Key Insights

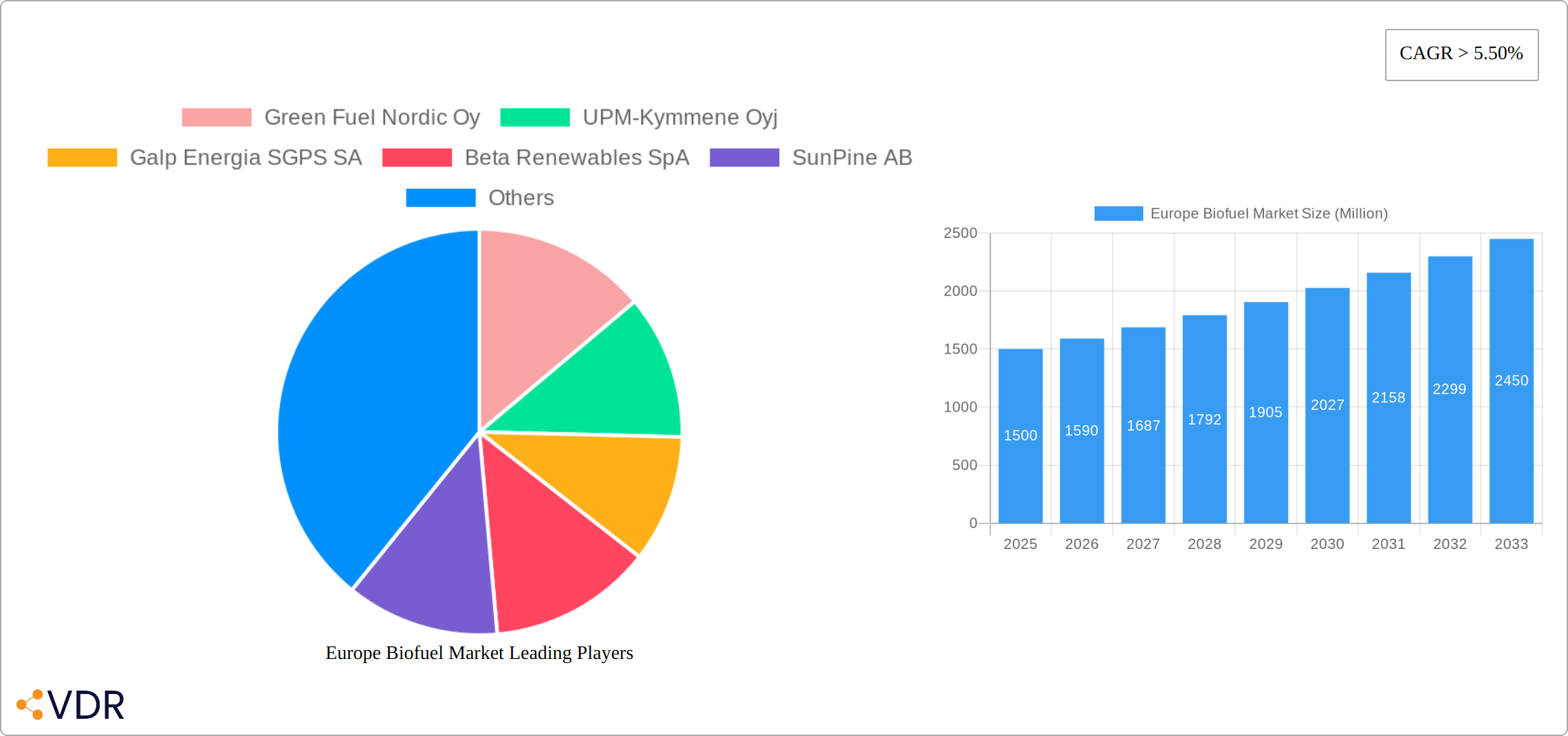

The European biofuel market, valued at approximately €XX million in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 5.5% from 2025 to 2033. This surge is driven primarily by stringent government regulations aimed at reducing greenhouse gas emissions from the transportation sector and increasing the adoption of renewable energy sources across Europe. The increasing awareness of climate change and consumer preference for sustainable alternatives further fuel market expansion. Major drivers include supportive government policies like biofuel mandates and subsidies, coupled with technological advancements leading to cost-effective biofuel production. Key feedstock sources are coarse grains, sugar crops, and vegetable oils, with biodiesel and ethanol dominating the product type segment. Germany, France, and the UK represent significant regional markets, benefitting from established infrastructure and supportive policies. However, challenges remain, including fluctuating feedstock prices, land-use competition, and the potential for indirect land use change (ILUC) effects.

Despite these restraints, the long-term outlook for the European biofuel market remains positive. Growth will be spurred by ongoing innovations in feedstock technology and biofuel processing, along with diversification into advanced biofuels derived from sustainable sources such as algae and waste biomass. Furthermore, the increasing integration of biofuels into existing fuel infrastructure and the development of sustainable supply chains will contribute to market expansion. Companies like Green Fuel Nordic Oy, UPM-Kymmene Oyj, and Galp Energia SGPS SA are key players driving innovation and shaping the market landscape. The market's future success hinges on addressing the environmental and economic sustainability challenges associated with biofuel production while continuing to meet the growing demand for cleaner transportation fuels. Further research into second-generation biofuels and technological advancements to reduce production costs will be critical in realizing the full potential of this expanding market.

Europe Biofuel Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe biofuel market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers and barriers, emerging opportunities, growth accelerators, key players, notable milestones, and a detailed market outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report uses data from the historical period (2019-2024) and forecasts the market from 2025-2033. The market is segmented by feedstock (coarse grain, sugar crop, vegetable oil, other feedstocks) and type (biodiesel, ethanol, other types). The report's analysis is crucial for businesses operating within the parent renewable energy market and the child biofuel market. Market values are presented in million units.

Europe Biofuel Market Dynamics & Structure

The European biofuel market is characterized by moderate concentration, with several major players alongside numerous smaller regional producers. Technological innovation, driven by the need for more efficient and sustainable production methods, is a key market driver. Stringent environmental regulations, including the Renewable Energy Directive (RED II), significantly shape market development. The market faces competition from traditional fossil fuels, but increasing concerns about climate change are boosting biofuel adoption. Furthermore, mergers and acquisitions (M&A) activity is prevalent, as larger companies seek to expand their market share and diversify their feedstock sources. The xx M&A deals recorded in the past five years indicate a consolidated market trend.

- Market Concentration: Moderately concentrated, with a few dominant players holding xx% market share.

- Technological Innovation: Focus on improving feedstock efficiency, reducing production costs, and enhancing biofuel quality.

- Regulatory Framework: Stringent environmental regulations driving market growth but also creating compliance challenges.

- Competitive Substitutes: Fossil fuels pose a significant threat, although growing environmental awareness is shifting demand.

- End-User Demographics: Primarily transportation (xx%), power generation (xx%), and industrial applications (xx%).

- M&A Trends: A growing number of acquisitions to expand capacity and diversify feedstock sources.

Europe Biofuel Market Growth Trends & Insights

The European biofuel market is experiencing robust growth, fueled by several key factors. Rising energy demand, coupled with increasingly stringent environmental regulations aimed at reducing greenhouse gas emissions, are primary drivers. Growing consumer awareness of climate change and a preference for sustainable transportation options further bolster market expansion. The market reached a valuation of xx million units in 2024, demonstrating a compound annual growth rate (CAGR) of xx% between 2019 and 2024. This positive trajectory is expected to continue, with a projected CAGR of xx% from 2025 to 2033, leading to an estimated market size of xx million units by 2033. Technological advancements play a crucial role, with improvements in feedstock processing and conversion technologies enhancing production efficiency and lowering costs. However, challenges persist, including securing a stable supply of feedstock and managing fluctuations in raw material prices. Government incentives and subsidies are vital in stimulating market growth, supporting technological innovation, and ensuring the long-term viability of the biofuel sector. This comprehensive analysis incorporates detailed macroeconomic forecasts and in-depth government policy analysis to provide a balanced and reliable market projection.

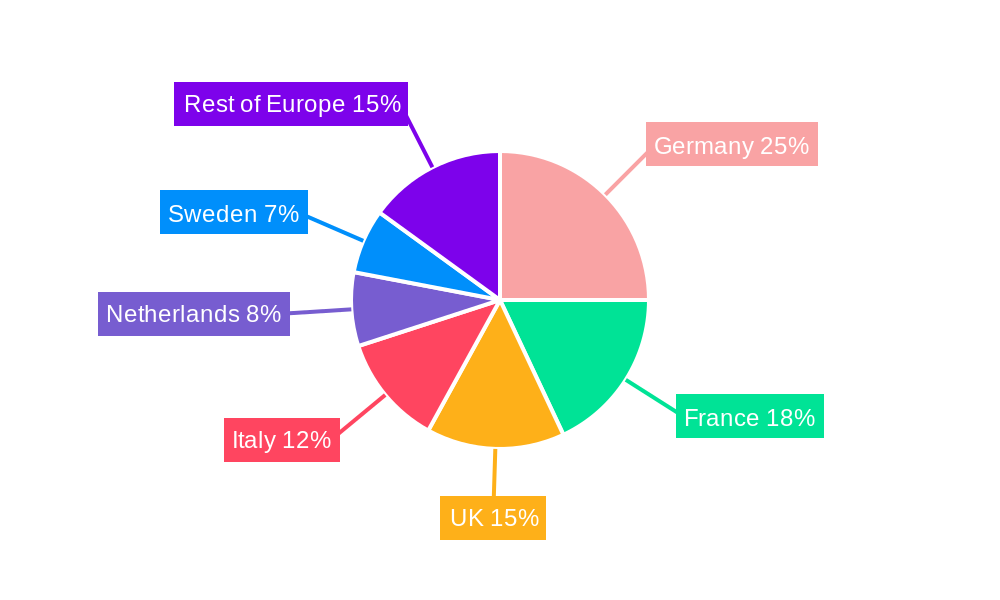

Dominant Regions, Countries, or Segments in Europe Biofuel Market

Germany, France, and the United Kingdom are currently the leading nations within the European biofuel market, collectively accounting for xx% of the total market share. This dominance is attributed to several factors including the establishment of robust national biofuel policies, the development of well-established supporting infrastructure, and a relatively high level of consumer acceptance of renewable energy solutions. In terms of product segments, biodiesel currently holds the largest market share at xx%, followed by ethanol at xx%. Regarding feedstock sources, vegetable oil maintains its position as the most prevalent, representing xx% of the market share due to readily available supplies and established processing infrastructure. However, the coarse grain segment is poised for significant growth in the coming years, driven by its potential for cost-effective biofuel production and recent advancements in efficient conversion technologies.

- Key Drivers:

- Supportive government policies and substantial financial incentives.

- A mature and well-established infrastructure for both production and distribution.

- A growing consumer base demonstrating increasing awareness of environmental issues and a strong preference for sustainable solutions.

- Dominance Factors:

- Existing, substantial production capacity and efficient, reliable supply chains.

- Favorable regulatory environments and consistent government support.

- Strong consumer demand driven by environmental concerns and a desire for sustainable alternatives.

Europe Biofuel Market Product Landscape

The European biofuel market showcases a diverse array of products. This includes biodiesel derived from various feedstocks such as rapeseed oil and used cooking oil, alongside ethanol produced from sugar crops and grains. Recent innovations are focused on enhancing several key aspects of biofuel production. These improvements target fuel properties, yield optimization, and minimizing environmental impact. The development of advanced biofuels from non-food sources like algae represents a significant growth opportunity for the industry. A significant number of companies are actively engaged in optimizing biofuel production processes to achieve greater cost efficiency and improved environmental performance.

Key Drivers, Barriers & Challenges in Europe Biofuel Market

Key Drivers:

- Increasing demand for renewable energy due to environmental concerns and energy security strategies.

- Stringent government regulations promoting biofuel adoption to meet emission reduction targets.

- Advancements in biofuel production technologies and feedstock utilization.

Key Barriers and Challenges:

- Fluctuations in feedstock prices and availability. This can lead to xx% cost variations.

- Competition from fossil fuels, particularly in terms of pricing.

- Regulatory complexities and varying standards across different European countries.

Emerging Opportunities in Europe Biofuel Market

The market presents several promising opportunities:

- Expansion into new feedstock sources, including agricultural residues and waste biomass.

- Development and commercialization of advanced biofuels with enhanced performance and reduced environmental impact.

- Increasing integration of biofuel production with other renewable energy sources to create synergistic solutions.

Growth Accelerators in the Europe Biofuel Market Industry

Several factors are poised to drive long-term market growth, including technological advancements that improve efficiency and reduce production costs, strategic partnerships and collaborations between energy companies and agricultural producers, and the ongoing expansion of biofuel infrastructure across Europe. Government policies and incentives also play a crucial role, encouraging the adoption of biofuels and supporting research and development activities. This combination of factors ensures the market's future sustainability and growth.

Key Players Shaping the Europe Biofuel Market Market

- Green Fuel Nordic Oy

- UPM-Kymmene Oyj

- Galp Energia SGPS SA

- Beta Renewables SpA

- SunPine AB

- Preem AB

- Svenska Cellulosa AB

- Borregaard ASA

- Biomethanol Chemie Nederland BV

Notable Milestones in Europe Biofuel Market Sector

- March 2022: Rossi Biofuel Zrt. inaugurated a new biodiesel plant in Hungary, increasing its annual production capacity by 60,000 tons.

- January 2022: Liebherr announced increased use of Neste MY Renewable Diesel in its German plant.

- January 2022: Repsol SA selected Honeywell Technologies to supply an ICSS for its new biofuel plant in Spain.

In-Depth Europe Biofuel Market Market Outlook

The future of the European biofuel market appears promising, driven by continued technological innovation, supportive government policies, and growing consumer demand for sustainable energy solutions. Strategic partnerships and investments in new feedstock sources will be crucial for maintaining market growth and ensuring the long-term sustainability of biofuel production. The market is expected to witness significant expansion, with opportunities for both established players and new entrants to capitalize on the growing demand for environmentally friendly transportation fuels and industrial applications.

Europe Biofuel Market Segmentation

-

1. Type

- 1.1. Biodiesel

- 1.2. Ethanol

- 1.3. Other Types

-

2. Feedstock

- 2.1. Coarse Grain

- 2.2. Sugar Crop

- 2.3. Vegetable Oil

- 2.4. Other Feedstocks

Europe Biofuel Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Rest of Europe

Europe Biofuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa

- 3.4. Market Trends

- 3.4.1. Biodiesel is Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Biodiesel

- 5.1.2. Ethanol

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Feedstock

- 5.2.1. Coarse Grain

- 5.2.2. Sugar Crop

- 5.2.3. Vegetable Oil

- 5.2.4. Other Feedstocks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Biodiesel

- 6.1.2. Ethanol

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Feedstock

- 6.2.1. Coarse Grain

- 6.2.2. Sugar Crop

- 6.2.3. Vegetable Oil

- 6.2.4. Other Feedstocks

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Biodiesel

- 7.1.2. Ethanol

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Feedstock

- 7.2.1. Coarse Grain

- 7.2.2. Sugar Crop

- 7.2.3. Vegetable Oil

- 7.2.4. Other Feedstocks

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Biodiesel

- 8.1.2. Ethanol

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Feedstock

- 8.2.1. Coarse Grain

- 8.2.2. Sugar Crop

- 8.2.3. Vegetable Oil

- 8.2.4. Other Feedstocks

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Biodiesel

- 9.1.2. Ethanol

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Feedstock

- 9.2.1. Coarse Grain

- 9.2.2. Sugar Crop

- 9.2.3. Vegetable Oil

- 9.2.4. Other Feedstocks

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Germany Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 11. France Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Green Fuel Nordic Oy

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 UPM-Kymmene Oyj

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Galp Energia SGPS SA

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Beta Renewables SpA

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 SunPine AB

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Preem AB

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Svenska Cellulosa AB

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Borregaard ASA*List Not Exhaustive

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Biomethanol Chemie Nederland BV

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 Green Fuel Nordic Oy

List of Figures

- Figure 1: Europe Biofuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Biofuel Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Biofuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 4: Europe Biofuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 15: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 18: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 21: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 24: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biofuel Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Europe Biofuel Market?

Key companies in the market include Green Fuel Nordic Oy, UPM-Kymmene Oyj, Galp Energia SGPS SA, Beta Renewables SpA, SunPine AB, Preem AB, Svenska Cellulosa AB, Borregaard ASA*List Not Exhaustive, Biomethanol Chemie Nederland BV.

3. What are the main segments of the Europe Biofuel Market?

The market segments include Type, Feedstock.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems.

6. What are the notable trends driving market growth?

Biodiesel is Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa.

8. Can you provide examples of recent developments in the market?

March 2022: Rossi Biofuel Zrt, a subsidiary of the ENVIEN Group, inaugurated a new biodiesel plant in Hungary. This plant was built by BDI-BioEnergy International GmbH. The facility is a multi-feedstock plant in Komárom, Hungary. The new plant has a capacity of 60,000 tons per annum, and thus, the total biodiesel production capacity of the company has increased from 150,000 to 210,000 tons per annum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biofuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biofuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biofuel Market?

To stay informed about further developments, trends, and reports in the Europe Biofuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence