Key Insights

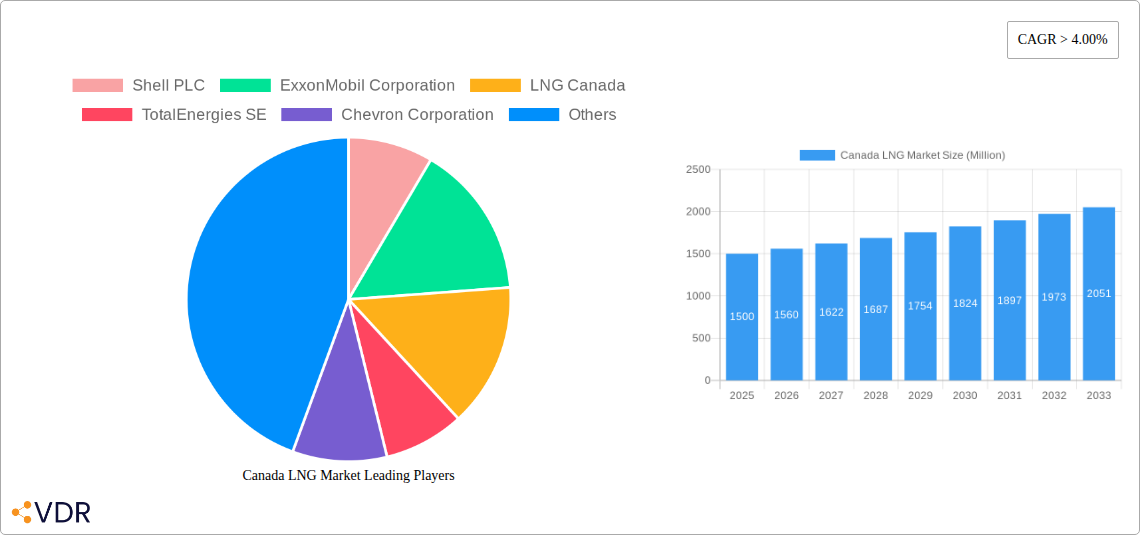

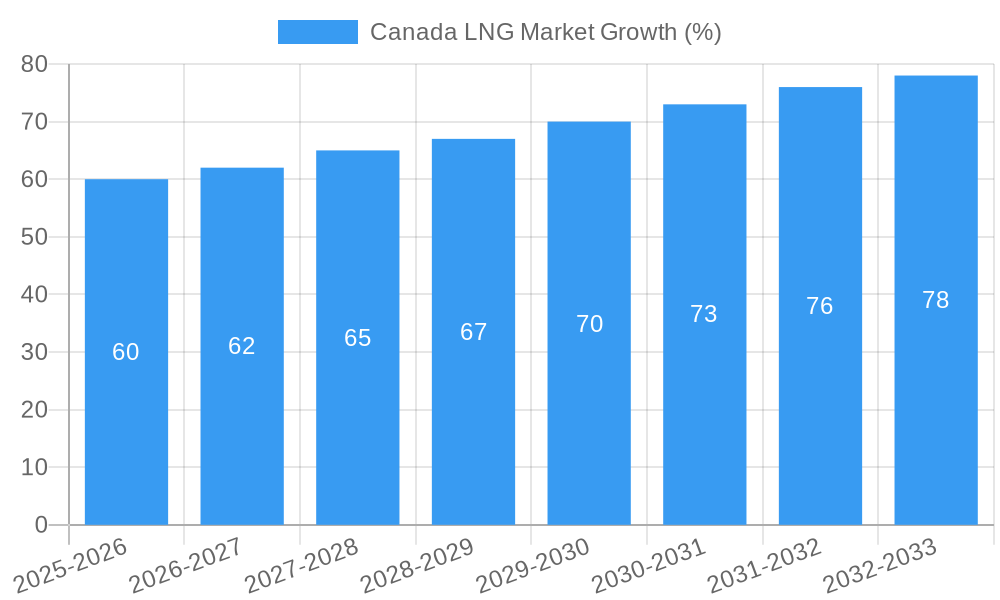

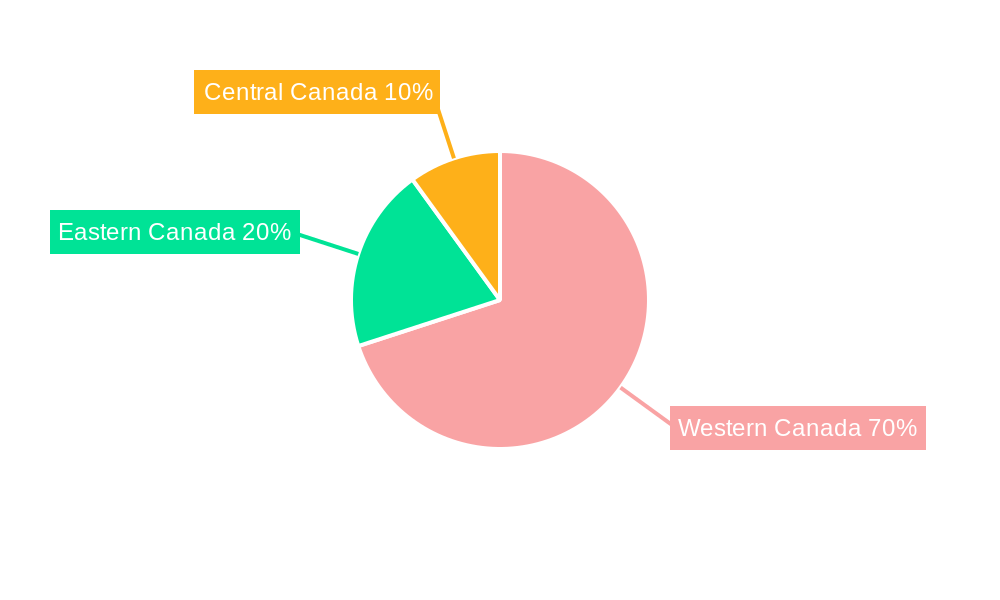

The Canadian LNG market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing global demand for cleaner energy sources positions LNG as a crucial transitional fuel, particularly in regions seeking to diversify their energy portfolios away from reliance on coal and oil. Secondly, Canada possesses substantial natural gas reserves, providing a solid foundation for LNG production and export. Thirdly, government initiatives promoting energy diversification and infrastructure development are creating a favorable investment climate. Significant investments in liquefaction plants, regasification facilities, and LNG shipping infrastructure across regions such as Western Canada (British Columbia in particular), Eastern Canada, and Central Canada, are fueling market expansion. The primary applications of LNG in Canada include power generation, transportation fuel (heavy-duty vehicles and maritime transport), and industrial uses. However, regulatory hurdles, environmental concerns surrounding methane emissions, and the fluctuating prices of natural gas represent potential challenges to sustained growth. Competition from other energy sources and the need for substantial capital investment in infrastructure remain key restraints. Major players like Shell, ExxonMobil, and LNG Canada are actively shaping the market landscape, leveraging their expertise and investment to drive project development and capacity expansion. The market segmentation, encompassing liquefaction, regasification, shipping, and diverse applications, reveals diverse opportunities for both established players and emerging businesses.

The forecast for the Canadian LNG market indicates continued expansion through 2033, primarily driven by export opportunities to Asian and European markets seeking secure and reliable energy supplies. The robust growth trajectory is expected despite potential fluctuations in global energy prices and evolving climate policies. Strategic partnerships, technological advancements in LNG production and transportation, and proactive environmental mitigation strategies will be crucial to ensuring sustainable and responsible growth within the Canadian LNG sector. Addressing concerns about environmental impact and community relations surrounding LNG projects will be pivotal in navigating the challenges and seizing the opportunities present in this dynamic market. The focus will likely shift towards sustainable LNG production and transportation, with an emphasis on minimizing carbon emissions.

Canada LNG Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canada LNG market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is crucial for industry professionals, investors, and stakeholders seeking a thorough understanding of this dynamic sector. The report is segmented by key infrastructure components (Liquefaction Plants, Regasification Facilities, Shipping) and application segments (Transportation Fuel, Power Generation, Other Applications).

Canada LNG Market Market Dynamics & Structure

This section analyzes the structure and dynamics of the Canadian LNG market, considering market concentration, technological advancements, regulatory landscapes, competitive substitutes, end-user demographics, and mergers & acquisitions (M&A) activity. The Canadian LNG market is characterized by a moderate level of concentration, with a few major players holding significant market share. However, the emergence of smaller, niche players, particularly in the context of renewable energy integration, is reshaping the competitive landscape.

- Market Concentration: The top 5 players (Shell PLC, ExxonMobil Corporation, LNG Canada, TotalEnergies SE, Chevron Corporation) hold an estimated xx% market share in 2025, while smaller players account for the remaining xx%.

- Technological Innovation: Focus on improving liquefaction efficiency, reducing emissions, and enhancing safety and security are key drivers of innovation. However, high initial investment costs can act as barriers.

- Regulatory Framework: Government policies regarding carbon emissions, environmental regulations, and indigenous land rights play a significant role in shaping project development and timelines.

- Competitive Substitutes: Natural gas, renewables (solar, wind), and other energy sources present competition.

- End-User Demographics: Primarily focused on export markets in Asia and Europe, with increasing domestic demand for power generation and potentially transportation fuel.

- M&A Trends: The past five years have witnessed xx M&A deals in the Canadian LNG sector, primarily focused on consolidating assets and streamlining operations.

Canada LNG Market Growth Trends & Insights

The Canadian LNG market experienced substantial growth between 2019 and 2024, driven by factors such as rising global demand for LNG, increasing investments in infrastructure development, and supportive government policies. The market is projected to continue its expansion, though at a more moderated pace, during the forecast period (2025-2033). This moderation reflects global energy transition efforts and the increasing competitiveness of alternative energy sources. Adoption rates have accelerated in recent years, largely influenced by the completion of major liquefaction plants.

- Market Size Evolution: The market size grew from xx Million units in 2019 to xx Million units in 2024 and is projected to reach xx Million units by 2033.

- Compound Annual Growth Rate (CAGR): The market exhibited a CAGR of xx% during 2019-2024 and is expected to show a CAGR of xx% during 2025-2033.

- Market Penetration: Market penetration increased from xx% in 2019 to xx% in 2024 and is projected to reach xx% by 2033.

- Technological Disruptions: The increasing integration of digital technologies and automation across the value chain is streamlining operations and improving efficiency.

Dominant Regions, Countries, or Segments in Canada LNG Market

British Columbia is the dominant region for LNG activity in Canada due to its abundant natural gas reserves and existing port infrastructure. This is further strengthened by the ongoing development of significant projects such as LNG Canada in Kitimat. The Liquefaction Plants segment plays the most critical role, driving overall market growth due to its position in the supply chain. The export-oriented nature of the Canadian LNG market further reinforces the importance of this segment.

- Key Drivers in British Columbia:

- Abundant natural gas reserves in the Montney and Duvernay formations.

- Existing port infrastructure in Kitimat and Prince Rupert.

- Supportive provincial and federal government policies.

- LNG Liquefaction Plants: This segment is the backbone of the Canadian LNG industry, accounting for the majority of market share and investment.

- Growth Potential: Continued expansion of existing facilities and potential development of new projects will fuel segment growth.

Canada LNG Market Product Landscape

The Canadian LNG market involves the production, transportation, and delivery of liquefied natural gas. Recent product innovations focus on enhancing liquefaction efficiency and reducing emissions during the liquefaction process. Technological advancements in cryogenic tank design and LNG carrier optimization have significantly improved transportation efficiency and safety. The focus is on optimizing the entire value chain, maximizing energy efficiency and reducing environmental impact.

Key Drivers, Barriers & Challenges in Canada LNG Market

Key Drivers: Rising global demand for LNG, significant natural gas reserves in Western Canada, and government support for energy infrastructure projects are key drivers of market expansion. The potential to integrate carbon capture and storage (CCS) technologies further boosts the long-term growth outlook.

Challenges: High capital expenditures associated with LNG infrastructure development, regulatory hurdles and permitting processes, and global energy transition efforts which affect long-term demand projections, alongside potential supply chain disruptions and geopolitical instability, are primary challenges. The impact of these challenges translates into potential delays in project development and increased project costs.

Emerging Opportunities in Canada LNG Market

Emerging opportunities lie in the development of small-scale LNG facilities to serve remote communities and industrial customers, the potential for LNG bunkering to support the growth of LNG as a marine fuel, and the exploration of carbon capture and storage (CCS) technologies to reduce environmental impacts. Further collaboration with First Nations and local communities is expected to unlock further opportunities for sustainable development.

Growth Accelerators in the Canada LNG Market Industry

Technological advancements, such as the development of more efficient liquefaction technologies and innovative cryogenic transportation solutions, will accelerate market growth. Strategic partnerships and collaborations between energy companies, engineering firms, and indigenous communities are crucial for facilitating infrastructure development and reducing environmental impacts. The strategic expansion of export markets will also drive long-term growth.

Key Players Shaping the Canada LNG Market Market

- Shell PLC

- ExxonMobil Corporation

- LNG Canada

- TotalEnergies SE

- Chevron Corporation

- Fluor Corporation

- TechnipFMC PLC

Notable Milestones in Canada LNG Market Sector

- October 2022: LNG Canada accelerates construction of its Kitimat LNG terminal, projecting a peak workforce of 7,500 in the following year. Phase 1 is 70% complete, and the Coastal GasLink pipeline is 75% complete.

- February 2022: The Haisla Nation's Cedar LNG project submits its Environmental Assessment Certificate application, signaling progress towards its Kitimat export facility.

In-Depth Canada LNG Market Market Outlook

The Canadian LNG market holds significant future potential, driven by strong global demand, abundant domestic resources, and ongoing infrastructure development. Strategic investments in innovative technologies and sustainable practices will be crucial for maximizing the market's long-term growth. Partnerships with indigenous communities will be essential for successful project development and mitigating potential risks. The long-term outlook remains positive, contingent upon continued governmental support and consistent international demand.

Canada LNG Market Segmentation

-

1. LNG Infrastructure

- 1.1. LNG Liquefaction Plants

- 1.2. LNG Regasification Facilities

- 1.3. LNG Shipping

-

2. Application

- 2.1. Transportation Fuel

- 2.2. Power Generation

- 2.3. Other Application Types

Canada LNG Market Segmentation By Geography

- 1. Canada

Canada LNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Oil and Gas Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Penetration of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Upcoming LNG Projects Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada LNG Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 5.1.1. LNG Liquefaction Plants

- 5.1.2. LNG Regasification Facilities

- 5.1.3. LNG Shipping

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Transportation Fuel

- 5.2.2. Power Generation

- 5.2.3. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 6. Eastern Canada Canada LNG Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada LNG Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada LNG Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Shell PLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ExxonMobil Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 LNG Canada

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 TotalEnergies SE

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Chevron Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Fluor Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 TechnipFMC PLC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Shell PLC

List of Figures

- Figure 1: Canada LNG Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada LNG Market Share (%) by Company 2024

List of Tables

- Table 1: Canada LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada LNG Market Revenue Million Forecast, by LNG Infrastructure 2019 & 2032

- Table 3: Canada LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Canada LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada LNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada LNG Market Revenue Million Forecast, by LNG Infrastructure 2019 & 2032

- Table 10: Canada LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Canada LNG Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada LNG Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Canada LNG Market?

Key companies in the market include Shell PLC, ExxonMobil Corporation, LNG Canada, TotalEnergies SE, Chevron Corporation, Fluor Corporation, TechnipFMC PLC.

3. What are the main segments of the Canada LNG Market?

The market segments include LNG Infrastructure, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Oil and Gas Projects.

6. What are the notable trends driving market growth?

Upcoming LNG Projects Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Penetration of Renewable Energy.

8. Can you provide examples of recent developments in the market?

October 2022: LNG Canada ramped construction at its Kitimat liquefied natural gas (LNG) terminal. The workforce is expected to peak at 7,500 people next year. The first phase of the LNG project is 70% completed, and the Coastal GasLink (CGL) pipeline is 75% completed. Once complete, the terminal for the liquefaction, storage, and loading of liquefied natural gas will export LNG produced by the project's partners in the Montney Formation gas fields near Dawson Creek.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada LNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada LNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada LNG Market?

To stay informed about further developments, trends, and reports in the Canada LNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence