Key Insights

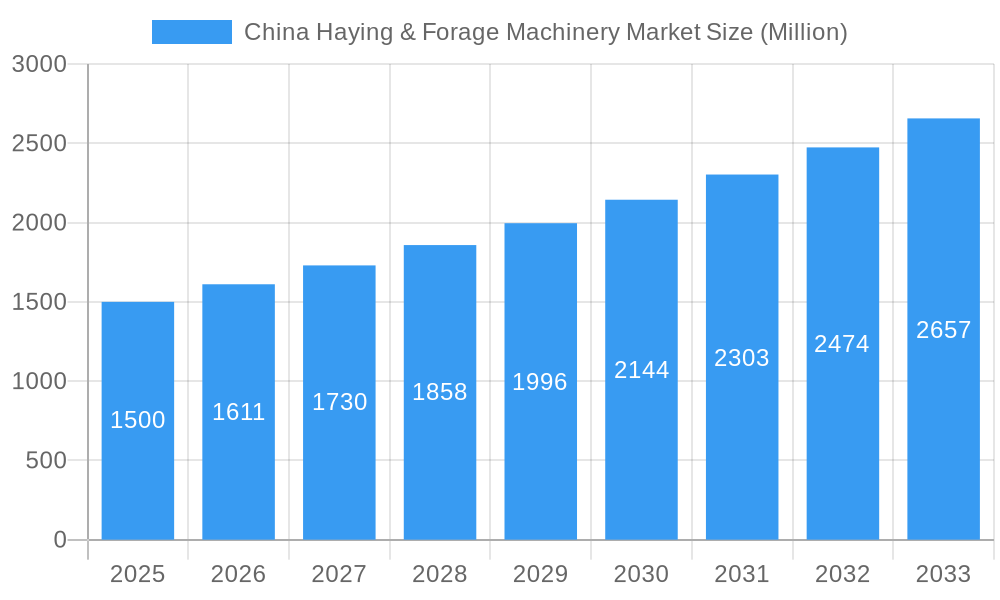

The China Haying & Forage Machinery Market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.08% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the increasing demand for livestock products in China is driving the need for efficient and high-capacity haying and forage machinery. Secondly, government initiatives promoting agricultural modernization and mechanization are providing incentives for farmers to adopt advanced technologies, boosting market adoption. Thirdly, the growing awareness of sustainable farming practices and the need to optimize yields are contributing to the market's growth. The market is segmented by type, encompassing mowers, balers, harvesters, and other related equipment, with mowers and balers currently dominating market share due to their widespread use in various farming operations. Key players such as Kuhn Group, Kubota Corporation, Deere & Company, CNH Industrial, and Krone North America are driving innovation and competition within the market.

China Haying & Forage Machinery Market Market Size (In Billion)

However, the market faces certain restraints. High initial investment costs associated with purchasing advanced haying and forage machinery can be a barrier for smaller farms. Additionally, the uneven distribution of agricultural infrastructure and technological expertise across different regions of China presents a challenge. Despite these challenges, the long-term outlook for the China Haying & Forage Machinery Market remains positive. Continuous technological advancements, government support, and increasing farmer awareness of the benefits of mechanization are expected to drive significant market growth over the forecast period. The market is poised to see greater adoption of automated and precision technologies, further enhancing efficiency and productivity within the agricultural sector. The shift towards larger-scale farming operations will further propel the demand for high-capacity machinery, ensuring sustained growth in the coming years. Competition amongst key players will continue to be fierce, leading to continuous innovation and improved product offerings.

China Haying & Forage Machinery Market Company Market Share

China Haying & Forage Machinery Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Haying & Forage Machinery Market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. It serves as an invaluable resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The parent market is the broader Agricultural Machinery Market in China, while the child market focuses specifically on hay making and forage harvesting equipment. The market size is estimated at XX million units in 2025.

China Haying & Forage Machinery Market Market Dynamics & Structure

This section delves into the intricate structure of the Chinese haying and forage machinery market, analyzing its concentration, technological advancements, regulatory landscape, competitive dynamics, and end-user characteristics. The analysis integrates quantitative and qualitative data, examining factors that shape market competition and growth.

Market Concentration: The market is characterized by a mix of global giants and domestic players, with the top 5 players holding an estimated XX% market share in 2025. Consolidation through mergers and acquisitions (M&A) is expected to continue, driving further concentration. The number of M&A deals in the sector between 2019-2024 totaled xx.

Technological Innovation: Technological advancements, such as precision agriculture technologies and automation, are key drivers. However, challenges remain in terms of high R&D costs and the need for skilled labor to operate advanced machinery.

Regulatory Framework: Government policies promoting agricultural modernization and improved efficiency significantly influence market growth. Stringent emission standards and safety regulations also play a crucial role.

Competitive Substitutes: Traditional methods of haymaking and forage harvesting pose some competition, but technological advantages of modern machinery are driving substitution.

End-User Demographics: The primary end-users are large-scale farms and agricultural cooperatives, with increasing adoption among smaller farms driven by government subsidies and improved affordability.

M&A Trends: Strategic acquisitions by multinational corporations to expand market share and access advanced technologies are prominent trends. The average deal value between 2019 and 2024 was estimated at XX million USD.

China Haying & Forage Machinery Market Growth Trends & Insights

This section analyzes the market's historical and projected growth trajectory, exploring factors influencing adoption rates and consumer behavior. Data from various sources, including industry reports and government statistics, provide a comprehensive understanding of market evolution.

The China Haying & Forage Machinery Market exhibited a CAGR of XX% during the historical period (2019-2024). This growth is projected to continue at a CAGR of XX% during the forecast period (2025-2033), reaching an estimated market size of XX million units by 2033. Market penetration is currently at approximately XX% and is expected to increase to XX% by 2033, driven by factors such as increasing mechanization in agriculture, rising disposable incomes, and government support for agricultural modernization. Technological disruptions, such as the introduction of autonomous harvesting systems, are anticipated to further accelerate market growth. A shift towards larger, more efficient machines is also observable, reflecting the changing needs of the agricultural sector.

Dominant Regions, Countries, or Segments in China Haying & Forage Machinery Market

This section identifies the key regions and segments driving market growth. The analysis focuses on factors contributing to the dominance of particular areas and segments, examining market share and future potential.

Leading Segment: The mowers segment currently holds the largest market share, accounting for approximately XX% in 2025, followed by balers (XX%) and harvesters (XX%). This is attributed to the widespread use of mowers in various farming practices, creating high demand.

Key Growth Drivers: Favorable government policies supporting agricultural mechanization, a growing demand for high-quality animal feed, and increasing land consolidation are some of the prominent factors propelling segment growth. Moreover, infrastructure development in rural areas is improving access to machinery for farmers in remote regions.

Regional Performance: The northern and eastern regions of China, characterized by large-scale farming operations, are expected to dominate market growth in the coming years. These regions benefit from higher agricultural productivity and favorable climatic conditions conducive to hay and forage production.

China Haying & Forage Machinery Market Product Landscape

The market offers a diverse range of products, including mowers (disc mowers, drum mowers), balers (round balers, square balers), harvesters (forage harvesters, hay tedders), and other supporting equipment. Continuous innovation focuses on enhanced efficiency, reduced fuel consumption, and improved operator comfort. Recent innovations include features like GPS-guided automated systems for improved precision and reduced waste. Unique selling propositions revolve around advanced technologies like precision cutting, efficient bale formation, and integrated data management systems.

Key Drivers, Barriers & Challenges in China Haying & Forage Machinery Market

Key Drivers:

Increased government investment in agricultural mechanization, rising demand for high-quality animal feed, and growing awareness of efficient farming practices are major drivers. Furthermore, the increasing adoption of precision agriculture technologies and the expansion of large-scale farming operations are boosting market demand.

Key Barriers and Challenges:

High initial investment costs for advanced machinery, limited access to financing for small farmers, and the availability of skilled labor to operate sophisticated equipment represent significant challenges. Supply chain disruptions, particularly in the procurement of critical components, coupled with fluctuating raw material prices, add further complexity. Furthermore, strict environmental regulations impact the manufacturing and operation of certain machinery types.

Emerging Opportunities in China Haying & Forage Machinery Market

The market presents opportunities in several areas. The increasing demand for organic and sustainably produced forage creates a need for specialized equipment. Expansion into underserved rural markets and the development of customized solutions tailored to specific agricultural practices represent promising avenues. Further integration of precision agriculture technologies such as AI-powered systems for crop monitoring and yield optimization will drive innovation and new market segments.

Growth Accelerators in the China Haying & Forage Machinery Market Industry

Technological advancements, particularly in automation and precision farming, are driving long-term growth. Strategic partnerships between manufacturers and agricultural cooperatives to provide integrated solutions enhance market penetration. Government initiatives aimed at promoting agricultural modernization and supporting smallholder farmers create an enabling environment. Expansion into new regions and the development of innovative financing schemes for farmers are crucial accelerators.

Key Players Shaping the China Haying & Forage Machinery Market Market

Notable Milestones in China Haying & Forage Machinery Market Sector

- 2020: Introduction of a new line of autonomous forage harvesters by Deere & Company.

- 2021: Government launches a subsidy program to encourage the adoption of modern haying and forage machinery by smallholder farmers.

- 2022: AGCO Corporation establishes a new manufacturing facility in China to cater to the growing local demand.

- 2023: Merger between two leading domestic hay baler manufacturers results in increased market consolidation.

- 2024: Launch of a new precision hay-making technology that significantly reduces fuel consumption and increases efficiency.

In-Depth China Haying & Forage Machinery Market Market Outlook

The future of the China Haying & Forage Machinery Market appears promising, driven by technological innovations, increasing agricultural mechanization, and supportive government policies. The market is poised for sustained growth, presenting significant opportunities for both established players and new entrants. Strategic investments in research and development, expansion into new market segments, and the development of sustainable and efficient solutions are key to capitalizing on this market's potential. The focus on precision agriculture and automation will be crucial to further improve efficiency and productivity within the agricultural sector, further propelling market expansion.

China Haying & Forage Machinery Market Segmentation

-

1. Type

- 1.1. Mowers

- 1.2. Balers

- 1.3. Harvesters

- 1.4. Others

-

2. Type

- 2.1. Mowers

- 2.2. Balers

- 2.3. Harvesters

- 2.4. Others

China Haying & Forage Machinery Market Segmentation By Geography

- 1. China

China Haying & Forage Machinery Market Regional Market Share

Geographic Coverage of China Haying & Forage Machinery Market

China Haying & Forage Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Rising Demand For Balers In Livestock Feedlots

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Haying & Forage Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mowers

- 5.1.2. Balers

- 5.1.3. Harvesters

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mowers

- 5.2.2. Balers

- 5.2.3. Harvesters

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kuhn Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kubota Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Farm Kin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CNH Industrial

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Krone North America Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yanmar Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGCO Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CLAAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kuhn Group

List of Figures

- Figure 1: China Haying & Forage Machinery Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Haying & Forage Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: China Haying & Forage Machinery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: China Haying & Forage Machinery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: China Haying & Forage Machinery Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: China Haying & Forage Machinery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: China Haying & Forage Machinery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: China Haying & Forage Machinery Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Haying & Forage Machinery Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the China Haying & Forage Machinery Market?

Key companies in the market include Kuhn Group, Kubota Corporation, Farm Kin, Deere Corporation, CNH Industrial, Krone North America Inc, Yanmar Company Limited, AGCO Corporation, CLAAS.

3. What are the main segments of the China Haying & Forage Machinery Market?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Rising Demand For Balers In Livestock Feedlots.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Haying & Forage Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Haying & Forage Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Haying & Forage Machinery Market?

To stay informed about further developments, trends, and reports in the China Haying & Forage Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence