Key Insights

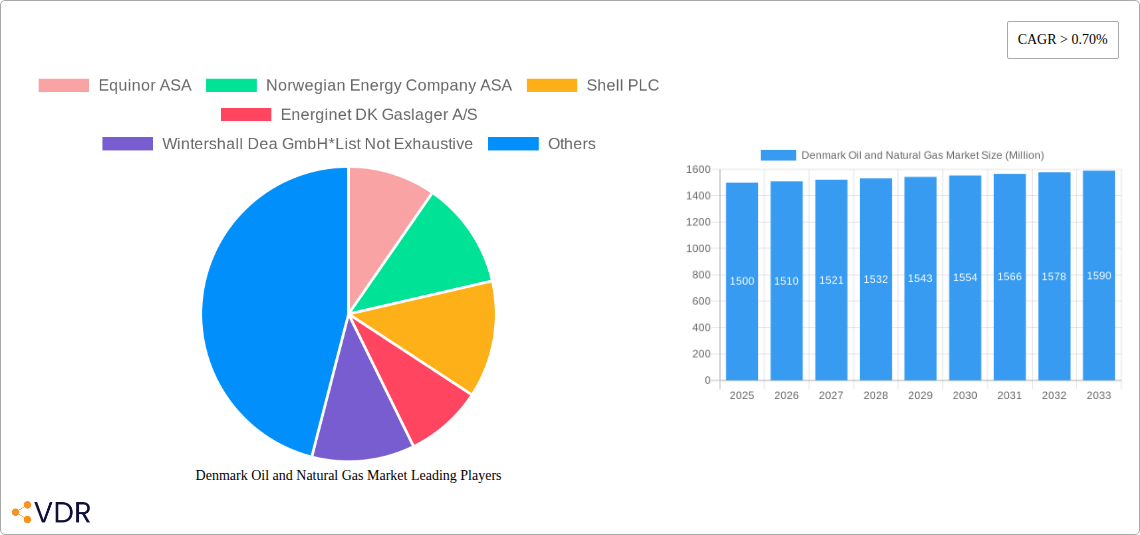

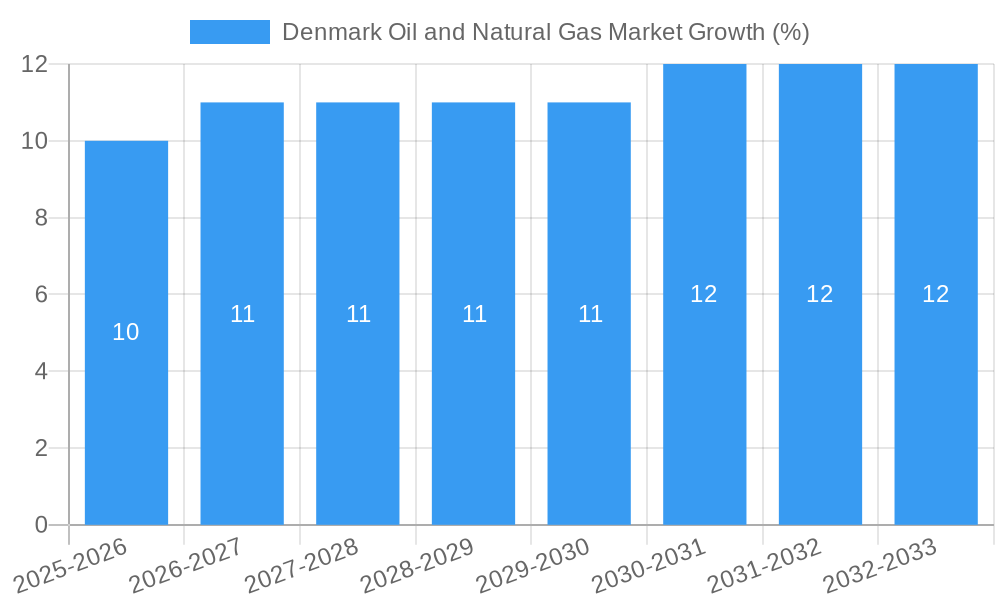

The Denmark oil and natural gas market, valued at approximately €1.5 billion in 2025, exhibits a robust growth trajectory, projected to expand at a compound annual growth rate (CAGR) exceeding 0.70% from 2025 to 2033. This growth is driven by several key factors. Firstly, Denmark's ongoing efforts to diversify its energy sources, while still maintaining a reliance on natural gas for power generation and heating, contribute to sustained demand. Secondly, increasing industrial activity and a growing population exert upward pressure on energy consumption. Furthermore, strategic investments in pipeline infrastructure and exploration activities, although limited compared to larger energy-producing nations, contribute positively to market expansion. However, the transition towards renewable energy sources, particularly wind power, poses a significant constraint on the growth of the traditional oil and gas sector. Government policies promoting renewable energy adoption and stricter environmental regulations are expected to gradually reduce the reliance on fossil fuels in the long term. The market is segmented primarily into crude oil, natural gas, and condensate, with natural gas likely holding the largest market share due to its prevalent use in power generation and heating. Major players like Equinor ASA, Norwegian Energy Company ASA, Shell PLC, and TotalEnergies SE are active in the Danish market, engaging in exploration, production, and distribution activities, although the overall market remains relatively smaller compared to larger European energy markets.

The forecast period (2025-2033) suggests a moderate but consistent expansion of the Danish oil and gas market. The relatively low CAGR reflects the balancing act between sustained industrial and residential energy demand and the government's commitment to renewable energy transition. While the short-term outlook remains positive due to existing infrastructure and continued natural gas demand, the long-term outlook is dependent on the pace of renewable energy adoption and the evolving geopolitical landscape influencing energy prices and security of supply. Specific segment growth will depend on policy changes and efficiency improvements within the respective sectors (industrial, residential). Further analysis requires detailed data on energy consumption patterns across various sectors and the anticipated investment in renewable energy infrastructure.

Denmark Oil and Natural Gas Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Denmark oil and natural gas market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and policymakers seeking a nuanced understanding of this evolving market.

Parent Market: European Oil and Natural Gas Market Child Market: Denmark Oil and Natural Gas Market

Denmark Oil and Natural Gas Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Danish oil and natural gas sector. The market is moderately concentrated, with key players like Equinor ASA, Norwegian Energy Company ASA, Shell PLC, Energinet DK Gaslager A/S, Wintershall Dea GmbH, and TotalEnergies SE holding significant shares. However, the emergence of smaller players and potential M&A activity could reshape this landscape.

- Market Concentration: Moderate, with xx% market share held by the top 5 players in 2024.

- Technological Innovation: Focus on enhanced oil recovery (EOR) techniques and exploration in deeper waters. Innovation is driven by the need for increased efficiency and reduced environmental impact. Barriers include high capital investment requirements and regulatory complexities.

- Regulatory Framework: Stringent environmental regulations and licensing processes influence exploration and production activities. Government policies promoting renewable energy sources present both challenges and opportunities.

- Competitive Substitutes: Growing renewable energy capacity (wind, solar) poses a competitive threat to natural gas.

- End-User Demographics: Primarily industrial users (power generation, manufacturing) and residential consumers.

- M&A Trends: A moderate level of M&A activity is anticipated, driven by consolidation and strategic expansion. The volume of deals is predicted to average xx per year during the forecast period.

Denmark Oil and Natural Gas Market Growth Trends & Insights

The Danish oil and natural gas market experienced [insert growth rate]% CAGR during the historical period (2019-2024). This growth was driven by [insert reasons, e.g., increasing energy demand, strategic investments in infrastructure]. However, the forecast period (2025-2033) is projected to see a [insert growth rate]% CAGR, influenced by factors such as the increasing adoption of renewable energy sources and government policies promoting energy transition. Market penetration of natural gas in the residential sector is expected to remain stable at xx% during this period, while industrial consumption will continue to be the largest consumer segment, with a xx% market share in 2033. Technological disruptions, such as the increasing efficiency of renewable energy technologies, will continue to reshape the market landscape. Consumer behavior shifts toward environmentally friendly energy sources will also impact the growth trajectory of the traditional oil and natural gas sector.

Dominant Regions, Countries, or Segments in Denmark Oil and Natural Gas Market

The North Sea region is the dominant segment in the Danish oil and natural gas market, contributing xx% of total production in 2024. This dominance is primarily attributed to the presence of established offshore oil and gas fields. Crude oil and natural gas represent the major components of the market, with crude oil holding a slightly larger market share (xx%) compared to natural gas (xx%) in 2024. Condensate constitutes a smaller but growing segment of the market.

- Key Drivers for North Sea dominance: Existing infrastructure, proven reserves, and ongoing exploration activities.

- Growth Potential of other segments: Limited potential for significant expansion in other regions due to geographical limitations and stringent environmental regulations.

Denmark Oil and Natural Gas Market Product Landscape

The product landscape is characterized by a focus on efficiency and optimization of existing reserves. Technological advancements in extraction techniques like EOR and improved pipeline infrastructure enhance production efficiency and reduce environmental impact. The focus on product quality and safety, along with competitive pricing, shapes the overall product landscape. Unique selling propositions include reliable supply chains and commitment to environmental sustainability.

Key Drivers, Barriers & Challenges in Denmark Oil and Natural Gas Market

Key Drivers:

- Increasing energy demand from industrial sectors.

- Strategic investments in infrastructure development (e.g., Baltic Pipe).

- Continued exploration and development of offshore reserves.

Key Challenges:

- Stringent environmental regulations impacting exploration and production activities.

- Competition from renewable energy sources resulting in reduced market share (estimated at xx% reduction by 2033).

- Supply chain vulnerabilities, particularly related to geopolitical instability.

Emerging Opportunities in Denmark Oil and Natural Gas Market

- Exploration of untapped potential in deeper water reserves.

- Development of carbon capture and storage (CCS) technologies.

- Increased utilization of natural gas as a transition fuel towards a cleaner energy future.

Growth Accelerators in the Denmark Oil and Natural Gas Market Industry

Technological advancements in EOR techniques, combined with strategic partnerships to enhance infrastructure development and improve supply chain resilience, are key catalysts for long-term growth. Furthermore, exploring and developing new carbon-neutral technologies can create new opportunities for sustainable growth in the market.

Key Players Shaping the Denmark Oil and Natural Gas Market Market

- Equinor ASA

- Norwegian Energy Company ASA (Assuming this refers to Equinor, as it's a previous name)

- Shell PLC

- Energinet DK Gaslager A/S

- Wintershall Dea GmbH

- TotalEnergies SE

Notable Milestones in Denmark Oil and Natural Gas Market Sector

- September 2022: Ineos announces development of the Solsort West oil and gas field, expected to begin production in Q4 2023. This signifies renewed investment in the Danish sector.

- March 2022: Resumption of Baltic Pipe construction, expected to reach full capacity (10 billion cubic meters) by January 1, 2023, enhancing Denmark's gas import capabilities.

In-Depth Denmark Oil and Natural Gas Market Market Outlook

The Danish oil and natural gas market is poised for moderate growth over the forecast period. While renewable energy sources will continue to gain prominence, natural gas will retain a significant role as a transition fuel. Strategic investments in infrastructure, technological advancements, and a focus on sustainability will shape the future market dynamics and present significant opportunities for established and new players alike. The market is expected to reach a value of xx million by 2033.

Denmark Oil and Natural Gas Market Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Denmark Oil and Natural Gas Market Segmentation By Geography

- 1. Denmark

Denmark Oil and Natural Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 0.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Upstream Operations to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Oil and Natural Gas Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Norwegian Energy Company ASA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shell PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Energinet DK Gaslager A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wintershall Dea GmbH*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TotalEnergies SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Denmark Oil and Natural Gas Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Oil and Natural Gas Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 3: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 4: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 5: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 8: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 9: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 10: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Oil and Natural Gas Market?

The projected CAGR is approximately > 0.70%.

2. Which companies are prominent players in the Denmark Oil and Natural Gas Market?

Key companies in the market include Equinor ASA, Norwegian Energy Company ASA, Shell PLC, Energinet DK Gaslager A/S, Wintershall Dea GmbH*List Not Exhaustive, TotalEnergies SE.

3. What are the main segments of the Denmark Oil and Natural Gas Market?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Upstream Operations to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

September 2022: Petrochemicals group Ineos announced the development of an oil and gas field in Denmark. Ineos will develop the Solsort West field in the North Sea with Danoil and Nordsøfonden. The first oil and gas production is expected in the fourth quarter of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Oil and Natural Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Oil and Natural Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Oil and Natural Gas Market?

To stay informed about further developments, trends, and reports in the Denmark Oil and Natural Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence