Key Insights

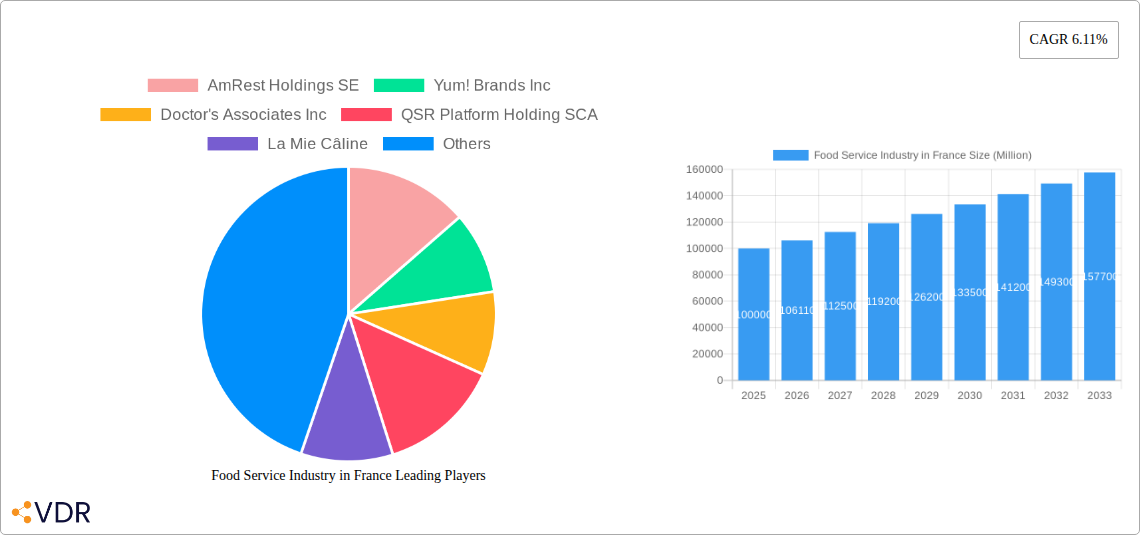

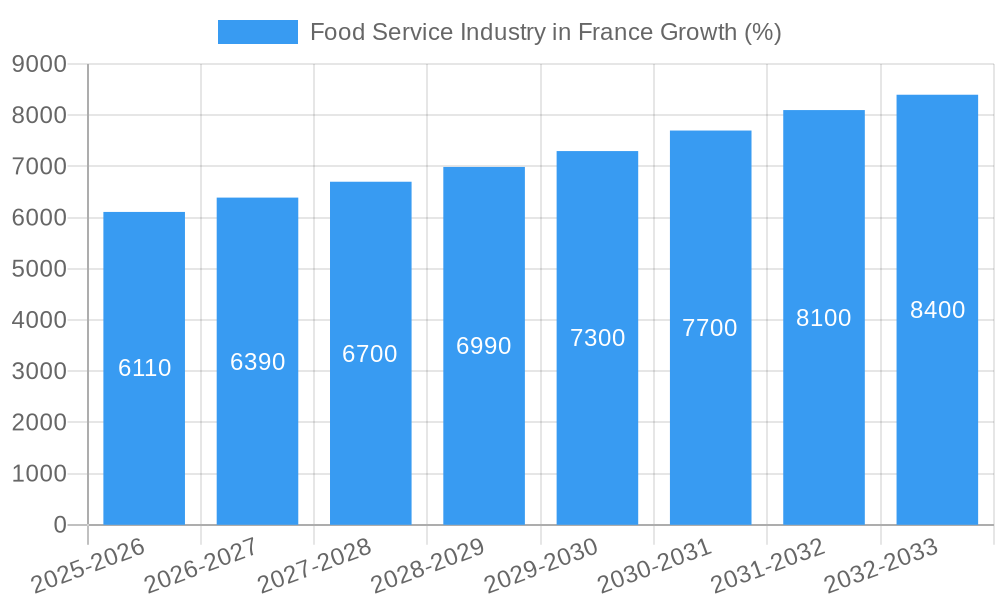

The French food service industry, a vibrant and diverse sector, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 6.11% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a burgeoning tourism sector fuels demand, particularly in leisure and lodging locations. Secondly, the increasing popularity of quick-service restaurants (QSRs) and cafes catering to diverse cuisines continues to attract consumers seeking convenience and variety. The rise of chained outlets reflects established brands' successful strategies in penetrating the market, while independent outlets contribute significantly to the sector's dynamism and culinary innovation. Furthermore, evolving consumer preferences, including a growing demand for healthy and sustainable options, present opportunities for businesses adapting to these trends. France's strong economy and increasing disposable incomes also contribute to the market's expansion. However, challenges remain, including rising operating costs (labor and rent), intense competition, and the impact of global economic uncertainties.

The segmentation of the French food service market reveals valuable insights. While chained outlets dominate market share, independent restaurants contribute significantly to the culinary landscape, appealing to those seeking unique experiences. The geographic distribution of food service businesses highlights the importance of strategic location. Leisure, lodging, retail, and standalone locations all contribute to the overall market size. The presence of both international giants like McDonald's and AmRest, along with strong local players like Groupe Bertrand and Le Duff, underscores the competitive yet dynamic nature of this sector. Analyzing these segments and understanding the specific drivers and challenges within each is critical for strategic investment and business development in the French food service industry. Growth within the cafes and bars segment is likely to be particularly strong, reflecting changing consumer preferences and the social nature of dining out.

Food Service Industry in France: Market Dynamics, Growth & Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic French food service industry, encompassing market size, growth trends, competitive landscape, and future projections. The study period covers 2019-2033, with 2025 as the base and estimated year. It delves into key segments including cafes & bars, other QSR cuisines, chained and independent outlets, across diverse locations like leisure, lodging, retail, standalone, and travel. The report uses the latest data to provide actionable insights for industry professionals, investors, and strategic decision-makers.

Food Service Industry in France Market Dynamics & Structure

The French food service market, valued at €XX billion in 2024, exhibits a moderately concentrated structure with key players like McDonald's Corporation and Groupe Bertrand holding significant market share. Technological innovation, driven by digital ordering platforms and automated kitchen systems, is transforming the industry. Stringent regulatory frameworks concerning food safety and hygiene significantly impact operational costs. Competitive substitutes, including meal delivery services and grocery stores offering ready-to-eat options, pose ongoing challenges. Consumer demographics, particularly the growing preference for convenient and healthy food options, shape market demand. M&A activity remains brisk, with several notable transactions in recent years, contributing to market consolidation.

- Market Concentration: Highly competitive, with a few dominant players commanding significant shares. The top 5 players hold approximately xx% of market share.

- Technological Innovation: Adoption of online ordering, mobile payment systems, and kitchen automation is steadily increasing, but faces challenges including high initial investment costs and integration complexities for smaller establishments.

- Regulatory Framework: Strict food safety and labor laws influence operational costs and business models.

- Competitive Substitutes: Meal delivery services and retail grocery prepared meal sections pose a considerable threat, especially to the QSR and café segments.

- End-User Demographics: A growing young population coupled with an increasing preference for convenient, healthy, and diverse cuisines drives market growth.

- M&A Trends: A significant number of mergers and acquisitions (approximately xx deals in the last 5 years) indicate increasing consolidation, mostly within the QSR and café segments.

Food Service Industry in France Growth Trends & Insights

The French food service market experienced a CAGR of xx% during 2019-2024, driven by factors such as rising disposable incomes, changing lifestyle preferences, and the increasing popularity of quick-service restaurants (QSRs). The market is projected to maintain a robust growth trajectory with a projected CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of €XX billion by 2033. The adoption of online ordering and delivery services continues to accelerate, while technological disruptions in areas such as AI-powered kitchen automation are slowly but steadily changing the business landscape. Consumers are increasingly demanding healthier, more sustainable options, influencing menu innovation and operational practices.

Dominant Regions, Countries, or Segments in Food Service Industry in France

The Paris region dominates the French food service market, accounting for approximately xx% of the total revenue in 2024. Other major cities like Lyon, Marseille, and Bordeaux also exhibit significant growth potential. Within segments, the QSR (Quick Service Restaurant) cuisine segment, specifically encompassing fast-casual and fast-food establishments, experienced the highest growth rate during the historical period. Chained outlets hold a larger market share compared to independent outlets, benefiting from brand recognition, economies of scale, and standardized operations. The leisure and travel segments are experiencing accelerated growth due to increased tourism and local leisure activities.

- Key Drivers (Paris Region): High population density, strong tourism, robust consumer spending, and well-developed infrastructure contribute to Paris's dominance.

- Key Drivers (QSR Cuisine): Consumer preference for speed and convenience fuels growth.

- Key Drivers (Chained Outlets): Economies of scale, brand recognition, and standardized operations grant them a competitive advantage.

- Key Drivers (Leisure & Travel): Growing tourism and domestic leisure spending boost this segment's performance.

- Market Share: Paris Region (xx%), QSR (xx%), Chained Outlets (xx%).

Food Service Industry in France Product Landscape

The French food service market showcases a diverse range of product offerings, including traditional French cuisine, international fast-food chains, and innovative fusion concepts. Technological advancements have led to the introduction of personalized meal customization options through digital platforms, self-ordering kiosks, and optimized kitchen technologies that improve efficiency and reduce waste. The focus on sustainable and locally sourced ingredients is increasingly prominent, meeting growing consumer demands for ethical and environmentally conscious choices.

Key Drivers, Barriers & Challenges in Food Service Industry in France

Key Drivers: Rising disposable incomes, changing lifestyles, increasing urbanization, and a preference for convenience are driving market expansion. Government initiatives to support local businesses and tourism also contribute positively. Technological innovations, especially in online ordering and delivery, significantly accelerate growth.

Challenges: Rising inflation, labor shortages, and supply chain disruptions represent major hurdles. Stringent regulatory compliance and increasing competition, especially from international chains, add to the pressure. The fluctuating cost of raw materials significantly impacts profitability.

Emerging Opportunities in Food Service Industry in France

Untapped markets in smaller cities and rural areas hold significant potential. Healthier food options, personalized meal plans, and sustainable sourcing strategies present lucrative opportunities. The integration of technology, especially AI-powered solutions for customer service and kitchen management, promises enhanced efficiency and customer satisfaction.

Growth Accelerators in the Food Service Industry in France Industry

Strategic partnerships between foodservice operators and technology providers will enhance efficiency and customer experience. Expansion into new market segments, such as meal kit delivery services or ghost kitchens, will allow operators to diversify and reach new customer segments. Government support for the industry through tax incentives and streamlining regulations will foster growth.

Key Players Shaping the Food Service Industry in France Market

- AmRest Holdings SE

- Yum! Brands Inc

- Doctor's Associates Inc

- QSR Platform Holding SCA

- La Mie Câline

- Groupe Bertrand

- Carrefour SA

- The Blachere Group

- Agapes Restauration

- Groupe Le Duff

- Areas SAU

- Lagardère Group

- Domino's Pizza Enterprises Ltd

- Groupe Delineo

- Starbucks Corporation

- Hana Group

- McDonald's Corporation

- Soleo

Notable Milestones in Food Service Industry in France Sector

- April 2023: QSR Platform Holding SCA partners with Foodtastic to bring Pita Pit to France and Western Europe (50 planned locations). Foodtastic to expand O'Tacos in Canada (at least 50 locations).

- March 2023: McDonald's France temporarily replaces potato fries with vegetable fries (beets, carrots, parsnips).

- November 2022: Lagardère Travel Retail acquires 100% of Marché International AG (Marché Group).

In-Depth Food Service Industry in France Market Outlook

The French food service industry is poised for continued growth, driven by technological advancements, evolving consumer preferences, and strategic industry consolidation. Opportunities exist in expanding into underserved markets, embracing sustainable practices, and leveraging technology to enhance customer experiences. Strategic partnerships and investments in innovation will be crucial for sustained success in this dynamic market.

Food Service Industry in France Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Food Service Industry in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food Service Industry in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1 High coffee consumption in the country

- 3.4.2 attracts a large number of international players driving the growth of cafes.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North America Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6.1.1. Cafes & Bars

- 6.1.1.1. By Cuisine

- 6.1.1.1.1. Bars & Pubs

- 6.1.1.1.2. Juice/Smoothie/Desserts Bars

- 6.1.1.1.3. Specialist Coffee & Tea Shops

- 6.1.1.1. By Cuisine

- 6.1.2. Cloud Kitchen

- 6.1.3. Full Service Restaurants

- 6.1.3.1. Asian

- 6.1.3.2. European

- 6.1.3.3. Latin American

- 6.1.3.4. Middle Eastern

- 6.1.3.5. North American

- 6.1.3.6. Other FSR Cuisines

- 6.1.4. Quick Service Restaurants

- 6.1.4.1. Bakeries

- 6.1.4.2. Burger

- 6.1.4.3. Ice Cream

- 6.1.4.4. Meat-based Cuisines

- 6.1.4.5. Pizza

- 6.1.4.6. Other QSR Cuisines

- 6.1.1. Cafes & Bars

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Location

- 6.3.1. Leisure

- 6.3.2. Lodging

- 6.3.3. Retail

- 6.3.4. Standalone

- 6.3.5. Travel

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7. South America Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7.1.1. Cafes & Bars

- 7.1.1.1. By Cuisine

- 7.1.1.1.1. Bars & Pubs

- 7.1.1.1.2. Juice/Smoothie/Desserts Bars

- 7.1.1.1.3. Specialist Coffee & Tea Shops

- 7.1.1.1. By Cuisine

- 7.1.2. Cloud Kitchen

- 7.1.3. Full Service Restaurants

- 7.1.3.1. Asian

- 7.1.3.2. European

- 7.1.3.3. Latin American

- 7.1.3.4. Middle Eastern

- 7.1.3.5. North American

- 7.1.3.6. Other FSR Cuisines

- 7.1.4. Quick Service Restaurants

- 7.1.4.1. Bakeries

- 7.1.4.2. Burger

- 7.1.4.3. Ice Cream

- 7.1.4.4. Meat-based Cuisines

- 7.1.4.5. Pizza

- 7.1.4.6. Other QSR Cuisines

- 7.1.1. Cafes & Bars

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Location

- 7.3.1. Leisure

- 7.3.2. Lodging

- 7.3.3. Retail

- 7.3.4. Standalone

- 7.3.5. Travel

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8. Europe Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8.1.1. Cafes & Bars

- 8.1.1.1. By Cuisine

- 8.1.1.1.1. Bars & Pubs

- 8.1.1.1.2. Juice/Smoothie/Desserts Bars

- 8.1.1.1.3. Specialist Coffee & Tea Shops

- 8.1.1.1. By Cuisine

- 8.1.2. Cloud Kitchen

- 8.1.3. Full Service Restaurants

- 8.1.3.1. Asian

- 8.1.3.2. European

- 8.1.3.3. Latin American

- 8.1.3.4. Middle Eastern

- 8.1.3.5. North American

- 8.1.3.6. Other FSR Cuisines

- 8.1.4. Quick Service Restaurants

- 8.1.4.1. Bakeries

- 8.1.4.2. Burger

- 8.1.4.3. Ice Cream

- 8.1.4.4. Meat-based Cuisines

- 8.1.4.5. Pizza

- 8.1.4.6. Other QSR Cuisines

- 8.1.1. Cafes & Bars

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Location

- 8.3.1. Leisure

- 8.3.2. Lodging

- 8.3.3. Retail

- 8.3.4. Standalone

- 8.3.5. Travel

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9. Middle East & Africa Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9.1.1. Cafes & Bars

- 9.1.1.1. By Cuisine

- 9.1.1.1.1. Bars & Pubs

- 9.1.1.1.2. Juice/Smoothie/Desserts Bars

- 9.1.1.1.3. Specialist Coffee & Tea Shops

- 9.1.1.1. By Cuisine

- 9.1.2. Cloud Kitchen

- 9.1.3. Full Service Restaurants

- 9.1.3.1. Asian

- 9.1.3.2. European

- 9.1.3.3. Latin American

- 9.1.3.4. Middle Eastern

- 9.1.3.5. North American

- 9.1.3.6. Other FSR Cuisines

- 9.1.4. Quick Service Restaurants

- 9.1.4.1. Bakeries

- 9.1.4.2. Burger

- 9.1.4.3. Ice Cream

- 9.1.4.4. Meat-based Cuisines

- 9.1.4.5. Pizza

- 9.1.4.6. Other QSR Cuisines

- 9.1.1. Cafes & Bars

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlets

- 9.2.2. Independent Outlets

- 9.3. Market Analysis, Insights and Forecast - by Location

- 9.3.1. Leisure

- 9.3.2. Lodging

- 9.3.3. Retail

- 9.3.4. Standalone

- 9.3.5. Travel

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10. Asia Pacific Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10.1.1. Cafes & Bars

- 10.1.1.1. By Cuisine

- 10.1.1.1.1. Bars & Pubs

- 10.1.1.1.2. Juice/Smoothie/Desserts Bars

- 10.1.1.1.3. Specialist Coffee & Tea Shops

- 10.1.1.1. By Cuisine

- 10.1.2. Cloud Kitchen

- 10.1.3. Full Service Restaurants

- 10.1.3.1. Asian

- 10.1.3.2. European

- 10.1.3.3. Latin American

- 10.1.3.4. Middle Eastern

- 10.1.3.5. North American

- 10.1.3.6. Other FSR Cuisines

- 10.1.4. Quick Service Restaurants

- 10.1.4.1. Bakeries

- 10.1.4.2. Burger

- 10.1.4.3. Ice Cream

- 10.1.4.4. Meat-based Cuisines

- 10.1.4.5. Pizza

- 10.1.4.6. Other QSR Cuisines

- 10.1.1. Cafes & Bars

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlets

- 10.2.2. Independent Outlets

- 10.3. Market Analysis, Insights and Forecast - by Location

- 10.3.1. Leisure

- 10.3.2. Lodging

- 10.3.3. Retail

- 10.3.4. Standalone

- 10.3.5. Travel

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 11. Germany Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 12. France Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 13. Italy Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 AmRest Holdings SE

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Yum! Brands Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Doctor's Associates Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 QSR Platform Holding SCA

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 La Mie Câline

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Groupe Bertrand

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Carrefour SA

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 The Blachere Group

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Agapes Restauration

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Groupe Le Duff

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Areas SAU

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Lagardère Group

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Domino's Pizza Enterprises Ltd

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Groupe Delineo

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Starbucks Corporation

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.16 Hana Group

- 18.2.16.1. Overview

- 18.2.16.2. Products

- 18.2.16.3. SWOT Analysis

- 18.2.16.4. Recent Developments

- 18.2.16.5. Financials (Based on Availability)

- 18.2.17 McDonald's Corporation

- 18.2.17.1. Overview

- 18.2.17.2. Products

- 18.2.17.3. SWOT Analysis

- 18.2.17.4. Recent Developments

- 18.2.17.5. Financials (Based on Availability)

- 18.2.18 Soleo

- 18.2.18.1. Overview

- 18.2.18.2. Products

- 18.2.18.3. SWOT Analysis

- 18.2.18.4. Recent Developments

- 18.2.18.5. Financials (Based on Availability)

- 18.2.1 AmRest Holdings SE

List of Figures

- Figure 1: Global Food Service Industry in France Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Europe Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 3: Europe Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 5: North America Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 6: North America Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 7: North America Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 8: North America Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 9: North America Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 10: North America Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 13: South America Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 14: South America Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 15: South America Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 16: South America Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 17: South America Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 18: South America Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 21: Europe Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 22: Europe Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 23: Europe Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 24: Europe Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 25: Europe Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 26: Europe Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 29: Middle East & Africa Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 30: Middle East & Africa Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 31: Middle East & Africa Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 32: Middle East & Africa Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 33: Middle East & Africa Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 34: Middle East & Africa Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 37: Asia Pacific Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 38: Asia Pacific Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 39: Asia Pacific Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 40: Asia Pacific Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 41: Asia Pacific Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 42: Asia Pacific Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Service Industry in France Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Global Food Service Industry in France Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 22: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 23: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 24: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 29: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 30: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 31: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 42: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 43: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 44: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 45: Turkey Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Israel Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: GCC Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: North Africa Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East & Africa Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 52: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 53: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 54: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 55: China Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: India Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Japan Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: South Korea Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: ASEAN Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Oceania Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of Asia Pacific Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Service Industry in France?

The projected CAGR is approximately 6.11%.

2. Which companies are prominent players in the Food Service Industry in France?

Key companies in the market include AmRest Holdings SE, Yum! Brands Inc, Doctor's Associates Inc, QSR Platform Holding SCA, La Mie Câline, Groupe Bertrand, Carrefour SA, The Blachere Group, Agapes Restauration, Groupe Le Duff, Areas SAU, Lagardère Group, Domino's Pizza Enterprises Ltd, Groupe Delineo, Starbucks Corporation, Hana Group, McDonald's Corporation, Soleo.

3. What are the main segments of the Food Service Industry in France?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

High coffee consumption in the country. attracts a large number of international players driving the growth of cafes..

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

April 2023: QSR Platform Holding SCA announced that it would be partnering with Foodtastic to bring the Pita Pit brand to France and Western Europe by opening 50 Pita Pits. In return, Foodtastic will expand O'Tacos in Canada by opening at least 50 locations in 2023.March 2023: McDonald's France replaced its potatoes with french fries and offered vegetable fries for a limited time. During this period, beets, carrots, and parsnips replaced the famous potato fries.November 2022: Lagardère Travel Retail signed an agreement to acquire 100% of the shares in Marché International AG, the holding company of the Marché Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Service Industry in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Service Industry in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Service Industry in France?

To stay informed about further developments, trends, and reports in the Food Service Industry in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence