Key Insights

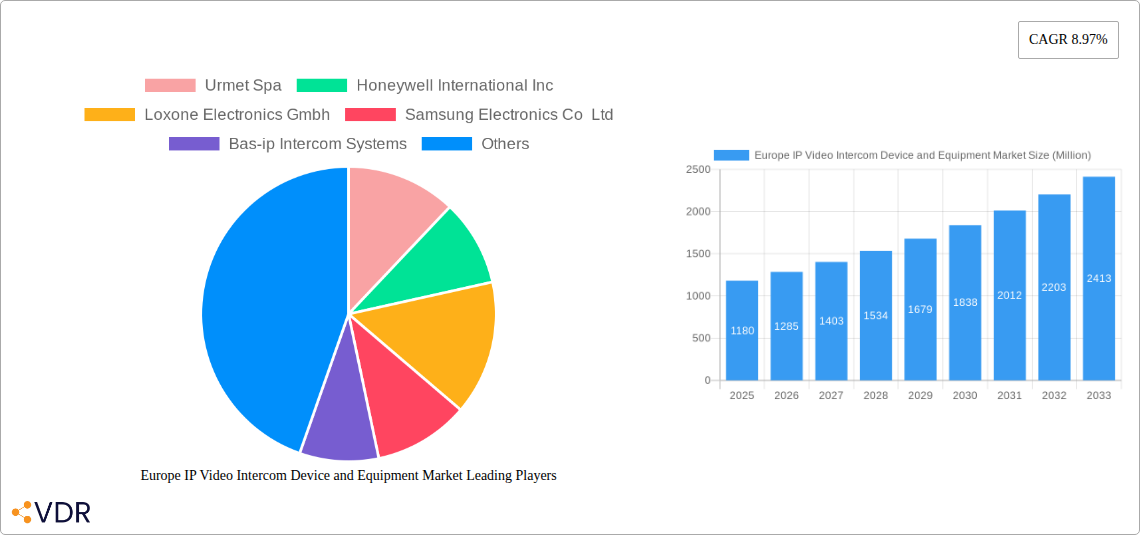

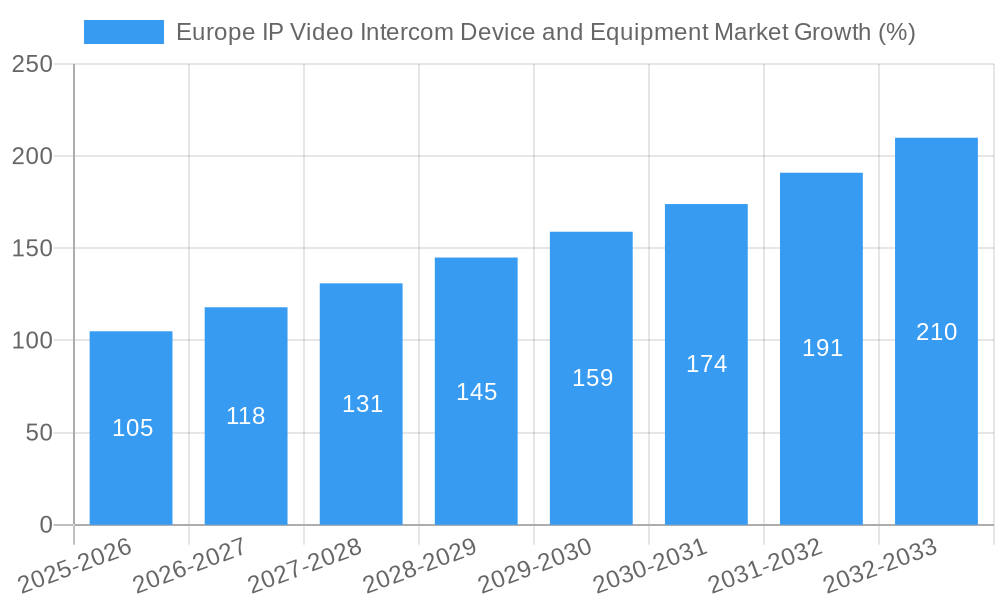

The European IP Video Intercom Device and Equipment market is experiencing robust growth, projected to reach €1.18 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.97% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing security concerns across residential, commercial, and governmental sectors are fueling demand for advanced security solutions like IP video intercoms, offering features beyond basic access control, including remote monitoring, video recording, and integration with smart home ecosystems. Secondly, technological advancements such as improved video quality, enhanced analytics capabilities (e.g., facial recognition), and seamless integration with existing security infrastructure are driving adoption. The market is segmented by country (with Germany, France, and the UK leading) and end-user (commercial, residential, and governmental sectors), reflecting diverse application needs and varying adoption rates. The competitive landscape is marked by a mix of established players like Honeywell and Samsung, alongside specialized firms like 2N Telekomunikace and Doorbird, indicating a dynamic market with diverse product offerings catering to specific needs.

The market's continued growth will be influenced by several trends. The rising popularity of smart home technology and the increasing demand for integrated security systems are strong positive drivers. Government initiatives promoting smart city development and stricter building codes emphasizing security are also contributing factors. However, restraints such as high initial investment costs for advanced IP video intercom systems and the need for specialized technical expertise for installation and maintenance might pose challenges. Furthermore, cybersecurity concerns related to network connectivity and data protection require careful consideration by both manufacturers and users. Despite these challenges, the long-term outlook remains positive, driven by sustained demand for enhanced security, technological innovations, and the expanding adoption of smart home technologies across Europe.

Europe IP Video Intercom Device and Equipment Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe IP Video Intercom Device and Equipment market, covering the period from 2019 to 2033. With a focus on key market segments, including residential and commercial applications across major European countries, this report is essential for businesses operating in or planning to enter this dynamic market. The report analyzes market dynamics, growth trends, dominant players, and emerging opportunities, providing valuable insights for strategic decision-making. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033.

Europe IP Video Intercom Device and Equipment Market Dynamics & Structure

The European IP video intercom market exhibits a moderately concentrated structure, with key players like Urmet Spa, Honeywell International Inc, and Hikvision holding significant market share. However, smaller, specialized companies also contribute significantly to market innovation. Technological innovation is a crucial driver, with advancements in video quality, connectivity (Wi-Fi, PoE), integration with smart home systems, and biometric security enhancing product appeal. Regulatory frameworks surrounding data privacy and security compliance (e.g., GDPR) impose significant constraints, influencing product development and market access. Competitive substitutes, such as traditional intercom systems and access control solutions, continue to exist, but the market trend strongly favors the advanced capabilities of IP-based systems. End-user demographics are diversifying, driven by increasing smart home adoption in the residential sector and heightened security needs in commercial and government entities. M&A activity has been moderate, primarily driven by strategic acquisitions of smaller innovative companies by established players, fostering technology integration and broader market reach.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2024).

- Technological Drivers: Improved video quality, advanced connectivity, smart home integration, biometric security.

- Regulatory Influences: GDPR compliance, data privacy regulations impacting product development.

- Competitive Substitutes: Traditional intercoms, access control systems.

- M&A Activity: Moderate activity focused on technology acquisition and market expansion. xx deals closed in 2024.

- Innovation Barriers: High initial investment in R&D, stringent regulatory compliance.

Europe IP Video Intercom Device and Equipment Market Growth Trends & Insights

The European IP video intercom market has demonstrated robust growth throughout the historical period (2019-2024), driven by factors such as rising security concerns, increasing adoption of smart home technology, and the growing preference for convenient and user-friendly communication systems. The market size is projected to reach xx million units in 2025 and further expand at a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by continuous technological advancements, including the integration of advanced features such as facial recognition, cloud-based storage, and seamless mobile application integration. Consumer behavior is shifting towards connected devices, with users increasingly seeking convenient remote monitoring and access control capabilities. Technological disruptions, such as the introduction of AI-powered features and enhanced cybersecurity measures, are playing a pivotal role in enhancing market appeal and driving adoption. Market penetration across various end-user segments (residential, commercial, government) is expected to increase significantly during the forecast period. The transition from legacy analog systems to modern IP-based solutions is creating substantial growth opportunities. The market is also experiencing increased demand for versatile, customizable solutions and integrated systems offering comprehensive security and communication solutions.

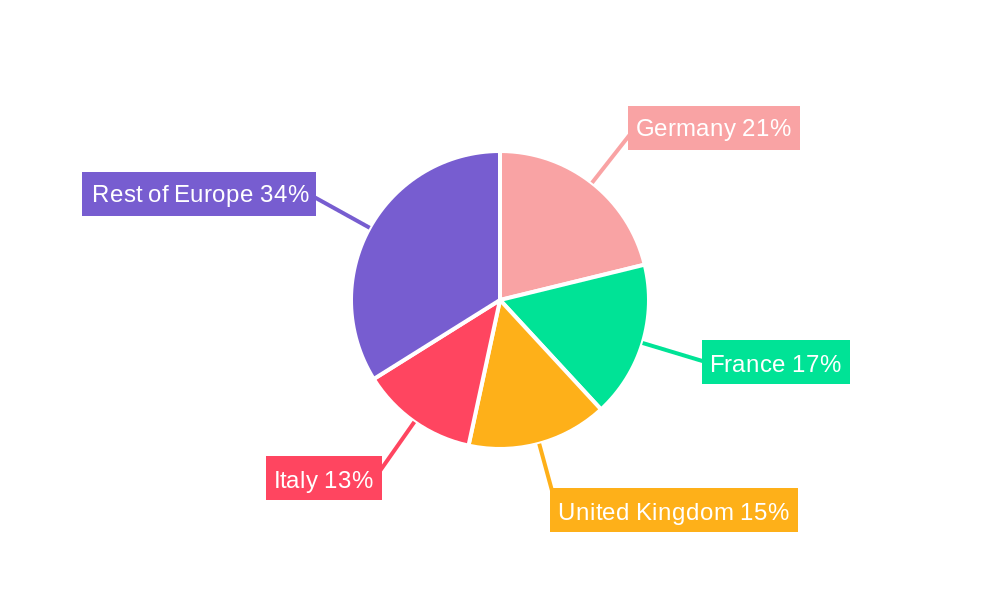

Dominant Regions, Countries, or Segments in Europe IP Video Intercom Device and Equipment Market

The United Kingdom, Germany, and France represent the dominant markets within Europe for IP video intercom devices and equipment. These countries demonstrate a high level of technological adoption, robust economic conditions, and a strong emphasis on residential and commercial security. The Rest of Europe segment also contributes significantly to overall market growth, although at a slightly slower rate than the leading countries. The residential segment holds the largest market share, driven by individual homeowners prioritizing safety and home automation. However, the commercial segment shows significant growth potential due to increasing investments in security upgrades and access control management solutions across sectors like retail, healthcare, and education.

- United Kingdom: High adoption of smart home technologies, strong consumer spending power.

- Germany: Established security infrastructure, high demand for advanced features.

- France: Growing focus on residential security, increasing government investments.

- Residential Segment: Largest market share, driven by home automation trends.

- Commercial Segment: High growth potential, driven by investments in advanced security systems.

Europe IP Video Intercom Device and Equipment Market Product Landscape

The European IP video intercom market offers a diverse range of products, from basic single-door stations to sophisticated multi-unit systems integrated with access control, video surveillance, and smart home platforms. Product innovations focus on improved video quality (high-resolution cameras, wide-angle lenses), enhanced connectivity (Wi-Fi, 4G/5G LTE), advanced security features (biometric authentication, encryption), and seamless integration with smart home ecosystems. Key performance metrics include video resolution, field of view, audio quality, connectivity options, and ease of installation. Unique selling propositions often include features such as mobile application integration for remote access and control, cloud-based storage for recorded video, and advanced analytics capabilities. Technological advancements continue to drive the development of more robust, feature-rich, and user-friendly IP video intercom systems.

Key Drivers, Barriers & Challenges in Europe IP Video Intercom Device and Equipment Market

Key Drivers: Increasing security concerns, rising adoption of smart home technologies, demand for advanced communication and access control solutions, government initiatives promoting smart city development. For example, government incentives for smart home upgrades are driving adoption in the residential sector.

Challenges & Restraints: High initial investment costs for IP-based systems compared to traditional intercoms. Complex installation processes can hinder wider adoption, especially among individual homeowners. Data security and privacy concerns remain significant obstacles. Supply chain disruptions have led to increased manufacturing and component costs impacting profitability. Competition among established players and new entrants is intensifying, leading to pricing pressures.

Emerging Opportunities in Europe IP Video Intercom Device and Equipment Market

Emerging opportunities lie in the integration of AI-powered features such as facial recognition and intelligent video analytics to enhance security. The expanding market for smart building technologies creates opportunities for integrated IP video intercom systems within larger building management systems. Untapped markets within the SME segment and rural areas hold significant potential for growth. Evolving consumer preferences towards seamless user interfaces and subscription-based services present exciting opportunities for market expansion. The growing popularity of smart assistants and voice control integration offers additional avenues for development.

Growth Accelerators in the Europe IP Video Intercom Device and Equipment Market Industry

Several key factors will accelerate the growth of the European IP video intercom market in the long term. Technological advancements like enhanced image processing capabilities, increased data storage capacity, and improved connectivity standards will continue to drive innovation. Strategic partnerships between technology providers and building automation companies will facilitate seamless integration into broader smart home and building ecosystems. Government initiatives supporting the deployment of smart city technologies create new growth opportunities, enhancing market development. Increased awareness of security risks and the desire for better safety measures fuels ongoing market growth.

Key Players Shaping the Europe IP Video Intercom Device and Equipment Market Market

- Urmet Spa

- Honeywell International Inc

- Loxone Electronics Gmbh

- Samsung Electronics Co Ltd

- Bas-ip Intercom Systems

- Ring (amazon inc)

- Siedle

- Hangzhou Hikvision Digital Technology Co Ltd

- Alpha Communications

- Farfisa

- Doorbird (bird Home Automation Gmbh)

- Commend International Gmbh (tkh Group Nv)

- 2n Telekomunikace

- Netatmo (legrand)

- Paxton Access Ltd

- Panasonic Corporation

Notable Milestones in Europe IP Video Intercom Device and Equipment Market Sector

- September 2021: Axis ARTPEC 7 processor powers the 2N IP Style intercom, enhancing image quality and low-light performance.

- May 2021: DoorBird introduces door intercoms with integrated fingerprint sensors, enhancing biometric authentication.

In-Depth Europe IP Video Intercom Device and Equipment Market Market Outlook

The future of the European IP video intercom market appears promising, driven by continuous technological innovation, increasing security concerns, and growing adoption of smart home solutions. The market is poised for robust growth, with significant opportunities for companies offering innovative, integrated, and user-friendly solutions. Strategic partnerships, focused R&D, and aggressive marketing strategies will be crucial for success in this competitive landscape. The market is expected to witness a surge in demand for advanced features, seamless integration with existing smart home systems, and improved cybersecurity measures. Companies focusing on providing comprehensive solutions that address the evolving needs of both residential and commercial customers will be best positioned to capitalize on the significant growth potential of this market.

Europe IP Video Intercom Device and Equipment Market Segmentation

-

1. End-User

- 1.1. Commercial

- 1.2. Residential

- 1.3. Government Or Others

-

2. Product Type

- 2.1. Wired

- 2.2. Wireless

- 2.3. Battery-powered

-

3. Features

- 3.1. Facial recognition

- 3.2. Fingerprint scanning

- 3.3. Motion detection

- 3.4. Night vision

Europe IP Video Intercom Device and Equipment Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe IP Video Intercom Device and Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Incentive to Maintain High Hygiene Standards in Professional Environments; High Demand from Professional Services in Healthcare

- 3.3. Market Restrains

- 3.3.1. Increasing Vulnerability Related To Cyber-attacks and Frauds

- 3.4. Market Trends

- 3.4.1. Increasing Home Security Concern Owing to Growing Crime Rate to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe IP Video Intercom Device and Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.1.3. Government Or Others

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.2.3. Battery-powered

- 5.3. Market Analysis, Insights and Forecast - by Features

- 5.3.1. Facial recognition

- 5.3.2. Fingerprint scanning

- 5.3.3. Motion detection

- 5.3.4. Night vision

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Germany Europe IP Video Intercom Device and Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe IP Video Intercom Device and Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe IP Video Intercom Device and Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe IP Video Intercom Device and Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe IP Video Intercom Device and Equipment Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe IP Video Intercom Device and Equipment Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe IP Video Intercom Device and Equipment Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Urmet Spa

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Honeywell International Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Loxone Electronics Gmbh

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Samsung Electronics Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bas-ip Intercom Systems

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Ring (amazon inc)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Siedle

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hangzhou Hikvision Digital Technology Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Alpha Communications

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Farfisa

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Doorbird (bird Home Automation Gmbh)

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Commend International Gmbh (tkh Group Nv)

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 2n Telekomunikace

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Netatmo (legrand)

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Paxton Access Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Panasonic Corporation

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Urmet Spa

List of Figures

- Figure 1: Europe IP Video Intercom Device and Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe IP Video Intercom Device and Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 5: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 7: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Features 2019 & 2032

- Table 8: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Features 2019 & 2032

- Table 9: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Germany Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: France Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Sweden Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 28: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 29: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 31: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Features 2019 & 2032

- Table 32: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Features 2019 & 2032

- Table 33: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: United Kingdom Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Germany Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: France Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Italy Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Italy Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Spain Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Netherlands Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Netherlands Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Belgium Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Belgium Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Sweden Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Sweden Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Norway Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Norway Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Poland Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Poland Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Denmark Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Denmark Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe IP Video Intercom Device and Equipment Market?

The projected CAGR is approximately 8.97%.

2. Which companies are prominent players in the Europe IP Video Intercom Device and Equipment Market?

Key companies in the market include Urmet Spa, Honeywell International Inc, Loxone Electronics Gmbh, Samsung Electronics Co Ltd, Bas-ip Intercom Systems, Ring (amazon inc), Siedle, Hangzhou Hikvision Digital Technology Co Ltd, Alpha Communications, Farfisa, Doorbird (bird Home Automation Gmbh), Commend International Gmbh (tkh Group Nv), 2n Telekomunikace, Netatmo (legrand), Paxton Access Ltd, Panasonic Corporation.

3. What are the main segments of the Europe IP Video Intercom Device and Equipment Market?

The market segments include End-User, Product Type , Features .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Incentive to Maintain High Hygiene Standards in Professional Environments; High Demand from Professional Services in Healthcare.

6. What are the notable trends driving market growth?

Increasing Home Security Concern Owing to Growing Crime Rate to Drive the Growth.

7. Are there any restraints impacting market growth?

Increasing Vulnerability Related To Cyber-attacks and Frauds.

8. Can you provide examples of recent developments in the market?

September 2021 - Axis ARTPEC 7 processor powers the 2N IP Style, a Sweden-based key player in the IP camera industry, was introduced. The ARTPEC 7 processor provides superb image quality and efficient compression to the 2N IP Style intercom. The ARTPEC 7 processor excels in maintaining image color even in low-light situations. A 5-megapixel camera with a maximum resolution of 2560 x 1920 pixels or QHD widescreen resolution (2560 x 1440 pixels) is included with the 2N IP Style. The camera's wide viewing angles (144° horizontal and 126° vertical) ensure that the resident can see everything outside their door.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe IP Video Intercom Device and Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe IP Video Intercom Device and Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe IP Video Intercom Device and Equipment Market?

To stay informed about further developments, trends, and reports in the Europe IP Video Intercom Device and Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence