Key Insights

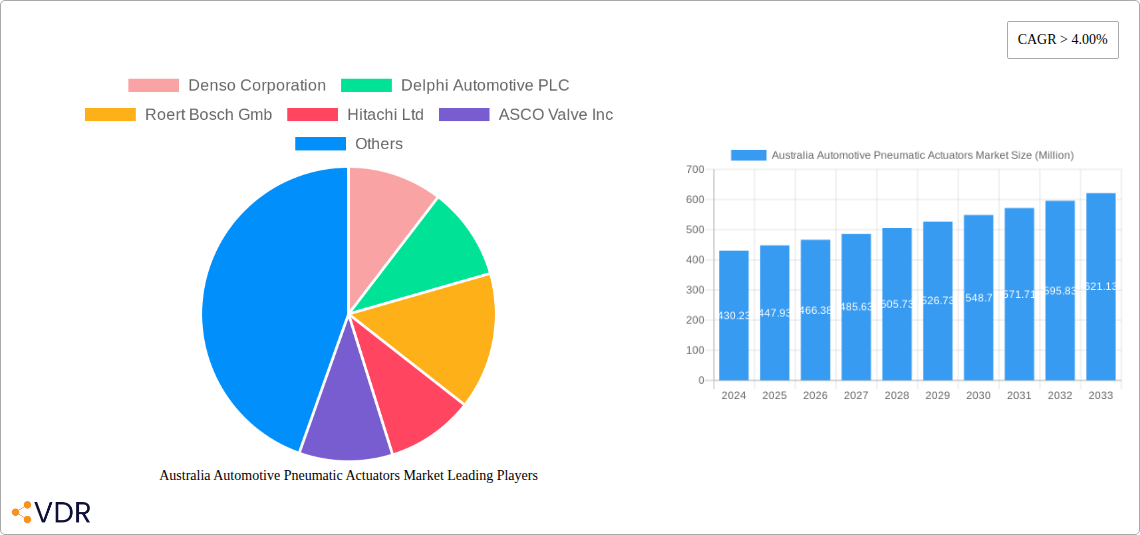

The Australian automotive pneumatic actuators market is poised for steady growth, driven by increasing demand for enhanced vehicle performance, safety, and emissions control. In 2024, the market is estimated to be valued at USD 430.23 million, projecting a Compound Annual Growth Rate (CAGR) of 4.1% through to 2033. This growth is underpinned by the widespread adoption of advanced powertrain systems, including sophisticated fuel injection and throttle control mechanisms, which rely heavily on pneumatic actuation for precise and responsive operation. The increasing stringency of environmental regulations and the growing consumer preference for fuel-efficient vehicles further bolster the demand for these components. Furthermore, the evolving landscape of commercial vehicles, with a focus on automation and improved operational efficiency, also presents significant opportunities for pneumatic actuators.

Australia Automotive Pneumatic Actuators Market Market Size (In Million)

The market’s expansion is further fueled by technological advancements that lead to the development of more compact, efficient, and durable pneumatic actuators. Key trends include the integration of smart technologies for real-time diagnostics and predictive maintenance, as well as a shift towards electrification that, while posing a long-term challenge, also presents opportunities for hybrid pneumatic systems. While the upfront cost of advanced pneumatic systems and the emergence of alternative actuation technologies like electric actuators represent potential restraints, the established reliability, cost-effectiveness in certain applications, and proven performance of pneumatic actuators ensure their continued relevance. Key players like Denso Corporation, Robert Bosch GmbH, and Continental AG are actively investing in research and development to innovate and capture market share within Australia.

Australia Automotive Pneumatic Actuators Market Company Market Share

Australia Automotive Pneumatic Actuators Market: Comprehensive Analysis & Future Outlook (2019-2033)

This report offers an in-depth analysis of the Australia Automotive Pneumatic Actuators Market, providing critical insights into its dynamics, growth trends, product landscape, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand the evolving Australian automotive sector. Discover the intricate interplay of technological advancements, regulatory landscapes, and consumer preferences shaping the demand for pneumatic actuators in vehicles, from passenger cars to commercial vehicles.

Australia Automotive Pneumatic Actuators Market Market Dynamics & Structure

The Australia Automotive Pneumatic Actuators Market exhibits a moderately consolidated structure, with key players like Denso Corporation, Delphi Automotive PLC, Robert Bosch GmbH, Hitachi Ltd, ASCO Valve Inc, Continental AG, Schrader Duncan Limited, Numatics Inc, and CTS Corporation holding significant market shares. Technological innovation is a primary driver, fueled by the ongoing transition towards electric vehicles (EVs) and the increasing adoption of advanced driver-assistance systems (ADAS) that often integrate pneumatic control mechanisms. Stringent emission standards and evolving safety regulations are also influencing actuator design and adoption. While direct pneumatic actuation is more prevalent in internal combustion engine (ICE) vehicles, innovation is occurring in hybrid systems and specialized EV applications where pneumatic systems might control auxiliary functions or specific sub-systems. Competitive product substitutes, primarily electric actuators, pose a challenge, necessitating continuous innovation in pneumatic actuator efficiency and functionality. End-user demographics are shifting towards a younger, tech-savvy population that demands advanced vehicle features and improved fuel efficiency. Mergers and acquisitions (M&A) are less frequent but can significantly alter market concentration.

- Market Concentration: Moderate, with a few dominant players.

- Technological Innovation Drivers: EV transition, ADAS integration, emission standards, safety regulations.

- Regulatory Frameworks: Increasingly stringent emission and safety standards.

- Competitive Product Substitutes: Electric actuators.

- End-User Demographics: Younger, tech-savvy consumers, demand for advanced features.

- M&A Trends: Limited, but impactful when they occur.

Australia Automotive Pneumatic Actuators Market Growth Trends & Insights

The Australia Automotive Pneumatic Actuators Market is poised for steady growth, driven by the enduring presence of internal combustion engine (ICE) vehicles and the specialized applications of pneumatic actuators in the evolving automotive ecosystem. While the automotive industry globally is transitioning towards electrification, the substantial existing fleet of ICE vehicles in Australia will continue to demand replacement parts and aftermarket pneumatic actuators for throttle control, fuel injection, and braking systems. Furthermore, even in electric vehicles, pneumatic actuators can find niche applications in auxiliary systems such as door locks, suspension adjustments, and HVAC controls, thereby contributing to overall market penetration. The market size is projected to grow from approximately 15.5 million units in 2019 to an estimated 22.8 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Adoption rates for advanced pneumatic actuators are influenced by factors such as vehicle sophistication and the demand for enhanced performance and reliability. Technological disruptions, while more prominent in electric actuator development, also push pneumatic actuator manufacturers to innovate in areas like miniaturization, improved sealing, and enhanced responsiveness. Consumer behavior shifts towards greater demand for fuel efficiency and precise vehicle control indirectly benefit pneumatic systems that contribute to these aspects. The estimated market size for pneumatic actuators in Australia was 18.2 million units in 2025.

Dominant Regions, Countries, or Segments in Australia Automotive Pneumatic Actuators Market

Within the Australian automotive landscape, Passenger Cars represent the dominant segment for pneumatic actuators, driven by their sheer volume in the overall vehicle fleet and the widespread application of pneumatic systems in essential functions like throttle control, fuel injection, and braking. The demand for reliable and cost-effective pneumatic solutions in passenger cars is consistently high, making them the primary growth engine. Geographically, while Australia is a single country market, key urban centers such as Sydney, Melbourne, Brisbane, Perth, and Adelaide are significant consumption hubs due to higher vehicle density and the presence of automotive repair and maintenance infrastructure. The Throttle Actuators application type is expected to maintain its leadership position, as precise engine management is crucial for performance and fuel efficiency in a wide range of passenger vehicles. However, the growth in Brake Actuators, especially with the increasing integration of advanced braking systems in passenger cars for enhanced safety, is notable.

- Dominant Vehicle Type: Passenger Cars (accounting for an estimated 70% of the market share in 2025).

- Dominant Application Type: Throttle Actuators (holding approximately 40% of the application segment share in 2025).

- Key Urban Hubs Driving Demand: Sydney, Melbourne, Brisbane, Perth, Adelaide.

- Growth Drivers in Passenger Cars: High vehicle ownership, demand for reliable engine and braking components, aftermarket replacement needs.

- Factors Influencing Brake Actuator Growth: Advancements in ABS, ESC, and other safety systems.

Australia Automotive Pneumatic Actuators Market Product Landscape

The product landscape for automotive pneumatic actuators in Australia is characterized by continuous refinement of existing technologies and exploration of niche applications. Manufacturers are focusing on developing actuators that offer enhanced precision, faster response times, and improved durability to meet the demands of modern vehicles. Innovations include compact designs for easier integration, advanced sealing technologies to prevent leakage and ensure longevity, and materials that can withstand harsh under-hood environments. While the core functionality of pneumatic actuators remains similar across various applications like throttle control, fuel injection, and braking, the specific performance metrics, such as actuation force, speed, and control accuracy, are tailored to each application. Unique selling propositions often revolve around cost-effectiveness, reliability, and established performance in traditional ICE powertrains. Technological advancements are also geared towards improving energy efficiency within the pneumatic system itself, even as the broader industry moves towards electrification.

Key Drivers, Barriers & Challenges in Australia Automotive Pneumatic Actuators Market

Key Drivers: The primary forces propelling the Australia Automotive Pneumatic Actuators Market include the substantial existing fleet of Internal Combustion Engine (ICE) vehicles requiring ongoing maintenance and replacement parts. The pursuit of enhanced fuel efficiency and precise engine control in ICE vehicles also drives demand for sophisticated pneumatic actuators. Furthermore, the cost-effectiveness and proven reliability of pneumatic systems in many traditional automotive applications continue to ensure their relevance, especially in the aftermarket segment.

Barriers & Challenges: The most significant challenge is the global shift towards electric vehicles (EVs), which inherently reduce the reliance on traditional pneumatic actuation systems for core powertrain functions. The increasing adoption of electric actuators as a substitute, offering potentially higher precision and integration with electronic control units, presents a competitive threat. Supply chain disruptions and fluctuating raw material costs can impact production and pricing. Regulatory hurdles related to emissions and noise pollution, while not directly targeting pneumatic actuators, can indirectly influence the design and application of ICE components.

Emerging Opportunities in Australia Automotive Pneumatic Actuators Market

Emerging opportunities lie in the aftermarket for existing ICE vehicles, where the demand for reliable pneumatic actuator replacements will persist for many years. Niche applications within EVs, such as pneumatic controls for HVAC systems, door locks, and even specialized suspension systems, represent an untapped market. Furthermore, the development of hybrid pneumatic-electric systems that leverage the strengths of both technologies could open new avenues. The growing focus on vehicle diagnostics and predictive maintenance also presents an opportunity for manufacturers to integrate sensors and smart functionalities into pneumatic actuators, enabling remote monitoring and proactive servicing.

Growth Accelerators in the Australia Automotive Pneumatic Actuators Market Industry

Catalysts driving long-term growth in the Australia Automotive Pneumatic Actuators Market include the continued strength of the aftermarket sector for ICE vehicles. Strategic partnerships between pneumatic actuator manufacturers and automotive repair chains can expand distribution and service networks. Market expansion strategies may involve developing specialized pneumatic solutions for emerging vehicle categories or focusing on regions with a higher concentration of older vehicle models. Technological breakthroughs in materials science and manufacturing processes that lead to more efficient, lighter, and cost-effective pneumatic actuators will also act as significant growth accelerators, ensuring their continued competitiveness against electric alternatives in specific applications.

Key Players Shaping the Australia Automotive Pneumatic Actuators Market Market

- Denso Corporation

- Delphi Automotive PLC

- Robert Bosch GmbH

- Hitachi Ltd

- ASCO Valve Inc

- Continental AG

- Schrader Duncan Limited

- Numatics Inc

- CTS Corporation

Notable Milestones in Australia Automotive Pneumatic Actuators Market Sector

- 2019: Increased adoption of advanced fuel injection systems requiring more sophisticated pneumatic control.

- 2020: Supply chain adjustments due to global events impacted production schedules.

- 2021: Growing interest in lightweight pneumatic actuators for improved vehicle efficiency.

- 2022: Continued development of pneumatic actuators for hybrid vehicle auxiliary systems.

- 2023: Enhanced focus on durability and longevity in aftermarket actuator offerings.

- 2024: Emergence of smart pneumatic actuators with integrated diagnostic capabilities.

In-Depth Australia Automotive Pneumatic Actuators Market Market Outlook

The outlook for the Australia Automotive Pneumatic Actuators Market is characterized by resilience, driven by the substantial ICE vehicle parc and emerging niche applications. While the long-term trajectory of the automotive industry leans towards electrification, pneumatic actuators will remain integral to the maintenance and performance of millions of existing vehicles. Growth accelerators such as aftermarket demand, potential in hybrid-electric vehicle sub-systems, and advancements in smart actuator technology will sustain market relevance. Stakeholders should focus on innovation in areas of efficiency, durability, and integration to capitalize on the evolving landscape and secure a significant share in this dynamic market.

Australia Automotive Pneumatic Actuators Market Segmentation

-

1. Application Type

- 1.1. Throttle Actuators

- 1.2. Fuel Injection Actuators

- 1.3. Brake Actuators

- 1.4. Others

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicle

Australia Automotive Pneumatic Actuators Market Segmentation By Geography

- 1. Australia

Australia Automotive Pneumatic Actuators Market Regional Market Share

Geographic Coverage of Australia Automotive Pneumatic Actuators Market

Australia Automotive Pneumatic Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Luxury Vehicle Sale Across the Country

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With the Component

- 3.4. Market Trends

- 3.4.1. Growing Demand for Throttle Actuators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Automotive Pneumatic Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Throttle Actuators

- 5.1.2. Fuel Injection Actuators

- 5.1.3. Brake Actuators

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delphi Automotive PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Roert Bosch Gmb

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ASCO Valve Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sahrader Ducan Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Numatics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CTS Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Australia Automotive Pneumatic Actuators Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Australia Automotive Pneumatic Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 2: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 5: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 6: Australia Automotive Pneumatic Actuators Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Automotive Pneumatic Actuators Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Australia Automotive Pneumatic Actuators Market?

Key companies in the market include Denso Corporation, Delphi Automotive PLC, Roert Bosch Gmb, Hitachi Ltd, ASCO Valve Inc, Continental AG, Sahrader Ducan Limited, Numatics Inc, CTS Corporation.

3. What are the main segments of the Australia Automotive Pneumatic Actuators Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Luxury Vehicle Sale Across the Country.

6. What are the notable trends driving market growth?

Growing Demand for Throttle Actuators.

7. Are there any restraints impacting market growth?

High Costs Associated With the Component.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Automotive Pneumatic Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Automotive Pneumatic Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Automotive Pneumatic Actuators Market?

To stay informed about further developments, trends, and reports in the Australia Automotive Pneumatic Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence