Key Insights

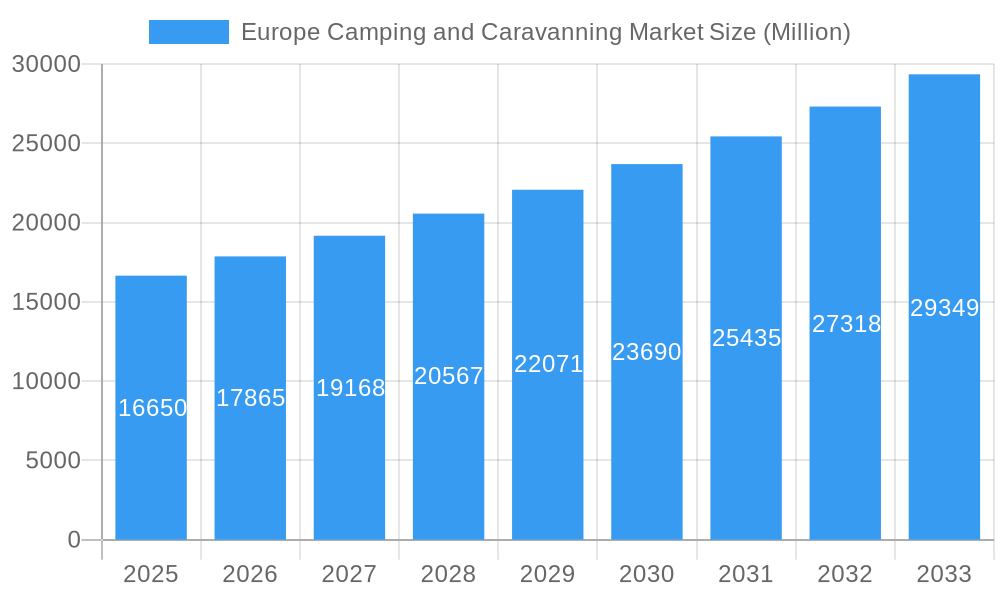

The European camping and caravanning market, valued at €16.65 billion in 2025, is projected to experience robust growth, driven by a rising preference for outdoor recreation, sustainable tourism, and the increasing affordability of camping equipment and RV rentals. The market's Compound Annual Growth Rate (CAGR) of 7.23% from 2025 to 2033 indicates a significant expansion, reaching an estimated €30 billion by 2033. Several factors contribute to this growth. The increasing popularity of glamping (glamorous camping), offering luxurious amenities within a natural setting, appeals to a broader demographic. Furthermore, the growing awareness of environmental sustainability is boosting the demand for eco-friendly camping options and responsible tourism practices. The market is segmented by destination type (national parks, private campgrounds, etc.), camper type (car camping, RV camping, backpacking), and distribution channel (direct sales, online travel agencies). Germany, France, and the United Kingdom represent the largest national markets, reflecting established camping cultures and extensive infrastructure. However, growth potential exists across all European countries as tourism trends shift toward nature-based experiences. The presence of established players like Kabe AB, Camping and Caravanning Club, and Trigano SA, alongside emerging smaller businesses catering to niche segments, signifies a dynamic and competitive market landscape.

Europe Camping and Caravanning Market Market Size (In Billion)

The competitive landscape is characterized by both established players and emerging businesses catering to specialized niches. Established brands leverage their extensive experience and strong brand recognition, while newer companies focus on innovative offerings, eco-friendly solutions, or tailored experiences. This competitive intensity drives innovation and ensures a diverse range of options for consumers. Challenges include managing the environmental impact of increased camping activity and addressing seasonal fluctuations in demand. However, the market is expected to overcome these challenges through sustainable tourism initiatives and strategic marketing campaigns targeting different segments throughout the year, maintaining a steady growth trajectory. The ongoing investment in campground infrastructure and technological advancements, such as online booking platforms and improved navigation tools, further contribute to the market's positive outlook.

Europe Camping and Caravanning Market Company Market Share

Europe Camping and Caravanning Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe camping and caravanning market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025, this report delves into market dynamics, growth trends, key players, and future opportunities within this thriving sector. The report segments the market by destination type, camper type, distribution channel, and country, providing granular data for informed decision-making. The total market size is projected to reach xx Million units by 2033.

Europe Camping and Caravanning Market Dynamics & Structure

The European camping and caravanning market is characterized by a moderately fragmented landscape with a mix of large multinational corporations and smaller, regional operators. Market concentration is relatively low, with no single dominant player controlling a significant portion of the market share. However, recent mergers and acquisitions (M&A) activity, such as the European Camping Group's (ECG) acquisition of Vacanceselect Group in January 2023, are leading to increased consolidation. This deal significantly boosted ECG's campsite portfolio, illustrating the ongoing strategic moves within the sector.

Key Dynamics:

- Technological Innovation: The adoption of online booking platforms, mobile applications, and smart camping technologies is driving market growth. However, barriers to innovation include the need for significant upfront investments in technology and the diverse technological literacy levels across the camping demographic.

- Regulatory Frameworks: National and regional regulations regarding campsite development, environmental protection, and safety standards influence market operations. Variations in regulations across different European countries present challenges for operators.

- Competitive Product Substitutes: Alternative vacation options such as hotels, resorts, and Airbnb compete for market share. However, the unique appeal of camping – nature immersion, affordability, and flexibility – continues to attract a large and growing customer base.

- End-User Demographics: The market caters to a diverse demographic, including families, couples, and adventure travelers. Growing interest in outdoor activities and sustainable tourism is driving demand.

- M&A Trends: As seen with ECG's recent acquisition, M&A activity is a significant trend, driven by the pursuit of economies of scale, geographic expansion, and brand diversification. The number of M&A deals recorded between 2019 and 2024 was approximately xx, with a total value of xx Million units.

Europe Camping and Caravanning Market Growth Trends & Insights

The European camping and caravanning market has demonstrated robust and consistent expansion over the historical period (2019-2024). This upward trajectory is fueled by a confluence of advantageous factors, including rising disposable incomes, a pronounced surge in consumer preference for outdoor recreational pursuits, and an increasing embrace of sustainable and eco-conscious tourism. Projections indicate that the market will sustain a healthy Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This anticipated growth will be propelled by both organic market expansion and strategic consolidations, exemplified by significant mergers such as the ECG-Vacanceselect integration. Furthermore, technological advancements are playing a pivotal role; innovations in recreational vehicle (RV) technology and the widespread availability of mobile applications for seamless campsite booking and access to essential information are actively contributing to market dynamism. A discernible shift in consumer behavior is evident, with a marked increase in the adoption of online booking channels, fundamentally reshaping the way campers plan and secure their travel experiences. Since 2019, market penetration for camping and caravanning has increased by an impressive XX%, with further substantial growth anticipated in the ensuing years.

Dominant Regions, Countries, or Segments in Europe Camping and Caravanning Market

Germany, France, and the United Kingdom stand out as the principal national markets within the European camping and caravanning sector. These leading nations benefit from highly developed camping infrastructures, thriving tourism industries, and a substantial segment of their populations possessing high disposable incomes. Concurrently, other nations within the "Rest of Europe" classification are exhibiting considerable growth potential, spurred by burgeoning tourism and ongoing infrastructure development.

By Destination Type: Privately owned campgrounds continue to lead the market, distinguished by their wide array of amenities and comprehensive services. However, State or National Park Campgrounds are offering a distinct and increasingly sought-after experience, demonstrating strong growth trajectories.

By Type of Camper: RV camping and car camping represent the most significant segments, largely due to their inherent convenience and cost-effectiveness. Nevertheless, backpacking is steadily gaining traction, particularly among enthusiasts seeking more adventurous outdoor experiences.

By Distribution Channel: Online Travel Agencies (OTAs) are rapidly augmenting their market share, mirroring the broader industry trend towards digital booking platforms. Despite this shift, direct sales channels remain highly relevant, especially for established campground operators and service providers.

Key Drivers:

- Resilient Domestic Tourism: The increased inclination towards "staycations" and local travel, a trend significantly amplified in the post-pandemic era, is providing a substantial boost to the market.

- Enhanced Infrastructure: Continuous investment in the development of new campsites and the modernization of existing facilities are collectively elevating the overall quality and appeal of the camping experience across Europe.

- Supportive Government Policies: Proactive tourism-focused strategies and initiatives implemented by various European governments, aimed at promoting and facilitating outdoor recreation, are acting as significant catalysts for market growth in numerous countries.

Dominance Factors:

- Market Share: Germany, France, and the UK currently command the largest portions of the market due to their well-established tourism infrastructure and the high purchasing power of their populations.

- Growth Potential: The "Rest of Europe" segment is poised for substantial growth, driven by the escalating popularity of eco-tourism and adventurous outdoor activities, offering promising new avenues for expansion.

Europe Camping and Caravanning Market Product Landscape

The camping and caravanning product landscape is constantly evolving, encompassing various types of RVs, caravans, tents, and related equipment. Innovations focus on improving comfort, convenience, and sustainability. Lightweight and compact designs are gaining popularity, catering to a broader range of users. Technological advancements, including integrated smart systems and solar power solutions, enhance the overall camping experience, while eco-friendly materials are increasingly being used in manufacturing. The unique selling propositions of different products range from luxury features in high-end RVs to affordability and ease of use in smaller, more basic camping equipment.

Key Drivers, Barriers & Challenges in Europe Camping and Caravanning Market

Key Drivers:

- Rising disposable incomes: Increased purchasing power allows more people to afford camping and caravanning trips.

- Growing interest in outdoor recreation: A shift towards healthier lifestyles and a desire for nature-based experiences drives demand.

- Government support for tourism: Various government initiatives support the growth of the tourism industry, including camping.

Key Challenges:

- Seasonality: The market is heavily influenced by seasonal variations in weather conditions, impacting demand and profitability.

- Supply chain disruptions: Global events, like the COVID-19 pandemic, can significantly impact the availability of essential camping equipment.

- Competition from other travel options: Alternative accommodation options, such as hotels and vacation rentals, compete for tourist spending.

Emerging Opportunities in Europe Camping and Caravanning Market

- Glamping Expansion: The burgeoning popularity of "glamorous camping" presents lucrative opportunities for operators to offer premium, high-end camping experiences that cater to a discerning clientele.

- Sustainable and Eco-Tourism Integration: The growing demand for environmentally responsible travel is driving the importance of eco-friendly camping practices and certifications, attracting a significant segment of environmentally conscious travelers.

- Technological Integration and Smart Camping: The adoption of smart camping technologies, including advanced app-based reservation systems, digital check-ins, and in-campsite amenity control via mobile devices, promises to enhance convenience and operational efficiency for both campers and providers.

- Wellness and Nature Retreats: An increasing focus on mental well-being and a desire for connection with nature are creating opportunities for specialized camping experiences that combine outdoor activities with wellness programs.

- Targeted Niche Markets: Developing specialized offerings for specific demographics, such as families with young children, solo female travelers, or digital nomads, can unlock new revenue streams and cater to evolving travel preferences.

Growth Accelerators in the Europe Camping and Caravanning Market Industry

Long-term growth in the European camping and caravanning market will be driven by several key factors. Technological advancements such as the development of more sustainable and technologically advanced RVs and camping gear will continue to fuel demand. Strategic partnerships between camping operators and technology providers will enhance the overall camper experience, while expansion into new markets and untapped demographics will further increase market penetration. The growing emphasis on sustainable and responsible tourism will also drive innovation and investment in the sector.

Key Players Shaping the Europe Camping and Caravanning Market Market

- Kabe AB

- Camping and Caravanning Club

- Soliferpolar AB

- Groupe Pilote

- Trigano SA

- Swift Group

- Canvas Holidays

- Adria Mobil

- Eurocamp

- Laika Caravans

Notable Milestones in Europe Camping and Caravanning Market Sector

- January 2023: The European Camping Group (ECG) successfully acquired the Vacanceselect Group, a strategic move that significantly broadened ECG's campsite portfolio and market reach across Europe.

- June 2022: The Camping and Caravanning Club invested in and opened two extensively refurbished club sites in England, substantially increasing their capacity and significantly enhancing the overall camping experience for their members.

- Late 2023: Several leading campground operators launched innovative mobile applications featuring enhanced booking capabilities, real-time availability updates, and personalized recommendations, further solidifying the digital transformation of the market.

In-Depth Europe Camping and Caravanning Market Market Outlook

The outlook for the European camping and caravanning market remains exceptionally positive and promising. Continued robust growth is anticipated, propelled by ongoing technological innovations, the formation of strategic partnerships and collaborations, and a sustained and deepening preference for outdoor recreational activities among a broad consumer base. The industry's commitment to sustainable tourism will continue to be a defining characteristic, driving significant investments in eco-friendly infrastructure, practices, and products. This evolving landscape presents a wealth of opportunities for both established market leaders and agile new entrants, particularly in regions and segments identified for their high growth potential. Strategic acquisitions, mergers, and well-executed expansions into emerging markets will be critical determinants in shaping the future trajectory and competitive dynamics of the European camping and caravanning industry.

Europe Camping and Caravanning Market Segmentation

-

1. Destination Type

- 1.1. State or National Park Campgrounds

- 1.2. Privately Owned Campgrounds

- 1.3. Public o

- 1.4. Backcountry, National Forest or Wilderness Areas

- 1.5. Parking Lots

- 1.6. Others

-

2. Type of Camper

- 2.1. Car Camping

- 2.2. RV Camping

- 2.3. Backpacking

- 2.4. Others

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Online Travel Agencies

- 3.3. Traditional Travel Agencies

Europe Camping and Caravanning Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Camping and Caravanning Market Regional Market Share

Geographic Coverage of Europe Camping and Caravanning Market

Europe Camping and Caravanning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Growth of RV Camping is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination Type

- 5.1.1. State or National Park Campgrounds

- 5.1.2. Privately Owned Campgrounds

- 5.1.3. Public o

- 5.1.4. Backcountry, National Forest or Wilderness Areas

- 5.1.5. Parking Lots

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type of Camper

- 5.2.1. Car Camping

- 5.2.2. RV Camping

- 5.2.3. Backpacking

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Online Travel Agencies

- 5.3.3. Traditional Travel Agencies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Destination Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kabe AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Camping and Caravanning Club

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Soliferpolar AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Groupe Pilote

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trigano SA*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Swift Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canvas Holidays

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Adria Mobil

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eurocamp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Laika Caravans

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kabe AB

List of Figures

- Figure 1: Europe Camping and Caravanning Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Camping and Caravanning Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 2: Europe Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 3: Europe Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Camping and Caravanning Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 6: Europe Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 7: Europe Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Europe Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Camping and Caravanning Market?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the Europe Camping and Caravanning Market?

Key companies in the market include Kabe AB, Camping and Caravanning Club, Soliferpolar AB, Groupe Pilote, Trigano SA*List Not Exhaustive, Swift Group, Canvas Holidays, Adria Mobil, Eurocamp, Laika Caravans.

3. What are the main segments of the Europe Camping and Caravanning Market?

The market segments include Destination Type, Type of Camper, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Growth of RV Camping is Driving the Market.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

January 2023: European Camping Group (ECG) acquired Vacanceselect Group, with the deal set to more than triple its campsite portfolio to 500 destinations across France, Italy, Spain, Croatia, and The Netherlands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Camping and Caravanning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Camping and Caravanning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Camping and Caravanning Market?

To stay informed about further developments, trends, and reports in the Europe Camping and Caravanning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence