Key Insights

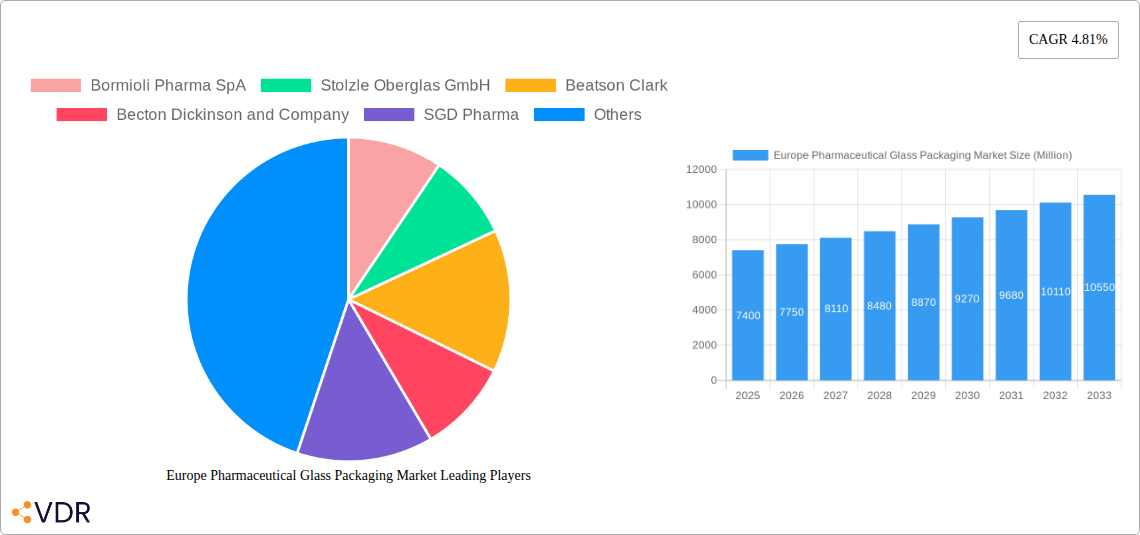

The Europe pharmaceutical glass packaging market is a significant sector experiencing steady growth, projected to reach €7.40 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 4.81% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for injectable drugs and other pharmaceuticals requiring sterile packaging significantly boosts the need for high-quality glass containers. Secondly, the growing emphasis on patient safety and drug efficacy necessitates robust and reliable packaging solutions, making pharmaceutical-grade glass a preferred material. Furthermore, stringent regulatory requirements across Europe regarding drug packaging and labeling are indirectly driving market growth by setting high quality standards that favor established glass packaging manufacturers. Lastly, the pharmaceutical industry's focus on supply chain resilience and reducing environmental impact further strengthens the market's growth trajectory, as glass is increasingly perceived as a sustainable packaging option compared to alternatives.

However, the market isn't without its challenges. Fluctuations in raw material prices (like silica sand) can impact production costs and profitability. Competition from alternative packaging materials, such as plastics (though often with regulatory hurdles regarding pharmaceutical applications), also presents a restraint. The market is characterized by a relatively concentrated landscape, with major players including Bormioli Pharma SpA, Stolzle Oberglas GmbH, Beatson Clark, Becton Dickinson and Company, SGD Pharma, Ardagh Group SA, Gaasch Packaging, Piramal Enterprises Ltd, and PGP Glass Private Limited vying for market share. The ongoing development of innovative glass packaging solutions, such as specialized coatings to enhance barrier properties and improve drug stability, will likely shape the market's competitive dynamics in the coming years. Regional variations in market growth within Europe are expected, with countries boasting larger pharmaceutical industries likely experiencing higher demand.

Europe Pharmaceutical Glass Packaging Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe pharmaceutical glass packaging market, encompassing market dynamics, growth trends, regional insights, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals seeking to understand this dynamic market and capitalize on emerging opportunities. The parent market is the broader European pharmaceutical packaging market, while the child market focuses specifically on glass packaging within this sector. Market values are presented in million units.

Europe Pharmaceutical Glass Packaging Market Market Dynamics & Structure

The European pharmaceutical glass packaging market is characterized by a moderate level of concentration, with several key players holding significant market share. The market size in 2025 is estimated at xx million units. Technological innovation, particularly in areas such as improved barrier properties and sustainable manufacturing processes, is a major driver. Stringent regulatory frameworks regarding material safety and product integrity significantly influence market dynamics. While plastic alternatives exist, glass packaging retains a strong position due to its inherent inertness and barrier properties, particularly for sensitive pharmaceuticals. End-user demographics are shaped by evolving pharmaceutical trends and increasing demand for specialized drug delivery systems. M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, resulting in a market share shift of approximately xx%.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on improved barrier properties, lightweighting, and sustainable manufacturing.

- Regulatory Framework: Stringent regulations concerning material safety and product integrity.

- Competitive Substitutes: Plastic and other alternative packaging materials pose a moderate competitive threat.

- End-User Demographics: Driven by increasing demand for injectable drugs and specialized drug delivery systems.

- M&A Trends: Moderate M&A activity, with xx deals recorded between 2019 and 2024.

Europe Pharmaceutical Glass Packaging Market Growth Trends & Insights

The European pharmaceutical glass packaging market experienced a CAGR of xx% during the historical period (2019-2024), driven by factors such as rising pharmaceutical production, increasing demand for injectables, and the inherent advantages of glass packaging in terms of inertness and barrier properties. The market is projected to maintain a healthy growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx%. Technological disruptions, such as the adoption of advanced manufacturing techniques and the development of specialized glass formulations, are contributing to this growth. Consumer behavior shifts, particularly in terms of increasing demand for convenience and sustainability, are also impacting market dynamics. Market penetration for innovative glass packaging solutions is estimated at xx% in 2025. Adoption rates for sustainable glass packaging are increasing at a rate of xx% annually.

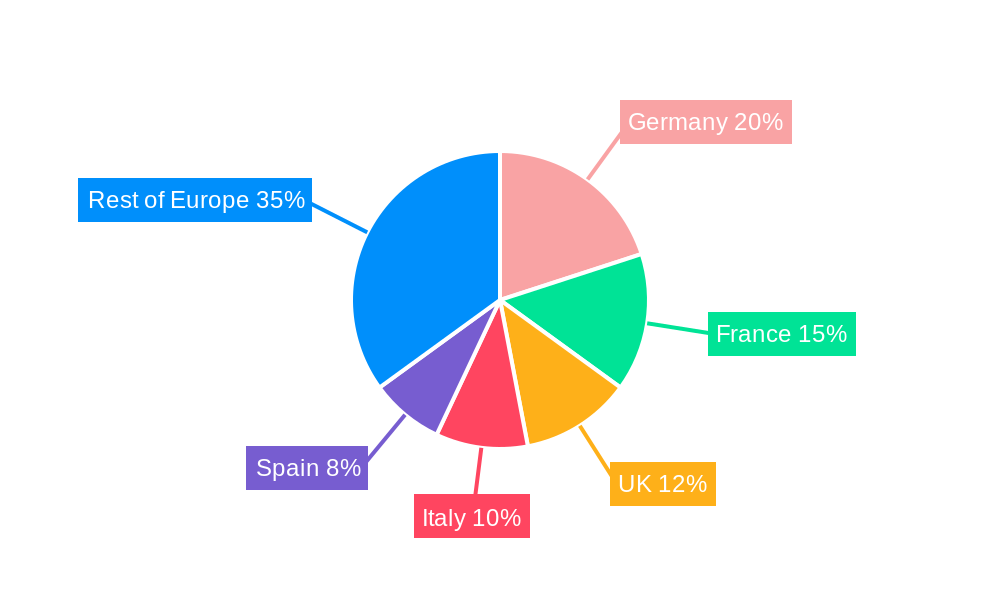

Dominant Regions, Countries, or Segments in Europe Pharmaceutical Glass Packaging Market

Germany, France, and the United Kingdom are the dominant regions within the European pharmaceutical glass packaging market, representing approximately xx% of the total market in 2025. These countries benefit from a well-established pharmaceutical industry, robust regulatory frameworks, and significant investments in healthcare infrastructure. The strong presence of major pharmaceutical companies and contract manufacturers in these regions further fuels market growth. Specific factors contributing to regional dominance include favorable economic policies supporting the pharmaceutical sector, advanced logistics networks, and a highly skilled workforce.

- Germany: Strong pharmaceutical industry, advanced manufacturing capabilities, and favorable regulatory environment.

- France: Significant presence of major pharmaceutical companies and contract manufacturers.

- United Kingdom: Well-developed healthcare infrastructure and robust regulatory framework.

- Growth Potential: Eastern European countries present significant growth potential due to rising healthcare expenditure and increasing pharmaceutical production.

Europe Pharmaceutical Glass Packaging Market Product Landscape

The European pharmaceutical glass packaging market offers a diverse range of products, including vials, ampoules, bottles, and jars, tailored to various pharmaceutical applications. Innovations focus on enhanced barrier properties, lightweight designs, and improved sustainability. Products are differentiated based on glass type (e.g., amber, flint), closure systems, and specialized coatings. Performance metrics include chemical inertness, barrier properties against oxygen and moisture, and compatibility with various pharmaceutical formulations. Unique selling propositions often center around improved product protection, enhanced convenience for drug administration, and environmentally friendly manufacturing processes.

Key Drivers, Barriers & Challenges in Europe Pharmaceutical Glass Packaging Market

Key Drivers:

- Increasing demand for injectable drugs and other parenteral formulations.

- Stringent regulatory requirements for pharmaceutical packaging, favoring the use of inert materials such as glass.

- Growing awareness of sustainability issues, driving demand for eco-friendly packaging solutions.

Key Challenges & Restraints:

- High raw material costs and fluctuating energy prices impacting production costs. (estimated impact on market growth: xx%).

- Intense competition from alternative packaging materials, such as plastics and polymers. (estimated market share loss: xx% by 2033).

- Supply chain disruptions, particularly during periods of global uncertainty. (estimated impact on production delays: xx% in 2024).

Emerging Opportunities in Europe Pharmaceutical Glass Packaging Market

- Growth in the biologics and biosimilars market creates opportunities for specialized glass packaging solutions.

- Increasing demand for convenient and user-friendly drug delivery systems opens avenues for innovative packaging designs.

- Growing focus on sustainable packaging practices presents opportunities for eco-friendly glass packaging options.

Growth Accelerators in the Europe Pharmaceutical Glass Packaging Market Industry

The long-term growth of the European pharmaceutical glass packaging market will be driven by technological advancements in glass manufacturing, leading to lighter, stronger, and more sustainable products. Strategic partnerships between packaging manufacturers and pharmaceutical companies will streamline supply chains and facilitate the development of innovative packaging solutions. Market expansion into emerging economies within Europe will further contribute to market growth.

Key Players Shaping the Europe Pharmaceutical Glass Packaging Market Market

- Bormioli Pharma SpA

- Stolzle Oberglas GmbH

- Beatson Clark

- Becton Dickinson and Company

- SGD Pharma

- Ardagh Group SA

- Gaasch Packaging

- Piramal Enterprises Ltd

- PGP Glass Private Limited

- *List Not Exhaustive

Notable Milestones in Europe Pharmaceutical Glass Packaging Market Sector

- January 2024: SGD Pharma launches a new siliconization facility in France, enhancing supply security and flexibility.

- October 2024: Stoelzle Pharma unveils the PharmaCos Line, a new range of amber glass jars and bottles for wellness and healthcare applications.

In-Depth Europe Pharmaceutical Glass Packaging Market Market Outlook

The European pharmaceutical glass packaging market is poised for sustained growth over the forecast period, driven by continuous innovation in glass technology, increased demand for high-quality packaging solutions, and a growing focus on sustainability. Strategic partnerships, investments in advanced manufacturing capabilities, and expansion into new markets will further contribute to the market's long-term potential. Companies that successfully adapt to evolving regulatory landscapes and consumer preferences will be well-positioned to capitalize on lucrative opportunities within this dynamic market.

Europe Pharmaceutical Glass Packaging Market Segmentation

-

1. Product

- 1.1. Bottles

- 1.2. Vials

- 1.3. Ampoules

- 1.4. Cartridges and Syringes

- 1.5. Other Products

Europe Pharmaceutical Glass Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pharmaceutical Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Spending on Pharmaceutical Research and Development is Expected to Drive the Market's Growth; Increasing Demand for Sustainable Packaging

- 3.3. Market Restrains

- 3.3.1. Increasing Spending on Pharmaceutical Research and Development is Expected to Drive the Market's Growth; Increasing Demand for Sustainable Packaging

- 3.4. Market Trends

- 3.4.1. Germany is Expected to Have a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bottles

- 5.1.2. Vials

- 5.1.3. Ampoules

- 5.1.4. Cartridges and Syringes

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bormioli Pharma SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stolzle Oberglas GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Beatson Clark

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Becton Dickinson and Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SGD Pharma

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardagh Group SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gaasch Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Piramal Enterprises Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PGP Glass Private Limited*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bormioli Pharma SpA

List of Figures

- Figure 1: Europe Pharmaceutical Glass Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Pharmaceutical Glass Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Europe Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Europe Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 5: Europe Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Europe Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 8: Europe Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 9: Europe Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Germany Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: France Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Spain Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Belgium Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Sweden Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Norway Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Norway Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Poland Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Poland Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Denmark Europe Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Glass Packaging Market?

The projected CAGR is approximately 4.81%.

2. Which companies are prominent players in the Europe Pharmaceutical Glass Packaging Market?

Key companies in the market include Bormioli Pharma SpA, Stolzle Oberglas GmbH, Beatson Clark, Becton Dickinson and Company, SGD Pharma, Ardagh Group SA, Gaasch Packaging, Piramal Enterprises Ltd, PGP Glass Private Limited*List Not Exhaustive.

3. What are the main segments of the Europe Pharmaceutical Glass Packaging Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Spending on Pharmaceutical Research and Development is Expected to Drive the Market's Growth; Increasing Demand for Sustainable Packaging.

6. What are the notable trends driving market growth?

Germany is Expected to Have a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Increasing Spending on Pharmaceutical Research and Development is Expected to Drive the Market's Growth; Increasing Demand for Sustainable Packaging.

8. Can you provide examples of recent developments in the market?

January 2024: SGD Pharma, one of the leaders in molded glass primary packaging for pharmaceuticals, unveiled a new siliconization facility at its cutting-edge Saint-Quentin Lamotte (SQLM) plant in France. This move bolsters its suite of in-house services, ensuring swifter responses, strengthened supply security, and greater flexibility in vial sizes. By applying a micro-layer silicone coating to their containers, SGD Pharma creates a protective barrier. This barrier reduces interactions between the drug and its packaging and safeguards the integrity of sensitive therapeutic products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Glass Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence