Key Insights

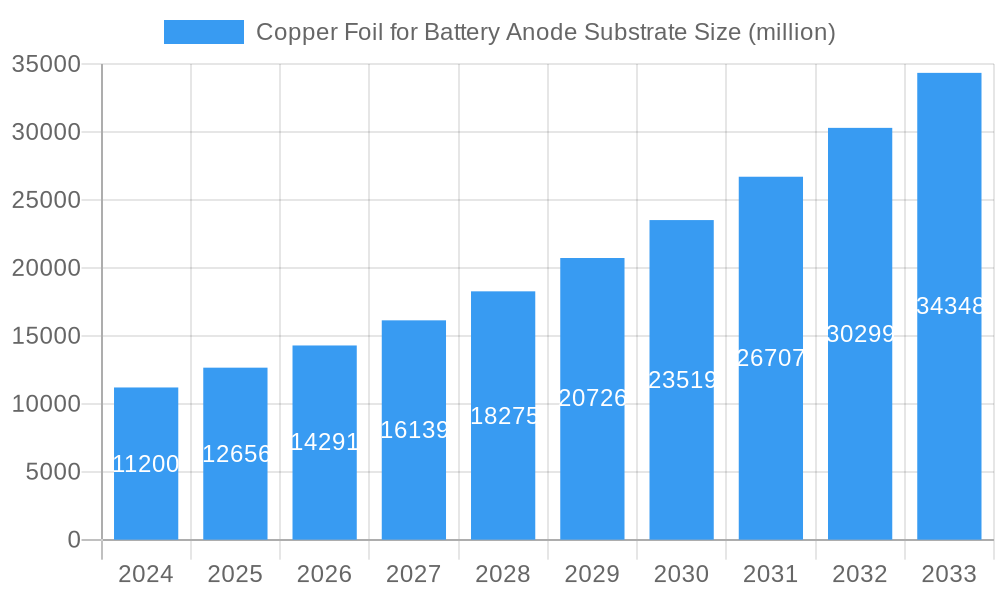

The global Copper Foil for Battery Anode Substrate market is experiencing robust expansion, driven by the insatiable demand for advanced battery technologies across various sectors. The market was valued at an estimated 11.2 billion USD in 2024, projecting a Compound Annual Growth Rate (CAGR) of 13% over the forecast period from 2025 to 2033. This significant growth is primarily fueled by the burgeoning electric vehicle (EV) industry, which relies heavily on high-performance lithium-ion batteries where copper foil serves as a critical anode current collector. Furthermore, the rapid adoption of consumer electronics, including smartphones, laptops, and wearable devices, all of which incorporate rechargeable batteries, contributes substantially to market expansion. The increasing focus on renewable energy storage solutions, such as grid-scale batteries for solar and wind power, also presents a significant opportunity for copper foil manufacturers. Advancements in battery technology, leading to higher energy densities and faster charging capabilities, necessitate the use of thinner, more conductive, and highly pure copper foils, driving innovation and market growth.

Copper Foil for Battery Anode Substrate Market Size (In Billion)

The market segmentation reveals a strong emphasis on thinner foil types. Very Thin Copper Foil (≤6μm) and Ultra-Thin Copper Foil (6-12μm) are gaining prominence due to their superior performance characteristics in next-generation batteries, offering weight reduction and improved energy density. While the automotive and consumer electronics sectors are the dominant applications, the "Others" segment, encompassing industrial batteries, medical devices, and aerospace, is also showing promising growth. Geographically, the Asia Pacific region, particularly China, is the leading market due to its established dominance in battery manufacturing and the high concentration of EV production. However, North America and Europe are also experiencing substantial growth, driven by government initiatives promoting EV adoption and investments in battery manufacturing facilities. Despite the optimistic outlook, the market faces certain restraints, including the volatility of copper prices and increasing competition from alternative anode materials and battery chemistries. Nevertheless, ongoing research and development in material science and manufacturing processes are expected to mitigate these challenges and sustain the market's upward trajectory.

Copper Foil for Battery Anode Substrate Company Market Share

This in-depth report provides a detailed examination of the global Copper Foil for Battery Anode Substrate market, encompassing its dynamics, growth trajectory, regional dominance, product landscape, key drivers, challenges, opportunities, and future outlook. Leveraging a study period from 2019 to 2033, with a base year of 2025, this analysis offers critical insights for industry stakeholders, investors, and decision-makers. The report meticulously analyzes market segments including Automotive, Consumer Electronics, and Others, and product types such as Very Thin Copper Foil (≤6μm), Ultra-Thin Copper Foil (6-12μm), Thin Copper Foil (12-18μm), Common Copper Foil (18-70μm), and Thick Copper Foil (>70μm).

Copper Foil for Battery Anode Substrate Market Dynamics & Structure

The Copper Foil for Battery Anode Substrate market exhibits a moderately concentrated structure, with key players like UACJ, Nuode, Jiujiang Defu, Wason Copper Foil, Jiangxi Tongbo, Guangdong Jia Yuan Tech, Anhui Tongguan, and Segments strategically positioned. Technological innovation is a primary driver, fueled by the relentless demand for higher energy density and faster charging capabilities in batteries. Advancements in electrodeposition techniques, surface treatment, and rolling processes are crucial for producing thinner, more uniform, and higher-strength copper foils, essential for next-generation battery anodes. Regulatory frameworks, particularly those promoting electric vehicle adoption and stringent battery performance standards, are indirectly shaping market demand. Competitive product substitutes, while limited in direct replacement for anode substrates, include alternative anode materials that indirectly influence the demand for copper foil. End-user demographics are shifting towards younger, tech-savvy consumers and environmentally conscious populations driving EV adoption. Mergers and acquisitions (M&A) activity is expected to increase as larger players seek to consolidate market share, acquire proprietary technologies, and expand production capacities to meet escalating demand. For instance, an estimated $5.2 billion in M&A deals are projected within the broader copper foil industry in the forecast period, reflecting strategic consolidation. Innovation barriers include the high capital expenditure required for advanced manufacturing facilities and the need for specialized expertise in materials science and electrochemistry.

Copper Foil for Battery Anode Substrate Growth Trends & Insights

The Copper Foil for Battery Anode Substrate market is poised for robust growth, driven by the exponential rise in electric vehicle (EV) adoption and the burgeoning demand for portable consumer electronics. The market size is projected to grow from an estimated $18.5 billion in the base year 2025 to a substantial $45.7 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period (2025-2033). This impressive growth trajectory is underpinned by several key factors. Firstly, the global push towards decarbonization and stringent emission regulations are accelerating the transition to EVs, where copper foil serves as a critical component of the anode substrate, directly impacting battery performance and longevity. The automotive application segment alone is expected to account for over 65% of the total market revenue by 2033. Secondly, the increasing sophistication of consumer electronics, including smartphones, laptops, and wearable devices, demands smaller, lighter, and more powerful batteries, thereby boosting the consumption of ultra-thin and very thin copper foils. Adoption rates for EVs are projected to reach 30% of new vehicle sales globally by 2030, a significant increase from current levels. Technological disruptions are also playing a pivotal role. Innovations in battery chemistry, such as the development of silicon-anode batteries, which offer higher energy density, are increasing the demand for specialized, thinner copper foils that can accommodate larger anode material loadings. Consumer behavior shifts towards sustainability and convenience further fuel the demand for high-performance batteries, directly translating into increased consumption of copper foil for anode substrates. The market penetration of advanced battery technologies, directly reliant on high-quality copper foil, is anticipated to reach 70% within the EV sector by 2033. The historical period (2019-2024) witnessed steady growth, laying the foundation for the accelerated expansion anticipated in the coming years, with an estimated market size of $15.9 billion in 2024.

Dominant Regions, Countries, or Segments in Copper Foil for Battery Anode Substrate

The Automotive application segment is the undeniable powerhouse driving the Copper Foil for Battery Anode Substrate market's growth. This dominance stems from the global surge in electric vehicle (EV) production, fueled by government incentives, stricter environmental regulations, and increasing consumer awareness regarding climate change. Countries like China, the United States, and several European nations are at the forefront of EV adoption, necessitating massive quantities of high-performance batteries, and consequently, copper foil anode substrates. China, in particular, is projected to hold over 40% of the global EV market share by 2030, making it the largest single market for battery-grade copper foil. The Ultra-Thin Copper Foil (6-12μm) type is experiencing the most significant growth within this segment, driven by the demand for lightweight and high-energy-density batteries in EVs. These foils enable manufacturers to incorporate more active anode material, thereby increasing the battery's overall capacity without significantly increasing its weight or volume. The market share of ultra-thin copper foil is expected to grow from 25% in the base year 2025 to an estimated 40% by 2033. Economic policies, such as subsidies for EV purchases and investments in battery manufacturing infrastructure, are crucial growth catalysts in leading regions. For instance, the US Inflation Reduction Act (IRA) is stimulating domestic battery production, creating a significant demand pull for copper foil. Infrastructure development, including the expansion of charging networks, further bolsters consumer confidence in EVs, indirectly benefiting the copper foil market. While Consumer Electronics remains a significant market, its growth rate is outpaced by the automotive sector's rapid expansion. The "Others" application segment, encompassing industrial energy storage and niche electronics, also contributes to market diversification but is not the primary growth engine. Within countries, South Korea, Japan, and Taiwan are also key players in the advanced battery manufacturing landscape, contributing to regional dominance in the consumption of specialized copper foils.

Copper Foil for Battery Anode Substrate Product Landscape

The product landscape for Copper Foil for Battery Anode Substrate is characterized by continuous innovation focused on enhanced performance metrics critical for advanced battery applications. Manufacturers are increasingly producing ultra-thin copper foils (6-12μm) and very thin copper foils (≤6μm) with improved tensile strength and uniformity. These advanced products are essential for accommodating higher loadings of active anode materials, such as silicon, leading to batteries with greater energy density and faster charging capabilities. Surface treatments are also a key area of development, aiming to optimize adhesion with anode materials and reduce interfacial resistance, thereby improving battery cycle life and overall efficiency. The primary applications are in lithium-ion batteries for electric vehicles and consumer electronics, where performance, safety, and lifespan are paramount. Technological advancements are enabling the production of foils with lower surface roughness and higher purity, crucial for preventing dendrite formation and ensuring battery safety.

Key Drivers, Barriers & Challenges in Copper Foil for Battery Anode Substrate

Key Drivers:

- Explosive EV Adoption: The global transition to electric vehicles is the primary growth driver, demanding massive quantities of copper foil for battery anode substrates.

- Demand for Higher Energy Density Batteries: Consumer electronics and EV manufacturers are continuously seeking batteries with increased capacity and faster charging, directly influencing copper foil specifications.

- Technological Advancements in Battery Chemistry: Development of silicon anodes and other high-capacity materials necessitates thinner, more robust copper foils.

- Governmental Policies and Incentives: Supportive regulations, subsidies for EVs, and investments in battery manufacturing are accelerating market growth.

Key Barriers & Challenges:

- High Capital Investment: Establishing state-of-the-art copper foil manufacturing facilities requires substantial upfront capital, limiting new entrants.

- Supply Chain Volatility: Fluctuations in copper prices and potential disruptions in raw material sourcing can impact production costs and lead times.

- Technological Complexity: Achieving the required ultra-thin tolerances and uniformity demands sophisticated manufacturing processes and stringent quality control.

- Environmental Regulations and Sustainability Concerns: While driving EV adoption, environmental regulations also impact the manufacturing processes of copper foil, requiring adherence to emission standards and waste management protocols. For instance, the cost of compliance with environmental regulations could add an estimated 3-5% to production costs.

- Intense Competition: The market is competitive, with established players and emerging manufacturers vying for market share, leading to price pressures.

Emerging Opportunities in Copper Foil for Battery Anode Substrate

Emerging opportunities within the Copper Foil for Battery Anode Substrate market lie in the development of next-generation battery technologies and geographical expansion. The increasing interest in solid-state batteries, which promise enhanced safety and energy density, presents a significant opportunity for novel copper foil designs and manufacturing techniques. Untapped markets in developing economies with growing middle classes and increasing EV penetration also offer substantial growth potential. Furthermore, innovative applications in renewable energy storage systems, beyond grid-scale solutions, such as decentralized energy storage for homes and businesses, will drive demand for high-performance battery foils. The evolving consumer preference for longer-lasting and faster-charging devices will also continue to fuel innovation in ultra-thin and high-conductivity copper foils.

Growth Accelerators in the Copper Foil for Battery Anode Substrate Industry

Several key catalysts are accelerating the growth of the Copper Foil for Battery Anode Substrate industry. Technological breakthroughs in electrodeposition and rolling processes are enabling the production of thinner, more uniform, and higher-strength copper foils at competitive costs. Strategic partnerships between copper foil manufacturers and battery cell producers are crucial for co-developing customized foil solutions that meet specific performance requirements. Market expansion strategies, including increased production capacity and global distribution networks, are vital for capturing the escalating demand from the automotive sector and consumer electronics. Investments in research and development for advanced battery materials and their corresponding anode substrate requirements are also critical growth accelerators.

Key Players Shaping the Copper Foil for Battery Anode Substrate Market

- UACJ

- Nuode

- Jiujiang Defu

- Wason Copper Foil

- Jiangxi Tongbo

- Guangdong Jia Yuan Tech

- Anhui Tongguan

Notable Milestones in Copper Foil for Battery Anode Substrate Sector

- 2019: Increased investment in R&D for thinner copper foils to support early EV battery development.

- 2020: Significant capacity expansion by key players to meet growing automotive demand.

- 2021: Breakthroughs in electrodeposition technology enabling production of ultra-thin foils with higher uniformity.

- 2022: Growing adoption of silicon-anode technologies, driving demand for specialized copper foil substrates.

- 2023: Strategic partnerships formed between copper foil manufacturers and major EV battery producers.

- 2024: Anticipated further advancements in surface treatment techniques for improved anode adhesion.

In-Depth Copper Foil for Battery Anode Substrate Market Outlook

The future outlook for the Copper Foil for Battery Anode Substrate market remains exceptionally bright, driven by sustained demand from the burgeoning electric vehicle sector and the continuous evolution of consumer electronics. Growth accelerators such as ongoing technological innovations in battery chemistries, particularly silicon-based anodes, will necessitate and reward the production of increasingly thinner and more robust copper foils. Strategic collaborations between upstream material suppliers and downstream battery manufacturers are projected to intensify, fostering co-creation and optimizing product development cycles. The market's ability to adapt to evolving regulatory landscapes and embrace sustainable manufacturing practices will be crucial for long-term success. The projected market size in 2033 stands at an estimated $45.7 billion, underscoring immense strategic opportunities for players who can innovate, scale production, and maintain competitive cost structures.

Copper Foil for Battery Anode Substrate Segmentation

-

1. Application

- 1.1. Automotive

- 1.2. Consumer Electronics

- 1.3. Others

-

2. Types

- 2.1. Very Thin Copper Foil (≤6μm)

- 2.2. Ultra-Thin Copper Foil (6-12μm)

- 2.3. Thin Copper Foil (12-18μm)

- 2.4. Common Copper Foil (18-70μm)

- 2.5. Thick Copper Foil (>70μm)

Copper Foil for Battery Anode Substrate Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Copper Foil for Battery Anode Substrate Regional Market Share

Geographic Coverage of Copper Foil for Battery Anode Substrate

Copper Foil for Battery Anode Substrate REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Copper Foil for Battery Anode Substrate Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive

- 5.1.2. Consumer Electronics

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Very Thin Copper Foil (≤6μm)

- 5.2.2. Ultra-Thin Copper Foil (6-12μm)

- 5.2.3. Thin Copper Foil (12-18μm)

- 5.2.4. Common Copper Foil (18-70μm)

- 5.2.5. Thick Copper Foil (>70μm)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Copper Foil for Battery Anode Substrate Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive

- 6.1.2. Consumer Electronics

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Very Thin Copper Foil (≤6μm)

- 6.2.2. Ultra-Thin Copper Foil (6-12μm)

- 6.2.3. Thin Copper Foil (12-18μm)

- 6.2.4. Common Copper Foil (18-70μm)

- 6.2.5. Thick Copper Foil (>70μm)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Copper Foil for Battery Anode Substrate Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive

- 7.1.2. Consumer Electronics

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Very Thin Copper Foil (≤6μm)

- 7.2.2. Ultra-Thin Copper Foil (6-12μm)

- 7.2.3. Thin Copper Foil (12-18μm)

- 7.2.4. Common Copper Foil (18-70μm)

- 7.2.5. Thick Copper Foil (>70μm)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Copper Foil for Battery Anode Substrate Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive

- 8.1.2. Consumer Electronics

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Very Thin Copper Foil (≤6μm)

- 8.2.2. Ultra-Thin Copper Foil (6-12μm)

- 8.2.3. Thin Copper Foil (12-18μm)

- 8.2.4. Common Copper Foil (18-70μm)

- 8.2.5. Thick Copper Foil (>70μm)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Copper Foil for Battery Anode Substrate Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive

- 9.1.2. Consumer Electronics

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Very Thin Copper Foil (≤6μm)

- 9.2.2. Ultra-Thin Copper Foil (6-12μm)

- 9.2.3. Thin Copper Foil (12-18μm)

- 9.2.4. Common Copper Foil (18-70μm)

- 9.2.5. Thick Copper Foil (>70μm)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Copper Foil for Battery Anode Substrate Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automotive

- 10.1.2. Consumer Electronics

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Very Thin Copper Foil (≤6μm)

- 10.2.2. Ultra-Thin Copper Foil (6-12μm)

- 10.2.3. Thin Copper Foil (12-18μm)

- 10.2.4. Common Copper Foil (18-70μm)

- 10.2.5. Thick Copper Foil (>70μm)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UACJ

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nuode

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jiujiang Defu

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wason Copper Foil

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jiangxi Tongbo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Guangdong Jia Yuan Tech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Anhui Tongguan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 UACJ

List of Figures

- Figure 1: Global Copper Foil for Battery Anode Substrate Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Copper Foil for Battery Anode Substrate Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Copper Foil for Battery Anode Substrate Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Copper Foil for Battery Anode Substrate Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Copper Foil for Battery Anode Substrate Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Copper Foil for Battery Anode Substrate Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Copper Foil for Battery Anode Substrate Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Copper Foil for Battery Anode Substrate Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Copper Foil for Battery Anode Substrate Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Copper Foil for Battery Anode Substrate Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Copper Foil for Battery Anode Substrate Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Copper Foil for Battery Anode Substrate Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Copper Foil for Battery Anode Substrate Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Copper Foil for Battery Anode Substrate Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Copper Foil for Battery Anode Substrate Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Copper Foil for Battery Anode Substrate Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Copper Foil for Battery Anode Substrate Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Copper Foil for Battery Anode Substrate Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Copper Foil for Battery Anode Substrate Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Copper Foil for Battery Anode Substrate Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Copper Foil for Battery Anode Substrate Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Copper Foil for Battery Anode Substrate Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Copper Foil for Battery Anode Substrate Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Copper Foil for Battery Anode Substrate Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Copper Foil for Battery Anode Substrate Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Copper Foil for Battery Anode Substrate Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Copper Foil for Battery Anode Substrate Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Copper Foil for Battery Anode Substrate Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Copper Foil for Battery Anode Substrate Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Copper Foil for Battery Anode Substrate Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Copper Foil for Battery Anode Substrate Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Copper Foil for Battery Anode Substrate Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Copper Foil for Battery Anode Substrate Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Copper Foil for Battery Anode Substrate?

The projected CAGR is approximately 13%.

2. Which companies are prominent players in the Copper Foil for Battery Anode Substrate?

Key companies in the market include UACJ, Nuode, Jiujiang Defu, Wason Copper Foil, Jiangxi Tongbo, Guangdong Jia Yuan Tech, Anhui Tongguan.

3. What are the main segments of the Copper Foil for Battery Anode Substrate?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Copper Foil for Battery Anode Substrate," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Copper Foil for Battery Anode Substrate report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Copper Foil for Battery Anode Substrate?

To stay informed about further developments, trends, and reports in the Copper Foil for Battery Anode Substrate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence