Key Insights

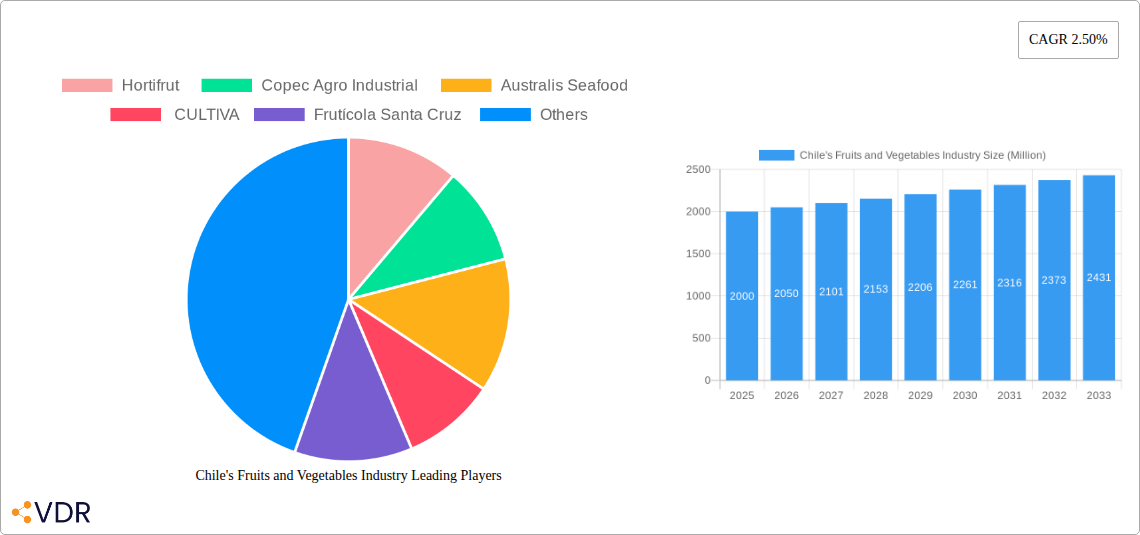

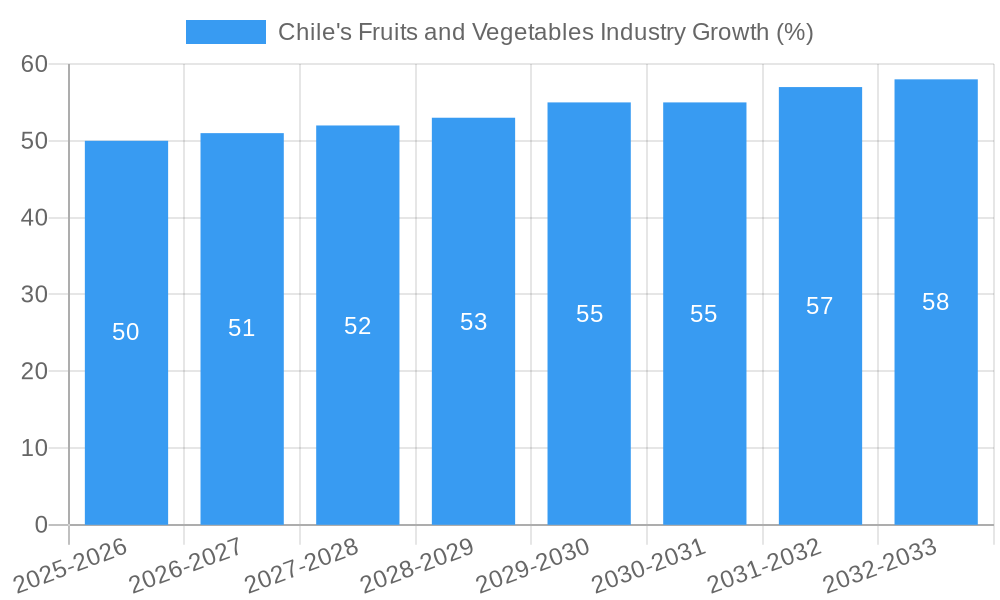

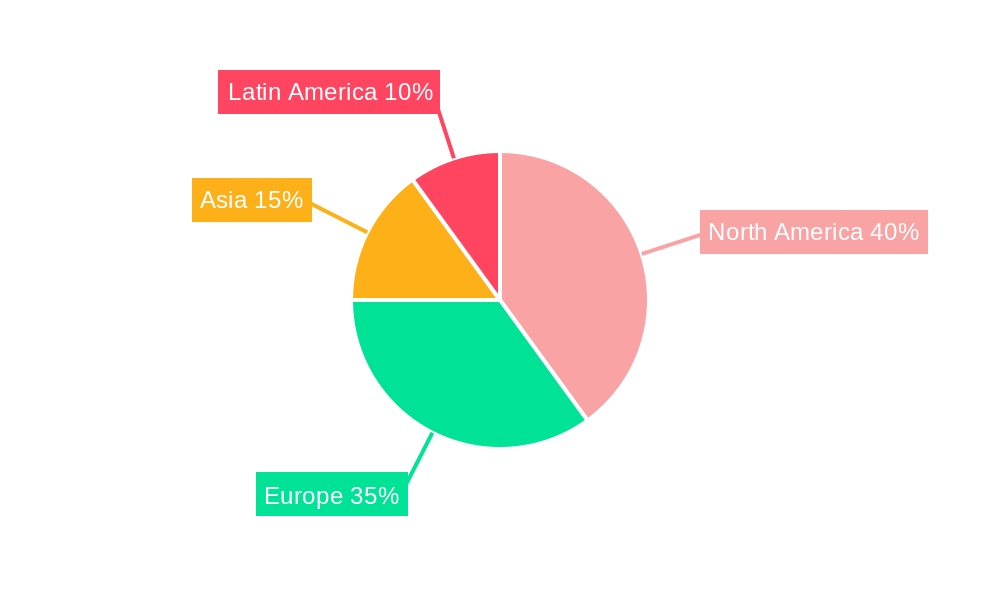

Chile's fruits and vegetables industry, valued at approximately $X million in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 2.50% from 2025 to 2033. This growth is driven by several factors. Firstly, Chile's favorable climate and fertile land provide ideal conditions for cultivating high-quality produce, making it a significant exporter to global markets, particularly North America and Europe. Secondly, increasing consumer demand for fresh, healthy food globally fuels the market's expansion. The growing awareness of the health benefits associated with fruit and vegetable consumption, coupled with rising disposable incomes in many regions, is further propelling market growth. Furthermore, technological advancements in farming techniques, such as precision agriculture and improved post-harvest handling, contribute to increased efficiency and reduced losses, supporting industry expansion. Key players like Hortifrut, Copec Agro Industrial, and Frutícola Santa Cruz are actively involved in leveraging these trends to strengthen their market positions. However, challenges such as fluctuating international prices, climate change impacts on crop yields, and increasing labor costs could potentially restrain growth. Nevertheless, the overall outlook remains positive, with the industry poised for consistent expansion over the forecast period.

The segmentation of the market reveals that fruits and vegetables represent significant portions of the total industry value. While precise figures for each segment's share are not available, analysis suggests a relatively balanced contribution from both segments, reflecting the diversity of Chilean agricultural production. Further research into import/export data and production volume is essential to quantify the relative contributions more accurately. The competitive landscape is characterized by a mix of large multinational corporations and smaller, locally owned businesses. These companies compete based on factors like product quality, price competitiveness, and market reach. Continued investments in infrastructure, sustainability initiatives, and value-added processing are expected to drive long-term profitability and competitiveness in this promising sector.

Chile's Fruits and Vegetables Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of Chile's dynamic fruits and vegetables industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market size, growth trends, key players, and future opportunities within the Chilean fruits and vegetables sector. The report analyzes both the parent market (Fruits and Vegetables) and child markets (Fruits and Vegetables separately) offering a granular view of production, consumption, import, export, and price trends.

Chile's Fruits and Vegetables Industry Market Dynamics & Structure

This section delves into the intricate structure of Chile's fruits and vegetables industry, analyzing market concentration, technological advancements, regulatory landscapes, competitive dynamics, and consumer demographics. We examine the impact of mergers and acquisitions (M&A) activity on market share distribution and competitive positioning.

- Market Concentration: The Chilean fruit and vegetable industry exhibits a moderately concentrated structure, with a few large players like Hortifrut and Frutícola Santa Cruz holding significant market share, alongside numerous smaller-scale producers. The concentration is higher in the export-oriented segments. xx% of the export market is controlled by the top 5 players.

- Technological Innovation: Technological advancements, such as precision agriculture, controlled-environment agriculture (CEA), and improved post-harvest handling technologies are driving efficiency and quality improvements. However, adoption rates vary across segments and farm sizes, with significant innovation barriers for smaller producers.

- Regulatory Framework: Chile's regulatory framework significantly impacts the industry, encompassing phytosanitary regulations, environmental standards, and labor laws. These regulations play a crucial role in shaping export opportunities and operational costs.

- Competitive Product Substitutes: Import competition, particularly from other Southern Hemisphere producers, presents a challenge, while consumer preferences for organic and sustainably produced fruits and vegetables offer opportunities.

- End-User Demographics: Growing health consciousness and rising disposable incomes are boosting demand for fresh produce, with a focus on convenience and value-added products.

- M&A Trends: Recent years have witnessed increased M&A activity, with large players like Hortifrut actively consolidating the industry through acquisitions (e.g., the USD 280 million acquisition of Atlantic Blue in 2021). This consolidation is expected to continue. The number of M&A deals in the period 2019-2024 totaled xx deals, with a value of xx Million USD.

Chile's Fruits and Vegetables Industry Growth Trends & Insights

This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior changes in Chile's fruits and vegetables industry. We project robust growth driven by increasing domestic consumption and sustained export demand.

The Chilean fruits and vegetables market is projected to experience significant growth over the forecast period (2025-2033). The market size, valued at xx Million units in 2025 (estimated), is expected to reach xx Million units by 2033, exhibiting a CAGR of xx%. This growth is primarily driven by the rising demand for healthy foods, increasing exports, and technological advancements within the industry. Consumer behavior is shifting towards premium quality, organic options, and convenience, impacting market segmentation and product innovation. The adoption of technological innovations, such as precision agriculture and controlled-environment agriculture, is accelerating, enhancing productivity and sustainability.

Dominant Regions, Countries, or Segments in Chile's Fruits and Vegetables Industry

This section identifies the leading regions, countries, or segments within the Chilean fruits and vegetables industry that are driving market growth. We assess the factors contributing to their dominance, including market share, growth potential, economic policies, and infrastructure.

- Fruits: The fruit segment dominates the industry, with exports accounting for a significant portion of production. Key regions contributing to this dominance include the Metropolitan Region, Valparaíso Region, and O'Higgins Region. High-value fruits like blueberries, grapes, and avocados are major export earners.

- Vegetables: The vegetable segment shows comparatively slower growth compared to fruits, with a greater focus on domestic consumption. Key drivers for future growth include diversification into high-value vegetables and improved processing technologies.

- Export Markets: The United States, the European Union, and Asian countries are significant export destinations for Chilean fruits and vegetables, significantly influencing market dynamics.

Chile's Fruits and Vegetables Industry Product Landscape

The Chilean fruits and vegetables industry is characterized by a diverse product landscape, including a wide range of fresh produce, processed goods, and value-added products. Innovation is driving improvements in quality, shelf life, and convenience. Recent advancements include the development of new cultivars with enhanced traits like disease resistance, improved flavor profiles, and extended shelf life. There's also a growing trend towards organic and sustainably grown products, catering to the increasing demand for environmentally friendly produce.

Key Drivers, Barriers & Challenges in Chile's Fruits and Vegetables Industry

Key Drivers:

- Rising global demand: Growth in health-conscious consumers globally fuels demand for high-quality Chilean produce.

- Favorable climatic conditions: Chile's unique geography and climate provide ideal conditions for fruit and vegetable cultivation.

- Government support: Government initiatives to promote exports and invest in agricultural technology contribute to industry growth.

Key Challenges:

- Water scarcity: Water resource constraints pose a significant challenge, particularly in arid regions.

- Labor shortages: Seasonal labor shortages can impact productivity and harvest efficiency.

- International competition: Competition from other fruit-producing countries requires continuous improvement in quality and efficiency. Estimated impact on industry revenue: xx Million units annually.

Emerging Opportunities in Chile's Fruits and Vegetables Industry

- Expansion into new markets: Exploring new export markets in Asia and Africa offers significant potential.

- Value-added products: Processing and adding value to produce increases profitability and creates new export opportunities.

- Organic and sustainable farming: Growing demand for environmentally friendly produce presents a substantial growth opportunity.

Growth Accelerators in the Chile's Fruits and Vegetables Industry Industry

Technological advancements, particularly in precision agriculture and post-harvest handling, are key growth drivers. Strategic partnerships between Chilean producers and international companies accelerate innovation and market access. Government initiatives supporting sustainable agricultural practices and promoting exports further fuel the industry's growth. The focus on developing new high-value crops and improving supply chain efficiency will significantly contribute to future expansion.

Key Players Shaping the Chile's Fruits and Vegetables Industry Market

- Hortifrut

- Copec Agro Industrial

- Australis Seafood

- CULTIVA

- Frutícola Santa Cruz

Notable Milestones in Chile's Fruits and Vegetables Industry Sector

- October 2021: Hortifrut acquired Atlantic Blue for USD 280 million, expanding its berry production capacity and market share.

- March 2021: Aerofarms and Hortifrut partnered to advance R&D in vertical farming for blueberries and cranberries.

- November 2022: The Chilean government eliminated mandatory methyl bromide fumigation for table grapes, boosting export competitiveness.

In-Depth Chile's Fruits and Vegetables Industry Market Outlook

The Chilean fruits and vegetables industry is poised for continued growth, driven by strong export demand, technological advancements, and a focus on sustainability. Strategic partnerships, expansion into new markets, and diversification into high-value products will further shape industry dynamics. The market exhibits significant potential, especially in organic and sustainably produced segments, offering numerous opportunities for innovation and expansion. The long-term outlook suggests sustained growth across various segments, with the export market playing a major role in shaping the industry's future trajectory.

Chile's Fruits and Vegetables Industry Segmentation

-

1. Type (Pr

- 1.1. Vegetables

- 1.2. Fruits

-

2. Type (Pr

- 2.1. Vegetables

- 2.2. Fruits

Chile's Fruits and Vegetables Industry Segmentation By Geography

- 1. Chile

Chile's Fruits and Vegetables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Increasing Exports of Fruits and Vegetables

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile's Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 5.1.1. Vegetables

- 5.1.2. Fruits

- 5.2. Market Analysis, Insights and Forecast - by Type (Pr

- 5.2.1. Vegetables

- 5.2.2. Fruits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hortifrut

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Copec Agro Industrial

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Australis Seafood

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CULTIVA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frutícola Santa Cruz

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Hortifrut

List of Figures

- Figure 1: Chile's Fruits and Vegetables Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Chile's Fruits and Vegetables Industry Share (%) by Company 2024

List of Tables

- Table 1: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 4: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2019 & 2032

- Table 5: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 6: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2019 & 2032

- Table 7: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 9: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 11: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 12: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2019 & 2032

- Table 13: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 14: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2019 & 2032

- Table 15: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile's Fruits and Vegetables Industry?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the Chile's Fruits and Vegetables Industry?

Key companies in the market include Hortifrut , Copec Agro Industrial , Australis Seafood , CULTIVA, Frutícola Santa Cruz .

3. What are the main segments of the Chile's Fruits and Vegetables Industry?

The market segments include Type (Pr, Type (Pr.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Increasing Exports of Fruits and Vegetables.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

November 2022: The Chilean government adopted a new strategy for increasing the sales of table grapes from the country to other regions, such as North America and Europe, by removing the mandatory requirement of methyl bromide fumigation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile's Fruits and Vegetables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile's Fruits and Vegetables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile's Fruits and Vegetables Industry?

To stay informed about further developments, trends, and reports in the Chile's Fruits and Vegetables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence