Key Insights

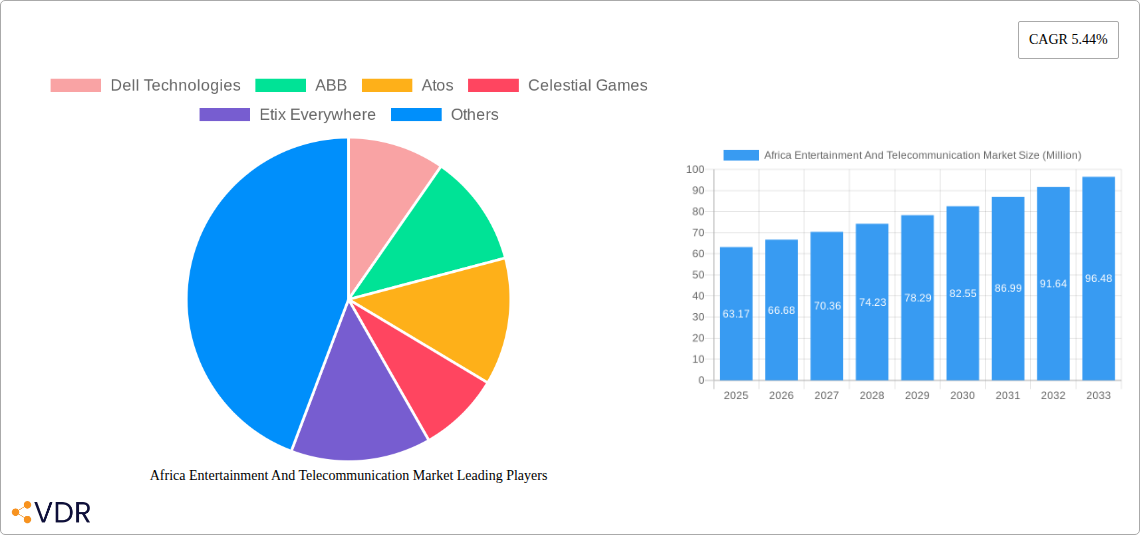

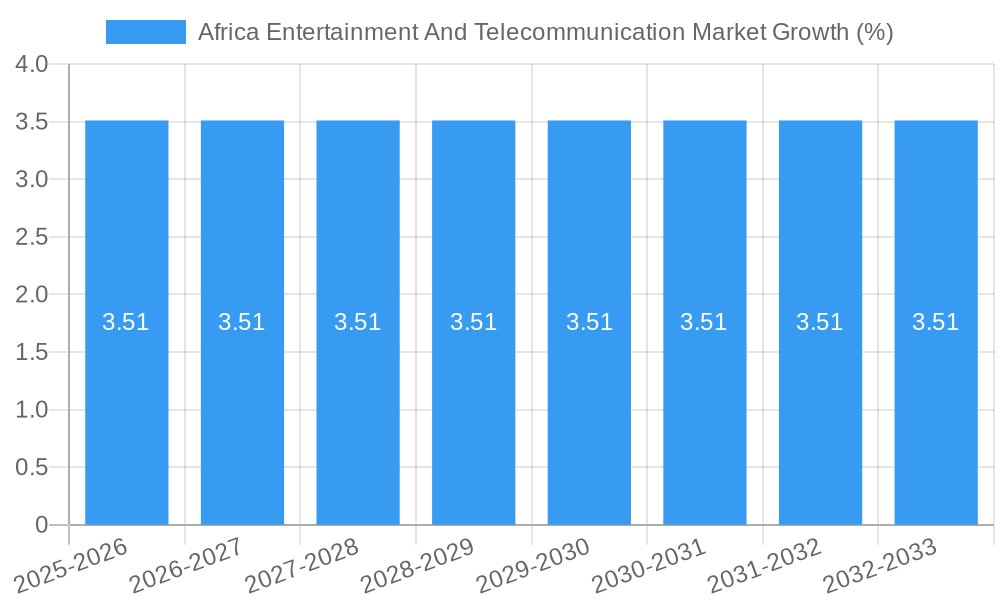

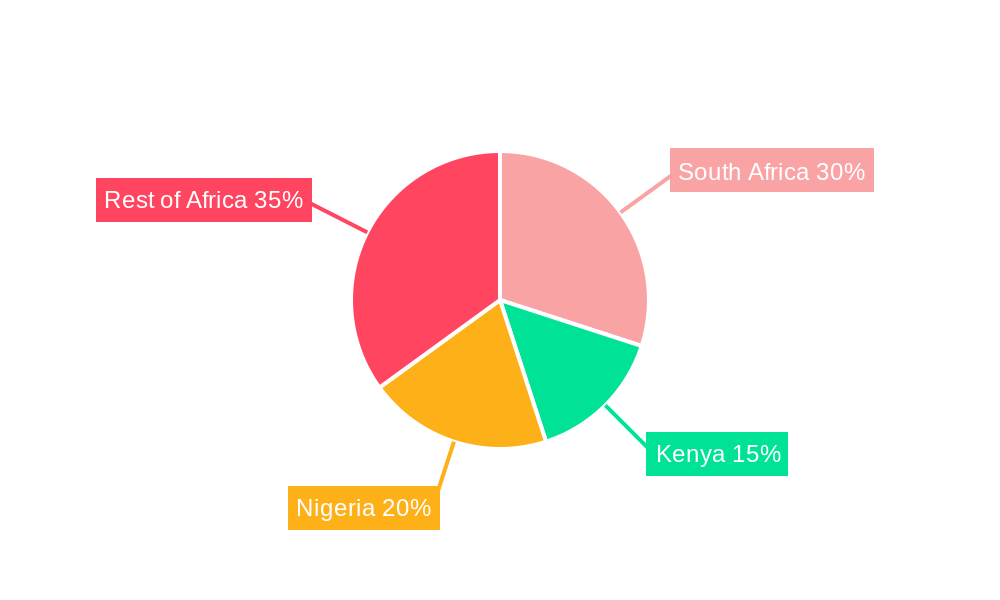

The African Entertainment and Telecommunications market, valued at $63.17 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.44% from 2025 to 2033. This expansion is fueled by several key drivers. The rising penetration of smartphones and affordable internet access across the continent is significantly broadening access to digital entertainment content, driving demand for streaming services, online gaming, and other digital forms of entertainment. Furthermore, increasing urbanization and a growing young population with high mobile phone usage are creating a fertile ground for the telecommunications sector. Investment in infrastructure, including expansion of 4G and 5G networks, is further accelerating market growth. However, challenges such as inconsistent internet connectivity in certain regions, digital literacy gaps, and regulatory hurdles pose potential restraints to market expansion. The market is segmented by platform (PC, Smartphone, Tablets, Gaming Consoles, Downloaded/Box PC, Browser PC), reflecting the diverse consumption patterns across different user groups and technological capabilities. Major players like Dell Technologies, IBM, and Cisco are contributing to the infrastructure development, while others like Celestial Games and Kagiso Interactive are driving the entertainment content creation and distribution. Regional variations exist within Africa, with countries like South Africa, Kenya, and Nigeria likely to dominate due to their relatively advanced digital infrastructure and larger populations. Future growth will depend on addressing infrastructure gaps, fostering digital literacy, and fostering innovation within the industry.

The forecast period of 2025-2033 presents significant opportunities for both established and emerging players. Strategic partnerships between telecom operators and content providers will be crucial in maximizing market penetration. The growth in mobile money and payment solutions will further facilitate the seamless consumption of digital entertainment. Sustained investment in robust and reliable infrastructure will be key to overcoming the challenges of inconsistent internet connectivity. The development of locally relevant and culturally sensitive content will be vital in capturing a broader audience across the diverse African market. Finally, addressing issues of affordability and accessibility will be critical to ensuring the benefits of the expanding entertainment and telecommunications sector reach all segments of the population.

Africa Entertainment and Telecommunication Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Africa Entertainment and Telecommunication Market, covering the period from 2019 to 2033. With a focus on market dynamics, growth trends, key players, and future opportunities, this report is an invaluable resource for industry professionals, investors, and strategists seeking to understand and capitalize on this rapidly expanding sector. The report utilizes a base year of 2025, with an estimated year of 2025 and a forecast period spanning 2025-2033. The historical period covered is 2019-2024. Market values are presented in million units.

Africa Entertainment and Telecommunication Market Market Dynamics & Structure

The African entertainment and telecommunications market is characterized by a dynamic interplay of factors influencing its growth and structure. Market concentration varies significantly across segments, with some dominated by a few large players while others exhibit a more fragmented landscape. Technological innovation, particularly in mobile technologies and digital content distribution, is a key driver, pushing the market towards greater accessibility and affordability. Regulatory frameworks, however, often pose challenges, impacting market entry and expansion. The rise of affordable smartphones and increased internet penetration are key factors driving market expansion. Competition from substitute products, including traditional media and entertainment sources, remains a consideration. End-user demographics are shifting towards a younger, more tech-savvy population, fueling demand for digital entertainment and communication services. Finally, M&A activity is increasingly prevalent as companies consolidate to gain market share and expand their service portfolios.

- Market Concentration: Highly fragmented in certain segments (e.g., gaming), consolidated in others (e.g., mobile telecom). xx% market share held by top 5 players in the mobile telecom segment.

- Technological Innovation: Rapid adoption of 4G/5G, mobile money, and streaming services.

- Regulatory Frameworks: Vary widely across countries, impacting licensing, spectrum allocation, and data privacy.

- Competitive Product Substitutes: Traditional media, social media platforms, etc.

- End-User Demographics: Predominantly young population with high smartphone penetration.

- M&A Trends: Increasing consolidation, particularly in the telecom sector. xx M&A deals recorded in the past five years.

Africa Entertainment and Telecommunication Market Growth Trends & Insights

The African entertainment and telecommunication market is experiencing robust growth, driven by rising disposable incomes, expanding internet and mobile network penetration, and the increasing popularity of digital content. Market size has expanded significantly over the past few years, with a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024, projected to reach xx Million units by 2033. This growth is fueled by technological advancements, including the widespread adoption of smartphones and affordable data plans. The shift in consumer behavior towards mobile-first entertainment and communication is further accelerating market expansion. The market penetration of smartphones is rapidly increasing across various regions of Africa.

Dominant Regions, Countries, or Segments in Africa Entertainment and Telecommunication Market

South Africa, Nigeria, Kenya, and Egypt are leading the market due to strong economic growth, advanced infrastructure, and a large consumer base. Smartphone segment shows the highest growth, driven by affordability and increasing internet penetration.

- Key Drivers:

- Economic Growth: Rising disposable incomes boosting spending on entertainment and communication services.

- Infrastructure Development: Improvements in mobile network coverage and internet access.

- Government Policies: Initiatives promoting digital inclusion and investment in ICT infrastructure.

- Dominance Factors:

- Market Share: South Africa holds the largest market share due to its advanced infrastructure and higher per capita income.

- Growth Potential: Sub-Saharan African countries exhibit high growth potential due to rapid population growth and increasing smartphone adoption.

- By Platform: Smartphone dominates the market, followed by PC and Tablet segments. Gaming consoles are showing rapid growth.

Africa Entertainment and Telecommunication Market Product Landscape

The market offers a diverse range of products, from basic mobile phones to sophisticated smartphones, high-speed internet services, streaming platforms, and gaming consoles. Innovation focuses on affordability, accessibility, and user-friendliness, catering to diverse consumer needs and technological capabilities. Key features include localization of content and services, support for multiple languages, and integration with mobile money platforms. Unique selling propositions often center on value-for-money data plans, bundled services, and tailored entertainment offerings.

Key Drivers, Barriers & Challenges in Africa Entertainment And Telecommunication Market

Key Drivers:

Increased smartphone penetration, rising internet adoption, growing demand for digital entertainment, and government initiatives promoting digital inclusion are driving market growth. The development of local content and services, tailored to African preferences, further fuels expansion.

Challenges:

- Infrastructure Gaps: Uneven distribution of broadband infrastructure and internet connectivity across the continent.

- Regulatory Hurdles: Complex and varying regulatory frameworks across countries create market entry barriers.

- Affordability: High cost of devices and data remains a barrier for many consumers.

- Digital Literacy: Limited digital literacy levels in some regions hindering technology adoption.

Emerging Opportunities in Africa Entertainment And Telecommunication Market

Untapped opportunities lie in expanding access to affordable internet and digital services in rural areas, developing localized content and applications, and leveraging mobile money for payment transactions. The growing popularity of mobile gaming and eSports presents significant growth opportunities, as does the expansion of streaming services tailored to African audiences. The development of innovative financial technologies integrated into entertainment platforms holds significant potential.

Growth Accelerators in the Africa Entertainment And Telecommunication Market Industry

Technological advancements, strategic partnerships between telecom operators and content providers, and expansion into underserved markets will be key growth drivers. Investments in infrastructure, coupled with government initiatives to enhance digital literacy, will further accelerate market expansion. The increasing adoption of cloud-based services and the growth of the Internet of Things (IoT) also presents promising opportunities.

Key Players Shaping the Africa Entertainment and Telecommunication Market Market

- Dell Technologies

- ABB

- Atos

- Celestial Games

- Etix Everywhere

- Eaton Corporation

- Kucheza

- NetApp

- IBM Corporation

- Kuluya

- Callaghan Engineering

- Lupp Group

- Arup Group

- Hewlett Packard Enterprise

- Kagiso Interactive

- Broadcom Inc

- Arista Networks

- Huawei

- Gamesole

- Chopup

- Nyamakop

- Cisco Systems

- Clockwork Acorn

Notable Milestones in Africa Entertainment and Telecommunication Market Sector

- November 2023: MTN South Africa's R1.9 billion payment to ICASA for spectrum fees signals increased investment in expanding network infrastructure and improving service delivery. This will likely lead to enhanced connectivity and improved digital services across the country.

In-Depth Africa Entertainment and Telecommunication Market Market Outlook

The future of the African entertainment and telecommunication market looks bright. Continued growth is anticipated, driven by sustained economic growth, rising smartphone adoption, and increasing internet penetration. Strategic partnerships, investments in infrastructure, and the development of innovative services will further shape the market landscape. The focus on affordable and accessible solutions will be crucial in driving inclusive growth and unlocking the full potential of this dynamic market. The market is poised for substantial expansion over the forecast period, offering lucrative opportunities for investors and industry players alike.

Africa Entertainment And Telecommunication Market Segmentation

-

1. Platform

- 1.1. PC

- 1.2. Smartphone

- 1.3. Tablets

- 1.4. Gaming Console

- 1.5. Downloaded/Box PC

- 1.6. Browser PC

-

2. Geography

- 2.1. Nigeria

- 2.2. Ethipia

- 2.3. Egypt

- 2.4. Morocco

- 2.5. Kenya

- 2.6. Algeria

- 2.7. Zimbabwe

Africa Entertainment And Telecommunication Market Segmentation By Geography

- 1. Nigeria

- 2. Ethipia

- 3. Egypt

- 4. Morocco

- 5. Kenya

- 6. Algeria

- 7. Zimbabwe

Africa Entertainment And Telecommunication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income; Improvement in Technology and Internet Network Access

- 3.3. Market Restrains

- 3.3.1 Issues Such as Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. Data Access and Availability of Internet Access to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. PC

- 5.1.2. Smartphone

- 5.1.3. Tablets

- 5.1.4. Gaming Console

- 5.1.5. Downloaded/Box PC

- 5.1.6. Browser PC

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Ethipia

- 5.2.3. Egypt

- 5.2.4. Morocco

- 5.2.5. Kenya

- 5.2.6. Algeria

- 5.2.7. Zimbabwe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Ethipia

- 5.3.3. Egypt

- 5.3.4. Morocco

- 5.3.5. Kenya

- 5.3.6. Algeria

- 5.3.7. Zimbabwe

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Nigeria Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. PC

- 6.1.2. Smartphone

- 6.1.3. Tablets

- 6.1.4. Gaming Console

- 6.1.5. Downloaded/Box PC

- 6.1.6. Browser PC

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Ethipia

- 6.2.3. Egypt

- 6.2.4. Morocco

- 6.2.5. Kenya

- 6.2.6. Algeria

- 6.2.7. Zimbabwe

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Ethipia Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. PC

- 7.1.2. Smartphone

- 7.1.3. Tablets

- 7.1.4. Gaming Console

- 7.1.5. Downloaded/Box PC

- 7.1.6. Browser PC

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Ethipia

- 7.2.3. Egypt

- 7.2.4. Morocco

- 7.2.5. Kenya

- 7.2.6. Algeria

- 7.2.7. Zimbabwe

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Egypt Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. PC

- 8.1.2. Smartphone

- 8.1.3. Tablets

- 8.1.4. Gaming Console

- 8.1.5. Downloaded/Box PC

- 8.1.6. Browser PC

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Ethipia

- 8.2.3. Egypt

- 8.2.4. Morocco

- 8.2.5. Kenya

- 8.2.6. Algeria

- 8.2.7. Zimbabwe

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Morocco Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. PC

- 9.1.2. Smartphone

- 9.1.3. Tablets

- 9.1.4. Gaming Console

- 9.1.5. Downloaded/Box PC

- 9.1.6. Browser PC

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Ethipia

- 9.2.3. Egypt

- 9.2.4. Morocco

- 9.2.5. Kenya

- 9.2.6. Algeria

- 9.2.7. Zimbabwe

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Kenya Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. PC

- 10.1.2. Smartphone

- 10.1.3. Tablets

- 10.1.4. Gaming Console

- 10.1.5. Downloaded/Box PC

- 10.1.6. Browser PC

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Nigeria

- 10.2.2. Ethipia

- 10.2.3. Egypt

- 10.2.4. Morocco

- 10.2.5. Kenya

- 10.2.6. Algeria

- 10.2.7. Zimbabwe

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Algeria Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 11.1.1. PC

- 11.1.2. Smartphone

- 11.1.3. Tablets

- 11.1.4. Gaming Console

- 11.1.5. Downloaded/Box PC

- 11.1.6. Browser PC

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Nigeria

- 11.2.2. Ethipia

- 11.2.3. Egypt

- 11.2.4. Morocco

- 11.2.5. Kenya

- 11.2.6. Algeria

- 11.2.7. Zimbabwe

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 12. Zimbabwe Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Platform

- 12.1.1. PC

- 12.1.2. Smartphone

- 12.1.3. Tablets

- 12.1.4. Gaming Console

- 12.1.5. Downloaded/Box PC

- 12.1.6. Browser PC

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. Nigeria

- 12.2.2. Ethipia

- 12.2.3. Egypt

- 12.2.4. Morocco

- 12.2.5. Kenya

- 12.2.6. Algeria

- 12.2.7. Zimbabwe

- 12.1. Market Analysis, Insights and Forecast - by Platform

- 13. South Africa Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 14. Sudan Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 15. Uganda Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 16. Tanzania Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 17. Kenya Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Africa Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Dell Technologies

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 ABB

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Atos

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Celestial Games

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Etix Everywhere

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Eaton Corporation

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Kucheza

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 NetApp

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 IBM Corporation

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Kuluya

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Callaghan Engineering

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Lupp Group

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.13 Arup Group

- 19.2.13.1. Overview

- 19.2.13.2. Products

- 19.2.13.3. SWOT Analysis

- 19.2.13.4. Recent Developments

- 19.2.13.5. Financials (Based on Availability)

- 19.2.14 Hewlett Packard Enterprise

- 19.2.14.1. Overview

- 19.2.14.2. Products

- 19.2.14.3. SWOT Analysis

- 19.2.14.4. Recent Developments

- 19.2.14.5. Financials (Based on Availability)

- 19.2.15 Kagiso Interactive

- 19.2.15.1. Overview

- 19.2.15.2. Products

- 19.2.15.3. SWOT Analysis

- 19.2.15.4. Recent Developments

- 19.2.15.5. Financials (Based on Availability)

- 19.2.16 Broadcom Inc

- 19.2.16.1. Overview

- 19.2.16.2. Products

- 19.2.16.3. SWOT Analysis

- 19.2.16.4. Recent Developments

- 19.2.16.5. Financials (Based on Availability)

- 19.2.17 Arista Networks

- 19.2.17.1. Overview

- 19.2.17.2. Products

- 19.2.17.3. SWOT Analysis

- 19.2.17.4. Recent Developments

- 19.2.17.5. Financials (Based on Availability)

- 19.2.18 Huawei

- 19.2.18.1. Overview

- 19.2.18.2. Products

- 19.2.18.3. SWOT Analysis

- 19.2.18.4. Recent Developments

- 19.2.18.5. Financials (Based on Availability)

- 19.2.19 Gamesole

- 19.2.19.1. Overview

- 19.2.19.2. Products

- 19.2.19.3. SWOT Analysis

- 19.2.19.4. Recent Developments

- 19.2.19.5. Financials (Based on Availability)

- 19.2.20 Chopup

- 19.2.20.1. Overview

- 19.2.20.2. Products

- 19.2.20.3. SWOT Analysis

- 19.2.20.4. Recent Developments

- 19.2.20.5. Financials (Based on Availability)

- 19.2.21 Nyamakop

- 19.2.21.1. Overview

- 19.2.21.2. Products

- 19.2.21.3. SWOT Analysis

- 19.2.21.4. Recent Developments

- 19.2.21.5. Financials (Based on Availability)

- 19.2.22 Cisco Systems

- 19.2.22.1. Overview

- 19.2.22.2. Products

- 19.2.22.3. SWOT Analysis

- 19.2.22.4. Recent Developments

- 19.2.22.5. Financials (Based on Availability)

- 19.2.23 Clockwork Acorn

- 19.2.23.1. Overview

- 19.2.23.2. Products

- 19.2.23.3. SWOT Analysis

- 19.2.23.4. Recent Developments

- 19.2.23.5. Financials (Based on Availability)

- 19.2.1 Dell Technologies

List of Figures

- Figure 1: Africa Entertainment And Telecommunication Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Entertainment And Telecommunication Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 3: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Africa Entertainment And Telecommunication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Africa Entertainment And Telecommunication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Africa Entertainment And Telecommunication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Africa Entertainment And Telecommunication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Africa Entertainment And Telecommunication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Africa Entertainment And Telecommunication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 13: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 16: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 19: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 22: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 25: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 28: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 31: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Entertainment And Telecommunication Market?

The projected CAGR is approximately 5.44%.

2. Which companies are prominent players in the Africa Entertainment And Telecommunication Market?

Key companies in the market include Dell Technologies, ABB, Atos, Celestial Games, Etix Everywhere, Eaton Corporation, Kucheza, NetApp, IBM Corporation, Kuluya, Callaghan Engineering, Lupp Group, Arup Group, Hewlett Packard Enterprise, Kagiso Interactive, Broadcom Inc, Arista Networks, Huawei, Gamesole, Chopup, Nyamakop, Cisco Systems, Clockwork Acorn.

3. What are the main segments of the Africa Entertainment And Telecommunication Market?

The market segments include Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income; Improvement in Technology and Internet Network Access.

6. What are the notable trends driving market growth?

Data Access and Availability of Internet Access to Drive the Growth.

7. Are there any restraints impacting market growth?

Issues Such as Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

November 2023 - MTN South Africa has paid the Independent Communications Authority of South Africa (ICASA) R1.9 billion to settle outstanding spectrum fees. While ICASA granted MTN and other telecom companies, such as Vodacom and Telkom, until October 2023 to pay their bills, MTN said it would make its R1.9 billion payment to expand the country's spectrum deployment in the second half of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Entertainment And Telecommunication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Entertainment And Telecommunication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Entertainment And Telecommunication Market?

To stay informed about further developments, trends, and reports in the Africa Entertainment And Telecommunication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence