Key Insights

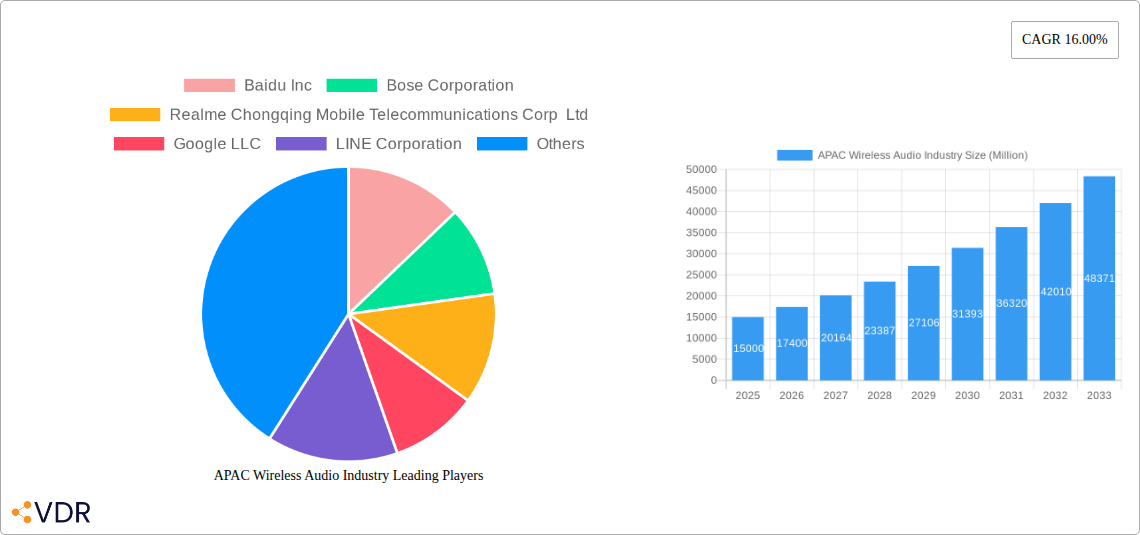

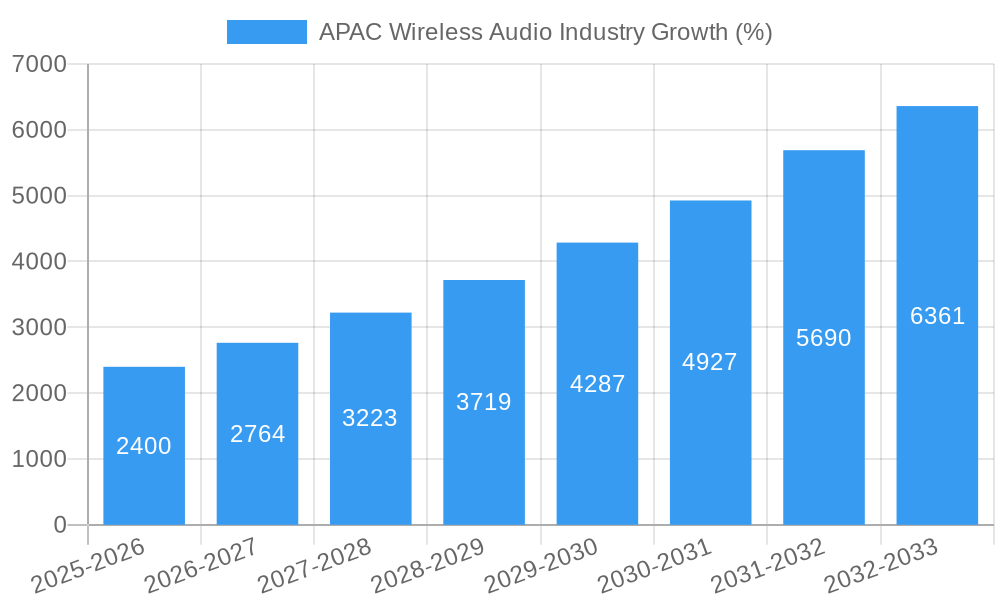

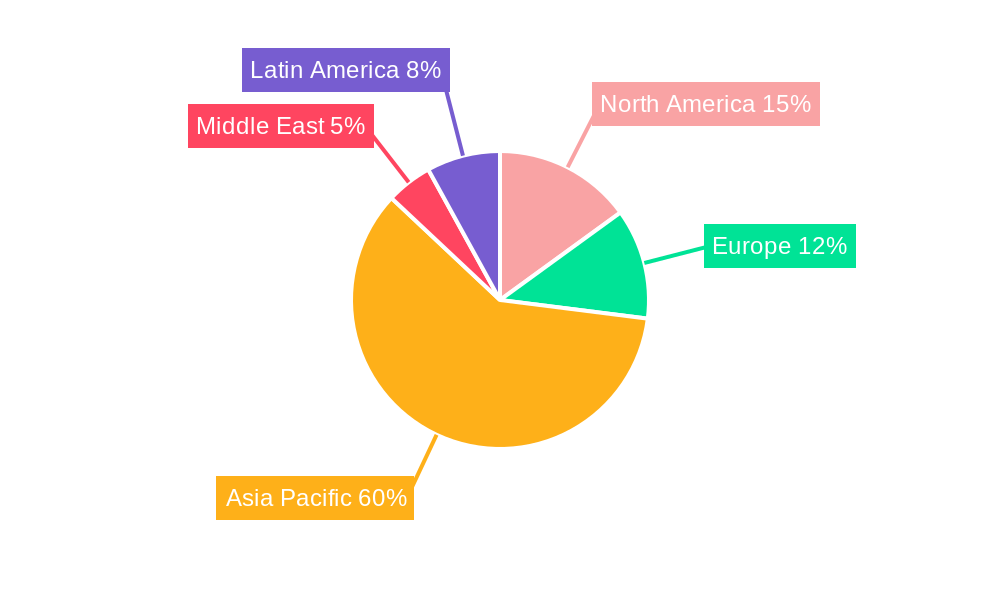

The Asia-Pacific (APAC) wireless audio market is experiencing robust growth, driven by increasing smartphone penetration, rising disposable incomes, and a burgeoning preference for convenient and high-quality audio experiences. The region's diverse demographics and varying levels of technological adoption contribute to a complex yet dynamic market landscape. While China, Japan, South Korea, and Southeast Asia represent significant market segments, each exhibits unique trends. China, for instance, shows strong domestic competition among brands like Xiaomi and Alibaba, alongside international players like Apple and Bose. Japan and South Korea display a higher adoption rate of premium smart speakers and personal audio devices, reflecting a mature market with discerning consumers. Southeast Asia presents a significant growth opportunity, fueled by increasing smartphone adoption and a younger, tech-savvy population. The market is segmented by device type, encompassing wireless speakers (including Wi-Fi speakers and smart speakers), wireless earphones, wireless headsets, and true wireless stereo (TWS) earbuds. The strong CAGR of 16% suggests continued expansion throughout the forecast period (2025-2033), with TWS earbuds and smart speakers expected to be key drivers of growth. However, potential restraints include price sensitivity in certain markets, competition from established players, and the need for continuous innovation to meet evolving consumer preferences.

The success of key players hinges on their ability to adapt to regional nuances. Localization strategies, including tailored product offerings and marketing campaigns, are crucial. Furthermore, the rise of local brands in markets like India and Southeast Asia presents both a challenge and an opportunity for established international companies. Effective supply chain management, particularly in navigating potential manufacturing and logistical hurdles, will also be critical for sustained market success. Competition is fierce, with established players like Apple, Samsung, and Bose facing challenges from rapidly growing Chinese brands. The continued integration of smart features, improved sound quality, and enhanced user experiences will be key differentiators in this highly competitive and evolving landscape. The forecast period promises significant expansion, demanding strategic agility and innovative product development from all market participants.

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) wireless audio market, covering the period 2019-2033. It offers in-depth insights into market dynamics, growth trends, dominant segments, key players, and future opportunities, empowering businesses to make informed strategic decisions. The report meticulously analyzes both parent markets (wireless audio devices) and child markets (True Wireless Stereo (TWS) earbuds, smart speakers, wireless headphones, etc.), providing a granular view of the APAC landscape. The base year is 2025, with estimations for 2025 and forecasts extending to 2033. All values are presented in Million units.

APAC Wireless Audio Industry Market Dynamics & Structure

This section delves into the intricate structure of the APAC wireless audio market, examining market concentration, technological advancements, regulatory frameworks, competitive dynamics, and end-user demographics. The analysis incorporates quantitative data on market share and M&A activity, as well as qualitative factors influencing market growth.

- Market Concentration: The APAC wireless audio market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, suggesting a moderately competitive landscape.

- Technological Innovation: Key technological drivers include advancements in Bluetooth technology (e.g., Bluetooth 5.3), noise cancellation capabilities, improved battery life, and the integration of AI-powered features like voice assistants. However, innovation barriers include high R&D costs and the need for interoperability standards.

- Regulatory Frameworks: Government regulations related to product safety, electromagnetic compatibility (EMC), and data privacy significantly influence market dynamics. Varying regulations across different APAC countries create complexities for manufacturers.

- Competitive Landscape: Intense competition exists among established players and emerging brands. Strategic partnerships, M&A activities, and product diversification are key competitive strategies. The number of M&A deals in the APAC wireless audio market from 2019 to 2024 was approximately xx.

- End-User Demographics: The market is driven by a growing young population with high disposable income and a preference for portable and convenient audio solutions. The increasing adoption of smartphones and smart devices further fuels market growth.

APAC Wireless Audio Industry Growth Trends & Insights

This section provides a detailed analysis of the APAC wireless audio market's growth trajectory. It leverages comprehensive market research data to understand the evolution of market size, adoption rates, technological disruptions, and evolving consumer behavior.

The APAC wireless audio market witnessed robust growth during the historical period (2019-2024), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. The market size in 2024 is estimated at xx Million units. This growth is attributed to factors such as increasing smartphone penetration, rising disposable incomes, and the growing popularity of wireless audio devices. The estimated market size for 2025 is xx Million units, and forecasts predict a CAGR of xx% from 2025 to 2033, resulting in a projected market size of xx Million units by 2033. Technological disruptions, such as the rise of TWS earbuds and the integration of advanced features like noise cancellation and spatial audio, are key factors driving growth. Furthermore, evolving consumer preferences toward premium audio experiences and personalized listening are shaping market dynamics. The market penetration of wireless earphones and headsets increased significantly during the study period, indicating strong consumer adoption.

Dominant Regions, Countries, or Segments in APAC Wireless Audio Industry

This section identifies and analyzes the leading regions, countries, and segments driving market growth within the APAC wireless audio industry. Key factors influencing market dominance are discussed, including economic policies, infrastructure, market share, and growth potential.

- China: Remains the dominant market, accounting for the largest market share due to its massive population, rapidly expanding middle class, and strong domestic manufacturing base.

- India: Shows significant growth potential, driven by increasing smartphone penetration and a young, tech-savvy population.

- South Korea: Exhibits high adoption rates of premium wireless audio products, reflecting a sophisticated consumer base with high disposable incomes.

- Japan: A mature market with a strong emphasis on high-quality audio products, though growth is relatively slower compared to emerging markets.

- Southeast Asia: A diverse region exhibiting varied levels of market maturity, with significant growth opportunities in countries like Indonesia, Vietnam, and the Philippines.

- Segments: True Wireless Stereo (TWS) earbuds are the fastest-growing segment, surpassing other wireless personal audio devices in terms of adoption. Smart speakers are also experiencing robust growth.

Vendor Market Share for Smart Speakers and Vendor Ranking for Smart Personal Audio Devices: South Korea

- Samsung Electronics Co Ltd holds the largest market share, followed by Google LLC and LG Electronics.

Vendor Ranking for Smart Speakers and Smart Personal Audio Devices: Japan, India

- Japan: Sony Corporation and Amazon com Inc lead the market.

- India: Boat and Xiaomi Corp are prominent players.

Vendor Ranking for Other Wireless Personal Audio Devices (Excl. TWS): Southeast Asia

- Realme Chongqing Mobile Telecommunications Corp Ltd, and Xiaomi Corp holds leading positions.

Type of Device:

- TWS Earbuds: The dominant segment, with significant growth driven by consumer preference for convenience and portability.

- Wireless Speakers: A mature segment, with growth driven by the increasing adoption of smart speakers.

- Wi-Fi Speakers: A niche segment growing steadily due to their high-fidelity audio capabilities.

- Wireless Headsets: A steady market with adoption driven by gaming and professional use cases.

APAP Wireless Audio Industry Product Landscape

The APAP wireless audio market showcases a diverse range of products, from basic wireless earbuds to sophisticated smart speakers with advanced features. Key product innovations include improved noise cancellation technology, extended battery life, and seamless integration with voice assistants. The market emphasizes enhanced audio quality, ergonomic designs, and user-friendly interfaces. Unique selling propositions often involve proprietary technologies, such as superior sound processing algorithms or advanced codecs for improved clarity and bass response. These advancements cater to diverse consumer preferences and create opportunities for both established and emerging players.

Key Drivers, Barriers & Challenges in APAC Wireless Audio Industry

Key Drivers:

- Increasing smartphone penetration and internet access.

- Rising disposable incomes and increased spending on consumer electronics.

- Growing demand for premium audio experiences and personalized listening.

- Technological advancements, including improved battery life and noise cancellation.

Key Challenges:

- Intense competition from both established and emerging brands.

- Supply chain disruptions and increased component costs.

- Regulatory hurdles and varying standards across different countries.

- Counterfeit products impacting brand reputation and market share. The impact of counterfeit products is estimated to result in xx Million units loss annually.

Emerging Opportunities in APAP Wireless Audio Industry

Emerging opportunities in the APAC wireless audio market include:

- Expansion into untapped markets in rural areas of emerging economies.

- Development of innovative applications for wireless audio, such as immersive gaming experiences and augmented reality (AR) integration.

- Catering to the growing demand for personalized audio experiences through AI-powered features.

- Increased focus on sustainability and environmentally friendly manufacturing practices.

Growth Accelerators in the APAC Wireless Audio Industry

Long-term growth in the APAC wireless audio market will be driven by continued technological advancements, such as the development of lossless audio codecs and improved spatial audio technologies. Strategic partnerships between audio device manufacturers and content providers will expand market reach and create new revenue streams. Furthermore, market expansion strategies targeting emerging economies and the integration of wireless audio devices into smart home ecosystems will fuel sustained growth.

Key Players Shaping the APAC Wireless Audio Industry Market

- Baidu Inc

- Bose Corporation

- Realme Chongqing Mobile Telecommunications Corp Ltd

- Google LLC

- LINE Corporation

- Apple Inc (Including Beats Electronics LLC)

- Samsung Electronics Co Ltd

- Xiaomi Corp

- Skullcandy Inc

- Amazon com Inc

- Alibaba Group

- GN Audio AS (Jabra)

- Harman International Industries Incorporated (JBL)

- Huawei Device Co Ltd

- Sony Corporation

Notable Milestones in APAC Wireless Audio Industry Sector

- 2020: Xiaomi launched its first truly wireless earbuds with active noise cancellation.

- 2021: Samsung partnered with AKG to launch a high-fidelity wireless headphone series.

- 2022: Apple introduced spatial audio support for its AirPods Pro.

- 2023: Several companies announced initiatives focusing on sustainable manufacturing practices.

In-Depth APAC Wireless Audio Industry Market Outlook

The APAC wireless audio market is poised for continued robust growth over the forecast period (2025-2033). Technological innovation, strategic partnerships, and expansion into untapped markets will drive this growth. The rising adoption of smart home ecosystems and the integration of AI features into wireless audio products will present significant opportunities for market participants. The continued focus on high-quality audio, enhanced user experience, and personalized listening will shape the future of the APAC wireless audio landscape.

APAC Wireless Audio Industry Segmentation

-

1. Type of Device

-

1.1. Wireless Speakers

- 1.1.1. Bluetooth-Only

- 1.1.2. Smart Speakers

- 1.1.3. Wi-Fi Sp

- 1.2. Wireless Earphones

- 1.3. Wireless Headsets

- 1.4. True Wireless Stereo

-

1.1. Wireless Speakers

APAC Wireless Audio Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Wireless Audio Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing usage for IoT based connected devices; Increased 5G and advanced networks infrastructure development

- 3.3. Market Restrains

- 3.3.1. High costs associated with software and procurement

- 3.4. Market Trends

- 3.4.1. Bluetooth Speakers to Witness Higest Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Wireless Speakers

- 5.1.1.1. Bluetooth-Only

- 5.1.1.2. Smart Speakers

- 5.1.1.3. Wi-Fi Sp

- 5.1.2. Wireless Earphones

- 5.1.3. Wireless Headsets

- 5.1.4. True Wireless Stereo

- 5.1.1. Wireless Speakers

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. North America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Wireless Speakers

- 6.1.1.1. Bluetooth-Only

- 6.1.1.2. Smart Speakers

- 6.1.1.3. Wi-Fi Sp

- 6.1.2. Wireless Earphones

- 6.1.3. Wireless Headsets

- 6.1.4. True Wireless Stereo

- 6.1.1. Wireless Speakers

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. South America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Wireless Speakers

- 7.1.1.1. Bluetooth-Only

- 7.1.1.2. Smart Speakers

- 7.1.1.3. Wi-Fi Sp

- 7.1.2. Wireless Earphones

- 7.1.3. Wireless Headsets

- 7.1.4. True Wireless Stereo

- 7.1.1. Wireless Speakers

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Europe APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Wireless Speakers

- 8.1.1.1. Bluetooth-Only

- 8.1.1.2. Smart Speakers

- 8.1.1.3. Wi-Fi Sp

- 8.1.2. Wireless Earphones

- 8.1.3. Wireless Headsets

- 8.1.4. True Wireless Stereo

- 8.1.1. Wireless Speakers

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Middle East & Africa APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 9.1.1. Wireless Speakers

- 9.1.1.1. Bluetooth-Only

- 9.1.1.2. Smart Speakers

- 9.1.1.3. Wi-Fi Sp

- 9.1.2. Wireless Earphones

- 9.1.3. Wireless Headsets

- 9.1.4. True Wireless Stereo

- 9.1.1. Wireless Speakers

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 10. Asia Pacific APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 10.1.1. Wireless Speakers

- 10.1.1.1. Bluetooth-Only

- 10.1.1.2. Smart Speakers

- 10.1.1.3. Wi-Fi Sp

- 10.1.2. Wireless Earphones

- 10.1.3. Wireless Headsets

- 10.1.4. True Wireless Stereo

- 10.1.1. Wireless Speakers

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 11. North America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Middle East APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Baidu Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Bose Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Realme Chongqing Mobile Telecommunications Corp Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Google LLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 LINE Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Apple Inc (Including Beats Electronics LLC)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Samsung Electronics Co Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Xiaomi Corp

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Skullcandy Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Amazon com Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Alibaba Group

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 GN Audio AS (Jabra)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Harman International Industries Incorporated (JBL)

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Huawei Device Co Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Sony Corporation

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 Baidu Inc

List of Figures

- Figure 1: Global APAC Wireless Audio Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 13: North America APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 14: North America APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 17: South America APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 18: South America APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 21: Europe APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 22: Europe APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East & Africa APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 25: Middle East & Africa APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 26: Middle East & Africa APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 29: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 30: Asia Pacific APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Wireless Audio Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: Global APAC Wireless Audio Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 15: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 20: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 25: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 36: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 44: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: ASEAN APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Oceania APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Wireless Audio Industry?

The projected CAGR is approximately 16.00%.

2. Which companies are prominent players in the APAC Wireless Audio Industry?

Key companies in the market include Baidu Inc, Bose Corporation, Realme Chongqing Mobile Telecommunications Corp Ltd, Google LLC, LINE Corporation, Apple Inc (Including Beats Electronics LLC), Samsung Electronics Co Ltd, Xiaomi Corp, Skullcandy Inc, Amazon com Inc, Alibaba Group, GN Audio AS (Jabra), Harman International Industries Incorporated (JBL), Huawei Device Co Ltd, Sony Corporation.

3. What are the main segments of the APAC Wireless Audio Industry?

The market segments include Type of Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing usage for IoT based connected devices; Increased 5G and advanced networks infrastructure development.

6. What are the notable trends driving market growth?

Bluetooth Speakers to Witness Higest Market Growth.

7. Are there any restraints impacting market growth?

High costs associated with software and procurement.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Wireless Audio Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Wireless Audio Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Wireless Audio Industry?

To stay informed about further developments, trends, and reports in the APAC Wireless Audio Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence