Key Insights

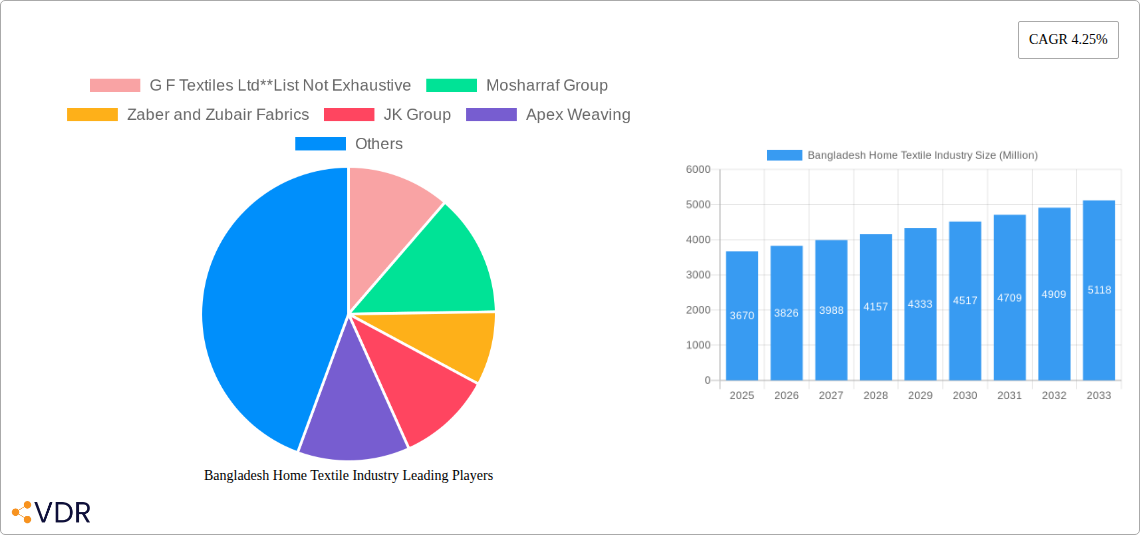

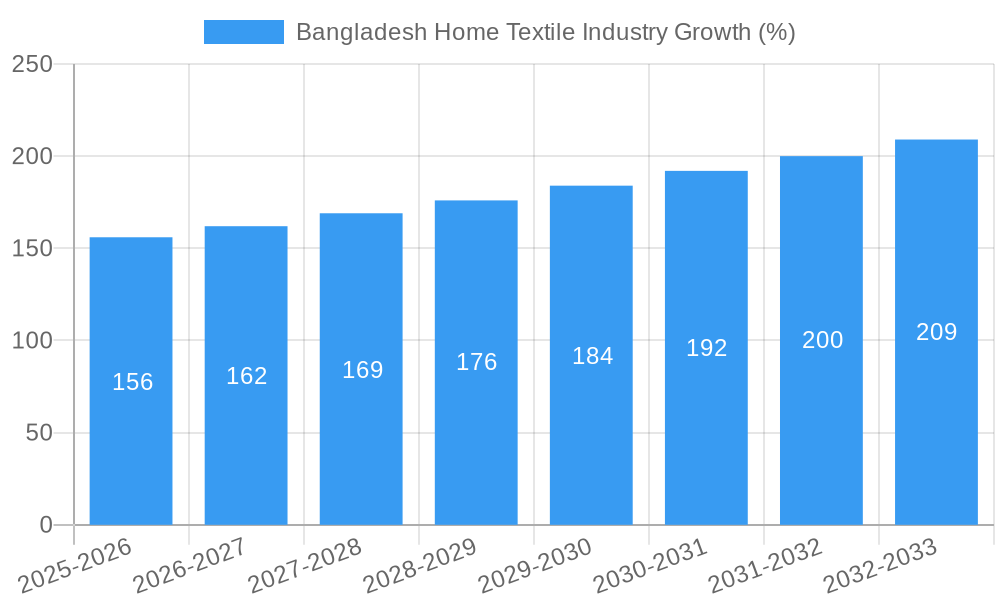

The Bangladesh home textile industry, valued at $3.67 billion in 2025, is projected to experience robust growth, driven by a burgeoning domestic market and increasing exports. A Compound Annual Growth Rate (CAGR) of 4.25% from 2025 to 2033 indicates a significant expansion, reaching an estimated value exceeding $5.5 billion by 2033. Key growth drivers include rising disposable incomes fueling demand for higher-quality home furnishings, a growing preference for comfortable and aesthetically pleasing living spaces, and the increasing popularity of online retail channels. The industry is segmented by product type (bed linen, bath linen, kitchen linen, upholstery, and floor coverings) and distribution channels (supermarkets, specialty stores, and online retailers), offering diverse avenues for growth. While precise data on specific segment performance is unavailable, it’s reasonable to expect bed linen and online sales to be particularly strong growth areas given global trends. Competitive dynamics are shaped by both established players like G F Textiles Ltd, Mosharraf Group, and DBL Group, alongside numerous smaller manufacturers. Challenges include maintaining consistent product quality, navigating fluctuating raw material prices, and adapting to evolving consumer preferences. However, strategic investments in technology, sustainable practices, and brand building are likely to position leading companies for continued success in this expanding market.

The industry's success is inextricably linked to Bangladesh's overall economic development and its position within the global textile supply chain. Government policies promoting the textile sector, including initiatives to enhance infrastructure and worker training, will play a vital role in shaping future growth. Furthermore, the industry's ability to respond to global trends in sustainability and ethical sourcing will be crucial for attracting environmentally conscious consumers and maintaining a strong international presence. Focus on innovation in design, manufacturing processes, and marketing strategies is vital to compete effectively both domestically and internationally and capitalise on the anticipated growth trajectory. Continued expansion in e-commerce is expected to reshape the distribution landscape, requiring companies to adapt their strategies and strengthen their online presence.

This comprehensive report provides a detailed analysis of the Bangladesh home textile industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive data analysis to deliver actionable insights into this dynamic market, encompassing both parent markets (textiles) and child markets (specific home textile products).

Bangladesh Home Textile Industry Market Dynamics & Structure

The Bangladesh home textile industry is characterized by a moderately concentrated market, with several large players competing alongside numerous smaller firms. Technological innovation, while present, faces barriers such as access to advanced technology and skilled labor. The regulatory framework, while generally supportive of the industry, faces ongoing challenges related to compliance and enforcement. The market witnesses competition from imported products, particularly from countries with lower labor costs. End-user demographics are shifting towards a younger, more affluent population with changing preferences in home décor. M&A activity is relatively moderate but shows potential for growth, particularly as larger players seek to consolidate their market share.

- Market Concentration: Moderately concentrated, with a top 5 market share of xx%.

- Technological Innovation: Driven by increasing demand for high-quality, sustainable products; hindered by access to technology and skilled workforce.

- Regulatory Framework: Supportive but faces challenges in enforcement and compliance.

- Competitive Substitutes: Imported products pose a significant competitive threat.

- End-User Demographics: Shifting towards younger, more affluent consumers with evolving tastes.

- M&A Trends: Moderate activity with potential for growth driven by consolidation efforts. Deal volume in 2024 estimated at xx Million USD.

Bangladesh Home Textile Industry Growth Trends & Insights

The Bangladesh home textile industry has experienced steady growth over the historical period (2019-2024), driven by rising disposable incomes, increasing urbanization, and a growing preference for comfortable and stylish home furnishings. This growth is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace. Technological disruptions, including automation in manufacturing and the rise of e-commerce, are reshaping the industry landscape. Consumer behavior shifts reflect growing demand for sustainable and ethically sourced products. The market size is projected to reach xx Million units by 2033, representing a CAGR of xx% during the forecast period. Market penetration for premium home textile products is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Bangladesh Home Textile Industry

The Dhaka region currently dominates the Bangladesh home textile market, driven by strong manufacturing infrastructure and proximity to major transportation hubs. Within product segments, bed linen enjoys the largest market share (xx%), followed by bath linen (xx%) and kitchen linen (xx%). The online distribution channel is experiencing the fastest growth, although supermarkets and hypermarkets remain the dominant distribution channel.

- Key Drivers for Dhaka Region: Established manufacturing base, accessible transportation, skilled labor concentration.

- Key Drivers for Bed Linen Segment: High demand, versatility, diverse product offerings.

- Key Drivers for Online Distribution: Rising internet penetration, convenience for consumers.

- Market Share (2025): Dhaka region (xx%), Bed Linen (xx%), Online (xx%).

- Growth Potential (2025-2033): Online (xx%), Kitchen Linen (xx%).

Bangladesh Home Textile Industry Product Landscape

The Bangladesh home textile industry offers a diverse range of products, including bed linen, bath linen, kitchen linen, upholstery coverings, and floor coverings. Recent innovations focus on sustainable materials, improved comfort, and advanced functionalities, such as antimicrobial treatments and moisture-wicking technologies. These innovations, alongside appealing designs, contribute to the unique selling propositions of many brands. Technological advancements encompass improved weaving techniques, dyeing processes, and finishing treatments, leading to superior product quality and durability.

Key Drivers, Barriers & Challenges in Bangladesh Home Textile Industry

Key Drivers: Rising disposable incomes, increasing urbanization, preference for home improvement, government support for the textile sector. The growing middle class is significantly boosting demand for high-quality home textiles.

Key Challenges: Intense competition from imports, rising raw material costs, fluctuations in global cotton prices, labor shortages, and sustainability concerns. Supply chain disruptions cause significant delays and increased production costs. Regulatory hurdles and trade barriers also pose challenges.

Emerging Opportunities in Bangladesh Home Textile Industry

Emerging opportunities include the growth of the e-commerce sector, increasing demand for eco-friendly and sustainable products, and the potential for expansion into new export markets. Niche product segments, such as specialized bedding for health and wellness, represent significant potential. Personalized home décor and customized textile products also hold considerable potential.

Growth Accelerators in the Bangladesh Home Textile Industry Industry

Long-term growth will be driven by technological advancements in manufacturing, strategic partnerships with international brands, and a focus on sustainable practices. Investing in research and development will be key to improving product quality and developing innovative textiles. Expanding into new markets, particularly in the e-commerce space, will also be crucial for achieving long-term growth.

Key Players Shaping the Bangladesh Home Textile Industry Market

- G F Textiles Ltd

- Mosharraf Group

- Zaber and Zubair Fabrics

- JK Group

- Apex Weaving

- Classical HomeTex

- Alltex Industries Limited

- Saad Musa Group

- ACS Textile

- DBL Group

Notable Milestones in Bangladesh Home Textile Industry Sector

- April 2022: Youngone Corporation plans a USD 500 million investment in Bangladesh's KEPZ for textiles and IT. This signifies significant foreign direct investment and enhances the technological capabilities of the sector.

- April 2022: DBL Group's investment in Vietnam for Eco-Thread production highlights the industry's global expansion and focus on high-value-added products. This signals a trend towards regional diversification.

In-Depth Bangladesh Home Textile Industry Market Outlook

The Bangladesh home textile industry is poised for continued growth, driven by domestic demand and export opportunities. Strategic investments in technology, sustainability, and brand building will be crucial for long-term success. The focus on high-value-added products and diversification into new markets will further enhance the industry's competitiveness and future growth prospects. The market is expected to see significant consolidation in the coming years, with larger players acquiring smaller firms to expand their market share and gain economies of scale.

Bangladesh Home Textile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Bangladesh Home Textile Industry Segmentation By Geography

- 1. Bangladesh

Bangladesh Home Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential and Commercial Construction Activities

- 3.3. Market Restrains

- 3.3.1 Alternative Water Heating Technologies

- 3.3.2 Such as Solar Water Heaters and Heat Pump Systems

- 3.4. Market Trends

- 3.4.1. Increasing Exports of Home Textiles from Bangladesh is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Home Textile Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 G F Textiles Ltd**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mosharraf Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zaber and Zubair Fabrics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JK Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Apex Weaving

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Classical HomeTex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alltex Industries Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saad Musa Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ACS Textile

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DBL Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 G F Textiles Ltd**List Not Exhaustive

List of Figures

- Figure 1: Bangladesh Home Textile Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bangladesh Home Textile Industry Share (%) by Company 2024

List of Tables

- Table 1: Bangladesh Home Textile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bangladesh Home Textile Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Bangladesh Home Textile Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Bangladesh Home Textile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Bangladesh Home Textile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Bangladesh Home Textile Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Bangladesh Home Textile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Bangladesh Home Textile Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Bangladesh Home Textile Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Bangladesh Home Textile Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Bangladesh Home Textile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Bangladesh Home Textile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Bangladesh Home Textile Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Bangladesh Home Textile Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Home Textile Industry?

The projected CAGR is approximately 4.25%.

2. Which companies are prominent players in the Bangladesh Home Textile Industry?

Key companies in the market include G F Textiles Ltd**List Not Exhaustive, Mosharraf Group, Zaber and Zubair Fabrics, JK Group, Apex Weaving, Classical HomeTex, Alltex Industries Limited, Saad Musa Group, ACS Textile, DBL Group.

3. What are the main segments of the Bangladesh Home Textile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential and Commercial Construction Activities.

6. What are the notable trends driving market growth?

Increasing Exports of Home Textiles from Bangladesh is Driving the Market.

7. Are there any restraints impacting market growth?

Alternative Water Heating Technologies. Such as Solar Water Heaters and Heat Pump Systems.

8. Can you provide examples of recent developments in the market?

April 2022: South Korean clothing, textiles, and footwear manufacturer Youngone Corporation is planning to invest up to USD 500 million at the Korean Export Processing Zone (KEPZ) in the textiles and information technology sectors in Bangladesh in the next few years, according to its chairman Kihak Sung.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Home Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Home Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Home Textile Industry?

To stay informed about further developments, trends, and reports in the Bangladesh Home Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence