Key Insights

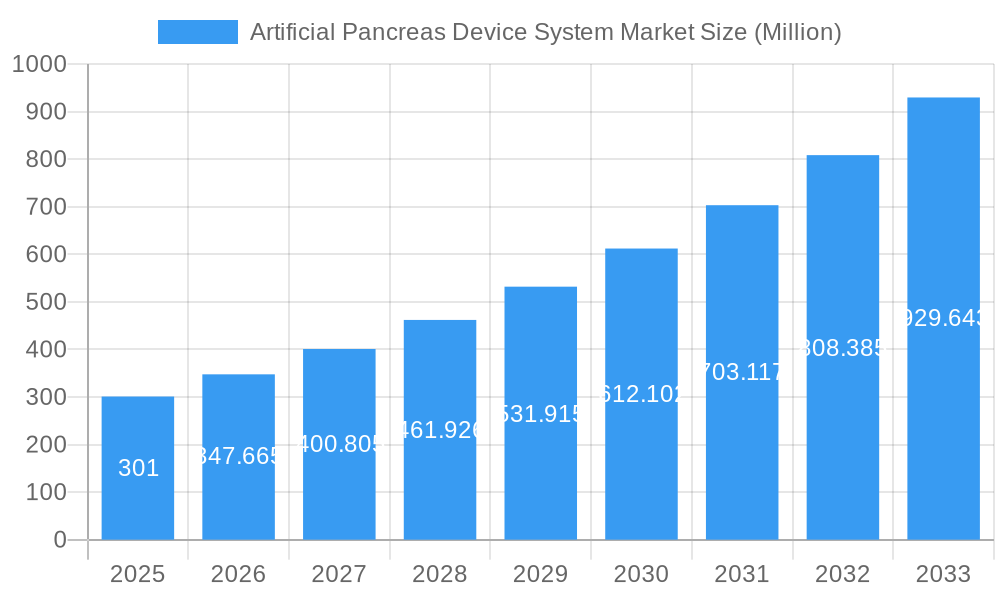

The global Artificial Pancreas Device System (APDS) market is experiencing robust growth, projected to reach an estimated USD 301 million in 2025. This expansion is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 15.5% over the forecast period (2025-2033). This significant upward trajectory is driven by the increasing prevalence of Type 1 diabetes, coupled with advancements in sensor technology and automated insulin delivery systems. Patients are increasingly seeking more effective and convenient solutions for diabetes management, moving away from traditional manual monitoring and injection methods towards integrated systems that offer improved glycemic control and enhanced quality of life. The growing awareness and adoption of these sophisticated devices, alongside supportive regulatory frameworks and rising healthcare expenditure, are key enablers of this market surge.

Artificial Pancreas Device System Market Market Size (In Million)

The APDS market is characterized by innovative product development, with a focus on improving system accuracy, user-friendliness, and integration capabilities. Key segments within the market include advanced device types like Threshold Suspended Device Systems (TSDS), Control to Range (CTR) Systems, and Control to Target (CTT) Systems, each offering distinct levels of automation and control. End-users such as hospitals and clinics are pivotal in driving adoption through clinical integration and patient support. Major companies like Medtronic PLC, Insulet Corporation, and DexCom Inc. are at the forefront, investing heavily in research and development to introduce next-generation APDS. Geographically, North America currently dominates the market due to high diabetes incidence, advanced healthcare infrastructure, and early adoption of innovative medical technologies, followed closely by Europe. The Asia Pacific region is also demonstrating substantial growth potential, driven by increasing healthcare investments and a growing patient population. While the market is on a strong upward path, factors such as the high cost of devices and the need for continuous technological refinement represent areas that will shape future market dynamics.

Artificial Pancreas Device System Market Company Market Share

Here is a compelling, SEO-optimized report description for the Artificial Pancreas Device System Market:

Artificial Pancreas Device System Market Analysis: Size, Share, Growth Trends, and Forecast (2019-2033)

Gain unparalleled insights into the dynamic Artificial Pancreas Device System market with this comprehensive report. We provide an in-depth analysis of market size, growth trends, competitive landscape, and future outlook, essential for stakeholders navigating the rapidly evolving diabetes management technology sector. This report explores the core artificial pancreas market, its parent market in medical devices, and crucial child markets such as insulin pump systems and continuous glucose monitoring (CGM) devices.

Key Features:

Unlock critical data and strategic intelligence to capitalize on the burgeoning opportunities within the artificial pancreas technology landscape.

- Market Segmentation: Detailed analysis by Device Type (Threshold Suspended Device System, Control To Range (CTR) System, Control to Target (CTT) System) and End User (Hospitals and Clinics, Others).

- Geographical Dominance: Identification of leading regions, countries, and segments driving market growth.

- Company Analysis: In-depth profiles of key players including Beta Bionics Inc, Admetsys Corp, DexCom Inc, Bigfoot Biomedical Inc, Defymed, Insulet Corporation, Medtronic PLC, Tandem Diabetes Care Inc, Pancreum Inc, Johnson & Johnson.

- Industry Developments: Insights into significant product launches and trial results.

- Future Outlook: Comprehensive forecast period (2025–2033) with base year 2025 and historical period (2019–2024).

- Quantitative Data: All values presented in million units for clarity and comparability.

Artificial Pancreas Device System Market Market Dynamics & Structure

The artificial pancreas device system market is characterized by moderate concentration, driven by significant technological innovation and stringent regulatory frameworks. The landscape is shaped by continuous advancements in algorithms and sensor technology, aiming to mimic the natural function of a healthy pancreas. Key drivers include the escalating prevalence of diabetes globally, increasing patient demand for improved quality of life and self-management, and growing reimbursement policies supporting advanced diabetes technologies. However, high development costs, complex clinical trial requirements, and the need for extensive patient education present substantial barriers to entry and market penetration. Competitive product substitutes, primarily traditional insulin delivery methods and manual glucose monitoring, are gradually being overshadowed by the superior efficacy and convenience of closed-loop systems. End-user demographics are increasingly skewed towards tech-savvy individuals with Type 1 diabetes seeking greater autonomy and tighter glycemic control. Merger and acquisition (M&A) trends are expected to accelerate as larger medical device companies aim to integrate innovative artificial pancreas technologies into their portfolios.

- Market Concentration: Moderate, with a few key players dominating but significant room for innovation and new entrants.

- Technological Innovation Drivers: Miniaturization of devices, improved sensor accuracy, advanced predictive algorithms, and seamless integration with other health monitoring platforms.

- Regulatory Frameworks: FDA and EMA approvals are critical; navigating these processes requires extensive clinical validation and post-market surveillance.

- Competitive Product Substitutes: Traditional insulin pens, vials, and older insulin pump models offer less sophisticated glycemic control.

- End-User Demographics: Predominantly Type 1 diabetes patients, with a growing interest from individuals with Type 2 diabetes requiring advanced insulin management.

- M&A Trends: Expected to increase as companies seek to acquire innovative technologies and expand their market share.

Artificial Pancreas Device System Market Growth Trends & Insights

The artificial pancreas device system market is poised for robust growth, driven by an expanding patient population with diabetes and an increasing demand for advanced, automated glycemic control solutions. The market size evolution is directly linked to the technological maturity and adoption rates of closed-loop systems, which offer significant improvements over traditional diabetes management. Technological disruptions, such as enhanced sensor accuracy and more sophisticated predictive algorithms, are constantly enhancing the efficacy and user experience of these devices. Consumer behavior shifts are notable, with patients actively seeking technologies that reduce the burden of manual diabetes management, improve time-in-range (TIR), and mitigate the risk of hypo- and hyperglycemic events. The market penetration of artificial pancreas systems, while still in its early stages, is accelerating due to increased awareness, physician advocacy, and favorable reimbursement scenarios in key markets.

The historical period (2019–2024) has witnessed significant foundational advancements, including the development of hybrid closed-loop systems that automate insulin delivery based on continuous glucose monitoring (CGM) data. These systems have demonstrated their ability to significantly improve glycemic control and reduce the daily management burden for individuals with diabetes. Looking ahead, the forecast period (2025–2033) is anticipated to see a surge in fully automated closed-loop systems, further refining insulin dosing and expanding their applicability to a broader patient cohort. The CAGR for this period is projected to be in the high double digits, reflecting the transformative potential of this technology. The increasing affordability and accessibility of CGM devices are also acting as significant catalysts, as they form the foundational component of any artificial pancreas system. Furthermore, the growing focus on personalized medicine within diabetes care aligns perfectly with the adaptive nature of artificial pancreas algorithms, which learn and adjust to individual patient needs and lifestyle patterns. The integration of these systems with other wearable health devices and the potential for AI-driven predictive analytics for long-term diabetes management will further fuel adoption.

Dominant Regions, Countries, or Segments in Artificial Pancreas Device System Market

The artificial pancreas device system market's growth is significantly influenced by regional economic policies, healthcare infrastructure, and the prevalence of diabetes. North America, particularly the United States, currently dominates the market due to a combination of factors. High healthcare expenditure, strong adoption rates of advanced medical technologies, supportive regulatory pathways (e.g., FDA approvals), and a large patient population with Type 1 and advanced Type 2 diabetes contribute to its leadership. The robust presence of key industry players and extensive research and development activities within the region further solidify its position.

- Dominant Region: North America

- Key Drivers: High disposable income, strong reimbursement policies for advanced medical devices, advanced healthcare infrastructure, and a high prevalence of diabetes requiring sophisticated management solutions.

- Market Share: Holds a significant majority of the global artificial pancreas market.

- Growth Potential: Continues to grow as new technologies are approved and adopted, with increasing focus on expanding access.

Within the Device Type segmentation, the Control to Target (CTT) System segment is a primary growth driver. These advanced systems, which proactively adjust insulin delivery to maintain glucose levels within a predefined target range, represent the cutting edge of artificial pancreas technology. Their superior ability to minimize glycemic variability and reduce the frequency of both hypoglycemia and hyperglycemia makes them highly desirable for patients seeking optimal diabetes management. The transition from Threshold Suspended Device Systems (which simply suspend insulin delivery when glucose is low) to more proactive CTR and CTT systems signifies the market's progression towards automated, intelligent glucose regulation.

- Dominant Device Type Segment: Control to Target (CTT) System

- Key Drivers: Enhanced glycemic control, reduced risk of dangerous blood sugar fluctuations, improved patient outcomes and quality of life, and advanced algorithmic capabilities.

- Market Share: Expected to capture an increasing share of the market as technology matures and adoption increases.

- Growth Potential: High, driven by continuous innovation in AI and sensor technology.

The End User segment of Hospitals and Clinics plays a pivotal role in the initial adoption and prescription of artificial pancreas device systems. These healthcare facilities are crucial for patient education, device calibration, and ongoing support, especially for newly diagnosed patients or those transitioning to advanced management technologies. As the technology becomes more user-friendly and integrated into routine care, the "Others" segment, encompassing home-use and direct-to-patient models facilitated by telehealth, is expected to grow in prominence.

- Dominant End User Segment (Initial Adoption): Hospitals and Clinics

- Key Drivers: Medical expertise for device initiation, patient training and support, diagnostic and therapeutic integration, and established channels for device dispensing.

- Market Share: Currently holds a significant portion of the initial device distribution.

- Growth Potential: Stable, with a shift towards home-based management as technology evolves.

Artificial Pancreas Device System Market Product Landscape

The artificial pancreas device system market is defined by a rapidly evolving product landscape focused on miniaturization, enhanced accuracy, and sophisticated algorithmic control. Current product innovations center on improving the interoperability of Continuous Glucose Monitoring (CGM) sensors and insulin pumps, creating integrated closed-loop systems. Key features include advanced predictive algorithms that anticipate glucose trends, automated insulin delivery adjustments based on real-time data and user inputs, and user-friendly interfaces for easy management. Unique selling propositions include the ability to significantly reduce the burden of manual diabetes management, improve glycemic control with higher Time-in-Range (TIR), and minimize the occurrence of severe hypoglycemia and hyperglycemia. Technological advancements are continuously leading to smaller, more discreet devices with longer battery life and improved connectivity options.

Key Drivers, Barriers & Challenges in Artificial Pancreas Device System Market

The artificial pancreas device system market is propelled by several key drivers. The escalating global prevalence of diabetes, particularly Type 1 diabetes, creates a substantial and growing patient pool actively seeking better management solutions. Technological advancements in sensor accuracy and algorithm development are continuously improving the efficacy and user experience of these devices. Increased patient awareness and demand for enhanced quality of life, along with a desire to reduce the daily burden of diabetes management, are significant motivators. Furthermore, evolving reimbursement policies and expanding insurance coverage for advanced diabetes technologies in key regions are crucial for accessibility and adoption.

However, the market faces considerable barriers and challenges. The high cost of research, development, and clinical trials presents a significant hurdle for manufacturers. Navigating complex and lengthy regulatory approval processes in different countries is another major constraint. The need for extensive patient and healthcare provider education on the proper use and management of these sophisticated systems requires significant investment. Supply chain disruptions, particularly for sensitive electronic components and manufacturing, can impact product availability. Lastly, ensuring data security and privacy for connected devices is paramount, adding to development complexities.

Emerging Opportunities in Artificial Pancreas Device System Market

Emerging opportunities in the artificial pancreas device system market lie in expanding accessibility to underserved populations and developing next-generation personalized solutions. The untapped potential in emerging economies, where diabetes prevalence is rising but advanced technology adoption is nascent, presents a significant growth avenue. Innovations in smartphone integration and telehealth platforms can further enhance remote monitoring and patient support, reducing reliance on in-person clinic visits. The development of artificial pancreas systems tailored for specific patient demographics, such as pediatric populations or individuals with specific comorbidities, offers niche market expansion. Furthermore, leveraging artificial intelligence and machine learning for predictive analytics to prevent diabetes-related complications and personalize treatment plans represents a significant future opportunity.

Growth Accelerators in the Artificial Pancreas Device System Market Industry

Several catalysts are accelerating the growth of the artificial pancreas device system industry. Technological breakthroughs in sensor accuracy and the development of more sophisticated, adaptive algorithms are continuously improving device performance and patient outcomes. Strategic partnerships between medical device manufacturers, pharmaceutical companies, and research institutions are fostering innovation and accelerating product development timelines. Market expansion strategies, including global product launches and penetration into new geographical regions, are broadening the reach of these life-changing technologies. The increasing focus on value-based healthcare and demonstrating improved patient outcomes with reduced long-term complication costs further encourages the adoption of these advanced systems.

Key Players Shaping the Artificial Pancreas Device System Market Market

- Beta Bionics Inc

- Admetsys Corp

- DexCom Inc

- Bigfoot Biomedical Inc

- Defymed

- Insulet Corporation

- Medtronic PLC

- Tandem Diabetes Care Inc

- Pancreum Inc

- Johnson & Johnson

Notable Milestones in Artificial Pancreas Device System Market Sector

- April 2022: Beta Bionics, Inc. presented positive results from the multi-center randomized Insulin-Only Bionic Pancreas Pivotal Trial (IO BPPT) at the International Conference on Advanced Technologies & Treatments for Diabetes (ATTD).

- March 2022: Medtronic launched MiniMed 780G, a next-generation closed-loop insulin pump system, in India.

In-Depth Artificial Pancreas Device System Market Market Outlook

The future outlook for the artificial pancreas device system market is exceptionally bright, driven by continued technological innovation and increasing global demand for sophisticated diabetes management solutions. Growth accelerators such as advancements in AI-powered predictive algorithms, enhanced sensor accuracy, and seamless device integration will further refine glycemic control and reduce patient burden. Strategic partnerships and expanding reimbursement policies will broaden market access, particularly in emerging economies. The market is projected to witness substantial growth, transitioning towards more personalized and automated systems, ultimately aiming to significantly improve the lives of individuals living with diabetes and reduce the long-term healthcare costs associated with the disease.

Artificial Pancreas Device System Market Segmentation

-

1. Device Type

- 1.1. Threshold Suspended Device System

- 1.2. Control To Range (CTR) System

- 1.3. Control to Target (CTT) System

-

2. End User

- 2.1. Hospitals and Clinics

- 2.2. Others

Artificial Pancreas Device System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Artificial Pancreas Device System Market Regional Market Share

Geographic Coverage of Artificial Pancreas Device System Market

Artificial Pancreas Device System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Diabetes; Technological Advancements and Increasing R&D activities by Key Players; Increasing Demand for Automated Systems for Glycemic Control

- 3.3. Market Restrains

- 3.3.1. High Cost of the Device Systems and Safety Concern

- 3.4. Market Trends

- 3.4.1. The Threshold Suspended Device System is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artificial Pancreas Device System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Threshold Suspended Device System

- 5.1.2. Control To Range (CTR) System

- 5.1.3. Control to Target (CTT) System

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals and Clinics

- 5.2.2. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America Artificial Pancreas Device System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Threshold Suspended Device System

- 6.1.2. Control To Range (CTR) System

- 6.1.3. Control to Target (CTT) System

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals and Clinics

- 6.2.2. Others

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Artificial Pancreas Device System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Threshold Suspended Device System

- 7.1.2. Control To Range (CTR) System

- 7.1.3. Control to Target (CTT) System

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals and Clinics

- 7.2.2. Others

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Asia Pacific Artificial Pancreas Device System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Threshold Suspended Device System

- 8.1.2. Control To Range (CTR) System

- 8.1.3. Control to Target (CTT) System

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals and Clinics

- 8.2.2. Others

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Middle East and Africa Artificial Pancreas Device System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Threshold Suspended Device System

- 9.1.2. Control To Range (CTR) System

- 9.1.3. Control to Target (CTT) System

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals and Clinics

- 9.2.2. Others

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. South America Artificial Pancreas Device System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Threshold Suspended Device System

- 10.1.2. Control To Range (CTR) System

- 10.1.3. Control to Target (CTT) System

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals and Clinics

- 10.2.2. Others

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Beta Bionics Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Admetsys Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DexCom Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bigfoot Biomedical Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Defymed

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Insulet Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Medtronic PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tandem Diabetes CareInc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pancreum Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Johnson & Johnson

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Beta Bionics Inc

List of Figures

- Figure 1: Global Artificial Pancreas Device System Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Artificial Pancreas Device System Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Artificial Pancreas Device System Market Revenue (undefined), by Device Type 2025 & 2033

- Figure 4: North America Artificial Pancreas Device System Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 5: North America Artificial Pancreas Device System Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: North America Artificial Pancreas Device System Market Volume Share (%), by Device Type 2025 & 2033

- Figure 7: North America Artificial Pancreas Device System Market Revenue (undefined), by End User 2025 & 2033

- Figure 8: North America Artificial Pancreas Device System Market Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Artificial Pancreas Device System Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Artificial Pancreas Device System Market Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Artificial Pancreas Device System Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Artificial Pancreas Device System Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Artificial Pancreas Device System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Artificial Pancreas Device System Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Artificial Pancreas Device System Market Revenue (undefined), by Device Type 2025 & 2033

- Figure 16: Europe Artificial Pancreas Device System Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 17: Europe Artificial Pancreas Device System Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 18: Europe Artificial Pancreas Device System Market Volume Share (%), by Device Type 2025 & 2033

- Figure 19: Europe Artificial Pancreas Device System Market Revenue (undefined), by End User 2025 & 2033

- Figure 20: Europe Artificial Pancreas Device System Market Volume (K Unit), by End User 2025 & 2033

- Figure 21: Europe Artificial Pancreas Device System Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Artificial Pancreas Device System Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Artificial Pancreas Device System Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Artificial Pancreas Device System Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Artificial Pancreas Device System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Artificial Pancreas Device System Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Artificial Pancreas Device System Market Revenue (undefined), by Device Type 2025 & 2033

- Figure 28: Asia Pacific Artificial Pancreas Device System Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 29: Asia Pacific Artificial Pancreas Device System Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: Asia Pacific Artificial Pancreas Device System Market Volume Share (%), by Device Type 2025 & 2033

- Figure 31: Asia Pacific Artificial Pancreas Device System Market Revenue (undefined), by End User 2025 & 2033

- Figure 32: Asia Pacific Artificial Pancreas Device System Market Volume (K Unit), by End User 2025 & 2033

- Figure 33: Asia Pacific Artificial Pancreas Device System Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Artificial Pancreas Device System Market Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Artificial Pancreas Device System Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Artificial Pancreas Device System Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Artificial Pancreas Device System Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Artificial Pancreas Device System Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Artificial Pancreas Device System Market Revenue (undefined), by Device Type 2025 & 2033

- Figure 40: Middle East and Africa Artificial Pancreas Device System Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 41: Middle East and Africa Artificial Pancreas Device System Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 42: Middle East and Africa Artificial Pancreas Device System Market Volume Share (%), by Device Type 2025 & 2033

- Figure 43: Middle East and Africa Artificial Pancreas Device System Market Revenue (undefined), by End User 2025 & 2033

- Figure 44: Middle East and Africa Artificial Pancreas Device System Market Volume (K Unit), by End User 2025 & 2033

- Figure 45: Middle East and Africa Artificial Pancreas Device System Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Artificial Pancreas Device System Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Artificial Pancreas Device System Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Artificial Pancreas Device System Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Artificial Pancreas Device System Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Artificial Pancreas Device System Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Artificial Pancreas Device System Market Revenue (undefined), by Device Type 2025 & 2033

- Figure 52: South America Artificial Pancreas Device System Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 53: South America Artificial Pancreas Device System Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 54: South America Artificial Pancreas Device System Market Volume Share (%), by Device Type 2025 & 2033

- Figure 55: South America Artificial Pancreas Device System Market Revenue (undefined), by End User 2025 & 2033

- Figure 56: South America Artificial Pancreas Device System Market Volume (K Unit), by End User 2025 & 2033

- Figure 57: South America Artificial Pancreas Device System Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Artificial Pancreas Device System Market Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Artificial Pancreas Device System Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Artificial Pancreas Device System Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Artificial Pancreas Device System Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Artificial Pancreas Device System Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 2: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 3: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 8: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 9: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 20: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 21: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 38: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 39: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 40: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 41: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 56: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 57: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 58: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 59: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 68: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 69: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 70: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 71: Global Artificial Pancreas Device System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Artificial Pancreas Device System Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Artificial Pancreas Device System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Artificial Pancreas Device System Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Pancreas Device System Market?

The projected CAGR is approximately 15.5%.

2. Which companies are prominent players in the Artificial Pancreas Device System Market?

Key companies in the market include Beta Bionics Inc, Admetsys Corp, DexCom Inc, Bigfoot Biomedical Inc, Defymed, Insulet Corporation, Medtronic PLC, Tandem Diabetes CareInc, Pancreum Inc, Johnson & Johnson.

3. What are the main segments of the Artificial Pancreas Device System Market?

The market segments include Device Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Diabetes; Technological Advancements and Increasing R&D activities by Key Players; Increasing Demand for Automated Systems for Glycemic Control.

6. What are the notable trends driving market growth?

The Threshold Suspended Device System is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of the Device Systems and Safety Concern.

8. Can you provide examples of recent developments in the market?

In April 2022, Beta Bionics, Inc., a medical technology company dedicated to the design, development, and commercialization of the iLet Bionic Pancreas presented positive results from the multi-center randomized Insulin-Only Bionic Pancreas Pivotal Trial (IO BPPT) at the International Conference on Advanced Technologies & Treatments for Diabetes (ATTD).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artificial Pancreas Device System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artificial Pancreas Device System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artificial Pancreas Device System Market?

To stay informed about further developments, trends, and reports in the Artificial Pancreas Device System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence