Key Insights

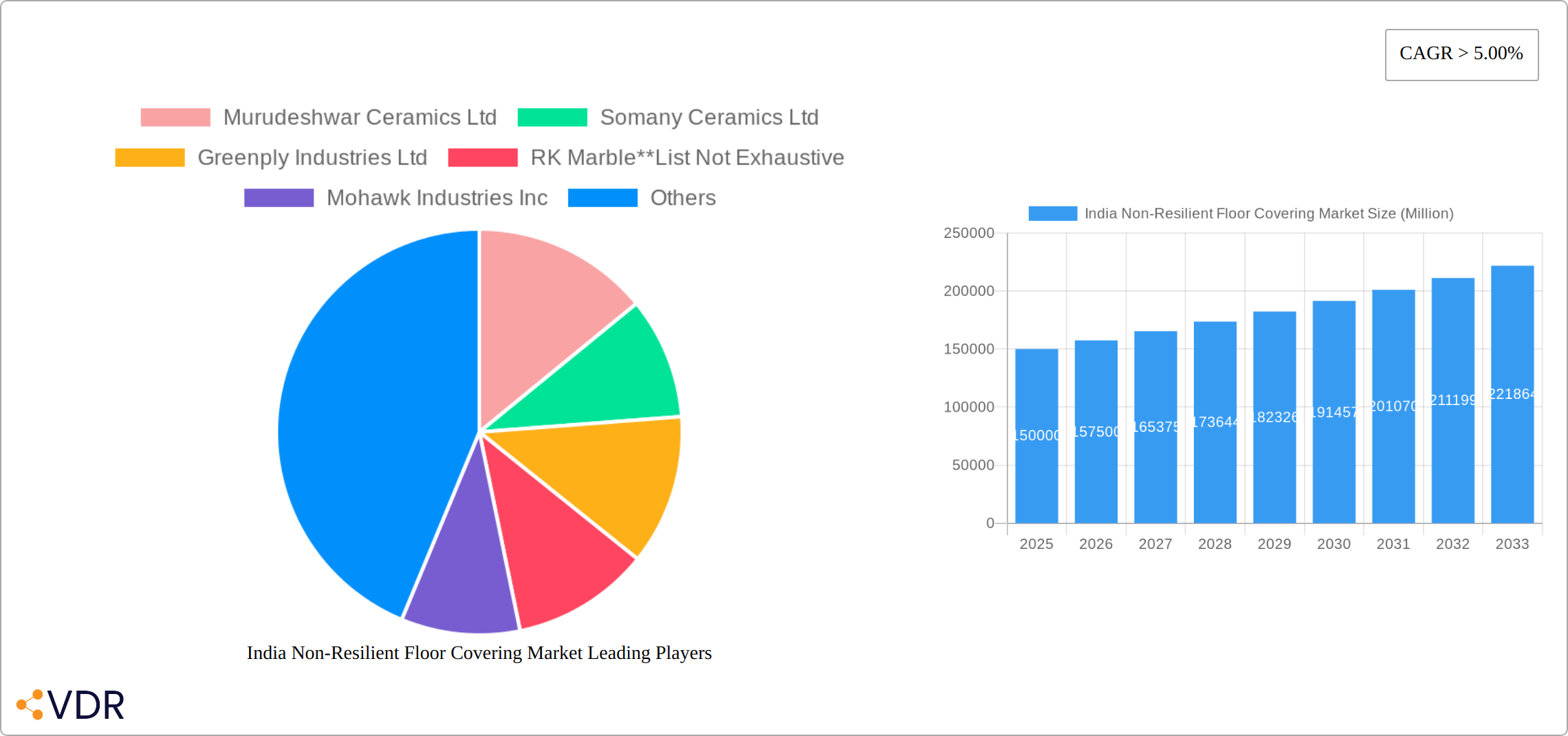

The India Non-Resilient Floor Covering Market is experiencing robust growth, driven by a burgeoning construction sector, increasing disposable incomes, and a rising preference for aesthetically pleasing and durable flooring solutions. The market, valued at approximately ₹150 billion (estimated based on a typical market size for developing economies with similar growth rates and the provided CAGR) in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 5% through 2033. This expansion is fueled by several key factors. The ongoing urbanization and infrastructure development initiatives across India are significantly boosting demand for non-resilient floor coverings in both residential and commercial projects. The increasing adoption of modern architectural designs and interior styles is further fueling the demand for diverse product offerings, including ceramic, stone, laminate, and wood tiles.

Significant growth is anticipated across various segments. The ceramic tile flooring segment currently holds the largest market share due to its cost-effectiveness and wide availability. However, the stone tile and laminate tile segments are expected to witness faster growth rates, driven by their superior aesthetic appeal and durability. In terms of end-users, the residential segment dominates, fueled by rising housing construction and renovation activities. However, the commercial segment, encompassing offices, retail spaces, and hospitality establishments, is poised for significant growth due to increasing investments in commercial real estate. Key players like Murudeshwar Ceramics Ltd, Somany Ceramics Ltd, and Kajaria Ceramics Ltd are actively shaping the market through product innovation, strategic partnerships, and expansion into new regions. While challenges exist, such as fluctuating raw material prices and intense competition, the overall outlook for the India Non-Resilient Floor Covering Market remains highly positive, promising substantial growth opportunities in the coming years.

India Non-Resilient Floor Covering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Non-Resilient Floor Covering Market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by product (Ceramic Tiles Flooring, Stone Tiles Flooring, Laminate Tiles Flooring, Wood Tiles Flooring, Others), end-user (Residential, Commercial), and distribution channel (Home Centers, Specialty Stores, Online, Others). The market size is presented in million units.

India Non-Resilient Floor Covering Market Dynamics & Structure

The Indian non-resilient floor covering market exhibits a moderately concentrated structure, with key players vying for market share. Technological innovation, particularly in material science and design, is a major driver, alongside evolving consumer preferences towards aesthetics and durability. Stringent regulatory frameworks concerning environmental standards and safety impact manufacturing processes. Competitive pressures from resilient flooring alternatives necessitate continuous product differentiation. The market witnesses consistent M&A activity, particularly among smaller players seeking to enhance their market position.

- Market Concentration: xx% market share held by the top 5 players in 2024.

- Technological Innovation: Focus on sustainable materials, improved abrasion resistance, and innovative designs.

- Regulatory Framework: Compliance with building codes and environmental regulations influences product development and manufacturing.

- Competitive Substitutes: Resilient flooring options (vinyl, rubber) pose competition.

- M&A Activity: xx M&A deals observed between 2019 and 2024, with a predicted increase to xx by 2033.

- End-User Demographics: Growing urbanization and rising disposable incomes drive demand, particularly in the residential segment.

India Non-Resilient Floor Covering Market Growth Trends & Insights

The Indian non-resilient floor covering market experienced significant growth between 2019 and 2024, driven by increasing construction activity, rising disposable incomes, and a shift towards improved home aesthetics. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), propelled by ongoing urbanization and infrastructural development. Technological advancements such as improved manufacturing techniques and the introduction of eco-friendly materials further fuel market expansion. Consumer preferences are shifting towards durable, aesthetically pleasing, and easy-to-maintain flooring solutions. Market penetration for premium segments, like engineered wood flooring, is expected to increase substantially. The residential segment currently dominates, but the commercial sector is poised for accelerated growth.

Dominant Regions, Countries, or Segments in India Non-Resilient Floor Covering Market

The market is geographically diverse, with significant growth observed across major metropolitan areas and tier-1 cities. However, the southern and western regions exhibit particularly strong growth due to robust real estate development and higher disposable incomes. Within product segments, ceramic tiles flooring commands the largest market share owing to its affordability and versatility. The residential segment continues to be the largest end-user, although the commercial segment demonstrates significant growth potential due to increased construction of commercial buildings and infrastructure projects. Online distribution channels are gaining traction, though traditional channels like home centers remain dominant.

- Leading Region: Southern and Western regions are witnessing the highest growth.

- Dominant Segment (Product): Ceramic Tiles Flooring (xx% market share in 2024)

- Dominant Segment (End-User): Residential (xx% market share in 2024)

- Dominant Segment (Distribution): Home Centers (xx% market share in 2024)

- Key Drivers: Rapid urbanization, rising construction activities, infrastructural developments, and government initiatives promoting affordable housing.

India Non-Resilient Floor Covering Market Product Landscape

The market showcases a diverse range of non-resilient floor coverings, with ceramic tiles remaining the most popular choice. Recent innovations focus on improved durability, enhanced aesthetics, and sustainable materials. Manufacturers are introducing larger format tiles, textured surfaces, and digitally printed designs to cater to evolving consumer tastes. Performance metrics such as abrasion resistance, stain resistance, and water resistance are crucial in determining product success. Unique selling propositions (USPs) often involve superior durability, unique designs, or eco-friendly manufacturing processes.

Key Drivers, Barriers & Challenges in India Non-Resilient Floor Covering Market

Key Drivers: Increasing disposable incomes, growing urbanization, rising construction activity, government initiatives promoting affordable housing, and the growing preference for aesthetically pleasing and durable flooring solutions.

Challenges: Fluctuations in raw material prices, intense competition, and the need to comply with stringent environmental regulations. Supply chain disruptions, particularly observed in 2022, impacted production and delivery timelines. The availability of skilled labor also poses a challenge.

Emerging Opportunities in India Non-Resilient Floor Covering Market

Untapped markets in rural areas present significant growth opportunities. The increasing adoption of eco-friendly and sustainable materials provides a niche for manufacturers. Smart home integration and the use of technology for enhanced flooring solutions represent new avenues for innovation.

Growth Accelerators in the India Non-Resilient Floor Covering Market Industry

Technological advancements in materials science and manufacturing processes are accelerating market growth. Strategic partnerships between manufacturers and real estate developers are creating new distribution channels and improving market access. The expansion into previously untapped markets will broaden the customer base and drive sales.

Key Players Shaping the India Non-Resilient Floor Covering Market Market

- Murudeshwar Ceramics Ltd

- Somany Ceramics Ltd

- Greenply Industries Ltd

- RK Marble

- Mohawk Industries Inc

- RAK Ceramics India Private Ltd

- Century Plyboards India Ltd

- Accord Floors

- Kajaria Ceramics Ltd

Notable Milestones in India Non-Resilient Floor Covering Market Sector

- 2022 (Q3): Somany Ceramics Ltd launched its VC Shield technology, enhancing abrasion resistance and product lifespan.

- 2022 (Q4): Accord Floors introduced Outdoor Wooden Decking Flooring, expanding into the outdoor flooring market.

In-Depth India Non-Resilient Floor Covering Market Market Outlook

The Indian non-resilient floor covering market is poised for sustained growth driven by robust construction activity, increasing disposable incomes, and a shift towards premium flooring solutions. Strategic partnerships, technological advancements, and expansion into new markets present lucrative opportunities for industry players. The focus on sustainable and eco-friendly products will further shape the market's trajectory in the coming years.

India Non-Resilient Floor Covering Market Segmentation

-

1. Product

- 1.1. Ceramic Tiles Flooring

- 1.2. Stone Tiles Flooring

- 1.3. Laminate Tiles Flooring

- 1.4. Wood Tiles Flooring

- 1.5. Others

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Others

India Non-Resilient Floor Covering Market Segmentation By Geography

- 1. India

India Non-Resilient Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Number of E-Commerce Users is Driving the Market; Increase in Residential Construction is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Low Replacement Demand

- 3.4. Market Trends

- 3.4.1. Ceramic Tiles Occupy A Major Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Ceramic Tiles Flooring

- 5.1.2. Stone Tiles Flooring

- 5.1.3. Laminate Tiles Flooring

- 5.1.4. Wood Tiles Flooring

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North India India Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Murudeshwar Ceramics Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Somany Ceramics Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Greenply Industries Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 RK Marble**List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mohawk Industries Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 RAK Ceramics India Private Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Century Plyboards India Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Accord Floors

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kajaria Ceramics Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Murudeshwar Ceramics Ltd

List of Figures

- Figure 1: India Non-Resilient Floor Covering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Non-Resilient Floor Covering Market Share (%) by Company 2024

List of Tables

- Table 1: India Non-Resilient Floor Covering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Non-Resilient Floor Covering Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: India Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: India Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: India Non-Resilient Floor Covering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Non-Resilient Floor Covering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Non-Resilient Floor Covering Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: India Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 13: India Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: India Non-Resilient Floor Covering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Non-Resilient Floor Covering Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the India Non-Resilient Floor Covering Market?

Key companies in the market include Murudeshwar Ceramics Ltd, Somany Ceramics Ltd, Greenply Industries Ltd, RK Marble**List Not Exhaustive, Mohawk Industries Inc, RAK Ceramics India Private Ltd, Century Plyboards India Ltd, Accord Floors, Kajaria Ceramics Ltd.

3. What are the main segments of the India Non-Resilient Floor Covering Market?

The market segments include Product, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Number of E-Commerce Users is Driving the Market; Increase in Residential Construction is Driving the Market.

6. What are the notable trends driving market growth?

Ceramic Tiles Occupy A Major Share of the Market.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Low Replacement Demand.

8. Can you provide examples of recent developments in the market?

In 2022, Somany's most recent innovation The VC shield technology is now available in the market. which is developed by somany's own R&D facility to create unique VC shield technology. It is well-known for its abrasion resistance and long lifespan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Non-Resilient Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Non-Resilient Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Non-Resilient Floor Covering Market?

To stay informed about further developments, trends, and reports in the India Non-Resilient Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence