Key Insights

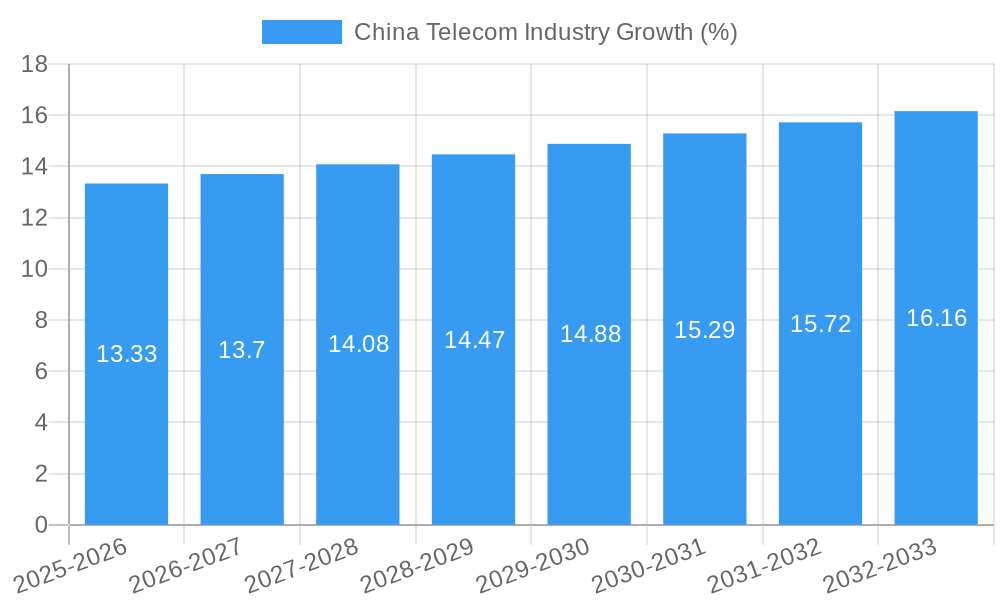

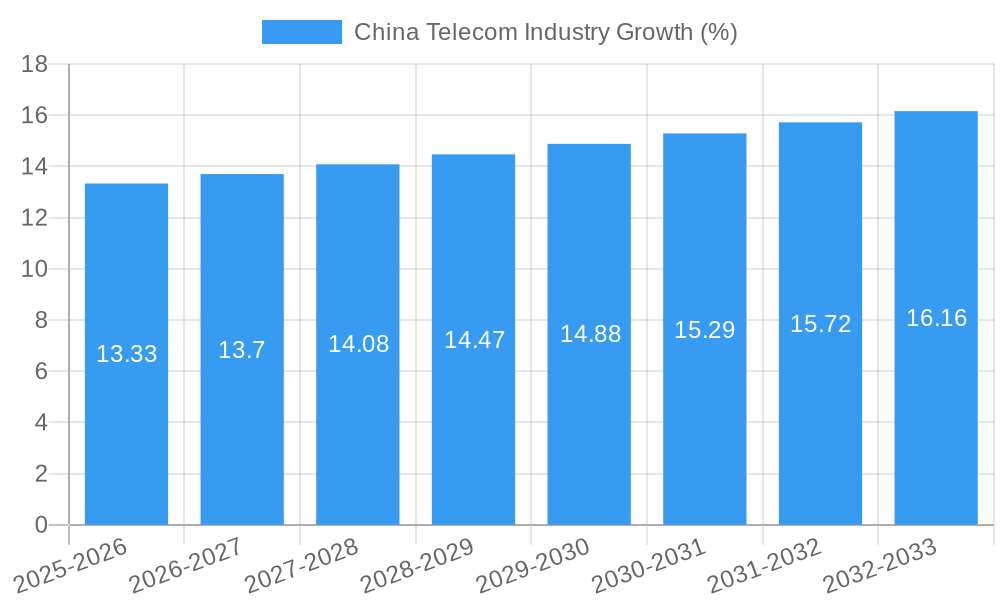

The China telecom industry, valued at $491.90 million in 2025, exhibits a steady growth trajectory with a Compound Annual Growth Rate (CAGR) of 2.71%. This growth is driven by increasing smartphone penetration, rising data consumption fueled by the proliferation of mobile video streaming and online gaming, and the ongoing expansion of 5G infrastructure. Key segments within this market include voice services, wireless data and messaging (including internet and handset data packages with bundled discounts), and Over-The-Top (OTT) and PayTV services. Competition is intense, with major players like China Telecom Corp, China Mobile (though not explicitly listed, a major player implicitly included in market data), China Unicom, Tencent Holdings Ltd., and ZTE Corporation vying for market share through innovative service offerings and strategic partnerships. The industry's growth is somewhat tempered by factors such as price competition, increasing regulatory scrutiny, and the need for continuous investment in network infrastructure upgrades to support the growing demand for higher bandwidth services. Future growth will likely be influenced by the government's initiatives to promote digitalization and the continued expansion of 5G networks across both urban and rural areas. The projected market size for 2033 can be estimated using the CAGR, but this projection hinges on consistent economic growth and the aforementioned driving forces remaining strong.

The success of individual companies depends heavily on their ability to adapt to evolving consumer preferences, optimize network efficiency, and develop value-added services that differentiate their offerings. The dominance of large state-owned enterprises like China Telecom and China Mobile suggests a landscape characterized by both scale and robust infrastructure. However, the emergence of tech giants like Tencent indicates that the industry is undergoing a transformation, with new entrants and converging technologies adding complexity and dynamism to the market. Therefore, strategic alliances, mergers and acquisitions, and continuous technological advancements will likely shape the competitive landscape in the coming years. The focus will shift towards providing seamless, integrated services across multiple platforms and devices, catering to a rapidly evolving digital ecosystem.

China Telecom Industry: Market Dynamics, Trends, and Growth Forecast (2019-2033)

This comprehensive report delivers an in-depth analysis of the dynamic China Telecom industry, providing invaluable insights for industry professionals, investors, and strategic planners. We delve into market structure, growth trends, key players, and emerging opportunities across various segments, offering a complete picture of this rapidly evolving landscape. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Key market segments like Voice Services, Wireless Data & Messaging Services (including Internet & Handset Data packages), and OTT & PayTV Services are analyzed extensively, including Average Revenue Per User (ARPU) and market size estimations in million units. The parent market is the broader telecommunications industry in China, while the child markets analyzed are the specific service segments mentioned above.

China Telecom Industry Market Dynamics & Structure

The China Telecom industry is characterized by high market concentration, with a few dominant players holding significant market share. Technological innovation, driven by 5G deployment and advancements in network infrastructure, is a key driver, while stringent regulatory frameworks shape market competition. Competitive product substitutes, such as VoIP services and alternative communication platforms, exert pressure on traditional players. The end-user demographic is evolving, with increasing penetration of smartphones and growing demand for data-intensive services. Mergers and acquisitions (M&A) activity, though less frequent in recent years, remains a potential factor influencing market structure.

- Market Concentration: China Mobile holds a dominant market share, while China Telecom and China Unicom compete for significant positions. xx% of the market is controlled by the top three players (estimated).

- Technological Innovation: 5G rollout is a major catalyst, driving investments in infrastructure and service innovation. Fiber optics expansion also supports significant growth.

- Regulatory Framework: Government policies regarding network infrastructure investment, spectrum allocation, and data security shape market dynamics.

- M&A Activity: The past five years have witnessed xx M&A deals (estimated), mainly focused on smaller players and specialized service providers.

- Innovation Barriers: High capital expenditure requirements and regulatory hurdles pose significant barriers to entry for new players.

China Telecom Industry Growth Trends & Insights

The China Telecom industry has witnessed robust growth over the past few years, propelled by rising smartphone penetration, increasing internet usage, and the government's push for digitalization. This growth is expected to continue, although at a moderated pace compared to previous years. Market size has expanded significantly, particularly in the data and messaging segment. Technological disruptions, such as the widespread adoption of 5G, are reshaping consumer behavior, leading to greater demand for high-bandwidth services. The Compound Annual Growth Rate (CAGR) for the overall market during 2019-2024 was xx%, and is projected to be xx% during 2025-2033. Market penetration of 5G services has increased rapidly, reflecting a substantial shift in consumer preferences.

Dominant Regions, Countries, or Segments in China Telecom Industry

The coastal regions of China, including Guangdong, Jiangsu, and Zhejiang, are the most dominant regions, owing to higher levels of economic activity, infrastructure development, and higher population density. However, significant growth is expected in less developed regions as infrastructure investments expand and internet penetration increases. The Wireless: Data and Messaging Services segment is the fastest-growing segment, fueled by the soaring demand for mobile internet access and data-centric applications.

Key Drivers:

- Strong economic growth in coastal regions.

- Extensive infrastructure development, including 5G networks and fiber optic cables.

- Favorable government policies supporting digital infrastructure and adoption.

- High smartphone penetration rates.

Dominant Segment: Wireless Data and Messaging Services demonstrates the highest growth potential, with an estimated market size of xx Million in 2025. The ARPU for the overall services segment in 2025 is estimated to be xx. Voice Services market is expected to decline slowly due to substitutions. OTT and PayTV services show a steady growth potential, driven by increasing internet adoption.

Market Size Estimates (Million units):

- Voice Services: 2020: xx, 2021: xx, 2022: xx, 2023: xx, 2024: xx, 2025: xx, 2026: xx, 2027: xx

- Wireless Data & Messaging: 2020: xx, 2021: xx, 2022: xx, 2023: xx, 2024: xx, 2025: xx, 2026: xx, 2027: xx

- OTT & PayTV Services: 2020: xx, 2021: xx, 2022: xx, 2023: xx, 2024: xx, 2025: xx, 2026: xx, 2027: xx

China Telecom Industry Product Landscape

The product landscape is characterized by a wide range of offerings, from basic voice and data services to sophisticated 5G-enabled packages, high-speed internet access, and bundled OTT and PayTV options. Key features include increasing data speeds, improved network coverage, and value-added services tailored to specific consumer segments. The industry is also witnessing the emergence of innovative products such as next-generation home gateways combining router, STB, and gateway functionalities, as exemplified by ZTE's recent launch. This drives efficiency and enhances the user experience.

Key Drivers, Barriers & Challenges in China Telecom Industry

Key Drivers:

- Rising smartphone penetration and internet usage.

- Government support for digital infrastructure development.

- Growing demand for high-bandwidth services (e.g., video streaming, online gaming).

- Technological advancements like 5G deployment.

Challenges & Restraints:

- Intense competition among established players.

- High capital expenditure requirements for network infrastructure upgrades.

- Regulatory hurdles and compliance requirements.

- Potential supply chain disruptions impacting equipment availability and pricing. This had a xx% impact on market growth in 2022 (estimated).

Emerging Opportunities in China Telecom Industry

- Expansion of 5G services to less-developed regions.

- Growth in the Internet of Things (IoT) market.

- Development of innovative applications for 5G technology (e.g., autonomous vehicles, smart cities).

- Increasing adoption of cloud-based services and edge computing.

- Growth in the demand for specialized services catered to enterprises and businesses.

Growth Accelerators in the China Telecom Industry

Continued investments in 5G infrastructure and the expanding IoT sector will be key drivers of long-term growth. Strategic partnerships between telecom providers and technology companies will fuel innovation, while expansion into underserved markets will unlock significant potential. The development of advanced data analytics and AI-powered solutions will further enhance service efficiency and customer experience.

Key Players Shaping the China Telecom Industry Market

- China Telecom Corp

- FiberHome Telecommunication Technologies Co Ltd

- ZTE Corporation

- Singtel Optus Pty (Note: This links to the parent company)

- China Satellite Communications Co Ltd

- Wingtech Technology Co Ltd

- China Railway Signal & Communication Co Ltd

- Jiangsu Zhongtian Technology Co Ltd

- Tencent Holdings Ltd

- China United Network Communications Group Co Ltd

Notable Milestones in China Telecom Industry Sector

- August 2022: China Telecom adds 44 million 5G subscribers, reaching 231.7 million. This signifies substantial growth in 5G adoption and increased market competitiveness.

- September 2022: ZTE Corporation launches a new-generation 4K Wi-Fi 6 mesh media gateway STB, improving home entertainment and reducing operator costs. This innovative product enhances the user experience and opens up new market opportunities.

In-Depth China Telecom Industry Market Outlook

The China Telecom industry is poised for continued growth, driven by technological advancements, expanding infrastructure, and the increasing demand for data-intensive services. Strategic partnerships and expansion into new markets will be crucial for maintaining competitiveness. The focus on 5G deployment, IoT applications, and advanced analytics will shape the future landscape, creating significant opportunities for established players and new entrants alike. The potential for further market consolidation through M&A activity cannot be ignored.

China Telecom Industry Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

China Telecom Industry Segmentation By Geography

- 1. China

China Telecom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.71% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continuous roll out of 5G; Growth of high-quality defensive companies; Demand for new digital services

- 3.3. Market Restrains

- 3.3.1. High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Stellar performance of 5G would trigger wireless segment growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Telecom Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China Satellite Communications Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Telecom Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FiberHome Telecommunication Technologies Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wingtech Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Railway Signal & Communication Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ZTE Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Singtel Optus Pty

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jiangsu Zhongtian Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tencent Holdings Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China United Network Communications Group Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Satellite Communications Co Ltd

List of Figures

- Figure 1: China Telecom Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Telecom Industry Share (%) by Company 2024

List of Tables

- Table 1: China Telecom Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Telecom Industry Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 3: China Telecom Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Telecom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Telecom Industry Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 6: China Telecom Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Telecom Industry?

The projected CAGR is approximately 2.71%.

2. Which companies are prominent players in the China Telecom Industry?

Key companies in the market include China Satellite Communications Co Ltd, China Telecom Corp, FiberHome Telecommunication Technologies Co Ltd, Wingtech Technology Co Ltd, China Railway Signal & Communication Co Ltd, ZTE Corporation, Singtel Optus Pty, Jiangsu Zhongtian Technology Co Ltd, Tencent Holdings Ltd, China United Network Communications Group Co Ltd.

3. What are the main segments of the China Telecom Industry?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD 491.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Continuous roll out of 5G; Growth of high-quality defensive companies; Demand for new digital services.

6. What are the notable trends driving market growth?

Stellar performance of 5G would trigger wireless segment growth.

7. Are there any restraints impacting market growth?

High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

In August 2022, according to data provided in its most recent financial report, China Telecom added about 44 million more consumers to its 5G package during the first half of this year, bringing the number at the end of June to 231.7 million - more than 60% of its whole mobile client base of 384.2 million. However, it still lags behind the market leader, China Mobile, which, according to its most recent financial report, has 970 million mobile subscribers, 511 million of whom have signed up for 5G packages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Telecom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Telecom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Telecom Industry?

To stay informed about further developments, trends, and reports in the China Telecom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence