Key Insights

The European Financial Advisory Services market is experiencing substantial growth, propelled by increasing regulatory complexity, the imperative for digital transformation within financial institutions, and a growing demand for specialized expertise in areas such as Mergers & Acquisitions (M&A), risk management, and wealth management. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.5%, expanding from a market size of 184.8 billion in the base year 2025. This expansion is driven by both large corporations seeking strategic guidance and smaller businesses navigating financial challenges. Leading firms, including KPMG, Deloitte, and McKinsey & Company, dominate the market, leveraging their extensive networks and established reputations. The market also witnesses the emergence of niche players, fostering competition and innovation. Ongoing economic uncertainty and potential regulatory shifts in Europe present both opportunities and challenges. The increasing demand for advisory services related to sustainability and Environmental, Social, and Governance (ESG) factors is a significant emerging trend, further shaping market growth.

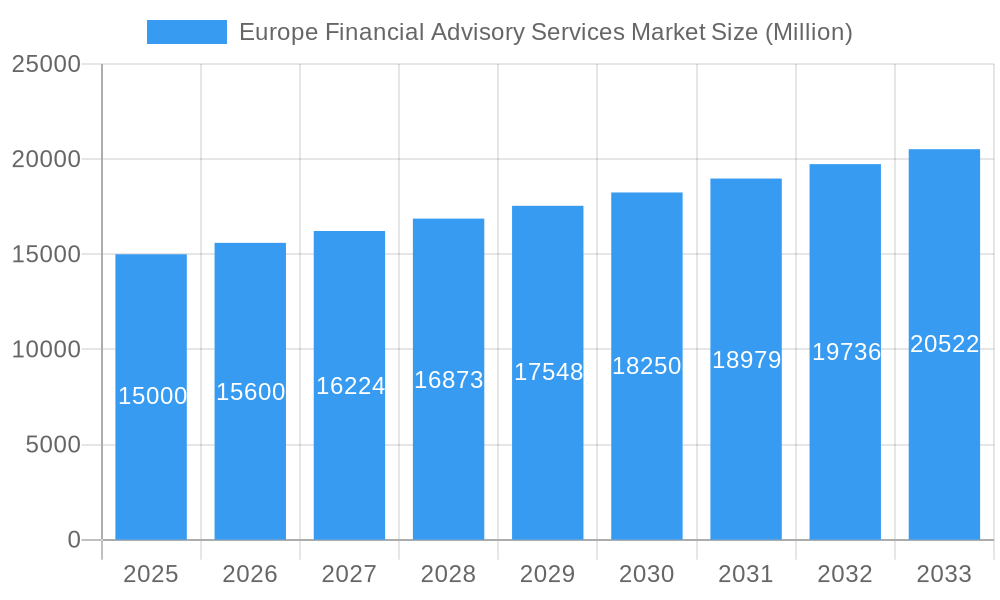

Europe Financial Advisory Services Market Market Size (In Billion)

Looking ahead to 2033, the market is poised for continued expansion, driven by sustained growth in cross-border transactions, increasing fintech integration, and the evolving needs of a complex financial landscape. Geographic distribution of market share within Europe will likely vary, with major financial centers such as London, Frankfurt, and Paris commanding a significant portion. Market segmentation by service type (e.g., M&A advisory, restructuring advisory, wealth management), client type (e.g., corporations, financial institutions, high-net-worth individuals), and geographic location will continue to be crucial in shaping market dynamics and investment strategies. The future success of the market hinges on the ability of advisory firms to adapt to technological advancements, evolving regulatory frameworks, and the dynamic demands of their clients.

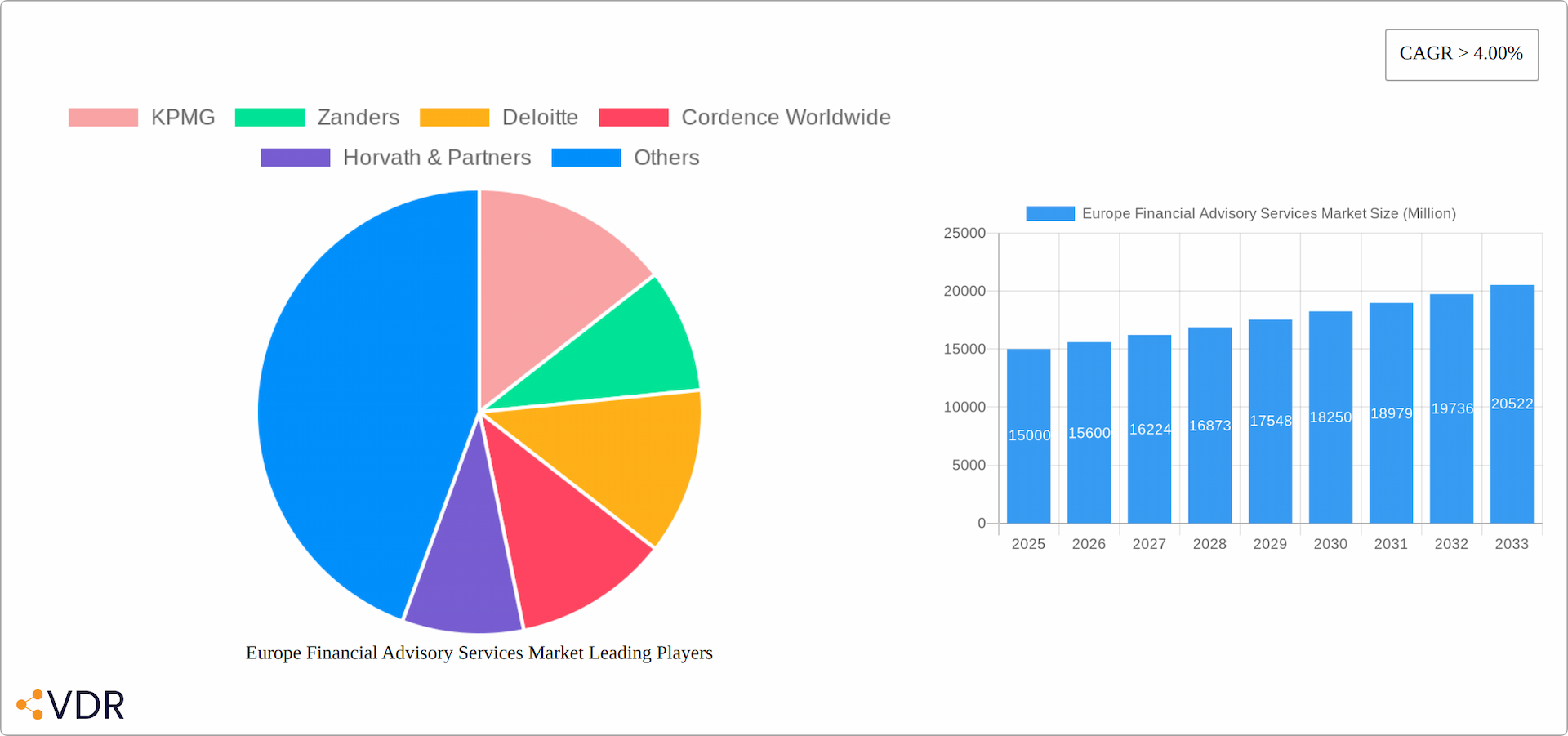

Europe Financial Advisory Services Market Company Market Share

Europe Financial Advisory Services Market: Comprehensive Analysis (2019-2033)

This comprehensive report offers an in-depth analysis of the Europe Financial Advisory Services market, covering market dynamics, growth trends, dominant regions, product landscape, key drivers, challenges, emerging opportunities, growth accelerators, key players, and notable milestones. The study period spans from 2019 to 2033, with 2025 designated as the base and estimated year. The forecast period is from 2025-2033, and the historical period is 2019-2024. The market size is presented in billion units.

Europe Financial Advisory Services Market Market Dynamics & Structure

The European financial advisory services market is characterized by a moderately concentrated landscape, with several large multinational firms and numerous specialized boutiques competing for market share. Technological innovation, particularly in areas like fintech and AI-driven analytics, is a significant driver of growth, while regulatory frameworks like GDPR and MiFID II significantly influence operations. The market faces competitive pressure from product substitutes, such as robo-advisors, and is witnessing a steady rise in mergers and acquisitions (M&A) activity. End-user demographics, including the increasing number of high-net-worth individuals and the growing demand for specialized financial advice, also shape market trends.

- Market Concentration: Moderately concentrated, with a top 5 market share of xx%.

- Technological Innovation: Strong growth driven by AI, machine learning, and blockchain technologies.

- Regulatory Framework: Significant influence from GDPR, MiFID II, and other directives.

- M&A Activity: xx deals in the past 5 years, with an average deal value of xx million.

- Innovation Barriers: High initial investment costs, data security concerns, and regulatory compliance hurdles.

Europe Financial Advisory Services Market Growth Trends & Insights

The European financial advisory services market has exhibited steady growth over the historical period (2019-2024), with a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), driven by increasing demand for personalized financial planning, wealth management, and corporate advisory services. Technological disruptions, particularly the rise of fintech solutions, are altering consumer behavior, pushing towards greater digital engagement and self-service options. Market penetration for digital advisory platforms is increasing at a rate of xx% annually.

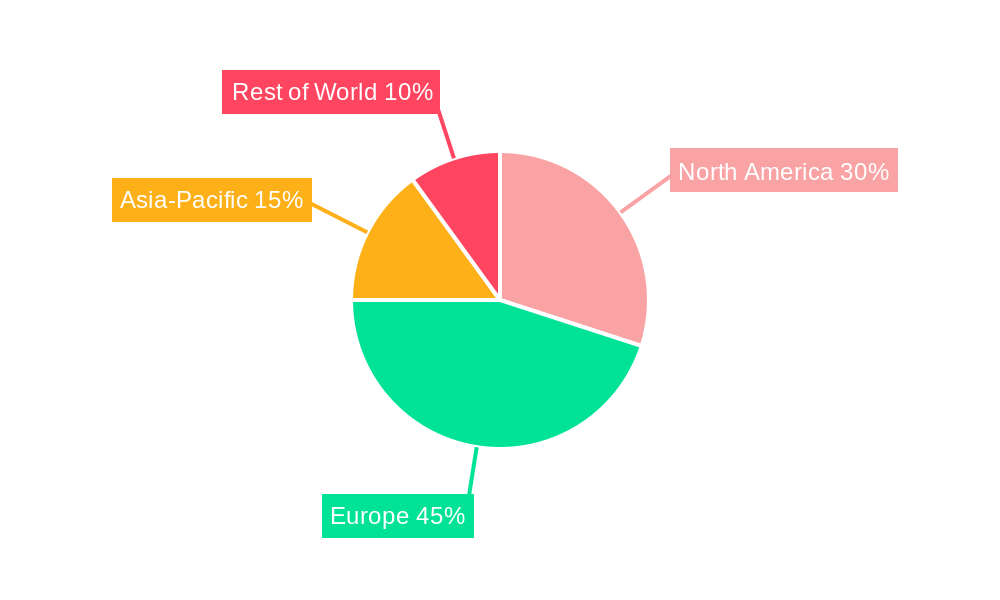

Dominant Regions, Countries, or Segments in Europe Financial Advisory Services Market

The UK, Germany, and France remain the dominant markets within the European financial advisory services sector, collectively accounting for a significant portion of the total market value. These countries benefit from robust financial ecosystems, a high concentration of wealth, and generally favorable regulatory environments. However, other regions are showing significant growth potential. The continued growth in these leading markets is largely driven by several key factors:

- Strong Economic Performance (with nuances): While overall European economic performance varies by country, strong GDP growth in key sectors contributes to increased disposable income and investment activity in the dominant markets. Understanding regional economic variations is crucial for accurate market forecasting.

- Evolving Financial Infrastructure: While robust regulatory frameworks and established financial institutions are present, ongoing developments and adaptations to new technologies and evolving regulations are shaping the competitive landscape. Access to capital remains a key factor, particularly for smaller firms and fintech startups.

- High Net Worth Individuals (HNWIs) and Growing Affluent Class: A significant population of HNWIs continues to drive demand for sophisticated wealth management solutions. Furthermore, the expanding affluent class represents a growing market segment for personalized financial advisory services.

- Increased Demand for Specialized Services: The market is witnessing increasing demand for specialized services catering to specific needs such as sustainable investing, impact investing, and family office services.

Europe Financial Advisory Services Market Product Landscape

The European financial advisory services market offers a diverse range of products and services, including wealth management, retirement planning, investment advisory (including ESG and impact investing), corporate finance, risk management, and regulatory compliance. The market is characterized by ongoing innovation, with a focus on personalized solutions leveraging advanced data analytics, artificial intelligence, and robo-advisory technologies to enhance efficiency and the overall client experience. These advancements are creating unique selling propositions centered around improved investment outcomes, cost reduction, increased accessibility, and greater transparency.

Key Drivers, Barriers & Challenges in Europe Financial Advisory Services Market

Key Drivers: The market's expansion is fueled by increasing demand for comprehensive financial planning, rising wealth levels across various demographics, rapid technological advancements in financial technology (fintech), and generally supportive government policies (although this varies across different European countries and may be impacted by changing political landscapes). The growing awareness of the importance of financial planning, especially among younger generations, also plays a key role.

Key Challenges: The industry faces significant challenges, including intense competition, frequent regulatory changes (requiring significant compliance efforts and investment), cybersecurity threats (posing a significant risk to client data and firm reputation), and the ongoing need for continuous professional development to keep pace with evolving market trends and technological advancements. Compliance costs remain a substantial portion of total operational expenses for many firms, impacting profitability and competitiveness. Geopolitical uncertainty and economic volatility also add complexity.

Emerging Opportunities in Europe Financial Advisory Services Market

The European financial advisory services market presents numerous emerging opportunities, including: the growing demand for sustainable and responsible finance advisory services (aligning with ESG and impact investing principles), the development of personalized robo-advisory services tailored to the preferences and financial goals of younger demographics, and expansion into underserved regional markets within Europe. The increasing adoption of blockchain technology offers opportunities for secure and transparent transactions, enhancing trust and efficiency. Furthermore, the integration of innovative technologies like AI and machine learning can lead to the development of more sophisticated and personalized financial solutions.

Growth Accelerators in the Europe Financial Advisory Services Market Industry

Strategic partnerships between traditional advisory firms and fintech companies, fostering innovation and access to new technologies, are crucial growth drivers. Moreover, expansion into new geographical markets and the development of niche specializations, catering to specific client needs like family offices, are likely to further accelerate growth in the coming years.

Key Players Shaping the Europe Financial Advisory Services Market Market

- KPMG (KPMG)

- Zanders

- Deloitte (Deloitte)

- Cordence Worldwide

- Horvath & Partners

- Alvarez & Marsal (Alvarez & Marsal)

- Coeius Consulting

- McKinsey & Company (McKinsey & Company)

- Mercer (Mercer)

- Delta Capita

- List Not Exhaustive

Notable Milestones in Europe Financial Advisory Services Market Sector

- February 2023: Deloitte's acquisition of 27 Pilots significantly expanded its capabilities in serving startups and scale-ups, highlighting the increasing importance of this segment within the financial advisory landscape.

- January 2023: BearingPoint's acquisition of Levo Consultants strengthened its presence in the French financial services market, illustrating the competitive dynamics and strategic growth initiatives within the region.

- [Add other recent significant mergers, acquisitions, or regulatory changes as relevant]

In-Depth Europe Financial Advisory Services Market Market Outlook

The European financial advisory services market exhibits significant long-term growth potential, driven by continuous technological advancements, evolving client needs, and increasing regulatory scrutiny. Strategic partnerships, expansion into niche markets, and a focus on sustainable finance will play crucial roles in shaping future market leaders and unlocking new strategic opportunities. The market is expected to reach xx million by 2033.

Europe Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

- 1.6. Other Types

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. Bfsi

- 3.2. It And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

- 3.7. Other Industry Verticals

Europe Financial Advisory Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Financial Advisory Services Market Regional Market Share

Geographic Coverage of Europe Financial Advisory Services Market

Europe Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Tax Advisory by Financial Advisory Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. Bfsi

- 5.3.2. It And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KPMG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zanders

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deloitte

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cordence Worldwide

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Horvath & Partners

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alvarez & Marsal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Coeus Consulting

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 McKinsey & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mercer

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Delta Capita**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 KPMG

List of Figures

- Figure 1: Europe Financial Advisory Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Financial Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Europe Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: Europe Financial Advisory Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Europe Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Europe Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Financial Advisory Services Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Europe Financial Advisory Services Market?

Key companies in the market include KPMG, Zanders, Deloitte, Cordence Worldwide, Horvath & Partners, Alvarez & Marsal, Coeus Consulting, McKinsey & Company, Mercer, Delta Capita**List Not Exhaustive.

3. What are the main segments of the Europe Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 184.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Tax Advisory by Financial Advisory Services.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Deloitte boosted its start-up and scale-up capabilities with the acquisition of 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 Pilots as part of its portfolio, Deloitte will be able to better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth through to technology, infrastructure, and venture capital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the Europe Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence