Key Insights

The Indian Electro-Hydraulic Power Steering (EHPS) market is poised for substantial expansion, fueled by the rapid growth of the automotive sector and the increasing integration of Advanced Driver-Assistance Systems (ADAS). The historical period (2019-2024) saw significant market development, driven by rising vehicle production across passenger cars and commercial vehicles. While specific historical market size data is limited, industry estimates for 2024 suggest a market value around ₹1500 crore (approx. $180 million USD). This upward trend is projected to continue through the forecast period (2025-2033), supported by government incentives for vehicle safety and fuel efficiency, growing disposable incomes enhancing vehicle affordability, and the expanding application of EHPS in two-wheelers and commercial fleets. The market also benefits from consumer demand for enhanced driving comfort and superior fuel economy.

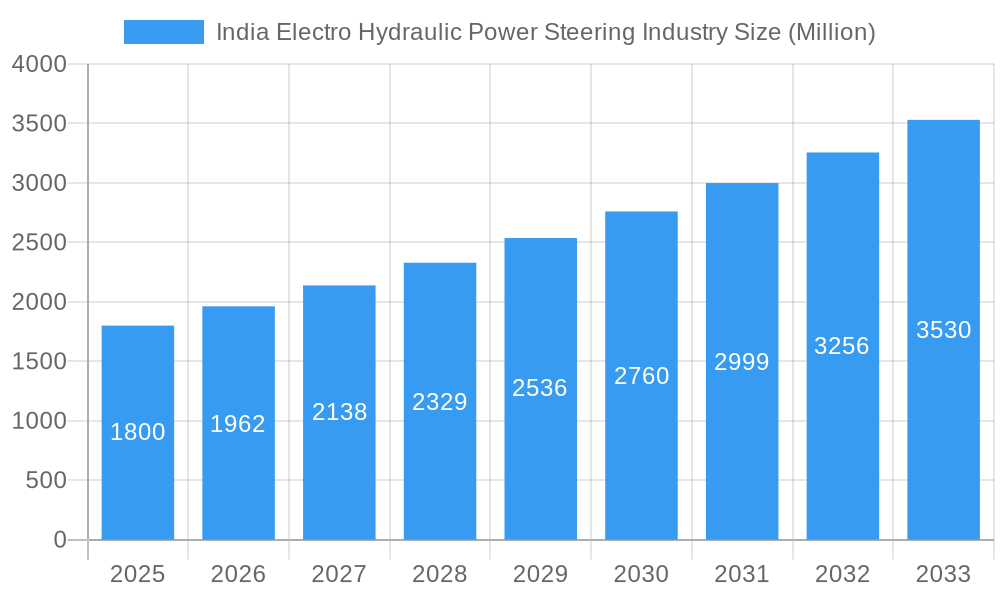

India Electro Hydraulic Power Steering Industry Market Size (In Billion)

Projections indicate a Compound Annual Growth Rate (CAGR) of approximately 5.2% for the India EHPS market during the forecast period (2025-2033). This growth is expected to drive the market size to an estimated $29378.8 million by the 2025 base year. Key growth drivers include technological innovations focused on cost optimization, efficiency enhancements, and seamless integration with ADAS functionalities. Despite potential challenges such as price sensitivity within the Indian market and competition from Electric Power Steering (EPS), the overall outlook for the India EHPS industry remains robust, presenting considerable opportunities for stakeholders in the coming years.

India Electro Hydraulic Power Steering Industry Company Market Share

India Electro Hydraulic Power Steering Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India electro hydraulic power steering (EHPS) industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and estimated year. This analysis is crucial for manufacturers, suppliers, investors, and industry professionals seeking to understand this rapidly evolving market. The total market size is projected to reach xx Million units by 2033.

India Electro Hydraulic Power Steering Industry Market Dynamics & Structure

The Indian EHPS market exhibits a moderately concentrated structure, with key players such as JTEKT Corporation, Denso Corporation, Danfoss, NSK Ltd, Hitachi Automotive Systems Ltd, Nexteer Automotive, and ZF TRW Automotive Holdings Corp holding significant market share. Technological innovation, driven by the need for enhanced fuel efficiency and driver assistance features, is a key driver. Stringent emission norms and safety regulations are shaping the industry landscape. The market faces competition from alternative steering technologies, such as electric power steering (EPS). The automotive industry’s growth significantly influences EHPS demand, with passenger vehicles contributing the largest share. M&A activity within the automotive components sector, while not extremely high in this specific segment, has played a role in shaping market dynamics.

- Market Concentration: Moderately concentrated, with top 7 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on improving efficiency, integrating advanced driver-assistance systems (ADAS), and reducing emissions.

- Regulatory Framework: Compliance with stringent safety and emission standards drives innovation and market growth.

- Competitive Substitutes: Electric Power Steering (EPS) poses a major competitive threat, gradually gaining market share.

- End-User Demographics: Passenger vehicle segment dominates, followed by commercial vehicles.

- M&A Trends: Limited but impactful M&A activity involving component manufacturers and automotive original equipment manufacturers (OEMs). Approximately xx deals in the last 5 years.

India Electro Hydraulic Power Steering Industry Growth Trends & Insights

The Indian EHPS market has witnessed robust growth over the historical period (2019-2024), driven primarily by rising vehicle production, particularly in the passenger vehicle segment. The market size expanded from xx Million units in 2019 to xx Million units in 2024, registering a CAGR of xx%. This growth is expected to continue, albeit at a slightly moderated pace, during the forecast period (2025-2033), reaching xx Million units by 2033 with a projected CAGR of xx%. Increased adoption of EHPS in both passenger and commercial vehicles, along with technological advancements leading to improved fuel efficiency and performance, are major factors contributing to this growth. The increasing preference for advanced safety features and government initiatives promoting fuel-efficient vehicles further supports market expansion. Consumer behavior shifts towards higher-end vehicles and greater awareness about safety are also driving the demand for EHPS.

Dominant Regions, Countries, or Segments in India Electro Hydraulic Power Steering Industry

The passenger vehicle segment dominates the Indian EHPS market, accounting for approximately xx% of the total market share in 2025. This is largely due to the rapid growth of the passenger vehicle industry in India, coupled with the increasing preference for vehicles with enhanced safety features and fuel efficiency. Among component types, the Motor and Pump Unit segment holds the largest share due to its importance in the EHPS system. Geographically, major metropolitan areas and automotive manufacturing hubs witness the highest demand due to higher vehicle density and established manufacturing infrastructure.

- Key Drivers for Passenger Vehicle Segment: Rising disposable incomes, increasing urbanization, and government policies promoting vehicle ownership.

- Key Drivers for Motor and Pump Unit Segment: Critical components of EHPS systems, necessitating high demand.

- Geographic Dominance: States with strong automotive manufacturing clusters and high vehicle density experience the highest demand.

India Electro Hydraulic Power Steering Industry Product Landscape

The Indian EHPS market features a range of products catering to diverse vehicle types and performance requirements. Innovations focus on enhancing efficiency, reducing noise and vibration, and integrating advanced features like variable assistance and adaptive steering. Manufacturers are emphasizing improved durability, reliability, and cost-effectiveness to appeal to a wider range of customers. Technological advancements include the use of advanced materials and manufacturing techniques to optimize system performance and reduce weight. The focus is on incorporating advanced features while maintaining affordability, enabling wider adoption across vehicle segments.

Key Drivers, Barriers & Challenges in India Electro Hydraulic Power Steering Industry

Key Drivers:

- Growing demand for passenger and commercial vehicles.

- Increasing preference for fuel-efficient vehicles.

- Government regulations promoting vehicle safety and emission reduction.

- Technological advancements leading to improved performance and features.

Challenges:

- Competition from EPS technology.

- Supply chain disruptions impacting component availability and pricing.

- High initial investment costs associated with EHPS technology.

- Potential regulatory changes impacting product standards and compliance.

Emerging Opportunities in India Electro Hydraulic Power Steering Industry

- Expansion into untapped rural markets: Increasing vehicle penetration in rural areas presents a significant opportunity for EHPS manufacturers.

- Integration with ADAS features: Developing EHPS systems capable of seamless integration with ADAS technologies enhances the value proposition and boosts demand.

- Focus on customized solutions: Providing tailored EHPS solutions to meet the specific needs of different vehicle platforms expands market reach.

Growth Accelerators in the India Electro Hydraulic Power Steering Industry Industry

Technological breakthroughs, such as the development of more efficient and compact EHPS units, are crucial for driving market growth. Strategic partnerships between EHPS manufacturers and automotive OEMs streamline supply chains and accelerate product development. Expanding into new market segments, such as electric and hybrid vehicles, and developing cost-effective solutions to expand market penetration, are further factors contributing to sustained growth.

Key Players Shaping the India Electro Hydraulic Power Steering Market

Notable Milestones in India Electro Hydraulic Power Steering Industry Sector

- 2020: Introduction of new EHPS models with improved fuel efficiency by major players.

- 2022: Implementation of stricter emission norms in India impacting EHPS design and manufacturing.

- 2023: Strategic partnership between a leading EHPS manufacturer and an Indian automotive OEM.

- 2024: Launch of cost-effective EHPS solutions catering to entry-level vehicles.

In-Depth India Electro Hydraulic Power Steering Industry Market Outlook

The Indian EHPS market is poised for sustained growth in the coming years. Continuous technological innovations, strategic partnerships, and government support will drive the market expansion. Emerging trends like the integration of EHPS with ADAS systems and the growing demand for electric and hybrid vehicles will significantly contribute to future market potential. Opportunities exist for manufacturers to develop cost-effective solutions, focus on customization, and expand into untapped market segments to capitalize on the industry's robust growth prospects.

India Electro Hydraulic Power Steering Industry Segmentation

-

1. Component Type

- 1.1. Hybrid

- 1.2. Steering Column

- 1.3. Motor and Pump Unit

- 1.4. Other Components

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

India Electro Hydraulic Power Steering Industry Segmentation By Geography

- 1. India

India Electro Hydraulic Power Steering Industry Regional Market Share

Geographic Coverage of India Electro Hydraulic Power Steering Industry

India Electro Hydraulic Power Steering Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising EV Sales to Fuel Automotive PCB Demand

- 3.3. Market Restrains

- 3.3.1. Complex Design and Integration Challenges

- 3.4. Market Trends

- 3.4.1. Electric Power Steering (Eps) Technology Phasing Out the Electro-Hydraulic System

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Electro Hydraulic Power Steering Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Hybrid

- 5.1.2. Steering Column

- 5.1.3. Motor and Pump Unit

- 5.1.4. Other Components

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JTEKT Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Danfoss

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NSK Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Automotive Systems Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nexteer Automotive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ZF TRW Automotive Holdings Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 JTEKT Corporation

List of Figures

- Figure 1: India Electro Hydraulic Power Steering Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Electro Hydraulic Power Steering Industry Share (%) by Company 2025

List of Tables

- Table 1: India Electro Hydraulic Power Steering Industry Revenue million Forecast, by Component Type 2020 & 2033

- Table 2: India Electro Hydraulic Power Steering Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 3: India Electro Hydraulic Power Steering Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Electro Hydraulic Power Steering Industry Revenue million Forecast, by Component Type 2020 & 2033

- Table 5: India Electro Hydraulic Power Steering Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: India Electro Hydraulic Power Steering Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Electro Hydraulic Power Steering Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the India Electro Hydraulic Power Steering Industry?

Key companies in the market include JTEKT Corporation, Denso Corporation, Danfoss, NSK Ltd, Hitachi Automotive Systems Ltd, Nexteer Automotive, ZF TRW Automotive Holdings Corp.

3. What are the main segments of the India Electro Hydraulic Power Steering Industry?

The market segments include Component Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 29378.8 million as of 2022.

5. What are some drivers contributing to market growth?

Rising EV Sales to Fuel Automotive PCB Demand.

6. What are the notable trends driving market growth?

Electric Power Steering (Eps) Technology Phasing Out the Electro-Hydraulic System.

7. Are there any restraints impacting market growth?

Complex Design and Integration Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Electro Hydraulic Power Steering Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Electro Hydraulic Power Steering Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Electro Hydraulic Power Steering Industry?

To stay informed about further developments, trends, and reports in the India Electro Hydraulic Power Steering Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence