Key Insights

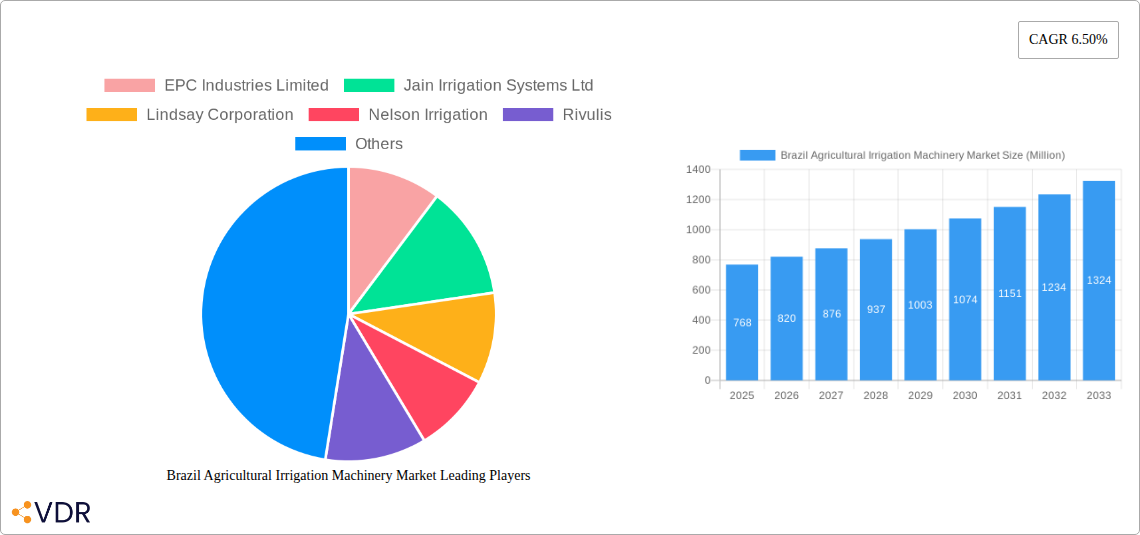

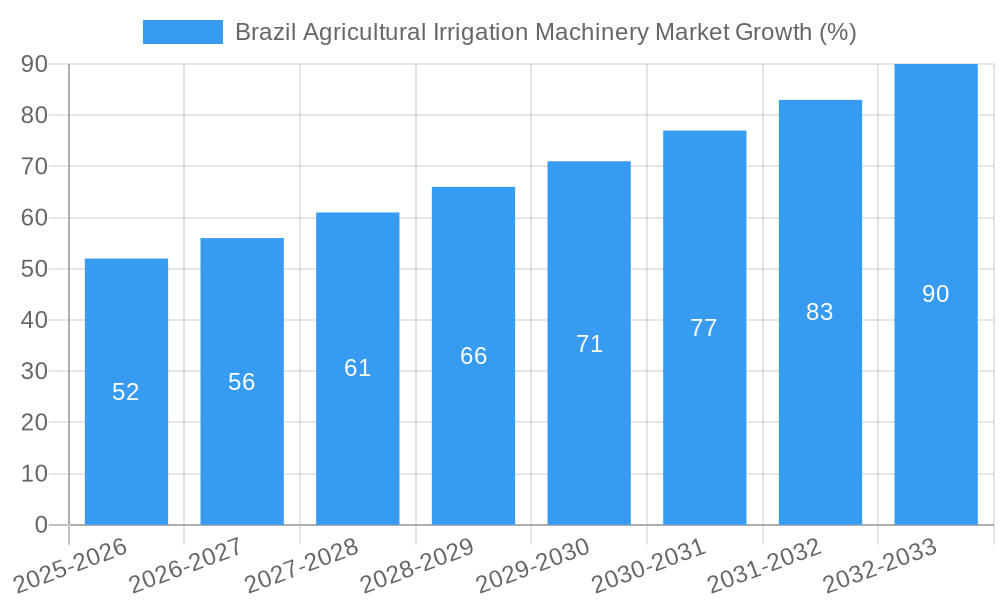

The Brazil agricultural irrigation machinery market is experiencing robust growth, driven by factors such as increasing water scarcity, rising demand for high-yield crops, and government initiatives promoting efficient water management in agriculture. The market's Compound Annual Growth Rate (CAGR) of 6.50% from 2019 to 2024 indicates a steady upward trajectory. This growth is fueled by the adoption of advanced irrigation technologies like drip and sprinkler irrigation systems, particularly in the fruit and vegetable sectors. The market is segmented by irrigation type (sprinkler, drip, pivot, etc.), application (crop type), and component (fittings and accessories). Major players such as EPC Industries Limited, Jain Irrigation Systems Ltd, and Netafim are vying for market share, offering a range of solutions to meet diverse agricultural needs. While challenges such as high initial investment costs and technological limitations in certain regions exist, the long-term benefits of water conservation and increased crop yields are driving market expansion. The forecast period (2025-2033) anticipates continued growth, particularly in regions with expanding agricultural production and increasing awareness of sustainable farming practices. The increasing adoption of precision irrigation techniques will further propel market growth in the coming years.

Brazil’s agricultural sector, facing increasing pressure to optimize water usage, is seeing a significant shift towards modern irrigation technologies. This is reflected in the strong growth of the agricultural irrigation machinery market, with a projected continuation of this trend throughout the forecast period. While the specific market size for 2025 isn't explicitly given, estimating based on a 6.5% CAGR from a reasonable assumed base year value (let's assume a 2019 market size of $500 million as a plausible starting point for illustration only) would project significant expansion by 2033. This expansion is being fueled by government incentives for water-efficient farming, increasing consumer demand for fresh produce, and the ongoing need to increase crop yields per unit of water. The dominance of key players like Jain Irrigation Systems Ltd demonstrates the level of market competitiveness, while ongoing technological advancements and the development of more efficient systems point toward further growth.

Brazil Agricultural Irrigation Machinery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil Agricultural Irrigation Machinery Market, covering market dynamics, growth trends, dominant segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market is segmented by type (Sprinkler Irrigation, Drip Irrigation, Pivot Irrigation, Fittings and Accessories), application (Crop, Non-Crop), and key players such as EPC Industries Limited, Jain Irrigation Systems Ltd, Lindsay Corporation, Nelson Irrigation, Rivulis, Rain Bird Corporation, Netafim, Irritec Sp, and Valmont Industries. The report utilizes data measured in million units.

Brazil Agricultural Irrigation Machinery Market Market Dynamics & Structure

The Brazil agricultural irrigation machinery market is characterized by moderate concentration, with a few large multinational players alongside numerous smaller, regional companies. Technological innovation, particularly in precision irrigation techniques like drip and subsurface irrigation, is a key driver. Government initiatives promoting water-efficient agriculture and favorable financing schemes are further boosting market growth. However, high initial investment costs and the need for skilled labor remain significant barriers. Competitive pressure from substitute technologies and the impact of fluctuating commodity prices also influence market dynamics. Mergers and acquisitions (M&A) activity has been relatively low in recent years (xx deals in the last 5 years), primarily driven by smaller companies seeking to expand their market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on precision irrigation, automation, and sensor technology. Barriers include high R&D costs and access to advanced technology.

- Regulatory Framework: Government regulations promoting water conservation and sustainable agriculture are supportive.

- Competitive Substitutes: Traditional flood irrigation remains a competitor, but its inefficiency is driving adoption of modern irrigation technologies.

- End-User Demographics: Primarily large-scale commercial farms, with increasing adoption by small and medium-sized farms.

- M&A Trends: Low volume of M&A activity, primarily involving smaller players.

Brazil Agricultural Irrigation Machinery Market Growth Trends & Insights

The Brazilian agricultural irrigation machinery market is experiencing significant growth, driven by increasing water scarcity, rising agricultural output, and government support for modern farming techniques. The market size witnessed a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024 and is projected to maintain a CAGR of xx% from 2025 to 2033, reaching xx million units by 2033. This growth is fueled by the growing adoption of advanced irrigation systems across various agricultural sectors, particularly in the rapidly expanding fruit and vegetable cultivation segments. Technological advancements and the introduction of smart irrigation systems that optimize water usage and improve crop yields are also playing a crucial role. Furthermore, favorable financing options and government incentives are accelerating market penetration, particularly in regions with limited water resources. Consumer behavior is shifting towards preference for water-efficient and high-yield farming practices, significantly driving market growth.

Dominant Regions, Countries, or Segments in Brazil Agricultural Irrigation Machinery Market

The Southeast region of Brazil dominates the agricultural irrigation machinery market, owing to its high concentration of agricultural activities and favorable climatic conditions. Within this region, states like São Paulo and Minas Gerais are key contributors. The Crop application segment holds the largest market share, followed by the Non-Crop segment. Among irrigation types, drip irrigation is witnessing faster growth than sprinkler irrigation owing to its water-saving capabilities.

- Key Drivers (Southeast Region):

- High agricultural output and concentration of farms.

- Government support for water-efficient agriculture.

- Favorable climate conditions.

- Well-developed infrastructure.

- Market Share and Growth Potential: Southeast region holds approximately xx% of market share, with projected growth of xx% during the forecast period.

Brazil Agricultural Irrigation Machinery Market Product Landscape

The Brazilian market showcases a diverse range of irrigation equipment, from traditional sprinkler systems to advanced drip and pivot irrigation technologies. Recent innovations include smart irrigation controllers with remote monitoring capabilities, soil moisture sensors for precise water delivery, and weather-based irrigation scheduling systems. These advancements aim to optimize water usage, minimize water stress on crops, and improve overall crop yields, ultimately increasing the return on investment for farmers. Unique selling propositions often center around water efficiency, ease of installation, and advanced control systems.

Key Drivers, Barriers & Challenges in Brazil Agricultural Irrigation Machinery Market

Key Drivers: Growing demand for food production, increasing water scarcity, government incentives for water-efficient technologies, and rising farmer awareness regarding improved yields are primary drivers.

Challenges: High initial investment costs, limited access to credit for smallholder farmers, lack of skilled labor for installation and maintenance, and inconsistent power supply in certain regions pose significant challenges. These hurdles can translate into a reduced market penetration rate, particularly in remote or underserved areas.

Emerging Opportunities in Brazil Agricultural Irrigation Machinery Market

The expansion of precision agriculture techniques, particularly in areas with limited water resources, presents significant untapped potential. The adoption of IoT-enabled smart irrigation systems with predictive analytics and remote management capabilities is an evolving opportunity. Moreover, increased focus on sustainable agricultural practices and the growth of the organic farming sector create further market expansion opportunities.

Growth Accelerators in the Brazil Agricultural Irrigation Machinery Market Industry

Technological breakthroughs in automation, precision irrigation, and water management are key growth accelerators. Strategic collaborations between irrigation equipment manufacturers, agricultural technology companies, and financial institutions expand market access and facilitate adoption. Government policies focused on water conservation and support for sustainable agriculture also contribute to market expansion.

Key Players Shaping the Brazil Agricultural Irrigation Machinery Market Market

- EPC Industries Limited

- Jain Irrigation Systems Ltd

- Lindsay Corporation

- Nelson Irrigation

- Rivulis

- Rain Bird Corporation

- Netafim

- Irritec Sp

- Valmont Industries

Notable Milestones in Brazil Agricultural Irrigation Machinery Market Sector

- 2020: Government launches a new subsidy program for farmers adopting water-efficient irrigation technologies.

- 2022: A major player in the market launches a new line of IoT-enabled irrigation controllers.

- 2023: A significant merger between two smaller irrigation companies expands market reach in the northeast region.

In-Depth Brazil Agricultural Irrigation Machinery Market Market Outlook

The Brazilian agricultural irrigation machinery market is poised for robust growth over the next decade, fueled by technological advancements, government support, and increasing farmer awareness. Strategic partnerships, expansion into underserved markets, and a focus on sustainable solutions will shape future market dynamics. The market’s potential rests in capitalizing on the growing demand for efficient and sustainable irrigation solutions across various agricultural sectors. The long-term outlook is positive, with significant opportunities for market players to innovate and expand their presence in this rapidly evolving landscape.

Brazil Agricultural Irrigation Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Brazil Agricultural Irrigation Machinery Market Segmentation By Geography

- 1. Brazil

Brazil Agricultural Irrigation Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts as a Healthy Snack; Increasing Government initiatives; Growing Cashew Nut Imports in The United States

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related To Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Drip Irrigation System Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 EPC Industries Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jain Irrigation Systems Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lindsay Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nelson Irrigation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rivulis

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rain Bird Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Netafim

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Irritec Sp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valmont Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 EPC Industries Limited

List of Figures

- Figure 1: Brazil Agricultural Irrigation Machinery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Agricultural Irrigation Machinery Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Brazil Agricultural Irrigation Machinery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Agricultural Irrigation Machinery Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Brazil Agricultural Irrigation Machinery Market?

Key companies in the market include EPC Industries Limited, Jain Irrigation Systems Ltd, Lindsay Corporation, Nelson Irrigation, Rivulis, Rain Bird Corporation, Netafim, Irritec Sp, Valmont Industries.

3. What are the main segments of the Brazil Agricultural Irrigation Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts as a Healthy Snack; Increasing Government initiatives; Growing Cashew Nut Imports in The United States.

6. What are the notable trends driving market growth?

Drip Irrigation System Dominates the Market.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related To Food Quality Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Agricultural Irrigation Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Agricultural Irrigation Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Agricultural Irrigation Machinery Market?

To stay informed about further developments, trends, and reports in the Brazil Agricultural Irrigation Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence