Key Insights

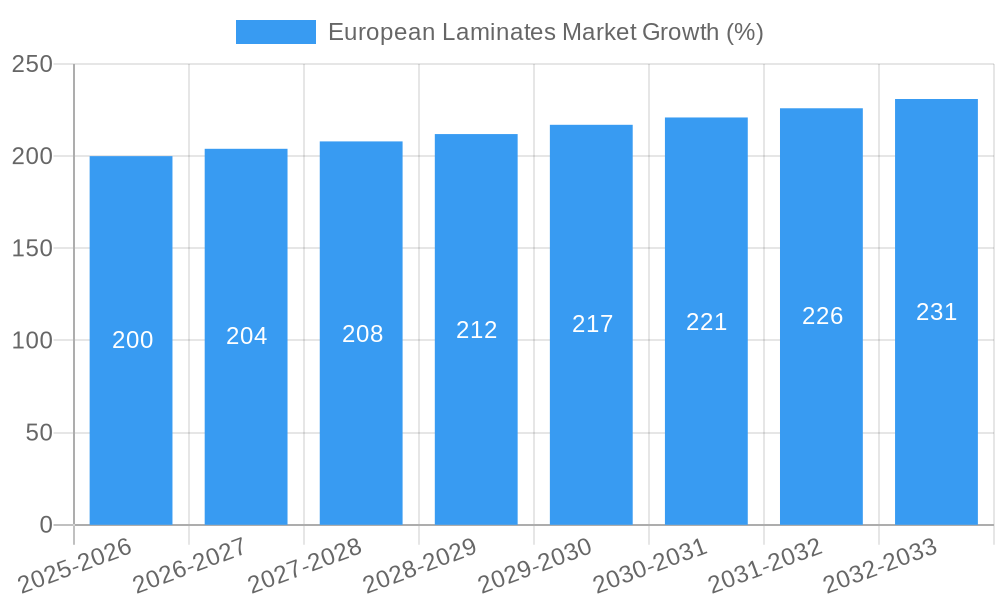

The European laminates market, valued at approximately €[Estimate based on market size XX and regional data, e.g., €10 billion] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 2.00% through 2033. This growth is fueled by several key factors. Increasing demand for durable, cost-effective flooring solutions in both residential and commercial sectors across major European economies like Germany, France, and the UK is a significant driver. The rising popularity of high-density fiberboard (HDF) laminates due to their superior performance and aesthetic appeal further contributes to market expansion. Moreover, innovative product designs, incorporating advanced surface technologies and diverse color palettes, cater to evolving consumer preferences and enhance market appeal. The segment encompassing online distribution channels is witnessing considerable expansion, mirroring broader e-commerce trends. However, potential restraints include fluctuations in raw material prices and increasing competition from alternative flooring materials like vinyl and engineered wood. The shift towards sustainable and eco-friendly flooring options presents both a challenge and an opportunity for manufacturers to innovate and develop more environmentally responsible products.

Within the European market, Germany, France, Italy, and the UK represent the largest national markets, exhibiting significant consumption of laminate flooring. The market segmentation by product type (HDF and MDF) indicates a clear preference towards HDF due to its superior strength and water resistance. Similarly, the residential segment dominates the application-based breakdown, reflecting the high demand for laminate flooring in homes. Leading players such as Classen Group, Tarkett S.A., and Mohawk Industries, Inc. are focusing on product innovation, strategic partnerships, and expanding their distribution networks to strengthen their market positions and capture a larger share of this growing market. Further market analysis suggests that future growth will be influenced by the success of companies in navigating economic uncertainties and adapting to changing consumer preferences for sustainability and style.

European Laminates Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the European laminates market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market.

European Laminates Market Dynamics & Structure

The European laminates market is characterized by a moderately concentrated structure, with key players like Tarkett S.A., Shaw Industries Group Inc., and Mohawk Industries Inc. holding significant market share. However, smaller regional players and niche players also contribute substantially. Technological innovation, driven by advancements in materials science and manufacturing processes, is a key driver. Stringent environmental regulations regarding formaldehyde emissions and sustainable sourcing are shaping the market landscape. The market faces competition from alternative flooring materials such as vinyl, hardwood, and engineered wood, each possessing unique cost-benefit profiles. The residential segment dominates the market, fuelled by increasing home renovations and new construction. M&A activity has been moderate, with a focus on strengthening product portfolios and geographical reach. Over the historical period (2019-2024), approximately xx M&A deals were recorded, resulting in a xx% shift in market share amongst the top 5 players.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on water-resistant, scratch-resistant, and eco-friendly laminates.

- Regulatory Framework: Strict emission standards driving adoption of sustainable materials.

- Competitive Substitutes: Vinyl, hardwood, and engineered wood flooring pose significant competition.

- End-User Demographics: Predominantly driven by residential segment, with increasing demand from commercial spaces.

- M&A Trends: Moderate activity, primarily focused on geographical expansion and product diversification.

European Laminates Market Growth Trends & Insights

The European laminates market experienced steady growth during the historical period (2019-2024), with a CAGR of approximately xx%. This growth is attributed to rising disposable incomes, increasing urbanization, and a preference for affordable and durable flooring solutions. Technological advancements, including the introduction of high-density fiberboard (HDF) and innovative surface treatments, have enhanced product quality and expanded application possibilities. Consumer preferences are shifting towards aesthetically appealing and eco-friendly options, creating opportunities for manufacturers offering sustainable laminates. The market penetration of laminates in residential and commercial applications is projected to increase further during the forecast period (2025-2033). By 2033, the market is forecast to reach xx Million units, driven by continued growth in renovation projects and new construction activities across Europe, alongside a rise in commercial applications in offices and retail spaces.

Dominant Regions, Countries, or Segments in European Laminates Market

Western Europe (specifically Germany, France, and the UK) accounts for the largest share of the European laminates market. This dominance is attributed to high construction activity, strong economic performance, and established consumer preferences for laminate flooring. The residential segment remains the leading application area, followed by the commercial segment, driven by demand for cost-effective and durable flooring solutions in offices, retail spaces, and hospitality establishments. High-Density Fiberboard (HDF) laminated flooring dominates the product type segment due to its superior durability and performance characteristics. Offline distribution channels currently hold a larger share, but online sales are gaining traction. Key growth drivers include robust construction activities, favorable economic conditions, and increased consumer spending on home improvement projects.

- Leading Region: Western Europe (Germany, France, UK)

- Leading Application: Residential

- Leading Product Type: High-Density Fiberboard (HDF) Laminated Flooring

- Leading Distribution Channel: Offline

- Key Growth Drivers: Construction boom, economic growth, increased consumer spending.

European Laminates Market Product Landscape

The European laminates market offers a wide range of products, varying in terms of design, material composition (HDF, MDF), thickness, and surface finish. Innovations focus on enhancing durability, water resistance, and aesthetic appeal. Advanced surface technologies create realistic wood grain effects, while improved core materials provide increased dimensional stability. Products are tailored for specific application needs, with specialized offerings for high-traffic commercial spaces and residential settings. Key selling propositions include affordability, ease of installation, and low maintenance requirements.

Key Drivers, Barriers & Challenges in European Laminates Market

Key Drivers: Increasing urbanization, rising disposable incomes, growing demand for affordable yet durable flooring solutions, and technological advancements leading to enhanced product features are major drivers. Government initiatives promoting sustainable building materials also contribute positively.

Challenges: Intense competition from alternative flooring materials, fluctuations in raw material prices, and the need for sustainable manufacturing practices to meet environmental regulations are key challenges. Supply chain disruptions due to geopolitical instability and the global pandemic have created additional constraints. The market is also sensitive to macroeconomic conditions, with economic downturns potentially impacting demand.

Emerging Opportunities in European Laminates Market

Growing demand for eco-friendly and sustainable laminates presents significant opportunities. Expansion into niche applications like sports flooring or specialized commercial settings (e.g., healthcare facilities) could unlock new market segments. The increasing adoption of online sales channels offers potential for increased market penetration and improved customer reach. Innovative designs and surface finishes that cater to diverse aesthetic preferences offer a route to differentiation.

Growth Accelerators in the European Laminates Market Industry

Strategic partnerships and collaborations between laminate manufacturers and designers are creating innovative products and expanding market reach. Technological breakthroughs, specifically in materials science and manufacturing techniques, are constantly enhancing the performance and sustainability of laminates. Expansion into new geographical markets, particularly in Eastern Europe and Scandinavian countries, offers substantial growth potential.

Key Players Shaping the European Laminates Market Market

- Classen Group

- Windmiller GmbH

- Shaw Industries Group Inc.

- Polyflor Ltd

- Tarkett S.A.

- Armstrong Flooring Inc.

- Mannington Mills Inc.

- Kaindl Flooring GMBH

- Parador

- Swiss Krono Group

- Mohawk Industries Inc.

- Beaulieu International Group

- Fatra a.s.

- Gerflor

- Forbo Flooring Systems

Notable Milestones in European Laminates Market Sector

- June 2021: Shaw Industries Group, Inc. partnered with Herndon Properties to deliver high-quality housing solutions, indirectly influencing laminate demand in new construction.

- October 2021: Armstrong Flooring launched Essentials Plus, a new rigid core product targeting the residential market, broadening product offerings.

- November 2021: Shaw Industries Group, Inc. expanded its Aiken County operations, signifying increased manufacturing capacity and future growth potential.

In-Depth European Laminates Market Market Outlook

The European laminates market is poised for continued growth in the forecast period (2025-2033), driven by sustained demand for affordable and durable flooring solutions. Technological advancements, a focus on sustainability, and strategic partnerships will shape future market dynamics. Companies focusing on innovation, sustainable practices, and targeted marketing strategies are expected to capture a greater share of the market. The long-term outlook is positive, with significant growth potential across various segments and regions.

European Laminates Market Segmentation

-

1. Product Type

- 1.1. High-Density Fiberboard Laminated Flooring

- 1.2. Medium-Density Fiberboard Laminated Flooring

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

European Laminates Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Russia

- 6. Belgium

- 7. Poland

- 8. Rest of Europe

European Laminates Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction

- 3.3. Market Restrains

- 3.3.1. Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring

- 3.4. Market Trends

- 3.4.1. Rising Construction Activities is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-Density Fiberboard Laminated Flooring

- 5.1.2. Medium-Density Fiberboard Laminated Flooring

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Russia

- 5.4.6. Belgium

- 5.4.7. Poland

- 5.4.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. High-Density Fiberboard Laminated Flooring

- 6.1.2. Medium-Density Fiberboard Laminated Flooring

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. High-Density Fiberboard Laminated Flooring

- 7.1.2. Medium-Density Fiberboard Laminated Flooring

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. High-Density Fiberboard Laminated Flooring

- 8.1.2. Medium-Density Fiberboard Laminated Flooring

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. High-Density Fiberboard Laminated Flooring

- 9.1.2. Medium-Density Fiberboard Laminated Flooring

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. High-Density Fiberboard Laminated Flooring

- 10.1.2. Medium-Density Fiberboard Laminated Flooring

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online

- 10.3.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Belgium European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. High-Density Fiberboard Laminated Flooring

- 11.1.2. Medium-Density Fiberboard Laminated Flooring

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.2.3. Industrial

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Online

- 11.3.2. Offline

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Poland European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. High-Density Fiberboard Laminated Flooring

- 12.1.2. Medium-Density Fiberboard Laminated Flooring

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Residential

- 12.2.2. Commercial

- 12.2.3. Industrial

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Online

- 12.3.2. Offline

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Europe European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. High-Density Fiberboard Laminated Flooring

- 13.1.2. Medium-Density Fiberboard Laminated Flooring

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Residential

- 13.2.2. Commercial

- 13.2.3. Industrial

- 13.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.3.1. Online

- 13.3.2. Offline

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. Germany European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 15. France European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 16. Italy European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 17. United Kingdom European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 18. Netherlands European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 19. Sweden European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 20. Rest of Europe European Laminates Market Analysis, Insights and Forecast, 2019-2031

- 21. Competitive Analysis

- 21.1. Market Share Analysis 2024

- 21.2. Company Profiles

- 21.2.1 Classen Group

- 21.2.1.1. Overview

- 21.2.1.2. Products

- 21.2.1.3. SWOT Analysis

- 21.2.1.4. Recent Developments

- 21.2.1.5. Financials (Based on Availability)

- 21.2.2 Windmiller GmbH**List Not Exhaustive

- 21.2.2.1. Overview

- 21.2.2.2. Products

- 21.2.2.3. SWOT Analysis

- 21.2.2.4. Recent Developments

- 21.2.2.5. Financials (Based on Availability)

- 21.2.3 Shaw Industries Group Inc

- 21.2.3.1. Overview

- 21.2.3.2. Products

- 21.2.3.3. SWOT Analysis

- 21.2.3.4. Recent Developments

- 21.2.3.5. Financials (Based on Availability)

- 21.2.4 Polyflor Ltd

- 21.2.4.1. Overview

- 21.2.4.2. Products

- 21.2.4.3. SWOT Analysis

- 21.2.4.4. Recent Developments

- 21.2.4.5. Financials (Based on Availability)

- 21.2.5 Tarkett S A

- 21.2.5.1. Overview

- 21.2.5.2. Products

- 21.2.5.3. SWOT Analysis

- 21.2.5.4. Recent Developments

- 21.2.5.5. Financials (Based on Availability)

- 21.2.6 Armstrong Flooring Inc

- 21.2.6.1. Overview

- 21.2.6.2. Products

- 21.2.6.3. SWOT Analysis

- 21.2.6.4. Recent Developments

- 21.2.6.5. Financials (Based on Availability)

- 21.2.7 Mannington Mills Inc

- 21.2.7.1. Overview

- 21.2.7.2. Products

- 21.2.7.3. SWOT Analysis

- 21.2.7.4. Recent Developments

- 21.2.7.5. Financials (Based on Availability)

- 21.2.8 Kaindl Flooring GMBH

- 21.2.8.1. Overview

- 21.2.8.2. Products

- 21.2.8.3. SWOT Analysis

- 21.2.8.4. Recent Developments

- 21.2.8.5. Financials (Based on Availability)

- 21.2.9 Parador

- 21.2.9.1. Overview

- 21.2.9.2. Products

- 21.2.9.3. SWOT Analysis

- 21.2.9.4. Recent Developments

- 21.2.9.5. Financials (Based on Availability)

- 21.2.10 Swiss Krono Group

- 21.2.10.1. Overview

- 21.2.10.2. Products

- 21.2.10.3. SWOT Analysis

- 21.2.10.4. Recent Developments

- 21.2.10.5. Financials (Based on Availability)

- 21.2.11 Mohawk Industries Inc

- 21.2.11.1. Overview

- 21.2.11.2. Products

- 21.2.11.3. SWOT Analysis

- 21.2.11.4. Recent Developments

- 21.2.11.5. Financials (Based on Availability)

- 21.2.12 Beaulieu International Group

- 21.2.12.1. Overview

- 21.2.12.2. Products

- 21.2.12.3. SWOT Analysis

- 21.2.12.4. Recent Developments

- 21.2.12.5. Financials (Based on Availability)

- 21.2.13 Fatra a s

- 21.2.13.1. Overview

- 21.2.13.2. Products

- 21.2.13.3. SWOT Analysis

- 21.2.13.4. Recent Developments

- 21.2.13.5. Financials (Based on Availability)

- 21.2.14 Gerflor

- 21.2.14.1. Overview

- 21.2.14.2. Products

- 21.2.14.3. SWOT Analysis

- 21.2.14.4. Recent Developments

- 21.2.14.5. Financials (Based on Availability)

- 21.2.15 Forbo Flooring Systems

- 21.2.15.1. Overview

- 21.2.15.2. Products

- 21.2.15.3. SWOT Analysis

- 21.2.15.4. Recent Developments

- 21.2.15.5. Financials (Based on Availability)

- 21.2.1 Classen Group

List of Figures

- Figure 1: European Laminates Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Laminates Market Share (%) by Company 2024

List of Tables

- Table 1: European Laminates Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Laminates Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: European Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: European Laminates Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: European Laminates Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: European Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany European Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France European Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy European Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom European Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands European Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden European Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe European Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: European Laminates Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: European Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: European Laminates Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: European Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: European Laminates Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: European Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: European Laminates Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: European Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: European Laminates Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: European Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: European Laminates Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: European Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: European Laminates Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: European Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: European Laminates Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: European Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: European Laminates Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: European Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: European Laminates Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: European Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: European Laminates Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: European Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: European Laminates Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: European Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: European Laminates Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 39: European Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: European Laminates Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: European Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: European Laminates Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 43: European Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: European Laminates Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 45: European Laminates Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Laminates Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the European Laminates Market?

Key companies in the market include Classen Group, Windmiller GmbH**List Not Exhaustive, Shaw Industries Group Inc, Polyflor Ltd, Tarkett S A, Armstrong Flooring Inc, Mannington Mills Inc, Kaindl Flooring GMBH, Parador, Swiss Krono Group, Mohawk Industries Inc, Beaulieu International Group, Fatra a s, Gerflor, Forbo Flooring Systems.

3. What are the main segments of the European Laminates Market?

The market segments include Product Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction.

6. What are the notable trends driving market growth?

Rising Construction Activities is Driving the Market.

7. Are there any restraints impacting market growth?

Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring.

8. Can you provide examples of recent developments in the market?

On 14th June 2021, Shaw Industries Group, Inc. partnership with local developers Steve and Tammy Herndon of Herndon Properties, delivering an experience on par with what young professionals and prospective associates would expect in larger markets. On 18th October 2021, Armstrong Flooring announced the launch of a new rigid core product, Essentials Plus. Designed for residential spaces, Essentials Plus features the newest, on-trend designs with excellent performance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Laminates Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Laminates Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Laminates Market?

To stay informed about further developments, trends, and reports in the European Laminates Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence