Key Insights

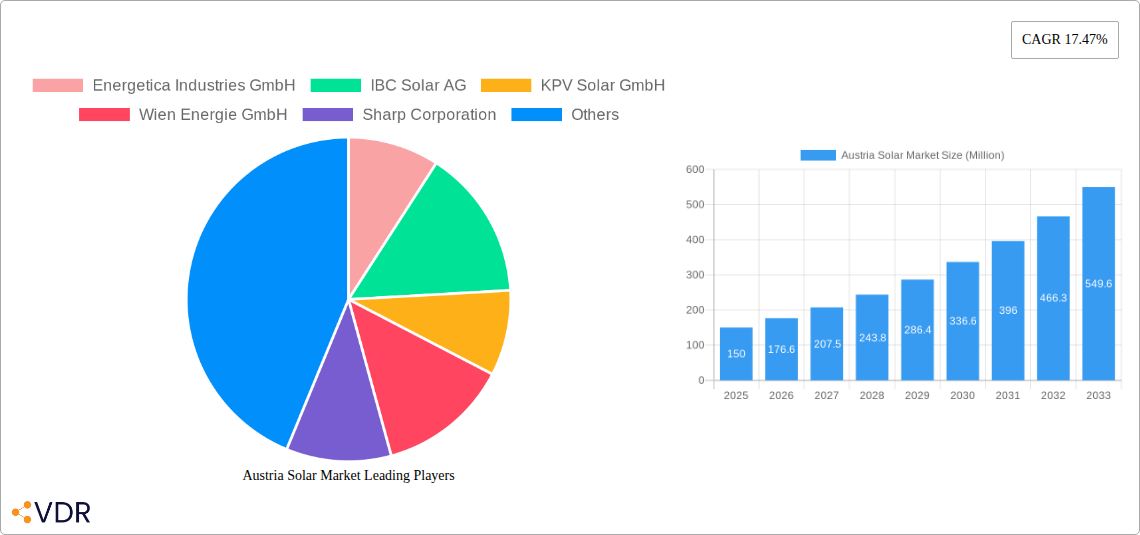

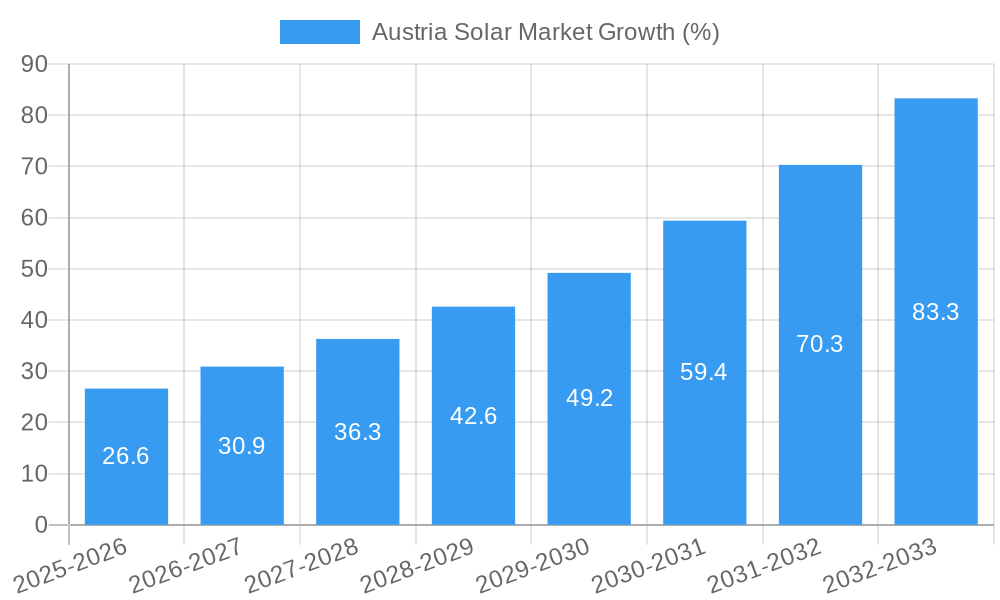

The Austrian solar market, valued at approximately €150 million in 2025 (estimated based on provided CAGR and market trends), is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 17.47% from 2025 to 2033. This significant expansion is driven by several key factors. Firstly, Austria's commitment to renewable energy targets and ambitious climate change mitigation policies creates a supportive regulatory environment for solar energy adoption. Secondly, decreasing solar panel costs and technological advancements in photovoltaic (PV) systems, particularly in efficiency and lifespan, make solar power a more economically viable option for residential, industrial, and utility-scale applications. Increasing consumer awareness of the environmental benefits of solar energy, coupled with government incentives and subsidies, further fuels market growth. While potential grid infrastructure limitations and seasonal variations in solar irradiance might present challenges, the overall market outlook remains highly positive, driven by strong governmental support and increasing public interest.

The market segmentation reveals a diverse landscape. The photovoltaic (PV) segment is expected to dominate, given its cost-effectiveness and widespread applicability across various sectors. Residential installations are likely to show robust growth driven by individual household adoption, while the industrial and utility segments are projected to expand due to large-scale project implementations and the need for sustainable energy solutions by businesses and energy providers. Key players like Energetica Industries GmbH, IBC Solar AG, and others are well-positioned to capitalize on this expanding market, offering a range of solar solutions and services. Competition is expected to intensify as more companies enter the market, leading to further technological advancements and price reductions, ultimately benefiting consumers and promoting wider solar adoption across Austria.

Austria Solar Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Austria solar market, encompassing market dynamics, growth trends, key players, and future outlook. It covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and policymakers. The report meticulously examines the parent market (Renewable Energy) and child markets (Solar PV, Solar Thermal) within the Austrian context, segmented by end-user (Residential, Industrial, Utility).

Austria Solar Market Market Dynamics & Structure

The Austrian solar market exhibits a moderately concentrated structure, with several key players holding significant market share. Technological innovation, driven primarily by advancements in PV technology and efficiency gains in solar thermal systems, is a key growth driver. The regulatory framework, including government incentives and feed-in tariffs, plays a crucial role in shaping market dynamics. While hydro and wind energy present competitive substitutes, the increasing cost-competitiveness of solar and supportive policies are fueling its growth. End-user demographics show a growing preference for renewable energy sources, especially among environmentally conscious residential consumers and large industrial users seeking to reduce their carbon footprint. M&A activity in the sector has been moderate, with a predicted xx number of deals in the last five years, primarily focused on consolidating smaller players.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on higher efficiency PV modules and improved solar thermal system performance.

- Regulatory Framework: Supportive policies and feed-in tariffs stimulate market growth.

- Competitive Substitutes: Wind and hydro power, but solar's cost competitiveness is increasing.

- M&A Activity: Predicted xx deals in the last five years; consolidation expected to continue.

Austria Solar Market Growth Trends & Insights

The Austrian solar market has witnessed substantial growth over the past few years, driven by increasing energy costs, environmental concerns, and government support. The market size expanded from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx%. This growth trajectory is expected to continue, with a projected market size of xx million units by 2033 and a CAGR of xx% during the forecast period. Increased adoption rates across residential, industrial, and utility sectors are fueling this expansion. Technological disruptions, such as the development of more efficient and affordable PV modules, further enhance market attractiveness. Changing consumer behavior, marked by a heightened awareness of sustainability and renewable energy adoption, presents a robust growth catalyst.

Dominant Regions, Countries, or Segments in Austria Solar Market

The PV segment dominates the Austrian solar market, accounting for approximately xx% of the total market value in 2024. This dominance is attributed to the lower upfront cost and wider applicability compared to solar thermal systems. Among end-users, the utility-scale segment is leading the growth, driven by large-scale solar park projects such as the 120 MW Nickelsdorf project. The residential sector shows steady growth, fueled by government incentives and increasing consumer awareness.

- Key Drivers (PV Segment): Falling PV module prices, government subsidies, and increasing demand from utility-scale projects.

- Key Drivers (Utility Sector): Government support for renewable energy projects, land availability, and economic incentives for large-scale power generation.

- Market Share: PV segment holds xx% market share (2024); Utility sector accounts for xx% of the total market value (2024).

Austria Solar Market Product Landscape

The Austrian solar market showcases a diverse product landscape comprising high-efficiency monocrystalline and polycrystalline PV modules, various solar thermal collectors (flat-plate, evacuated tube), and associated inverters, mounting systems, and storage solutions. Recent innovations focus on increasing energy efficiency, reducing production costs, and improving the aesthetic appeal of solar systems. These advancements make solar power systems more attractive and accessible to a broader range of consumers and businesses.

Key Drivers, Barriers & Challenges in Austria Solar Market

Key Drivers: Government incentives (feed-in tariffs, tax breaks), falling solar energy costs, increasing energy prices, and growing environmental awareness. The EU's ambitious renewable energy targets further drive adoption.

Key Challenges: Intermittency of solar power (requiring energy storage solutions), land availability for large-scale projects, and potential grid integration challenges. Supply chain disruptions can also affect project timelines and costs.

Emerging Opportunities in Austria Solar Market

The increasing integration of solar PV systems with energy storage solutions, along with growing interest in floating solar farms and agrivoltaics, represents significant untapped market potential. Furthermore, the shift towards community-based solar energy projects and the adoption of innovative financing models are opening up new opportunities for market expansion.

Growth Accelerators in the Austria Solar Market Industry

Technological advancements leading to higher efficiency and lower-cost solar panels are key growth catalysts. Strategic partnerships between solar companies, energy utilities, and technology providers are accelerating innovation and deployment. Market expansion into underpenetrated segments, like the agricultural sector (agrivoltaics), presents significant growth potential.

Key Players Shaping the Austria Solar Market Market

- Energetica Industries GmbH

- IBC Solar AG

- KPV Solar GmbH

- Wien Energie GmbH

- Sharp Corporation

- Crystalsol GmbH

- Hilber Solar GmbH

Notable Milestones in Austria Solar Market Sector

- June 2022: Construction commenced on a 120 MW solar park in Nickelsdorf, Austria's largest solar power plant upon completion. This project signifies a major step towards expanding the country's renewable energy capacity.

- October 2022: BayWa r.e. AG and EVN AG initiated construction of a 24.5-MWp floating solar PV farm, set to become Austria's largest floating solar power plant. This innovative approach showcases the potential of utilizing unconventional land resources for solar energy generation.

In-Depth Austria Solar Market Market Outlook

The Austrian solar market is poised for robust growth over the next decade, driven by supportive government policies, falling technology costs, and increasing consumer demand for renewable energy. Strategic investments in large-scale solar projects, coupled with advancements in energy storage and grid integration technologies, will further fuel market expansion. Opportunities abound for companies that leverage technological innovation, strategic partnerships, and effective market penetration strategies.

Austria Solar Market Segmentation

-

1. Technology

- 1.1. Solar Photovoltaic (PV)

- 1.2. Solar Thermal

-

2. End User

- 2.1. Residential

- 2.2. Industrial

- 2.3. Utility

Austria Solar Market Segmentation By Geography

- 1. Austria

Austria Solar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Solar PV Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria Solar Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Solar Thermal

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Industrial

- 5.2.3. Utility

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Energetica Industries GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBC Solar AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KPV Solar GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wien Energie GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sharp Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crystalsol GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hilber Solar GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Energetica Industries GmbH

List of Figures

- Figure 1: Austria Solar Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austria Solar Market Share (%) by Company 2024

List of Tables

- Table 1: Austria Solar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austria Solar Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Austria Solar Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Austria Solar Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 5: Austria Solar Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Austria Solar Market Volume gigawatt Forecast, by End User 2019 & 2032

- Table 7: Austria Solar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Austria Solar Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 9: Austria Solar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Austria Solar Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 11: Austria Solar Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 12: Austria Solar Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 13: Austria Solar Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Austria Solar Market Volume gigawatt Forecast, by End User 2019 & 2032

- Table 15: Austria Solar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Austria Solar Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria Solar Market?

The projected CAGR is approximately 17.47%.

2. Which companies are prominent players in the Austria Solar Market?

Key companies in the market include Energetica Industries GmbH, IBC Solar AG, KPV Solar GmbH, Wien Energie GmbH, Sharp Corporation, Crystalsol GmbH, Hilber Solar GmbH.

3. What are the main segments of the Austria Solar Market?

The market segments include Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Solar PV Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

Oct 2022: BayWa r.e. AG and EVN AG began construction of a 24.5-MWp floating solar photovoltaic (PV) farm on an artificial lake in northeast Austria. The facility will be set up on an area of 14 hectares and will be the country's largest floating solar power plant when completed in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria Solar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria Solar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria Solar Market?

To stay informed about further developments, trends, and reports in the Austria Solar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence