Key Insights

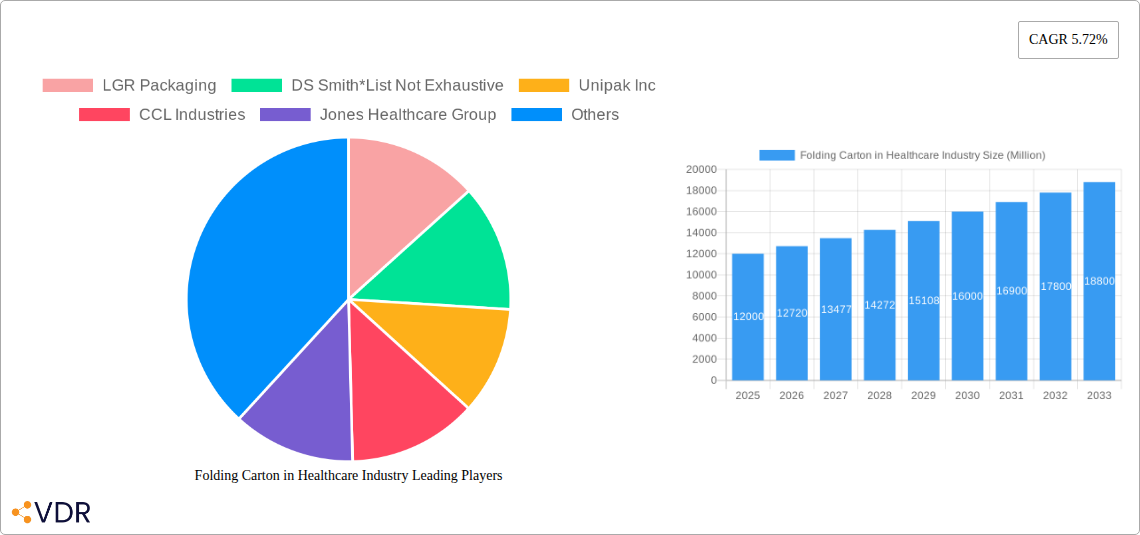

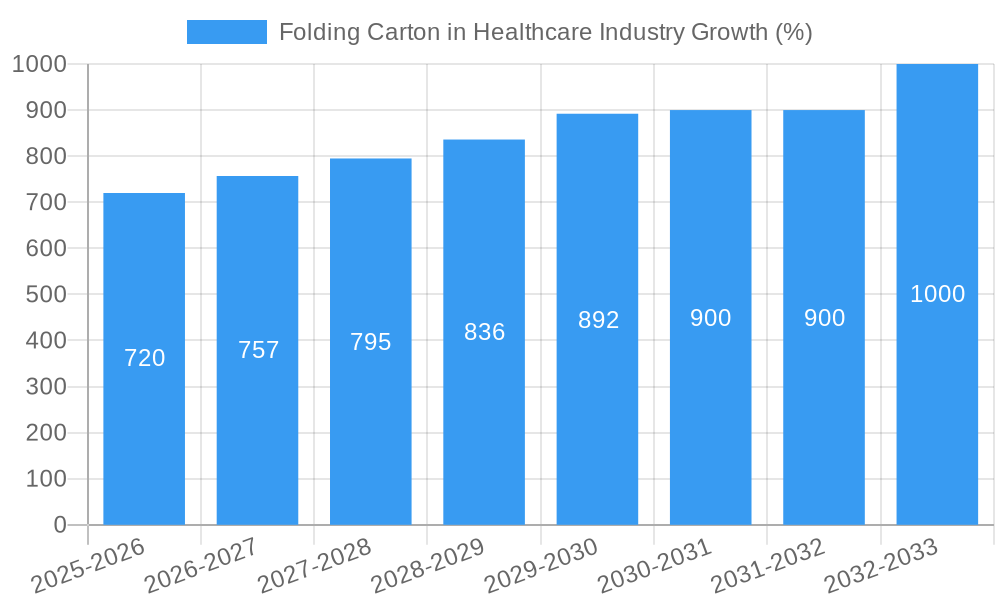

The healthcare folding carton market is experiencing robust growth, driven by the increasing demand for pharmaceutical and medical device packaging. A compound annual growth rate (CAGR) of 5.72% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several factors, including the rising prevalence of chronic diseases necessitating greater medication packaging, the expanding geriatric population requiring specialized packaging solutions, and the stringent regulatory environment promoting safe and tamper-evident packaging. Advancements in printing technologies, particularly digital and flexographic printing, are also contributing to market expansion by enabling personalized and high-quality packaging solutions. The market is segmented by product type (blister packs, vials, ampoules, injectables, and other medical devices), labelling type, and geographic region. While precise market size figures for 2025 are not provided, extrapolating from the 5.72% CAGR and a reasonable assumption of market size in the billions, we can project significant value for 2025, exceeding previous years, with continued growth expected through 2033.

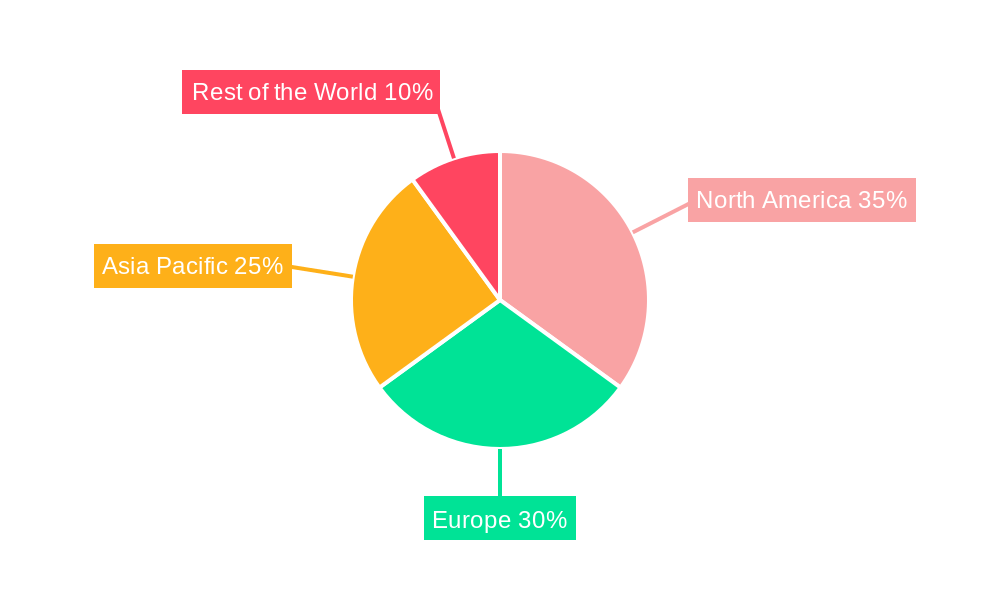

Major players like LGR Packaging, DS Smith, Unipak Inc, CCL Industries, and Jones Healthcare Group are actively shaping the market through innovation and strategic acquisitions. The competitive landscape is characterized by both large multinational corporations and specialized regional players. North America and Europe are currently leading regional markets, benefiting from robust healthcare infrastructure and stringent regulations. However, the Asia-Pacific region is poised for substantial growth due to increasing healthcare spending and a growing pharmaceutical industry. The market faces certain restraints, such as fluctuations in raw material prices and the increasing complexity of regulatory compliance, yet the overall outlook remains positive, driven by continuous advancements in packaging technology and the unwavering demand for safe and effective healthcare packaging.

Folding Carton in Healthcare Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Folding Carton in Healthcare Industry, encompassing market dynamics, growth trends, regional insights, product landscape, competitive analysis, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033. This report is invaluable for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic sector. Market values are presented in million units.

Folding Carton in Healthcare Industry Market Dynamics & Structure

The healthcare folding carton market exhibits a moderately consolidated structure, with key players holding significant market share. Technological advancements, particularly in digital and flexographic printing for labeling, are driving innovation. Stringent regulatory frameworks, such as FDA and IMDRF guidelines, significantly impact product design and manufacturing. The market experiences competition from alternative packaging solutions, including plastic containers and pouches. End-user demographics, encompassing pharmaceutical companies, medical device manufacturers, and contract packagers, significantly influence market demand. M&A activity within the sector remains moderate, with xx deals recorded between 2019-2024, representing a xx% increase compared to the previous period.

- Market Concentration: Moderately Consolidated (HHI: xx)

- Technological Drivers: Digital Printing, Flexography, Automation

- Regulatory Landscape: FDA, IMDRF, EU GMP

- Competitive Substitutes: Plastic Packaging, Pouches

- End-User Demographics: Pharmaceuticals, Medical Devices, Contract Packaging

- M&A Activity: xx deals (2019-2024), xx% CAGR

Folding Carton in Healthcare Industry Growth Trends & Insights

The global folding carton market for healthcare applications experienced significant growth between 2019 and 2024, expanding from xx million units to xx million units. This reflects a CAGR of xx%. This growth is attributed to several factors, including the rising demand for pharmaceuticals and medical devices, increasing focus on product safety and security, and the growing adoption of sophisticated packaging technologies. The market penetration of folding cartons in the healthcare sector is estimated at xx% in 2025 and is projected to reach xx% by 2033. Technological disruptions, such as the integration of smart packaging and serialization technologies, are further accelerating market expansion. Changing consumer behavior, emphasizing convenience and sustainability, is also shaping market trends.

Dominant Regions, Countries, or Segments in Folding Carton in Healthcare Industry

North America currently holds the largest market share in the healthcare folding carton industry, driven by robust pharmaceutical and medical device sectors, stringent regulatory environments, and higher disposable incomes. Europe follows as a significant market, boosted by strong healthcare infrastructure and increasing demand for innovative packaging solutions. Within product segments, the demand for folding cartons in the packaging of injectables, blisters and vials & ampoules is experiencing the highest growth due to their widespread use in pharmaceutical delivery systems. The labeling segment benefits from advancements in digital printing and flexography, leading to enhanced customization and branding opportunities. Stringent labeling regulations (FDA, IMDRF) further drive market growth.

- Leading Region: North America (Market Share: xx%)

- Key Growth Drivers:

- Stringent regulatory requirements for medical device labeling

- Advancements in digital printing and flexography

- Growth of the pharmaceutical and medical device industry

- High disposable incomes in developed economies

- High-Growth Segment: Injectables (CAGR: xx%)

Folding Carton in Healthcare Industry Product Landscape

The healthcare folding carton market offers a diverse range of products, including customized die-cut cartons, blister packs, and specialized containers for various medical devices and pharmaceuticals. Innovations focus on enhancing barrier properties, improving printability for enhanced branding, and integrating security features to combat counterfeiting. Advancements include sustainable materials and improved design for efficient logistics and enhanced patient experience. Unique selling propositions emphasize superior protection, tamper evidence, and ease of use.

Key Drivers, Barriers & Challenges in Folding Carton in Healthcare Industry

Key Drivers:

- Rising demand for pharmaceuticals and medical devices.

- Increasing focus on product safety and security.

- Advancements in printing and packaging technologies.

- Stringent regulatory requirements.

Key Barriers & Challenges:

- Fluctuations in raw material prices (e.g., paper, inks).

- Stringent environmental regulations impacting material selection.

- Intense competition from alternative packaging materials.

- Supply chain disruptions impacting timely delivery.

Emerging Opportunities in Folding Carton in Healthcare Industry

Emerging opportunities lie in the development of sustainable and eco-friendly folding cartons, utilizing recycled and biodegradable materials. The integration of smart packaging technologies, such as RFID tags and QR codes, presents significant growth potential for enhanced traceability and product authentication. Expansion into emerging markets with growing healthcare infrastructure offers substantial market expansion possibilities.

Growth Accelerators in the Folding Carton in Healthcare Industry Industry

Long-term growth will be fueled by technological advancements in sustainable packaging materials, further automation of production processes, and strategic partnerships between packaging companies and healthcare providers. Expansion into emerging markets and the development of innovative packaging solutions for new drug delivery systems will also be key growth catalysts.

Key Players Shaping the Folding Carton in Healthcare Industry Market

- LGR Packaging

- DS Smith

- Unipak Inc

- CCL Industries

- Jones Healthcare Group

- August Faller GmbH & co KG

- Nosco Inc

- Edelmann Group

- AR Packaging

- Stora Enso Group

- Big Valley Packaging

- Essentra PLC

- Keystone Folding Box Company

- Multi Packaging Solutions (WestRock)

Notable Milestones in Folding Carton in Healthcare Industry Sector

- 2021: Introduction of biodegradable folding cartons by [Company Name].

- 2022: Merger between [Company A] and [Company B], expanding market reach.

- 2023: Launch of a new line of tamper-evident folding cartons by [Company Name].

In-Depth Folding Carton in Healthcare Industry Market Outlook

The healthcare folding carton market is poised for continued expansion, driven by technological advancements, regulatory changes, and increasing healthcare spending globally. Strategic partnerships and the development of sustainable and innovative packaging solutions will be crucial for companies to gain a competitive advantage and capitalize on emerging market opportunities. The forecast period of 2025-2033 promises robust growth with substantial potential for market expansion and innovation.

Folding Carton in Healthcare Industry Segmentation

-

1. Product Type

- 1.1. Blisters

- 1.2. Vials & Ampoules

- 1.3. Injectables

- 1.4. Other Product Types (Medical Devices, etc)

-

2. Labelling

-

2.1. Labelling Type

- 2.1.1. Pressure Sensitive

- 2.1.2. In-Mold

- 2.1.3. Shrink-Sleeve

- 2.1.4. Glue-Applied

- 2.1.5. Others (Custom Die-cut, etc.)

- 2.2. Advancem

- 2.3. Key regu

-

2.4. Key specific manufacturers in Labelling

- 2.4.1. WS Packaging

- 2.4.2. Schreiner Group

- 2.4.3. Faubel & Co

- 2.4.4. OPM Group

-

2.1. Labelling Type

Folding Carton in Healthcare Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Folding Carton in Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent regulations related to discerning key product related information in the field of medical devices; Growing emphasis of monitoring & assisting patient medication; Focus on traceability & anti-counterfeiting in the healthcare sector; Product & Material-based innovations driven by major packaging manufacturers to drive demand

- 3.3. Market Restrains

- 3.3.1. ; High Inventory Costs and Premium Pricing

- 3.4. Market Trends

- 3.4.1. Growing Emphasis of Monitoring and Assisting Patient Medication

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Blisters

- 5.1.2. Vials & Ampoules

- 5.1.3. Injectables

- 5.1.4. Other Product Types (Medical Devices, etc)

- 5.2. Market Analysis, Insights and Forecast - by Labelling

- 5.2.1. Labelling Type

- 5.2.1.1. Pressure Sensitive

- 5.2.1.2. In-Mold

- 5.2.1.3. Shrink-Sleeve

- 5.2.1.4. Glue-Applied

- 5.2.1.5. Others (Custom Die-cut, etc.)

- 5.2.2. Advancem

- 5.2.3. Key regu

- 5.2.4. Key specific manufacturers in Labelling

- 5.2.4.1. WS Packaging

- 5.2.4.2. Schreiner Group

- 5.2.4.3. Faubel & Co

- 5.2.4.4. OPM Group

- 5.2.1. Labelling Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Blisters

- 6.1.2. Vials & Ampoules

- 6.1.3. Injectables

- 6.1.4. Other Product Types (Medical Devices, etc)

- 6.2. Market Analysis, Insights and Forecast - by Labelling

- 6.2.1. Labelling Type

- 6.2.1.1. Pressure Sensitive

- 6.2.1.2. In-Mold

- 6.2.1.3. Shrink-Sleeve

- 6.2.1.4. Glue-Applied

- 6.2.1.5. Others (Custom Die-cut, etc.)

- 6.2.2. Advancem

- 6.2.3. Key regu

- 6.2.4. Key specific manufacturers in Labelling

- 6.2.4.1. WS Packaging

- 6.2.4.2. Schreiner Group

- 6.2.4.3. Faubel & Co

- 6.2.4.4. OPM Group

- 6.2.1. Labelling Type

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Blisters

- 7.1.2. Vials & Ampoules

- 7.1.3. Injectables

- 7.1.4. Other Product Types (Medical Devices, etc)

- 7.2. Market Analysis, Insights and Forecast - by Labelling

- 7.2.1. Labelling Type

- 7.2.1.1. Pressure Sensitive

- 7.2.1.2. In-Mold

- 7.2.1.3. Shrink-Sleeve

- 7.2.1.4. Glue-Applied

- 7.2.1.5. Others (Custom Die-cut, etc.)

- 7.2.2. Advancem

- 7.2.3. Key regu

- 7.2.4. Key specific manufacturers in Labelling

- 7.2.4.1. WS Packaging

- 7.2.4.2. Schreiner Group

- 7.2.4.3. Faubel & Co

- 7.2.4.4. OPM Group

- 7.2.1. Labelling Type

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Blisters

- 8.1.2. Vials & Ampoules

- 8.1.3. Injectables

- 8.1.4. Other Product Types (Medical Devices, etc)

- 8.2. Market Analysis, Insights and Forecast - by Labelling

- 8.2.1. Labelling Type

- 8.2.1.1. Pressure Sensitive

- 8.2.1.2. In-Mold

- 8.2.1.3. Shrink-Sleeve

- 8.2.1.4. Glue-Applied

- 8.2.1.5. Others (Custom Die-cut, etc.)

- 8.2.2. Advancem

- 8.2.3. Key regu

- 8.2.4. Key specific manufacturers in Labelling

- 8.2.4.1. WS Packaging

- 8.2.4.2. Schreiner Group

- 8.2.4.3. Faubel & Co

- 8.2.4.4. OPM Group

- 8.2.1. Labelling Type

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Blisters

- 9.1.2. Vials & Ampoules

- 9.1.3. Injectables

- 9.1.4. Other Product Types (Medical Devices, etc)

- 9.2. Market Analysis, Insights and Forecast - by Labelling

- 9.2.1. Labelling Type

- 9.2.1.1. Pressure Sensitive

- 9.2.1.2. In-Mold

- 9.2.1.3. Shrink-Sleeve

- 9.2.1.4. Glue-Applied

- 9.2.1.5. Others (Custom Die-cut, etc.)

- 9.2.2. Advancem

- 9.2.3. Key regu

- 9.2.4. Key specific manufacturers in Labelling

- 9.2.4.1. WS Packaging

- 9.2.4.2. Schreiner Group

- 9.2.4.3. Faubel & Co

- 9.2.4.4. OPM Group

- 9.2.1. Labelling Type

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. North America Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 LGR Packaging

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 DS Smith*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Unipak Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 CCL Industries

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Jones Healthcare Group

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 August Faller GmbH & co KG

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 8 COMPETITIVE LANDSCAPE 8 1 COMPANY PROFILES

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Nosco Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Edelmann Group

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 AR Packaging

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Stora Enso Group

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Big Valley Packaging

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Essentra PLC Keystone Folding Box Company

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Multi Packaging Solutions (WestRock)

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 LGR Packaging

List of Figures

- Figure 1: Global Folding Carton in Healthcare Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 11: North America Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: North America Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2024 & 2032

- Figure 13: North America Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2024 & 2032

- Figure 14: North America Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2024 & 2032

- Figure 19: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2024 & 2032

- Figure 20: Europe Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2024 & 2032

- Figure 25: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2024 & 2032

- Figure 26: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2024 & 2032

- Figure 31: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2024 & 2032

- Figure 32: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 4: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Folding Carton in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Folding Carton in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Folding Carton in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Folding Carton in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 15: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 18: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 21: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 24: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Folding Carton in Healthcare Industry?

The projected CAGR is approximately 5.72%.

2. Which companies are prominent players in the Folding Carton in Healthcare Industry?

Key companies in the market include LGR Packaging, DS Smith*List Not Exhaustive, Unipak Inc, CCL Industries, Jones Healthcare Group, August Faller GmbH & co KG, 8 COMPETITIVE LANDSCAPE 8 1 COMPANY PROFILES, Nosco Inc, Edelmann Group, AR Packaging, Stora Enso Group, Big Valley Packaging, Essentra PLC Keystone Folding Box Company, Multi Packaging Solutions (WestRock).

3. What are the main segments of the Folding Carton in Healthcare Industry?

The market segments include Product Type, Labelling.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Stringent regulations related to discerning key product related information in the field of medical devices; Growing emphasis of monitoring & assisting patient medication; Focus on traceability & anti-counterfeiting in the healthcare sector; Product & Material-based innovations driven by major packaging manufacturers to drive demand.

6. What are the notable trends driving market growth?

Growing Emphasis of Monitoring and Assisting Patient Medication.

7. Are there any restraints impacting market growth?

; High Inventory Costs and Premium Pricing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Folding Carton in Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Folding Carton in Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Folding Carton in Healthcare Industry?

To stay informed about further developments, trends, and reports in the Folding Carton in Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence