Key Insights

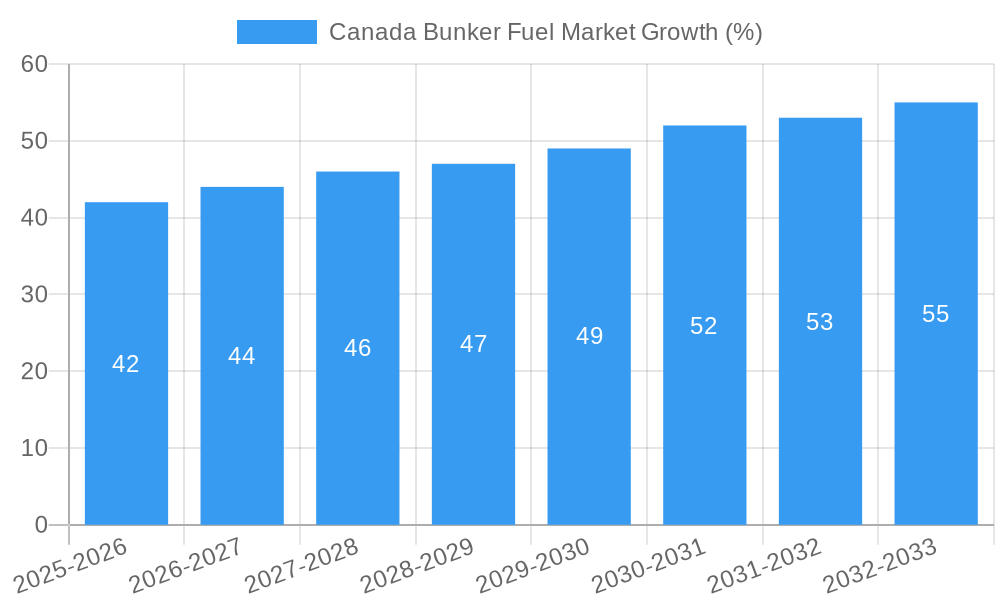

The Canada Bunker Fuel Market, valued at $1.42 billion in 2025, is projected to experience robust growth, driven primarily by increasing maritime trade activity and the expansion of the Canadian port infrastructure. The market's Compound Annual Growth Rate (CAGR) exceeding 2.93% from 2025 to 2033 indicates a significant upward trajectory. Key growth drivers include the rising demand for containerized goods, particularly in the context of global supply chains, and the ongoing development of efficient and sustainable shipping solutions. While environmental regulations pose potential restraints, the increasing adoption of cleaner fuels and technological innovations aimed at reducing emissions within the shipping industry are mitigating these challenges. Major players in the market comprise both fuel suppliers like PetroChina, TotalEnergies, and World Fuel Services, and major shipping companies such as Cosco Shipping Lines, OOCL, and Mediterranean Shipping Company, highlighting the integrated nature of the industry. Competition is likely to remain fierce as companies vie for market share through strategic partnerships, cost optimization, and technological advancements. Regional variations within the Canadian market might exist due to varying port activities and proximity to key shipping routes; however, detailed regional data is not yet available. Further growth is anticipated with ongoing infrastructure investments and the evolving regulatory landscape.

The forecast period (2025-2033) anticipates consistent growth, mirroring the global trend of increasing maritime trade. The historical period (2019-2024) likely saw moderate growth influenced by fluctuating global fuel prices and occasional disruptions to supply chains. While the precise segment breakdown is unavailable, logical segmentation would include fuel types (high-sulfur fuel oil, low-sulfur fuel oil, LNG), vessel types (container ships, tankers, bulk carriers), and regions within Canada. Analyzing these segments would offer a more granular understanding of market dynamics and potential areas of high growth. Future growth strategies for market participants should focus on adapting to environmental regulations, embracing technological advancements in fuel efficiency and emissions reduction, and securing strategic partnerships within the shipping industry.

Canada Bunker Fuel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canadian bunker fuel market, encompassing market dynamics, growth trends, regional performance, and key player strategies. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for fuel suppliers, ship owners, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The market value is projected to reach xx Million by 2033.

Canada Bunker Fuel Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Canadian bunker fuel market. The analysis delves into market concentration, examining the market share held by major players and assessing the level of competition. We explore the influence of technological innovation, including the adoption of cleaner fuels like LNG and biodiesel, and the impact of regulatory frameworks on market participants. The report also considers the role of substitute products and evolving end-user demands, incorporating insights from M&A activities within the sector.

- Market Concentration: The Canadian bunker fuel market exhibits a [High/Medium/Low] level of concentration, with the top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: The shift towards cleaner fuels, such as LNG and biofuels, is a major driver of innovation. However, challenges remain in terms of infrastructure development and cost-effectiveness.

- Regulatory Framework: Government regulations regarding emissions and fuel standards significantly impact market dynamics, prompting investments in cleaner technologies.

- Competitive Substitutes: Competition exists between various bunker fuels, including traditional heavy fuel oil (HFO), marine gas oil (MGO), LNG, and biofuels.

- End-User Demographics: The primary end-users are shipping companies, with varying demands based on vessel size and type.

- M&A Trends: The number of M&A deals in the Canadian bunker fuel market between 2019 and 2024 was approximately xx, reflecting [High/Medium/Low] consolidation activity.

Canada Bunker Fuel Market Growth Trends & Insights

This section presents a detailed analysis of the Canadian bunker fuel market's growth trajectory, utilizing extensive data and insights. The analysis covers market size evolution, adoption rates of various fuel types, the impact of technological disruptions, and shifts in consumer behavior within the shipping industry. Specific metrics, including the Compound Annual Growth Rate (CAGR) and market penetration rates for different fuel types, are provided to offer a granular understanding of market growth. The analysis will incorporate information from various sources, including industry reports, government data, and expert interviews to provide a comprehensive overview. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033).

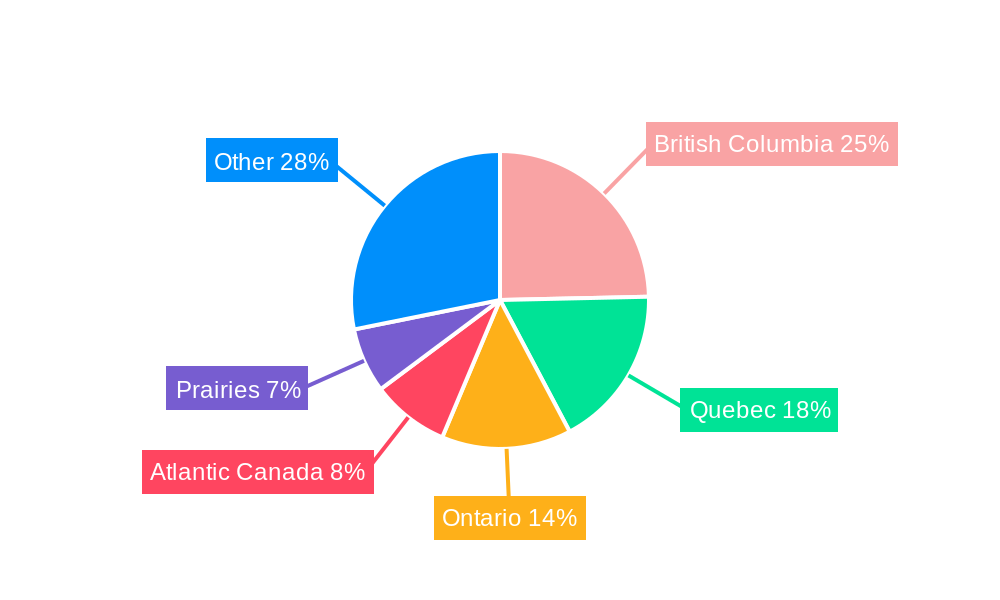

Dominant Regions, Countries, or Segments in Canada Bunker Fuel Market

This section identifies the leading regions and segments driving market growth within Canada. It examines factors contributing to their dominance, such as economic policies, port infrastructure, and shipping activity. The analysis considers market share, growth potential, and future prospects for each region and segment. Key drivers and challenges are highlighted using bullet points and paragraphs.

- Leading Region/Segment: [e.g., British Columbia due to its significant port activity and proximity to Asia]

- Key Drivers:

- Robust port infrastructure and efficient logistics.

- Government support for cleaner fuel adoption.

- Strong economic activity and trade volume.

- Dominance Factors:

- High shipping traffic and demand for bunker fuels.

- Strategic location facilitating efficient fuel distribution.

- Presence of major fuel suppliers and ship owners.

Canada Bunker Fuel Market Product Landscape

This section provides a concise overview of the various bunker fuel products available in the Canadian market, highlighting their applications, performance metrics, and unique selling propositions. It also explores technological advancements in bunker fuel production and distribution, emphasizing innovations that enhance efficiency, reduce emissions, and improve overall performance.

Key Drivers, Barriers & Challenges in Canada Bunker Fuel Market

This section outlines the key factors driving growth and the challenges hindering market expansion.

Key Drivers:

- Increasing global trade and shipping activity.

- Growing demand for cleaner, more environmentally friendly fuels.

- Government initiatives promoting sustainable shipping practices.

Key Challenges:

- Fluctuations in crude oil prices.

- Stringent environmental regulations and compliance costs.

- Infrastructure limitations for alternative fuel distribution (e.g., LNG).

Emerging Opportunities in Canada Bunker Fuel Market

This section highlights emerging trends and lucrative opportunities within the Canadian bunker fuel market. It focuses on untapped market segments, innovative applications of bunker fuels, and evolving consumer preferences within the shipping industry. Specific examples of emerging opportunities are provided.

Growth Accelerators in the Canada Bunker Fuel Market Industry

This section discusses the major catalysts driving long-term growth in the Canadian bunker fuel market, emphasizing technological advancements, strategic partnerships, and market expansion strategies. The analysis focuses on the factors that will contribute to sustained market expansion in the years to come.

Key Players Shaping the Canada Bunker Fuel Market Market

This section profiles key players in the Canadian bunker fuel market, including both fuel suppliers and ship owners.

Fuel Suppliers:

- PetroChina Company Limited

- TotalEnergies SE

- Peninsula Petroleum Ltd

- A P Møller – Mærsk AS

- World Fuel Services Corporation

- List of Other Prominent Companies

Ship Owners:

- Cosco Shipping Lines Co Ltd

- Orient Overseas Container Line (OOCL)

- Mediterranean Shipping Company

- Ocean Network Express

- CMA CGM Group

- List of Other Prominent Companies

Market Ranking/Share Analysis: [Insert market share data for each company, if available. Otherwise, use "xx%"].

Notable Milestones in Canada Bunker Fuel Market Sector

- May 2024: CSL Group's renewed B100 biodiesel initiative for its CSL Welland vessel, signifying a resurgence in biofuel adoption within the Canadian shipping industry.

- February 2024: The merger between Cryopeak LNG Solutions and Ferus Natural Gas Fuels, strengthening LNG production and distribution capabilities in Western Canada.

In-Depth Canada Bunker Fuel Market Market Outlook

The Canadian bunker fuel market is poised for significant growth driven by increasing shipping activity, the adoption of cleaner fuels, and supportive government policies. Strategic partnerships, technological breakthroughs in fuel efficiency and emission reduction, and expansion into new market segments will contribute to this positive outlook. The market presents substantial opportunities for both established players and new entrants.

Canada Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Liquefied Natural Gas (LNG)

- 1.5. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

Canada Bunker Fuel Market Segmentation By Geography

- 1. Canada

Canada Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising LNG Trade4.; Surge in Marine Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Rising LNG Trade4.; Surge in Marine Transportation

- 3.4. Market Trends

- 3.4.1. The Very Low Sulphur Fuel Oil (VLSFO) Segment is to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Liquefied Natural Gas (LNG)

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Fuel Suppliers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 1 PetroChina Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 2 TotalEnergies SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3 Peninsula Petroleum Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 4 A P Møller – Mærsk AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 5 World Fuel Services Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ship Owners

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1 Cosco Shipping Lines Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 2 Orient Overseas Container Line (OOCL)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3 Mediterranean Shipping Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 4 Ocean Network Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 5 CMA CGM Group*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Fuel Suppliers

List of Figures

- Figure 1: Canada Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Bunker Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Bunker Fuel Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Canada Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Canada Bunker Fuel Market Volume Billion Forecast, by Fuel Type 2019 & 2032

- Table 5: Canada Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 6: Canada Bunker Fuel Market Volume Billion Forecast, by Vessel Type 2019 & 2032

- Table 7: Canada Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada Bunker Fuel Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Canada Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: Canada Bunker Fuel Market Volume Billion Forecast, by Fuel Type 2019 & 2032

- Table 11: Canada Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 12: Canada Bunker Fuel Market Volume Billion Forecast, by Vessel Type 2019 & 2032

- Table 13: Canada Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Canada Bunker Fuel Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Bunker Fuel Market?

The projected CAGR is approximately > 2.93%.

2. Which companies are prominent players in the Canada Bunker Fuel Market?

Key companies in the market include Fuel Suppliers, 1 PetroChina Company Limited, 2 TotalEnergies SE, 3 Peninsula Petroleum Ltd, 4 A P Møller – Mærsk AS, 5 World Fuel Services Corporation, Ship Owners, 1 Cosco Shipping Lines Co Ltd, 2 Orient Overseas Container Line (OOCL), 3 Mediterranean Shipping Company, 4 Ocean Network Express, 5 CMA CGM Group*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi.

3. What are the main segments of the Canada Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising LNG Trade4.; Surge in Marine Transportation.

6. What are the notable trends driving market growth?

The Very Low Sulphur Fuel Oil (VLSFO) Segment is to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

4.; Rising LNG Trade4.; Surge in Marine Transportation.

8. Can you provide examples of recent developments in the market?

May 2024: CSL Group, a Canadian company, announced that its gearless bulk carrier, CSL Welland, will once again operate on B100 biodiesel for the upcoming season, signaling the revival of its biofuel initiative. In collaboration with Canada Clean Fuels Inc., the company is fueling eight of its vessels with B100 biodiesel sourced from North America and produced from waste plant materials.February 2024: Cryopeak LNG Solutions signed an agreement to merge operations with Ferus Natural Gas Fuels to develop a new liquefied natural gas (LNG) production and distribution organization across Canada. The company also manages three LNG production facilities through this expansion in Western Canada and operates the country's most significant LNG transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the Canada Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence