Key Insights

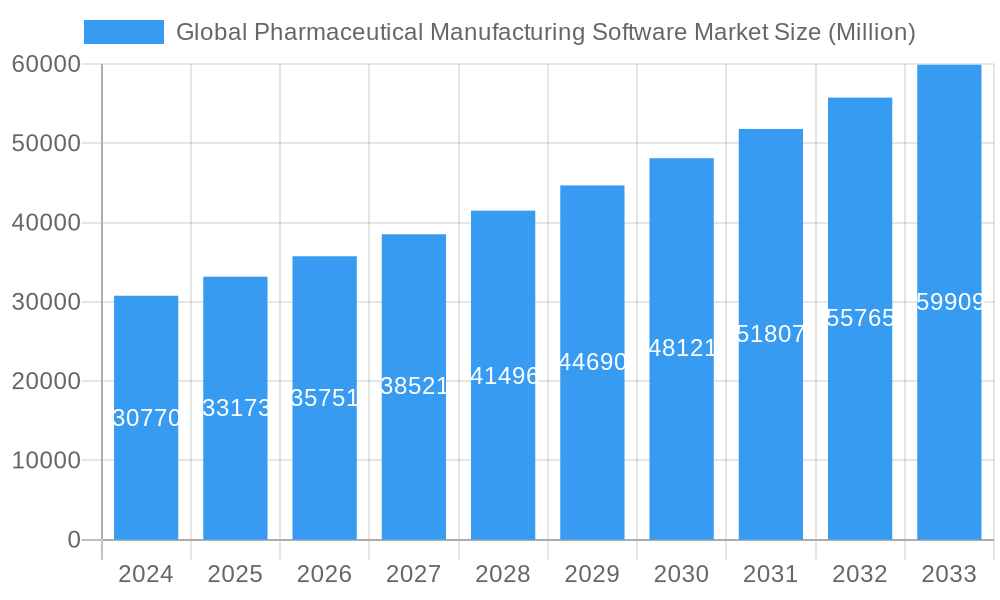

The global pharmaceutical manufacturing software market is poised for significant expansion, projected to reach an estimated USD 30.77 billion in 2024, demonstrating robust growth with a compound annual growth rate (CAGR) of 7.8% through 2033. This upward trajectory is fueled by the increasing demand for enhanced operational efficiency, stringent regulatory compliance requirements within the pharmaceutical industry, and the growing adoption of advanced technologies such as AI and machine learning for process optimization and quality control. The digital transformation across the pharmaceutical value chain is a primary driver, pushing manufacturers to invest in integrated software solutions that streamline R&D, production, supply chain management, and pharmacovigilance. The shift towards more complex biologics and personalized medicine further necessitates sophisticated software for managing intricate manufacturing processes and ensuring data integrity.

Global Pharmaceutical Manufacturing Software Market Market Size (In Billion)

Key trends shaping the market include the rising adoption of cloud-based solutions, offering scalability, flexibility, and cost-effectiveness for pharmaceutical companies of all sizes. The growing emphasis on data analytics and business intelligence is enabling better decision-making and predictive capabilities in manufacturing. While the market benefits from strong drivers, it also faces certain restraints, such as the high initial investment costs for implementing comprehensive software systems and the challenge of integrating legacy systems with new technologies. Nevertheless, the substantial market size and consistent growth signal a dynamic and evolving landscape, with opportunities for innovation and expansion across various market segments, particularly in large enterprises and SMEs seeking to modernize their operations and maintain a competitive edge.

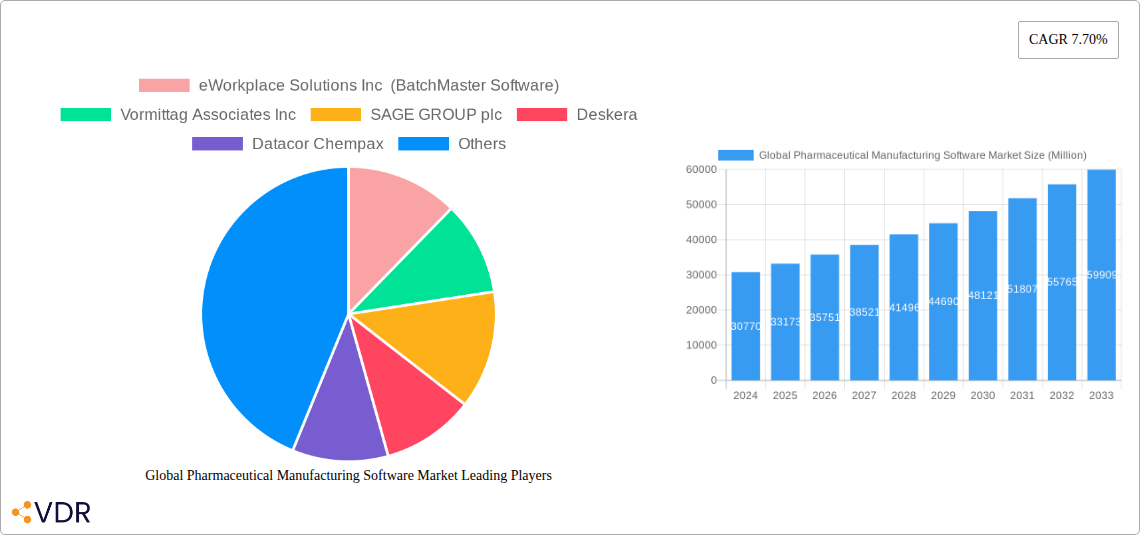

Global Pharmaceutical Manufacturing Software Market Company Market Share

Global Pharmaceutical Manufacturing Software Market: Comprehensive Report Analysis

Unlock the future of pharmaceutical production with our in-depth report on the Global Pharmaceutical Manufacturing Software Market. This critical analysis provides actionable insights into market dynamics, growth trends, and competitive landscapes, empowering industry leaders to make informed strategic decisions.

Global Pharmaceutical Manufacturing Software Market Dynamics & Structure

The Global Pharmaceutical Manufacturing Software Market is characterized by a moderately concentrated landscape, with key players leveraging technological innovation and strategic partnerships to gain a competitive edge. Driving this market are the relentless advancements in digital transformation, including Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT), which are revolutionizing production efficiency and quality control in pharmaceutical manufacturing. Stringent regulatory frameworks, such as those mandated by the FDA and EMA, necessitate robust compliance capabilities, making software solutions that ensure data integrity and traceability paramount.

- Technological Innovation Drivers:

- AI/ML for predictive maintenance and process optimization.

- IoT integration for real-time data acquisition and monitoring.

- Cloud computing for enhanced scalability and accessibility.

- Blockchain for secure supply chain management.

- Regulatory Frameworks: Strict adherence to cGMP, FDA 21 CFR Part 11, and EMA regulations is a primary driver for software adoption.

- Competitive Product Substitutes: While specialized software dominates, some ERP systems offer integrated functionalities, posing a competitive threat.

- End-User Demographics: The market is largely driven by large pharmaceutical enterprises seeking comprehensive solutions, but growing adoption among Small and Medium-Sized Enterprises (SMEs) presents significant growth potential.

- M&A Trends: Strategic acquisitions and partnerships are prevalent, aimed at expanding product portfolios and market reach. XX M&A deals were recorded in the historical period (2019-2024), indicating consolidation and innovation-driven growth strategies.

- Innovation Barriers: High implementation costs and the need for specialized expertise can present hurdles for smaller players.

Global Pharmaceutical Manufacturing Software Market Growth Trends & Insights

The Global Pharmaceutical Manufacturing Software Market is poised for substantial expansion, fueled by an escalating demand for enhanced efficiency, stringent regulatory compliance, and the imperative to accelerate drug development and production cycles. Leveraging advanced analytics and AI-driven insights, this market is witnessing an unprecedented evolution in its size and scope. The adoption rates for sophisticated manufacturing execution systems (MES), laboratory information management systems (LIMS), and enterprise resource planning (ERP) solutions are surging as pharmaceutical companies across the globe prioritize digital transformation to streamline operations and improve product quality.

- Market Size Evolution: The Global Pharmaceutical Manufacturing Software Market was valued at $XX billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This growth is underpinned by an increasing number of drug approvals and a rising global demand for pharmaceuticals.

- Adoption Rates: The shift towards digitalized manufacturing processes is accelerating, with adoption rates for cloud-based solutions increasing by XX% annually. SMEs are increasingly investing in these technologies to remain competitive.

- Technological Disruptions: The integration of AI and ML for process optimization, predictive maintenance, and quality assurance is a significant disruptor. Furthermore, advancements in automation and robotics, coupled with manufacturing intelligence platforms, are reshaping production paradigms.

- Consumer Behavior Shifts: While not directly consumer-facing, evolving patient needs for faster access to high-quality medications are indirectly influencing the demand for more agile and efficient pharmaceutical manufacturing processes, driving software adoption.

- Market Penetration: The market penetration of advanced pharmaceutical manufacturing software is estimated to reach XX% by 2033, indicating a substantial opportunity for vendors and service providers.

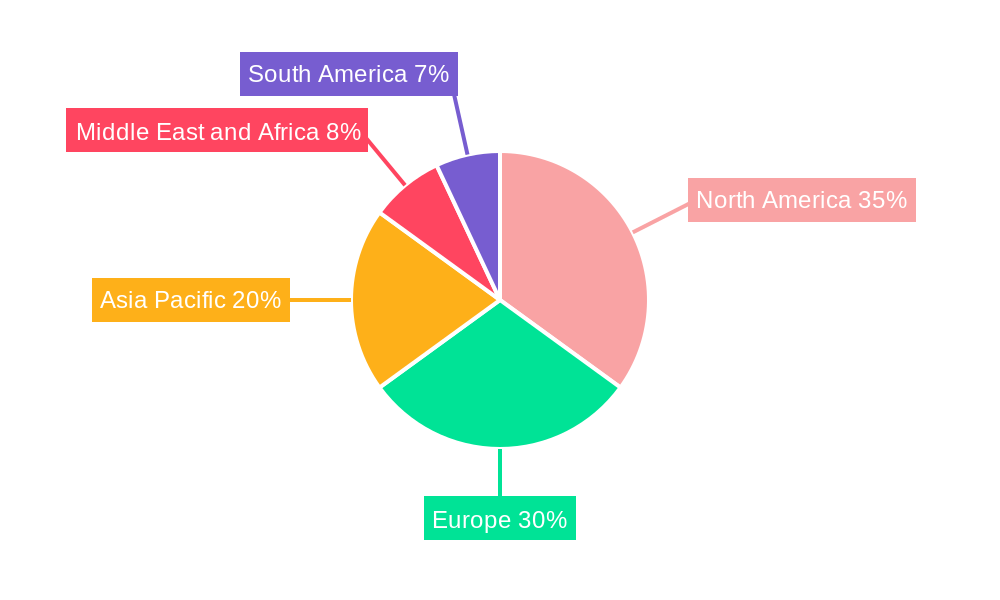

Dominant Regions, Countries, or Segments in Global Pharmaceutical Manufacturing Software Market

North America currently commands a dominant position in the Global Pharmaceutical Manufacturing Software Market, driven by a robust pharmaceutical industry, significant R&D investments, and a proactive approach to adopting advanced technologies. The United States, in particular, is a key growth engine due to the presence of numerous leading pharmaceutical companies, stringent regulatory standards that necessitate sophisticated software solutions, and a strong ecosystem of technology providers.

Dominant Region: North America

- Market Share: North America accounts for an estimated XX% of the global market share, driven by the US and Canada.

- Key Drivers:

- High concentration of leading pharmaceutical and biotechnology firms.

- Significant government and private sector investment in pharmaceutical R&D.

- Early and widespread adoption of digital transformation technologies.

- Strict regulatory environment (FDA) mandating advanced compliance software.

- Growth Potential: Continued innovation in biologics and personalized medicine will further fuel demand for specialized manufacturing software.

Dominant Segment: On-Cloud

- Market Share: The On-Cloud segment is projected to hold a substantial XX% market share by 2033, exhibiting a faster CAGR than its on-premise counterpart.

- Key Drivers:

- Scalability and flexibility for fluctuating production demands.

- Reduced upfront IT infrastructure costs and maintenance overheads.

- Enhanced accessibility and collaboration for geographically dispersed teams.

- Faster deployment and integration capabilities.

- Growth Potential: The increasing preference for subscription-based models and the need for remote monitoring and management of manufacturing processes will continue to drive cloud adoption.

Dominant Enterprise Segment: Large Enterprises

- Market Share: Large Enterprises currently represent the largest segment, accounting for approximately XX% of the market revenue.

- Key Drivers:

- Complex manufacturing processes requiring comprehensive, integrated solutions.

- Higher budgets for technology investments and digital transformation initiatives.

- Greater need for robust compliance and data management capabilities across multiple facilities.

- Growth Potential: While mature, large enterprises continue to invest in upgrading their systems and adopting newer technologies like AI and IoT to maintain their competitive edge. However, the Small and Medium-Sized Enterprises (SMEs) segment is experiencing a higher CAGR, indicating a significant future growth opportunity as more SMEs invest in digitalization to compete.

Global Pharmaceutical Manufacturing Software Market Product Landscape

The Global Pharmaceutical Manufacturing Software Market is rich with diverse and innovative product offerings designed to address specific needs across the pharmaceutical value chain. From comprehensive Manufacturing Execution Systems (MES) and Quality Management Systems (QMS) to specialized Laboratory Information Management Systems (LIMS) and Enterprise Resource Planning (ERP) modules, the landscape is driven by technological advancements focused on automation, compliance, and data integrity. Key innovations include the integration of AI/ML for predictive analytics, enhanced data visualization tools, and seamless integration capabilities with other enterprise systems.

- Unique Selling Propositions: Solutions offer features like real-time process monitoring, automated batch record generation, robust audit trail capabilities, and advanced analytics for yield optimization.

- Technological Advancements: The market is witnessing a surge in cloud-native solutions, the incorporation of digital twins for simulation and optimization, and the application of blockchain for enhanced supply chain transparency and security.

Key Drivers, Barriers & Challenges in Global Pharmaceutical Manufacturing Software Market

The Global Pharmaceutical Manufacturing Software Market is propelled by several key drivers, primarily centered around the increasing complexity of drug development, stringent global regulatory requirements, and the imperative for enhanced operational efficiency. The relentless pursuit of cost reduction and time-to-market acceleration in a highly competitive environment further fuels the demand for advanced software solutions.

Key Drivers:

- Regulatory Compliance: Evolving and stringent regulations (e.g., FDA, EMA) necessitate robust software for data integrity and traceability.

- Demand for Efficiency & Cost Reduction: Automation and optimized processes through software lead to reduced operational costs and faster production cycles.

- Globalization of Pharma Operations: Managing complex, geographically dispersed manufacturing sites requires integrated and scalable software solutions.

- Technological Advancements: AI, ML, IoT, and cloud computing are enabling new levels of automation and predictive capabilities.

Key Barriers & Challenges:

- High Implementation Costs: Significant upfront investment for software, hardware, and integration can be a barrier, especially for SMEs.

- Data Security & Privacy Concerns: Protecting sensitive intellectual property and patient data in the cloud or networked systems is a critical challenge.

- Legacy System Integration: Integrating new software with existing outdated systems can be complex, time-consuming, and costly.

- Skilled Workforce Shortage: A lack of trained personnel to implement, manage, and utilize advanced manufacturing software can hinder adoption.

- Regulatory Scrutiny & Validation: The rigorous validation processes required for pharmaceutical software add to the complexity and cost of implementation.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of hardware components and specialized services required for software deployment.

Emerging Opportunities in Global Pharmaceutical Manufacturing Software Market

The Global Pharmaceutical Manufacturing Software Market is rife with emerging opportunities, driven by advancements in digital technologies and the evolving needs of the pharmaceutical industry. The increasing focus on personalized medicine and the rise of biopharmaceuticals present a significant avenue for specialized software solutions that can handle complex and individualized production processes.

- Personalized Medicine & Biologics: Development of software for highly flexible and adaptable manufacturing of personalized therapies and complex biologics.

- AI-Powered Drug Discovery & Development Integration: Seamless integration of manufacturing software with AI tools used in early-stage drug discovery and clinical trial data analysis.

- Sustainability & Green Manufacturing: Software solutions that help monitor and optimize energy consumption, waste reduction, and overall environmental impact in pharmaceutical production.

- Enhanced Supply Chain Transparency: Leveraging blockchain and IoT for end-to-end visibility and traceability of raw materials and finished products, combating counterfeiting.

- Digital Twins for Process Simulation: Wider adoption of digital twins for simulating manufacturing processes, optimizing yields, and troubleshooting before physical implementation.

Growth Accelerators in the Global Pharmaceutical Manufacturing Software Market Industry

Several catalysts are accelerating the growth of the Global Pharmaceutical Manufacturing Software Market. The ongoing digital transformation initiatives across the pharmaceutical sector, coupled with increasing investments in R&D for novel therapies, are creating a sustained demand for sophisticated manufacturing software. Furthermore, government initiatives promoting technological adoption and the growing trend of Industry 4.0 principles are significant growth accelerators.

- Strategic Partnerships: Collaborations between software providers and pharmaceutical companies, as well as alliances with technology giants, are fostering innovation and market expansion.

- Technological Breakthroughs: Continuous advancements in AI, ML, IoT, and cloud computing are enabling more powerful, efficient, and integrated software solutions.

- Market Expansion Strategies: Vendors are actively expanding into emerging markets and focusing on providing tailored solutions for specific therapeutic areas or manufacturing needs.

Key Players Shaping the Global Pharmaceutical Manufacturing Software Market Market

- eWorkplace Solutions Inc (BatchMaster Software)

- Vormittag Associates Inc

- SAGE GROUP plc

- Deskera

- Datacor Chempax

- Logic ERP Solutions Pvt Ltd

- MasterControl Inc

- Intellect

- Aquilon Software

- Fishbowl

- Oracle

- ABB

Notable Milestones in Global Pharmaceutical Manufacturing Software Market Sector

- March 2022: Aizon, a developer of enterprise AI software, and Aggity, a Spanish firm focused on business digital transformation, established a partnership to accelerate digital transformation within manufacturing operations at the world's biggest pharmaceutical and biotech companies.

- March 2022: Triastek, Inc. and Siemens Ltd., China, agreed to collaborate on digital technologies for the worldwide pharmaceutical business. Triastek's industry-leading 3D printing and digital pharmaceutical technologies, combined with Siemens' global experience in automation and digitalization, result in unique and disruptive pharmaceutical research and manufacturing solutions.

In-Depth Global Pharmaceutical Manufacturing Software Market Market Outlook

The future outlook for the Global Pharmaceutical Manufacturing Software Market is exceptionally promising, driven by the continued integration of advanced digital technologies and the evolving demands of the global healthcare landscape. Strategic partnerships and the ongoing commitment to digital transformation are set to unlock new levels of efficiency and innovation.

- Future Market Potential: The market is expected to witness sustained high growth as pharmaceutical companies increasingly prioritize smart manufacturing, data-driven decision-making, and the agility required to respond to global health challenges and personalized medicine trends.

- Strategic Opportunities: Focus on cloud-native solutions, AI-powered predictive analytics, and robust cybersecurity measures will be critical for sustained success. Expansion into emerging economies and tailoring solutions for niche therapeutic areas represent significant strategic opportunities.

Global Pharmaceutical Manufacturing Software Market Segmentation

-

1. Product

- 1.1. On-Cloud

- 1.2. On-Premise

-

2. Enterprise

- 2.1. Large Enterprises

- 2.2. Small and Medium-Sized Enterprises (SMEs)

Global Pharmaceutical Manufacturing Software Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Pharmaceutical Manufacturing Software Market Regional Market Share

Geographic Coverage of Global Pharmaceutical Manufacturing Software Market

Global Pharmaceutical Manufacturing Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Adoption of Pharmaceutical Manufacturing Software by Pharmaceutical Companies; Increasing Cost of Drugs Manufacturing

- 3.3. Market Restrains

- 3.3.1. High Cost of Pharamceutical Manufacturing Software; Security Concerns Pertaining to On-Cloud Deployment

- 3.4. Market Trends

- 3.4.1. On-Cloud Software is Expected to Hold a Significant Share in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. On-Cloud

- 5.1.2. On-Premise

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Large Enterprises

- 5.2.2. Small and Medium-Sized Enterprises (SMEs)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. On-Cloud

- 6.1.2. On-Premise

- 6.2. Market Analysis, Insights and Forecast - by Enterprise

- 6.2.1. Large Enterprises

- 6.2.2. Small and Medium-Sized Enterprises (SMEs)

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. On-Cloud

- 7.1.2. On-Premise

- 7.2. Market Analysis, Insights and Forecast - by Enterprise

- 7.2.1. Large Enterprises

- 7.2.2. Small and Medium-Sized Enterprises (SMEs)

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. On-Cloud

- 8.1.2. On-Premise

- 8.2. Market Analysis, Insights and Forecast - by Enterprise

- 8.2.1. Large Enterprises

- 8.2.2. Small and Medium-Sized Enterprises (SMEs)

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. On-Cloud

- 9.1.2. On-Premise

- 9.2. Market Analysis, Insights and Forecast - by Enterprise

- 9.2.1. Large Enterprises

- 9.2.2. Small and Medium-Sized Enterprises (SMEs)

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. On-Cloud

- 10.1.2. On-Premise

- 10.2. Market Analysis, Insights and Forecast - by Enterprise

- 10.2.1. Large Enterprises

- 10.2.2. Small and Medium-Sized Enterprises (SMEs)

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 eWorkplace Solutions Inc (BatchMaster Software)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vormittag Associates Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SAGE GROUP plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Deskera

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Datacor Chempax

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Logic ERP Solutions Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MasterControl Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Intellect

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aquilon Software

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fishbowl

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Oracle

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ABB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 eWorkplace Solutions Inc (BatchMaster Software)

List of Figures

- Figure 1: Global Global Pharmaceutical Manufacturing Software Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 5: North America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 6: North America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 9: Europe Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 11: Europe Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 12: Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 15: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 17: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 18: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 21: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 23: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 24: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 27: South America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 29: South America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 30: South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 3: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 6: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 11: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 12: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 20: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 21: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 29: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 30: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 35: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 36: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Pharmaceutical Manufacturing Software Market?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Global Pharmaceutical Manufacturing Software Market?

Key companies in the market include eWorkplace Solutions Inc (BatchMaster Software), Vormittag Associates Inc, SAGE GROUP plc, Deskera, Datacor Chempax, Logic ERP Solutions Pvt Ltd, MasterControl Inc, Intellect, Aquilon Software, Fishbowl, Oracle, ABB.

3. What are the main segments of the Global Pharmaceutical Manufacturing Software Market?

The market segments include Product, Enterprise.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Adoption of Pharmaceutical Manufacturing Software by Pharmaceutical Companies; Increasing Cost of Drugs Manufacturing.

6. What are the notable trends driving market growth?

On-Cloud Software is Expected to Hold a Significant Share in the Market Studied.

7. Are there any restraints impacting market growth?

High Cost of Pharamceutical Manufacturing Software; Security Concerns Pertaining to On-Cloud Deployment.

8. Can you provide examples of recent developments in the market?

In March 2022, Aizon, a developer of enterprise AI software, and Aggity, a Spanish firm focused on business digital transformation, established a partnership to accelerate digital transformation within manufacturing operations at the world's biggest pharmaceutical and biotech companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Pharmaceutical Manufacturing Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Pharmaceutical Manufacturing Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Pharmaceutical Manufacturing Software Market?

To stay informed about further developments, trends, and reports in the Global Pharmaceutical Manufacturing Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence