Key Insights

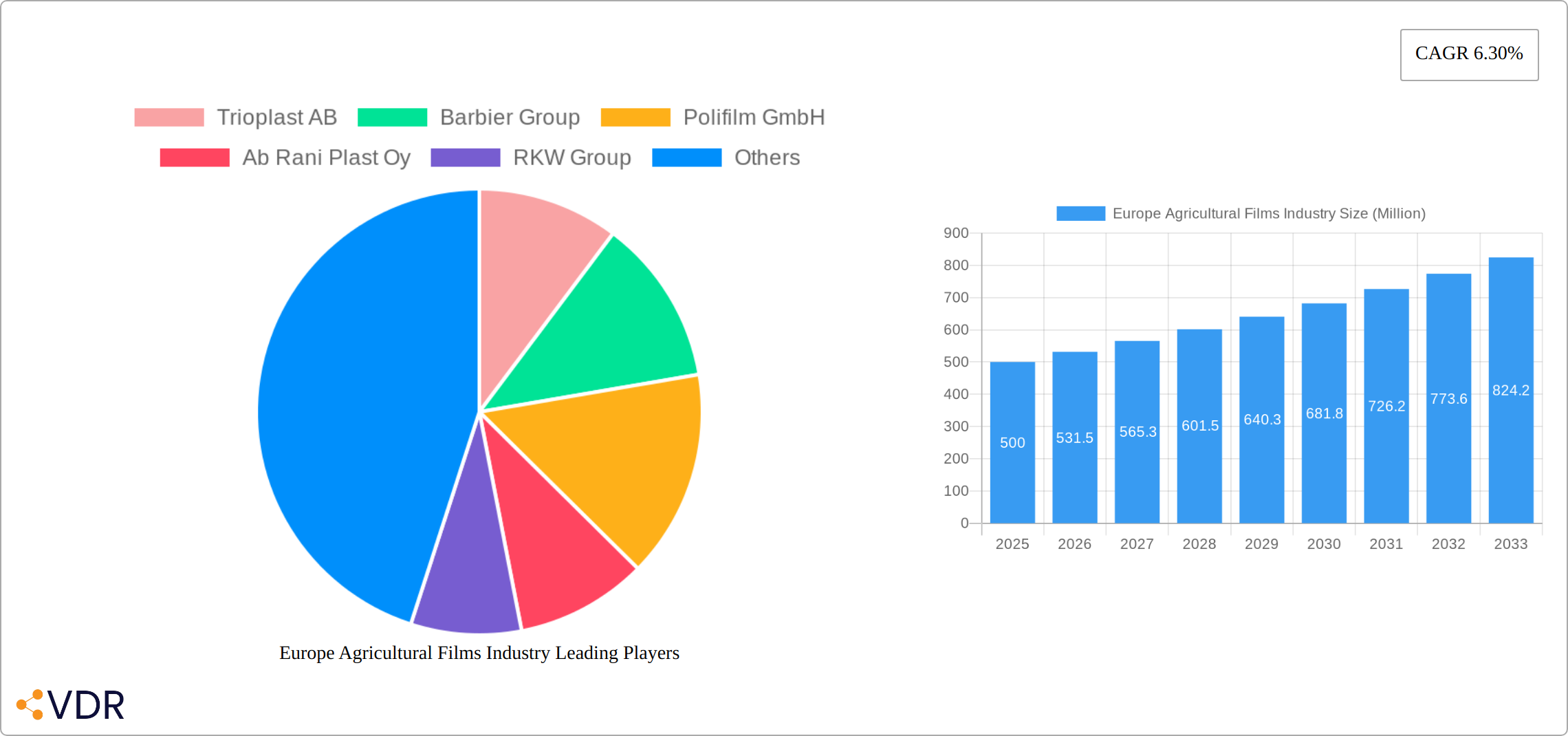

The European agricultural films market, valued at approximately €[Estimate based on market size XX and assuming XX is in millions of Euros – e.g., €500 million] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of modern agricultural practices, particularly greenhouse cultivation and precision farming, necessitates the use of specialized films for optimal crop yield and protection against environmental stressors. Furthermore, rising consumer demand for fresh produce throughout the year fuels the need for climate-controlled environments facilitated by agricultural films. Specific applications like silage film, which enhances feed preservation and reduces waste, are also contributing significantly to market growth. The prevalent use of polyethylene-based films, encompassing low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), and high-density polyethylene (HDPE), underlines the material's versatility and cost-effectiveness in various agricultural applications. Leading players like Trioplast AB, Barbier Group, and Berry Global are investing in innovation to improve film durability, UV resistance, and biodegradability, catering to evolving environmental concerns.

However, market growth faces certain constraints. Fluctuations in raw material prices, particularly crude oil, impact production costs and profitability. Stringent environmental regulations regarding plastic waste management also pose challenges for manufacturers. To navigate these constraints, companies are focusing on developing recyclable and biodegradable film alternatives, while simultaneously optimizing production processes to minimize environmental impact. Regional variations exist within Europe, with countries like Germany, France, and the United Kingdom leading the market due to their extensive agricultural sectors and advanced farming techniques. The forecast period (2025-2033) anticipates continued growth, shaped by technological advancements, sustainable material adoption, and evolving agricultural practices. Growth will be particularly significant in segments focusing on innovative, environmentally-friendly materials and solutions.

Europe Agricultural Films Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Agricultural Films market, covering the period 2019-2033, with a focus on 2025. It delves into market dynamics, growth trends, dominant segments (including Greenhouse, Silage, Mulching films and Low-Density Polyethylene, Linear Low-Density Polyethylene, High-Density Polyethylene types), key players, and future opportunities within the agricultural plastic films sector. The report is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this evolving market.

Europe Agricultural Films Industry Market Dynamics & Structure

The European agricultural films market exhibits a moderately concentrated structure, with key players like Trioplast AB, Barbier Group, and Polifilm GmbH holding significant market share (estimated xx% combined in 2025). Technological innovation, particularly in biodegradable and bio-based films, is a key driver. However, high R&D costs and regulatory hurdles present significant barriers to entry. Stringent environmental regulations across Europe are shaping the market, pushing manufacturers towards more sustainable solutions. Competitive substitutes, such as traditional mulching methods, remain prevalent, especially in smaller farms. The end-user demographic is predominantly comprised of large-scale agricultural businesses and farming cooperatives. M&A activity has been moderate in recent years (xx deals in 2019-2024), reflecting consolidation efforts within the industry.

- Market Concentration: Moderately concentrated, with top 3 players holding xx% market share in 2025.

- Technological Innovation: Driven by biodegradable and bio-based film development, but hindered by high R&D costs.

- Regulatory Framework: Stringent environmental regulations promoting sustainable solutions.

- Competitive Substitutes: Traditional mulching methods, posing a challenge to market penetration.

- End-User Demographics: Primarily large-scale agricultural businesses and cooperatives.

- M&A Trends: Moderate activity (xx deals from 2019-2024), indicating industry consolidation.

Europe Agricultural Films Industry Growth Trends & Insights

The European agricultural films market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to rising agricultural output, increasing adoption of modern farming techniques, and favorable government policies supporting agricultural modernization. The market is expected to continue its growth trajectory during the forecast period (2025-2033), reaching an estimated value of xx Million units by 2033. This growth will be fueled by factors such as the increasing demand for high-yield crops, the growing awareness of the benefits of agricultural films (e.g., improved crop yield and water conservation), and technological advancements leading to improved product quality and durability. Market penetration remains relatively high in major agricultural regions, but untapped potential exists in smaller farming communities. Consumer behavior shifts towards environmentally friendly products are driving demand for biodegradable alternatives.

Dominant Regions, Countries, or Segments in Europe Agricultural Films Industry

Western European countries, particularly France, Germany, and Spain, are the dominant regions in the European agricultural films market, owing to their large agricultural sectors and high adoption of advanced farming practices. The Greenhouse film segment commands the largest market share (xx% in 2025), driven by the increasing popularity of greenhouse farming in these regions. Furthermore, the demand for Low-Density Polyethylene (LDPE) films remains high due to its cost-effectiveness and versatility.

- Key Drivers in Western Europe:

- Large agricultural sector

- High adoption of advanced farming techniques

- Favorable government support for agricultural modernization

- Dominant Segments:

- Greenhouse films (xx% market share in 2025)

- LDPE films (xx% market share in 2025)

- Growth Potential: Significant potential in Eastern European countries as agricultural practices modernize.

Europe Agricultural Films Industry Product Landscape

The European agricultural films market offers a diverse range of products, including LDPE, LLDPE, and HDPE films, each tailored to specific applications. Innovations focus on improving film durability, UV resistance, and biodegradability. Unique selling propositions include enhanced water retention properties, improved weed control, and optimized light transmission. Technological advancements incorporate additives to enhance film performance and longevity.

Key Drivers, Barriers & Challenges in Europe Agricultural Films Industry

Key Drivers: Growing demand for food security, increasing adoption of protected cultivation techniques (greenhouses), and government incentives promoting sustainable agriculture.

Challenges: Fluctuations in raw material prices (e.g., crude oil), stringent environmental regulations, and increasing competition from biodegradable alternatives. The impact of raw material price volatility on profitability is estimated to be xx% in 2025.

Emerging Opportunities in Europe Agricultural Films Industry

Emerging opportunities lie in the increasing demand for biodegradable and compostable films, the expansion into the organic farming sector, and the development of smart films with integrated sensors for precision agriculture.

Growth Accelerators in the Europe Agricultural Films Industry Industry

Strategic partnerships between film manufacturers and agricultural technology companies, coupled with investments in R&D for sustainable and technologically advanced films, are key growth accelerators. Market expansion into Eastern European countries presents significant potential.

Key Players Shaping the Europe Agricultural Films Industry Market

- Trioplast AB

- Barbier Group

- Polifilm GmbH

- Ab Rani Plast Oy

- RKW Group

- BASF

- Berry Global

- Luigi Bandera SpA

- Duo Plast AG

Notable Milestones in Europe Agricultural Films Industry Sector

- 2021: Introduction of a new biodegradable film by Trioplast AB.

- 2022: Merger between two smaller agricultural film manufacturers in France.

- 2023: Launch of a smart film with integrated sensors by a leading German company (xx).

In-Depth Europe Agricultural Films Industry Market Outlook

The European agricultural films market is poised for continued growth, driven by the increasing demand for sustainable solutions and the advancement of precision agriculture techniques. Strategic investments in R&D, focusing on biodegradable and smart films, will be crucial for success. The market presents lucrative opportunities for both established players and new entrants who can offer innovative, sustainable, and technologically advanced products.

Europe Agricultural Films Industry Segmentation

-

1. Type

- 1.1. Low-Density Polyethylene

- 1.2. Linear Low-Density Polyethylene

- 1.3. High-Density Polyethylene

- 1.4. Others

-

2. Application

- 2.1. Greenhouse

- 2.2. Silage

- 2.3. Mulching

- 2.4. Others

-

3. Type

- 3.1. Low-Density Polyethylene

- 3.2. Linear Low-Density Polyethylene

- 3.3. High-Density Polyethylene

- 3.4. Others

-

4. Application

- 4.1. Greenhouse

- 4.2. Silage

- 4.3. Mulching

- 4.4. Others

Europe Agricultural Films Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

Europe Agricultural Films Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Horticulture Industry Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Low-Density Polyethylene

- 5.1.2. Linear Low-Density Polyethylene

- 5.1.3. High-Density Polyethylene

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Greenhouse

- 5.2.2. Silage

- 5.2.3. Mulching

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Low-Density Polyethylene

- 5.3.2. Linear Low-Density Polyethylene

- 5.3.3. High-Density Polyethylene

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Greenhouse

- 5.4.2. Silage

- 5.4.3. Mulching

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.5.2. United Kingdom

- 5.5.3. France

- 5.5.4. Spain

- 5.5.5. Italy

- 5.5.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Low-Density Polyethylene

- 6.1.2. Linear Low-Density Polyethylene

- 6.1.3. High-Density Polyethylene

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Greenhouse

- 6.2.2. Silage

- 6.2.3. Mulching

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Low-Density Polyethylene

- 6.3.2. Linear Low-Density Polyethylene

- 6.3.3. High-Density Polyethylene

- 6.3.4. Others

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Greenhouse

- 6.4.2. Silage

- 6.4.3. Mulching

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Low-Density Polyethylene

- 7.1.2. Linear Low-Density Polyethylene

- 7.1.3. High-Density Polyethylene

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Greenhouse

- 7.2.2. Silage

- 7.2.3. Mulching

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Low-Density Polyethylene

- 7.3.2. Linear Low-Density Polyethylene

- 7.3.3. High-Density Polyethylene

- 7.3.4. Others

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Greenhouse

- 7.4.2. Silage

- 7.4.3. Mulching

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Low-Density Polyethylene

- 8.1.2. Linear Low-Density Polyethylene

- 8.1.3. High-Density Polyethylene

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Greenhouse

- 8.2.2. Silage

- 8.2.3. Mulching

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Low-Density Polyethylene

- 8.3.2. Linear Low-Density Polyethylene

- 8.3.3. High-Density Polyethylene

- 8.3.4. Others

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Greenhouse

- 8.4.2. Silage

- 8.4.3. Mulching

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Spain Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Low-Density Polyethylene

- 9.1.2. Linear Low-Density Polyethylene

- 9.1.3. High-Density Polyethylene

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Greenhouse

- 9.2.2. Silage

- 9.2.3. Mulching

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Low-Density Polyethylene

- 9.3.2. Linear Low-Density Polyethylene

- 9.3.3. High-Density Polyethylene

- 9.3.4. Others

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Greenhouse

- 9.4.2. Silage

- 9.4.3. Mulching

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Low-Density Polyethylene

- 10.1.2. Linear Low-Density Polyethylene

- 10.1.3. High-Density Polyethylene

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Greenhouse

- 10.2.2. Silage

- 10.2.3. Mulching

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Low-Density Polyethylene

- 10.3.2. Linear Low-Density Polyethylene

- 10.3.3. High-Density Polyethylene

- 10.3.4. Others

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Greenhouse

- 10.4.2. Silage

- 10.4.3. Mulching

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Europe Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Low-Density Polyethylene

- 11.1.2. Linear Low-Density Polyethylene

- 11.1.3. High-Density Polyethylene

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Greenhouse

- 11.2.2. Silage

- 11.2.3. Mulching

- 11.2.4. Others

- 11.3. Market Analysis, Insights and Forecast - by Type

- 11.3.1. Low-Density Polyethylene

- 11.3.2. Linear Low-Density Polyethylene

- 11.3.3. High-Density Polyethylene

- 11.3.4. Others

- 11.4. Market Analysis, Insights and Forecast - by Application

- 11.4.1. Greenhouse

- 11.4.2. Silage

- 11.4.3. Mulching

- 11.4.4. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Germany Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Agricultural Films Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Trioplast AB

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Barbier Group

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Polifilm GmbH

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Ab Rani Plast Oy

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 RKW Group

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 BASF

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Berry Global

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Luigi Bandera Sp

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Duo Plast AG

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.1 Trioplast AB

List of Figures

- Figure 1: Europe Agricultural Films Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Agricultural Films Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Agricultural Films Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Europe Agricultural Films Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Europe Agricultural Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Europe Agricultural Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Europe Agricultural Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italy Europe Agricultural Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Europe Agricultural Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherlands Europe Agricultural Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Sweden Europe Agricultural Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Europe Agricultural Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Europe Agricultural Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Europe Agricultural Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Europe Agricultural Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Europe Agricultural Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Europe Agricultural Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 41: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Europe Agricultural Films Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 43: Europe Agricultural Films Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Europe Agricultural Films Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Agricultural Films Industry?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Europe Agricultural Films Industry?

Key companies in the market include Trioplast AB, Barbier Group, Polifilm GmbH, Ab Rani Plast Oy, RKW Group, BASF, Berry Global, Luigi Bandera Sp, Duo Plast AG.

3. What are the main segments of the Europe Agricultural Films Industry?

The market segments include Type, Application, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Horticulture Industry Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Agricultural Films Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Agricultural Films Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Agricultural Films Industry?

To stay informed about further developments, trends, and reports in the Europe Agricultural Films Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence