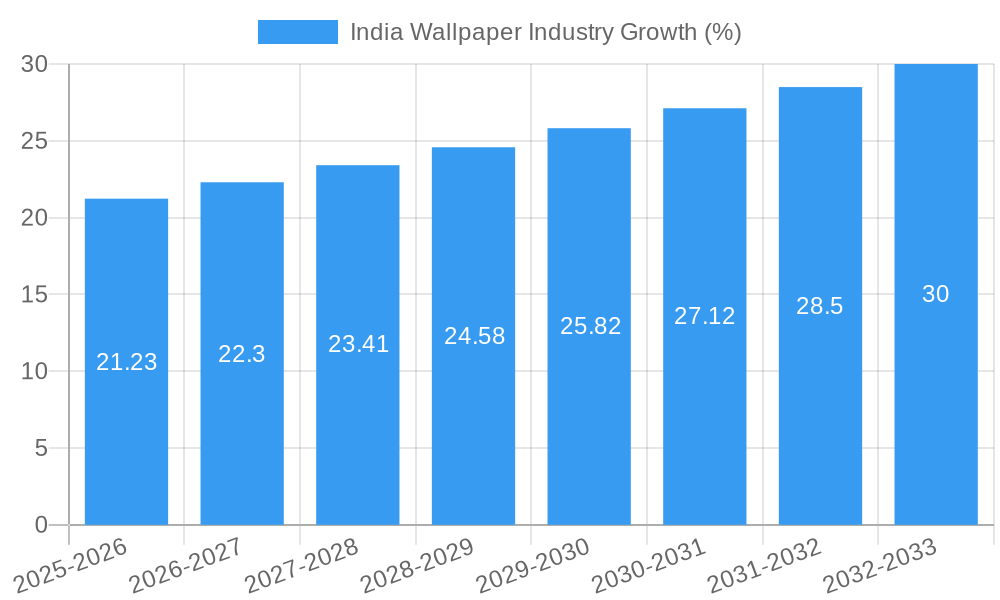

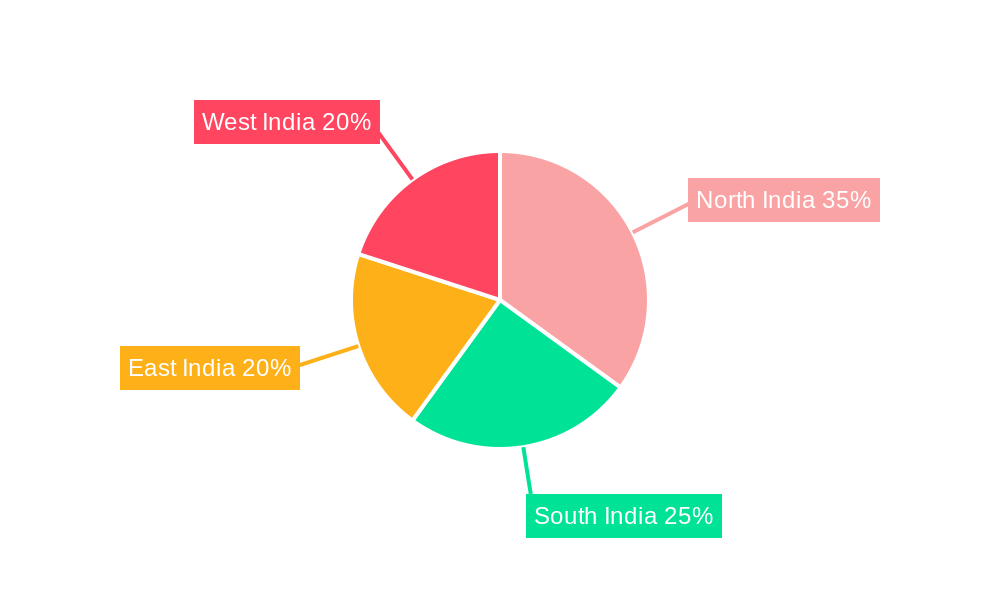

The India wallpaper market, valued at ₹433.70 million in 2025, is projected to experience robust growth, driven by increasing disposable incomes, rising urbanization, and a growing preference for home décor upgrades. The market's Compound Annual Growth Rate (CAGR) of 4.73% from 2025 to 2033 indicates a steady expansion. Key market segments include vinyl-based wallpapers, favored for durability and affordability, and non-woven options, appreciated for their ease of installation and eco-friendliness. The e-commerce channel is experiencing significant growth, offering consumers wider selections and convenient purchasing options. Residential applications dominate the market, although commercial sectors, particularly hospitality and office spaces, are also witnessing increased demand. Leading players like Asian Paints, Berger Paints, and Shalimar Paints leverage their established distribution networks to capture substantial market share. However, competition is intensifying with the emergence of specialized wallpaper brands catering to niche design preferences and innovative materials. Regional variations exist, with urban centers in North and West India demonstrating higher consumption compared to other regions, reflecting varying levels of disposable income and awareness. The market faces challenges including fluctuating raw material prices and the potential impact of economic downturns on consumer spending. However, the long-term outlook remains positive, supported by sustained growth in the construction and real estate sectors.

This positive trajectory is further reinforced by evolving consumer preferences towards personalized home décor. The rising popularity of DIY home improvement projects, coupled with greater access to online design inspiration, fuels demand for diverse wallpaper styles and patterns. Consequently, manufacturers are responding with innovative product offerings, including customizable wallpapers and eco-friendly options, to cater to this evolving demand. This strategic adaptation ensures competitiveness and sustained market growth within the foreseeable future. The presence of established paint companies expanding into the wallpaper market signals the growing significance of this segment within the broader home décor industry in India.

India Wallpaper Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the India wallpaper industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic market.

Keywords: India wallpaper market, wallpaper industry India, vinyl wallpaper India, non-woven wallpaper India, wallpaper market size India, wallpaper trends India, wallpaper manufacturers India, wallpaper distributors India, residential wallpaper India, commercial wallpaper India, wallpaper e-commerce India, wallpaper retail India.

India Wallpaper Industry Market Dynamics & Structure

The Indian wallpaper market, valued at xx Million units in 2024, is characterized by moderate concentration, with a few major players and numerous smaller firms. Technological innovation, primarily in material development and printing techniques, is a key driver. Regulatory frameworks concerning product safety and environmental impact play a role, though relatively less stringent compared to some developed markets. The primary competitive substitute remains paint, but wallpaper's aesthetic versatility offers a distinct advantage. End-user demographics are shifting towards younger, design-conscious homeowners and businesses seeking unique interior solutions. M&A activity has been relatively limited (xx deals in the last 5 years), indicating potential for consolidation in the future.

- Market Concentration: Moderately fragmented, with a top 5 market share of approximately xx%.

- Technological Innovation: Focus on eco-friendly materials, digital printing, and customizable designs.

- Regulatory Framework: Primarily focused on safety standards and import/export regulations.

- Competitive Substitutes: Paint, wall murals, textured wall finishes.

- End-User Demographics: Growing middle class, young professionals, and design-conscious consumers.

- M&A Trends: Limited activity, with potential for future consolidation among key players.

India Wallpaper Industry Growth Trends & Insights

The Indian wallpaper market experienced a CAGR of xx% during 2019-2024. This growth is fueled by rising disposable incomes, increasing urbanization, and a growing preference for aesthetically pleasing homes and offices. The adoption rate of wallpapers, particularly in residential settings, is steadily increasing, driven by online retail platforms and greater product accessibility. Technological disruptions, such as the advent of advanced digital printing technologies, are improving design flexibility and cost-effectiveness. Consumer behavior is shifting towards personalized and sustainable choices, influencing product innovation and marketing strategies. We project a CAGR of xx% for the forecast period (2025-2033), reaching xx Million units by 2033. Market penetration remains relatively low, presenting significant growth potential.

Dominant Regions, Countries, or Segments in India Wallpaper Industry

The residential segment currently dominates the market, accounting for approximately xx% of total sales. Within distribution channels, retail stores hold the largest share, though e-commerce is witnessing rapid growth. Metro cities and Tier-1 towns exhibit the highest demand, driven by higher disposable incomes and a preference for premium products. The Vinyl-based segment leads in terms of volume, followed by Non-woven and Paper/Traditional Wallpaper.

- Key Drivers: Rising disposable incomes, urbanization, increasing awareness of home décor trends.

- Dominance Factors: Residential segment's large size, retail channel’s established distribution network, metro cities’ high purchasing power.

- Growth Potential: Significant untapped potential in Tier-2 and Tier-3 cities, expansion of e-commerce, and the introduction of innovative product categories.

India Wallpaper Industry Product Landscape

The Indian wallpaper market offers a diverse range of products, from traditional paper-based options to advanced vinyl and non-woven alternatives. Technological advancements in digital printing have enabled intricate designs and customized patterns. Unique selling propositions include durability, ease of installation, and a vast array of designs catering to varied aesthetics. Key performance metrics include tear resistance, colorfastness, and ease of cleaning.

Key Drivers, Barriers & Challenges in India Wallpaper Industry

Key Drivers:

- Increasing disposable incomes and urbanization.

- Growing preference for aesthetically appealing interiors.

- Rise of e-commerce and online marketplaces.

- Introduction of innovative product designs and materials.

Key Challenges:

- Price sensitivity among consumers.

- Competition from paint and other wall coverings.

- Supply chain disruptions and fluctuating raw material costs.

- Lack of awareness in certain segments of the population.

Emerging Opportunities in India Wallpaper Industry

- Untapped Markets: Tier-2 and Tier-3 cities present significant growth potential.

- Innovative Applications: Expansion into commercial spaces and hospitality sectors.

- Evolving Consumer Preferences: Focus on sustainable, eco-friendly materials and personalized designs.

Growth Accelerators in the India Wallpaper Industry

Technological advancements in printing and material science, coupled with strategic partnerships between manufacturers and designers, are key catalysts for long-term growth. Expansion into newer markets and increased awareness campaigns will further drive market expansion.

Key Players Shaping the India Wallpaper Industry Market

- Shalimar Paints

- Ultra Walls (Sonu Art)

- Elementto Lifestyle Wallcoverings Pvt Ltd

- Excel Wallcoverings

- ATCO Interiors Private Limited (Wallpaper Bazaar)

- Gratex Industries Ltd

- WOLTOP INDIA PVT LTD

- Adornis Wallpapers

- Happy Walls

- Asian Paints Ltd

- Marshalls Wallcoverings

- Kamdhenu Paint

- Berger Paints Ltd

Notable Milestones in India Wallpaper Industry Sector

- April 2022: Launch of "Noor" wallpaper series by UDC Homes, highlighting Indian craftsmanship and design.

- January 2022: Nirmals Furnishings introduces Coordonne's "Wander" collection, showcasing luxury wallpaper options.

In-Depth India Wallpaper Industry Market Outlook

The Indian wallpaper market is poised for significant growth driven by strong economic expansion, rising urbanization, and evolving consumer preferences. Strategic investments in product innovation, distribution networks, and brand building will be crucial for success in this dynamic market. The market’s projected growth trajectory suggests substantial opportunities for both established players and new entrants.

India Wallpaper Industry Segmentation

-

1. Type

- 1.1. Vinyl-based

- 1.2. Non-woven

- 1.3. Paper/Traditional Wallpaper

- 1.4. Fabric (Textile)

-

2. Distribution Channel

- 2.1. E-commerce

- 2.2. Retail

-

3. End User

- 3.1. Residential

-

3.2. Commerci

- 3.2.1. Hospitality

- 3.2.2. Corporate Office Space

- 3.2.3. Salons and Spas

- 3.2.4. Hospitals

- 3.2.5. Other Commercial End Users

India Wallpaper Industry Segmentation By Geography

- 1. India

India Wallpaper Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Infrastructural Development And Changing Lifestyle; Growing Consumer Preference for decorative wallpaper instead of Painting

- 3.3. Market Restrains

- 3.3.1. Awareness And Alternatives; Shorter Life-span on Exposure to Heat & Moisture

- 3.4. Market Trends

- 3.4.1. Vinyl Based Wallpapers Account for the Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vinyl-based

- 5.1.2. Non-woven

- 5.1.3. Paper/Traditional Wallpaper

- 5.1.4. Fabric (Textile)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. E-commerce

- 5.2.2. Retail

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commerci

- 5.3.2.1. Hospitality

- 5.3.2.2. Corporate Office Space

- 5.3.2.3. Salons and Spas

- 5.3.2.4. Hospitals

- 5.3.2.5. Other Commercial End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Shalimar Paints

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ultra Walls (Sonu Art)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Elementto Lifestyle Wallcoverings Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Excel Wallcoverings

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ATCO Interiors Private Limited (Wallpaper Bazaar)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Gratex Industries Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 WOLTOP INDIA PVT LTD

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Adornis Wallpapers

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Happy Walls

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Asian Paints Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Marshalls Wallcoverings

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kamdhenu Paint*List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Berger Paints Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Shalimar Paints

List of Figures

- Figure 1: India Wallpaper Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Wallpaper Industry Share (%) by Company 2024

List of Tables

- Table 1: India Wallpaper Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Wallpaper Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Wallpaper Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: India Wallpaper Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: India Wallpaper Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Wallpaper Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Wallpaper Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Wallpaper Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Wallpaper Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Wallpaper Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Wallpaper Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Wallpaper Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: India Wallpaper Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: India Wallpaper Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Wallpaper Industry?

The projected CAGR is approximately 4.73%.

2. Which companies are prominent players in the India Wallpaper Industry?

Key companies in the market include Shalimar Paints, Ultra Walls (Sonu Art), Elementto Lifestyle Wallcoverings Pvt Ltd, Excel Wallcoverings, ATCO Interiors Private Limited (Wallpaper Bazaar), Gratex Industries Ltd, WOLTOP INDIA PVT LTD, Adornis Wallpapers, Happy Walls, Asian Paints Ltd, Marshalls Wallcoverings, Kamdhenu Paint*List Not Exhaustive, Berger Paints Ltd.

3. What are the main segments of the India Wallpaper Industry?

The market segments include Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 433.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Infrastructural Development And Changing Lifestyle; Growing Consumer Preference for decorative wallpaper instead of Painting.

6. What are the notable trends driving market growth?

Vinyl Based Wallpapers Account for the Significant Market Share.

7. Are there any restraints impacting market growth?

Awareness And Alternatives; Shorter Life-span on Exposure to Heat & Moisture.

8. Can you provide examples of recent developments in the market?

April 2022: Noor, a series of wallpapers by UDC Homes, honored India's illustrious architectural past and the skilled craft of the country's artisans. The new, colorful wallpaper patterns, which take their name from the Arabic word for light, "Nur," symbolize the various facets of nature and beauty, like the flutter of a bird, a hint of vegetation, and the peace just before dusk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Wallpaper Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Wallpaper Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Wallpaper Industry?

To stay informed about further developments, trends, and reports in the India Wallpaper Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence