Key Insights

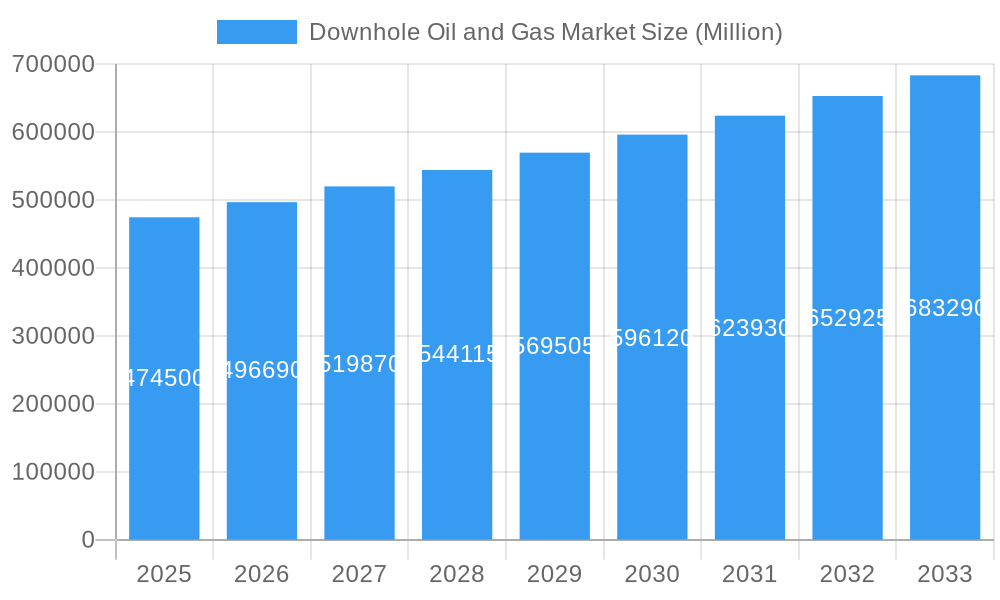

The global Downhole Oil and Gas Market is poised for robust expansion, projected to reach an estimated $474.5 billion in 2025. This growth is driven by increasing global energy demand, necessitating sustained exploration and production activities. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. Key market drivers include the ongoing need to replenish dwindling oil and gas reserves, advancements in drilling technologies that enhance efficiency and reach, and the development of unconventional resources such as shale oil and gas. The growing complexity of reservoir extraction further fuels the demand for sophisticated downhole tools and services. Consequently, companies are investing heavily in innovative solutions for improved reservoir characterization, wellbore integrity, and production optimization.

Downhole Oil and Gas Market Market Size (In Billion)

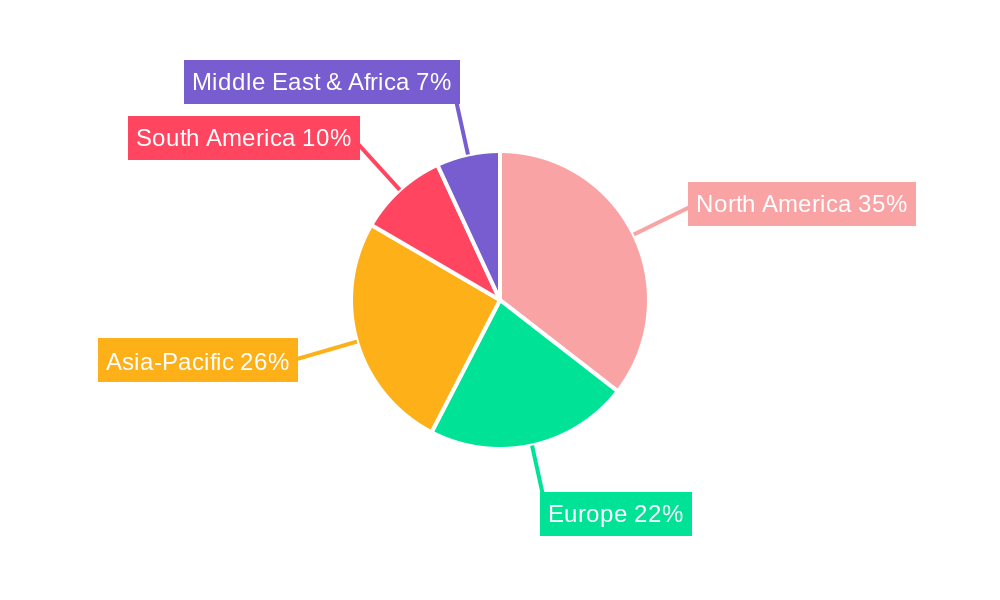

The market's expansion will be further shaped by critical trends such as the integration of digital technologies, including AI and IoT, for real-time monitoring and predictive maintenance of downhole equipment. This digital transformation is crucial for improving operational efficiency and reducing downtime. Geographically, North America is anticipated to maintain a significant market share due to its substantial unconventional resource base and advanced technological infrastructure. Asia-Pacific is expected to exhibit the fastest growth, fueled by increasing energy consumption and the exploration of new oil and gas fields. However, the market faces restraints such as stringent environmental regulations, volatility in crude oil prices which can impact exploration budgets, and the increasing focus on renewable energy sources. Nevertheless, the essential role of oil and gas in the global energy mix, coupled with technological innovations, underpins a positive outlook for the Downhole Oil and Gas Market.

Downhole Oil and Gas Market Company Market Share

Here's a SEO-optimized report description for the Downhole Oil and Gas Market, designed for maximum visibility and industry professional engagement.

Report Title: Downhole Oil and Gas Market: Global Outlook, Trends, and Forecast 2025-2033 - Analyzing Offshore vs. Onshore, Regional Dominance, and Key Player Strategies

Report Description:

Unlock critical insights into the global downhole oil and gas market, a vital sector poised for significant growth. This comprehensive report delves into the intricate dynamics, evolving trends, and future projections for the downhole oil and gas market, with an estimated 2025 market size of $XXX billion. We provide an in-depth analysis spanning from the historical period of 2019–2024 to a robust forecast period of 2025–2033, with a base year of 2025.

Explore the strategic landscape shaped by leading companies like Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, China Oilfield Services Limited, Target Well Control, Nabors Industries Ltd, and Wellserv Australia Private Ltd. Understand how their innovations and market strategies are influencing the parent market and its child segments.

This report meticulously dissects the market by Location of Deployment, analyzing both Offshore and Onshore operations, and scrutinizes growth across key geographies including North America, Europe, Asia-Pacific, South America, and the Middle-East and Africa. Discover the dominant regions and countries driving the downhole oil and gas equipment market, downhole oil and gas services market, and downhole oil and gas technology market.

Gain unparalleled understanding of:

With actionable data and expert analysis, this report is an indispensable resource for upstream oil and gas companies, service providers, technology developers, investors, and policymakers seeking to navigate and capitalize on the downhole oil and gas market opportunity.

- Market concentration, technological drivers, and regulatory frameworks.

- Growth trends, market size evolution, and adoption rates.

- Dominant regions and their key growth drivers.

- Product innovations, applications, and performance metrics.

- Key drivers, barriers, challenges, and emerging opportunities.

- Growth accelerators and strategic insights for the future.

Downhole Oil and Gas Market Market Dynamics & Structure

The global downhole oil and gas market, valued at an estimated $XXX billion in its base year of 2025, is characterized by a moderate to high level of market concentration. Key players like Schlumberger Limited, Halliburton Company, and Baker Hughes Company hold significant market shares, leveraging their extensive technological portfolios and global operational footprints. Technological innovation is a primary driver, with continuous advancements in drilling technologies, completion tools, and artificial lift systems aimed at enhancing recovery rates and operational efficiency in both onshore and offshore deployments. Regulatory frameworks, particularly concerning environmental safety and emissions reduction, are increasingly influencing operational practices and technology adoption. While competitive product substitutes exist in terms of alternative energy sources and enhanced oil recovery (EOR) techniques, the demand for essential downhole equipment and services remains robust. End-user demographics are largely composed of national oil companies (NOCs) and international oil companies (IOCs), with their investment cycles and exploration activities directly impacting market demand. Mergers and acquisitions (M&A) trends are prevalent, as larger companies seek to expand their service offerings, acquire new technologies, and consolidate market positions. For instance, M&A deals in the historical period (2019-2024) totaled approximately $XX billion, reflecting a strategic push for scale and capability enhancement. Innovation barriers, such as high R&D costs and the long lead times for new technology deployment, are significant considerations for market participants.

- Market Concentration: Moderate to High, with leading players dominating segments.

- Technological Innovation Drivers: Enhanced drilling efficiency, improved reservoir access, and digital oilfield solutions.

- Regulatory Frameworks: Increasing emphasis on environmental compliance, safety standards, and carbon footprint reduction.

- Competitive Product Substitutes: Primarily alternative energy sources and EOR technologies.

- End-User Demographics: NOCs and IOCs form the core customer base.

- M&A Trends: Strategic consolidation for market share, technological acquisition, and service expansion. M&A Deal Volume (2019-2024): ~$XX billion.

- Innovation Barriers: High R&D investment, long deployment cycles, and stringent validation processes.

Downhole Oil and Gas Market Growth Trends & Insights

The global downhole oil and gas market is projected to witness a steady growth trajectory, with an estimated market size of $XXX billion in 2025, expanding to an estimated $XXX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This growth is fueled by increasing global energy demand, particularly for oil and gas, which continues to be a cornerstone of the global energy mix. The adoption rates of advanced downhole technologies, such as intelligent completion systems, advanced drilling fluid technologies, and digital monitoring solutions, are steadily rising. These technologies are crucial for maximizing hydrocarbon recovery from mature fields and enabling exploration in more challenging environments, including deepwater and unconventional reservoirs. Technological disruptions are primarily centered around automation, artificial intelligence (AI) for predictive maintenance and operational optimization, and the development of more sustainable and environmentally friendly drilling and completion practices. Consumer behavior shifts, driven by a growing emphasis on energy security and efficiency, are leading operators to invest in solutions that reduce downtime and improve production yields. The historical period (2019–2024) saw the market navigate volatile oil prices and the initial impacts of the global pandemic, with an estimated market size of $XXX billion in 2019, gradually recovering to $XXX billion by 2024. Market penetration of specialized downhole tools and services is increasing as operators seek to optimize their existing infrastructure and explore new reserves. The increasing complexity of reservoir exploration and production necessitates sophisticated downhole solutions, thereby driving demand for high-performance equipment and specialized services. The focus on enhanced oil recovery (EOR) techniques, often requiring advanced downhole interventions, also contributes significantly to market expansion. Furthermore, the ongoing energy transition, while pushing for renewables, also highlights the need for efficient and responsible production of existing fossil fuel resources, which directly benefits the downhole oil and gas sector. The integration of real-time data analytics and IoT devices in downhole operations is revolutionizing how wells are managed, leading to improved decision-making and operational efficiency, further bolstering market growth.

Dominant Regions, Countries, or Segments in Downhole Oil and Gas Market

The North America region is poised to be a dominant force in the global downhole oil and gas market, driven by its robust oil and gas industry, significant shale plays, and substantial investments in both onshore and offshore exploration and production activities. The United States, in particular, with its extensive shale oil and gas reserves, remains a major consumer of downhole equipment and services. The onshore segment within North America accounts for a substantial portion of the market, owing to the widespread application of hydraulic fracturing and horizontal drilling techniques, which necessitate a continuous supply of specialized downhole tools and completion technologies. The region's mature oilfields also demand advanced intervention and artificial lift solutions to sustain production. North America's market share in the global downhole oil and gas market is estimated to be around XX% in 2025, with a projected growth rate of XX% during the forecast period.

Key drivers for North America's dominance include:

- Abundant Shale Reserves: Vast unconventional resources in regions like the Permian Basin necessitate extensive downhole operations.

- Technological Prowess: Leading innovation in drilling and completion technologies originating from North American service companies.

- Favorable Regulatory Environment (historically): While evolving, historical policies have supported exploration and production.

- Infrastructure Development: Well-established pipeline networks and processing facilities support production.

- Investment Capital: Strong access to capital for exploration and development projects.

The Middle-East and Africa region also presents significant growth potential, driven by large conventional reserves and ongoing development projects. Countries like Saudi Arabia, UAE, and Qatar in the Middle East, and Angola and Nigeria in Africa, are major producers and investors in upstream activities. The offshore segment in these regions, particularly in deepwater exploration, is a key growth area, demanding sophisticated subsea equipment and specialized services. While the historical period saw fluctuations due to oil price volatility, the region is expected to see renewed investment.

The Asia-Pacific region, particularly China and Southeast Asian countries, is experiencing robust growth due to increasing energy demand, government support for energy independence, and the development of marginal and offshore fields. The onshore segment in China, driven by efforts to boost domestic production, is a significant market.

In terms of Location of Deployment, the Onshore segment is expected to maintain its lead due to the widespread nature of oil and gas extraction activities globally. However, the Offshore segment, particularly in deepwater and ultra-deepwater domains, is anticipated to witness a higher CAGR due to the increasing necessity to explore challenging reservoirs to meet future demand. The market size for the onshore segment in 2025 is estimated at $XXX billion, while the offshore segment is projected at $XXX billion.

Downhole Oil and Gas Market Product Landscape

The downhole oil and gas market product landscape is characterized by a diverse range of specialized equipment and technologies designed for efficient and safe extraction of hydrocarbons. Key product categories include drilling tools (e.g., drill bits, drill collars, downhole motors), completion tools (e.g., packers, safety valves, perforating systems), well intervention equipment (e.g., coiled tubing, slickline units), and artificial lift systems (e.g., submersible pumps, gas lift systems). Innovations are focused on enhancing operational efficiency, improving reservoir access, and extending well life. For instance, advancements in drill bit technology are enabling faster penetration rates in challenging formations, while intelligent completion systems allow for real-time downhole data acquisition and remote control of production. Performance metrics are measured by factors such as durability, precision, efficiency, safety, and cost-effectiveness. Unique selling propositions often revolve around proprietary materials, advanced manufacturing techniques, and integrated digital solutions that offer real-time monitoring and predictive analytics.

Key Drivers, Barriers & Challenges in Downhole Oil and Gas Market

Key Drivers:

The primary forces propelling the downhole oil and gas market include the persistent global demand for oil and gas, the need to extract hydrocarbons from increasingly complex and mature fields, and technological advancements that improve efficiency and reduce operational costs. Government policies aimed at ensuring energy security and domestic production also serve as significant drivers. The ongoing development of unconventional resources, particularly shale, continues to fuel demand for specialized drilling and completion technologies.

- Global Energy Demand: Sustained need for oil and gas as primary energy sources.

- Complex Reservoir Exploration: Necessity to access challenging offshore and unconventional onshore reserves.

- Technological Advancements: Innovations in drilling, completion, and monitoring systems.

- Energy Security Initiatives: Government focus on domestic production and resource independence.

- Shale Production: Continued investment in unconventional resource extraction.

Key Barriers & Challenges:

Despite the positive outlook, the market faces several hurdles. Volatility in oil prices can significantly impact investment decisions, leading to project delays or cancellations. Stringent environmental regulations and growing pressure for decarbonization pose challenges, requiring companies to invest in cleaner technologies and sustainable practices. Supply chain disruptions, geopolitical instability, and the availability of skilled labor are also critical concerns that can impede market growth.

- Oil Price Volatility: Fluctuations impact investment and exploration budgets.

- Environmental Regulations: Increasing compliance costs and pressure for emissions reduction.

- Supply Chain Disruptions: Global logistics challenges and material availability issues.

- Geopolitical Instability: Regional conflicts and political uncertainties affecting operations.

- Skilled Labor Shortages: Difficulty in finding and retaining experienced personnel.

- High Capital Expenditure: Significant upfront investment required for exploration and production.

Emerging Opportunities in Downhole Oil and Gas Market

Emerging opportunities in the downhole oil and gas market lie in the development and deployment of digital oilfield technologies, including AI-driven predictive analytics for equipment maintenance, IoT sensor integration for real-time monitoring, and advanced automation solutions for drilling operations. The growing focus on enhanced oil recovery (EOR) techniques presents a significant avenue for specialized downhole tools and services. Furthermore, the increasing exploration in ultra-deepwater and Arctic regions, though challenging, offers substantial growth potential for companies with specialized capabilities. The circular economy and sustainability initiatives are also creating opportunities for companies developing environmentally friendly downhole solutions and recycling technologies.

- Digital Oilfield Integration: AI, IoT, and automation for enhanced operations.

- Enhanced Oil Recovery (EOR) Solutions: Demand for specialized tools and chemicals.

- Ultra-Deepwater and Arctic Exploration: High-demand for advanced technologies.

- Sustainable Downhole Technologies: Focus on environmental impact reduction.

- Remote Operations and Monitoring: Growth in solutions for unmanned platforms.

Growth Accelerators in the Downhole Oil and Gas Market Industry

Several key growth accelerators are shaping the future of the downhole oil and gas industry. Technological breakthroughs, particularly in areas like advanced materials science for extreme environments and novel drilling fluid formulations, are enabling greater efficiency and access to previously unreachable reservoirs. Strategic partnerships between oilfield service companies, technology providers, and operators are crucial for co-developing and commercializing new solutions. Market expansion strategies, including entry into emerging oil-producing regions and the acquisition of complementary businesses, are also vital for sustained growth. The increasing demand for natural gas as a transitional fuel also indirectly supports investment in associated upstream infrastructure, including downhole technologies.

Key Players Shaping the Downhole Oil and Gas Market Market

- Target Well Control

- Weatherford International plc

- Baker Hughes Company

- China Oilfield Services Limited

- Halliburton Company

- Wellserv Australia Private Ltd

- Schlumberger Limited

- Nabors Industries Ltd

Notable Milestones in Downhole Oil and Gas Market Sector

- 2019: Schlumberger launches its new suite of intelligent completion systems designed for enhanced reservoir management.

- 2020: Halliburton announces a significant investment in digital solutions for its downhole services portfolio.

- 2021: Baker Hughes acquires a technology company specializing in advanced drilling automation.

- 2022: Weatherford International plc secures major contracts for its coiled tubing services in the Middle East.

- 2023: China Oilfield Services Limited (COSL) reports increased activity in offshore exploration projects.

- 2024: Target Well Control introduces a new line of high-pressure well control equipment.

- 2024: Nabors Industries Ltd expands its fleet of automated drilling rigs.

In-Depth Downhole Oil and Gas Market Market Outlook

The future outlook for the downhole oil and gas market is characterized by sustained growth, driven by continued global energy demand and the imperative to optimize existing reserves and explore new frontiers. Growth accelerators such as the integration of digital technologies, advancements in EOR techniques, and strategic collaborations will be paramount. The market will increasingly favor solutions that enhance efficiency, safety, and environmental performance. Companies that can innovate in areas like automation, AI-powered analytics, and sustainable downhole operations are well-positioned to capitalize on emerging opportunities and drive long-term success in this dynamic sector. The strategic importance of reliable and efficient hydrocarbon production ensures the continued relevance and growth of the downhole oil and gas market.

Downhole Oil and Gas Market Segmentation

-

1. Location of Deployment

- 1.1. Offshore

- 1.2. Onshore

-

2. Geogrpahy

- 2.1. North America

- 2.2. Europe

- 2.3. Asia-Pacific

- 2.4. South America

- 2.5. Middle-East and Africa

Downhole Oil and Gas Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Downhole Oil and Gas Market Regional Market Share

Geographic Coverage of Downhole Oil and Gas Market

Downhole Oil and Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Production from Unconventional Sources4.; Growing Energy Demand in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Onshore Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Downhole Oil and Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Offshore

- 5.1.2. Onshore

- 5.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia-Pacific

- 5.2.4. South America

- 5.2.5. Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. North America Downhole Oil and Gas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Offshore

- 6.1.2. Onshore

- 6.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 6.2.1. North America

- 6.2.2. Europe

- 6.2.3. Asia-Pacific

- 6.2.4. South America

- 6.2.5. Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. South America Downhole Oil and Gas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Offshore

- 7.1.2. Onshore

- 7.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 7.2.1. North America

- 7.2.2. Europe

- 7.2.3. Asia-Pacific

- 7.2.4. South America

- 7.2.5. Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Europe Downhole Oil and Gas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Offshore

- 8.1.2. Onshore

- 8.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 8.2.1. North America

- 8.2.2. Europe

- 8.2.3. Asia-Pacific

- 8.2.4. South America

- 8.2.5. Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Middle East & Africa Downhole Oil and Gas Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Offshore

- 9.1.2. Onshore

- 9.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 9.2.1. North America

- 9.2.2. Europe

- 9.2.3. Asia-Pacific

- 9.2.4. South America

- 9.2.5. Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Asia Pacific Downhole Oil and Gas Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Offshore

- 10.1.2. Onshore

- 10.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 10.2.1. North America

- 10.2.2. Europe

- 10.2.3. Asia-Pacific

- 10.2.4. South America

- 10.2.5. Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Target Well Control

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Weatherford International plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Baker Hughes Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Oilfield Services Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Halliburton Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wellserv Australia Private Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schlumberger Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nabors Industries Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Target Well Control

List of Figures

- Figure 1: Global Downhole Oil and Gas Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Downhole Oil and Gas Market Volume Breakdown (Tonnes, %) by Region 2025 & 2033

- Figure 3: North America Downhole Oil and Gas Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 4: North America Downhole Oil and Gas Market Volume (Tonnes), by Location of Deployment 2025 & 2033

- Figure 5: North America Downhole Oil and Gas Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 6: North America Downhole Oil and Gas Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 7: North America Downhole Oil and Gas Market Revenue (undefined), by Geogrpahy 2025 & 2033

- Figure 8: North America Downhole Oil and Gas Market Volume (Tonnes), by Geogrpahy 2025 & 2033

- Figure 9: North America Downhole Oil and Gas Market Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 10: North America Downhole Oil and Gas Market Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 11: North America Downhole Oil and Gas Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Downhole Oil and Gas Market Volume (Tonnes), by Country 2025 & 2033

- Figure 13: North America Downhole Oil and Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Downhole Oil and Gas Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Downhole Oil and Gas Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 16: South America Downhole Oil and Gas Market Volume (Tonnes), by Location of Deployment 2025 & 2033

- Figure 17: South America Downhole Oil and Gas Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 18: South America Downhole Oil and Gas Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 19: South America Downhole Oil and Gas Market Revenue (undefined), by Geogrpahy 2025 & 2033

- Figure 20: South America Downhole Oil and Gas Market Volume (Tonnes), by Geogrpahy 2025 & 2033

- Figure 21: South America Downhole Oil and Gas Market Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 22: South America Downhole Oil and Gas Market Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 23: South America Downhole Oil and Gas Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America Downhole Oil and Gas Market Volume (Tonnes), by Country 2025 & 2033

- Figure 25: South America Downhole Oil and Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Downhole Oil and Gas Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Downhole Oil and Gas Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 28: Europe Downhole Oil and Gas Market Volume (Tonnes), by Location of Deployment 2025 & 2033

- Figure 29: Europe Downhole Oil and Gas Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 30: Europe Downhole Oil and Gas Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 31: Europe Downhole Oil and Gas Market Revenue (undefined), by Geogrpahy 2025 & 2033

- Figure 32: Europe Downhole Oil and Gas Market Volume (Tonnes), by Geogrpahy 2025 & 2033

- Figure 33: Europe Downhole Oil and Gas Market Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 34: Europe Downhole Oil and Gas Market Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 35: Europe Downhole Oil and Gas Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Downhole Oil and Gas Market Volume (Tonnes), by Country 2025 & 2033

- Figure 37: Europe Downhole Oil and Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Downhole Oil and Gas Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Downhole Oil and Gas Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 40: Middle East & Africa Downhole Oil and Gas Market Volume (Tonnes), by Location of Deployment 2025 & 2033

- Figure 41: Middle East & Africa Downhole Oil and Gas Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 42: Middle East & Africa Downhole Oil and Gas Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 43: Middle East & Africa Downhole Oil and Gas Market Revenue (undefined), by Geogrpahy 2025 & 2033

- Figure 44: Middle East & Africa Downhole Oil and Gas Market Volume (Tonnes), by Geogrpahy 2025 & 2033

- Figure 45: Middle East & Africa Downhole Oil and Gas Market Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 46: Middle East & Africa Downhole Oil and Gas Market Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 47: Middle East & Africa Downhole Oil and Gas Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa Downhole Oil and Gas Market Volume (Tonnes), by Country 2025 & 2033

- Figure 49: Middle East & Africa Downhole Oil and Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Downhole Oil and Gas Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Downhole Oil and Gas Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 52: Asia Pacific Downhole Oil and Gas Market Volume (Tonnes), by Location of Deployment 2025 & 2033

- Figure 53: Asia Pacific Downhole Oil and Gas Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 54: Asia Pacific Downhole Oil and Gas Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 55: Asia Pacific Downhole Oil and Gas Market Revenue (undefined), by Geogrpahy 2025 & 2033

- Figure 56: Asia Pacific Downhole Oil and Gas Market Volume (Tonnes), by Geogrpahy 2025 & 2033

- Figure 57: Asia Pacific Downhole Oil and Gas Market Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 58: Asia Pacific Downhole Oil and Gas Market Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 59: Asia Pacific Downhole Oil and Gas Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Downhole Oil and Gas Market Volume (Tonnes), by Country 2025 & 2033

- Figure 61: Asia Pacific Downhole Oil and Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Downhole Oil and Gas Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 2: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Location of Deployment 2020 & 2033

- Table 3: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 4: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Geogrpahy 2020 & 2033

- Table 5: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 7: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 8: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Location of Deployment 2020 & 2033

- Table 9: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 10: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Geogrpahy 2020 & 2033

- Table 11: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 13: United States Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 15: Canada Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 17: Mexico Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 19: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 20: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Location of Deployment 2020 & 2033

- Table 21: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 22: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Geogrpahy 2020 & 2033

- Table 23: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 25: Brazil Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 27: Argentina Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 31: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 32: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Location of Deployment 2020 & 2033

- Table 33: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 34: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Geogrpahy 2020 & 2033

- Table 35: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 39: Germany Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 41: France Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 43: Italy Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 45: Spain Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 47: Russia Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 49: Benelux Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 51: Nordics Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 55: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 56: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Location of Deployment 2020 & 2033

- Table 57: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 58: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Geogrpahy 2020 & 2033

- Table 59: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 61: Turkey Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 63: Israel Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 65: GCC Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 67: North Africa Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 69: South Africa Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 73: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 74: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Location of Deployment 2020 & 2033

- Table 75: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 76: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Geogrpahy 2020 & 2033

- Table 77: Global Downhole Oil and Gas Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global Downhole Oil and Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 79: China Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 81: India Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 83: Japan Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 85: South Korea Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 89: Oceania Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Downhole Oil and Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Downhole Oil and Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Downhole Oil and Gas Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Downhole Oil and Gas Market?

Key companies in the market include Target Well Control, Weatherford International plc, Baker Hughes Company, China Oilfield Services Limited, Halliburton Company, Wellserv Australia Private Ltd, Schlumberger Limited, Nabors Industries Ltd.

3. What are the main segments of the Downhole Oil and Gas Market?

The market segments include Location of Deployment, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Production from Unconventional Sources4.; Growing Energy Demand in the Region.

6. What are the notable trends driving market growth?

Onshore Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Downhole Oil and Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Downhole Oil and Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Downhole Oil and Gas Market?

To stay informed about further developments, trends, and reports in the Downhole Oil and Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence