Key Insights

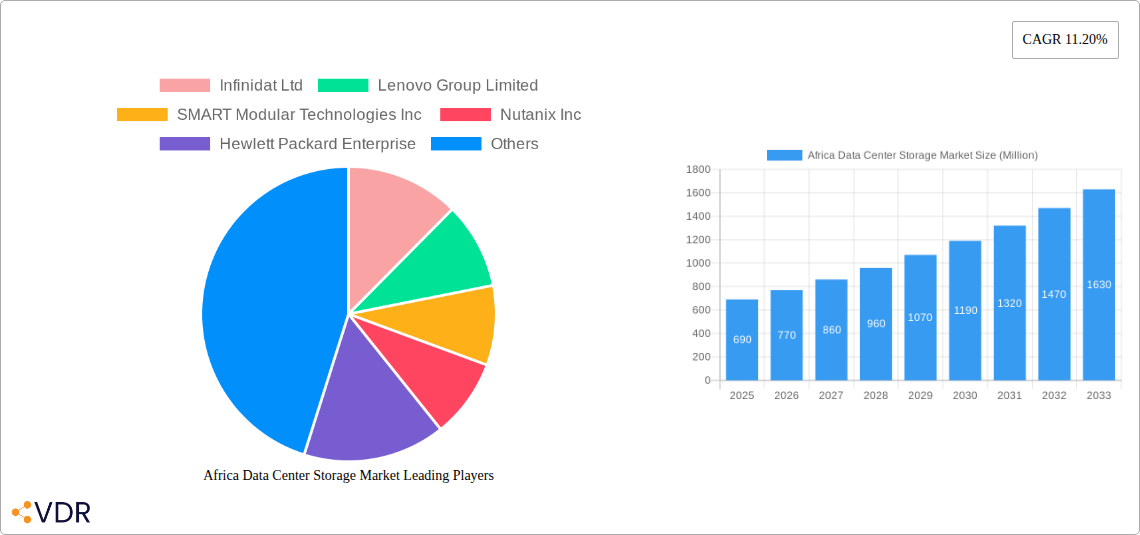

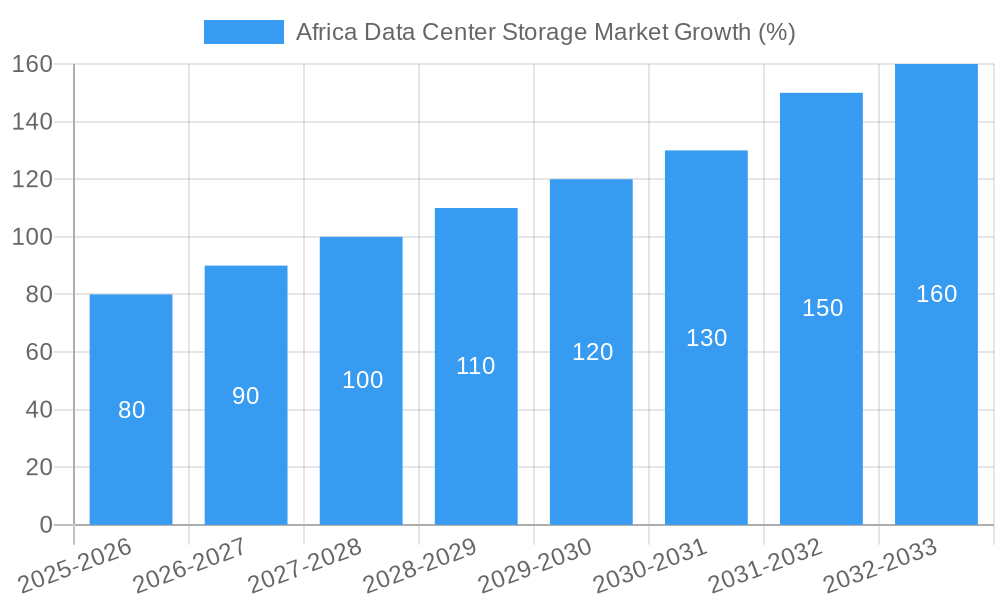

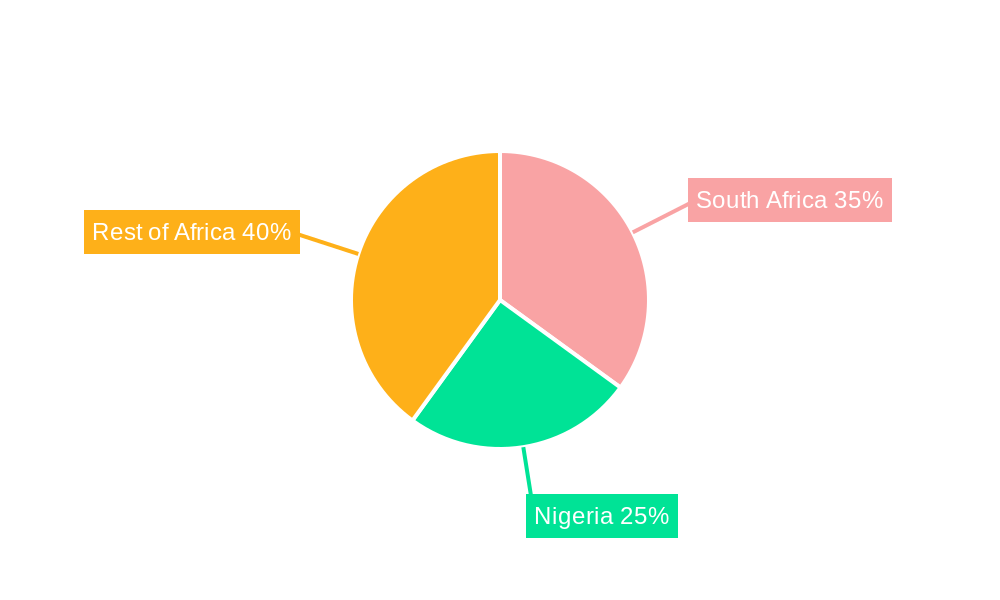

The Africa data center storage market, valued at $0.69 billion in 2025, is projected to experience robust growth, driven by increasing digitalization across various sectors, including IT & telecommunications, BFSI, and government. A compound annual growth rate (CAGR) of 11.20% from 2025 to 2033 indicates significant expansion potential. This growth is fueled by the rising adoption of cloud computing, big data analytics, and the expanding need for secure data storage solutions within a rapidly developing digital economy. Key market segments include Network Attached Storage (NAS), Storage Area Network (SAN), and All-Flash Storage, reflecting the preference for high-performance and scalable storage technologies. The South Africa and Nigeria markets are expected to lead regional growth, benefiting from increased investments in infrastructure and digital transformation initiatives. However, challenges such as limited IT infrastructure in certain regions and high initial investment costs for advanced storage solutions could somewhat restrain market expansion. The competitive landscape features both international players like Hewlett Packard Enterprise, Dell Inc, and Lenovo, and regional vendors, leading to a dynamic market environment characterized by both innovation and price competition. The market is poised for significant growth as businesses and government entities prioritize data security and efficiency, demanding enhanced storage capabilities to support their evolving technological needs.

The forecast for the Africa data center storage market beyond 2025 anticipates continued expansion, with the CAGR of 11.20% suggesting a market size exceeding $2 billion by 2033. This sustained growth is expected to be driven by the continued expansion of 4G/5G networks, increasing government investments in digital infrastructure, and a growing need for data storage to accommodate the needs of a larger, more technologically connected population. The increasing adoption of hybrid cloud models will also contribute to market growth, enabling organizations to balance the benefits of on-premises and cloud-based storage solutions. Furthermore, the rising demand for edge computing solutions, which require localized data storage, will be a significant driver of growth in the coming years. However, factors such as energy costs, cybersecurity concerns, and the need for skilled IT professionals to manage and maintain complex storage systems will continue to present challenges to the market's growth.

Africa Data Center Storage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa Data Center Storage Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth trends, key players, and future opportunities within the rapidly evolving African data center landscape. The market is segmented by storage technology (NAS, SAN, DAS, Other), storage type (Traditional, All-Flash, Hybrid), end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Others), and country (South Africa, Nigeria, and others). The total market value is predicted to reach xx Million by 2033.

Africa Data Center Storage Market Dynamics & Structure

The Africa Data Center Storage Market is characterized by a moderately concentrated landscape, with key players such as Dell, HPE, and Huawei holding significant market share. However, the market is witnessing increasing competition from emerging players and cloud providers. Technological innovation, particularly in all-flash and hybrid storage solutions, is a major driver, alongside rising data volumes and the expanding adoption of cloud computing across diverse sectors. Regulatory frameworks, while still evolving in several African nations, are increasingly focusing on data privacy and security, influencing vendor strategies. The market also sees the emergence of competitive product substitutes, such as cloud-based storage services. Mergers and acquisitions (M&A) activity remains relatively low compared to other regions, but strategic partnerships are becoming more common.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Significant growth driven by the adoption of All-Flash and Hybrid storage solutions.

- Regulatory Landscape: Evolving frameworks focusing on data security and privacy, impacting data center investments.

- Competitive Substitutes: Cloud storage solutions pose a growing competitive challenge.

- M&A Activity: Relatively low, but strategic partnerships are on the rise.

- End-User Demographics: Significant growth driven by the IT & Telecommunications and BFSI sectors.

Africa Data Center Storage Market Growth Trends & Insights

The Africa Data Center Storage Market experienced robust growth during the historical period (2019-2024), driven by increasing digitalization, rising data volumes, and growing adoption of cloud services. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by expanding 4G/5G network infrastructure, increasing government investments in digital transformation initiatives, and the burgeoning fintech sector. Market penetration of advanced storage technologies like all-flash storage is increasing steadily, albeit from a low base. Consumer behavior is shifting towards cloud-based storage solutions, presenting both opportunities and challenges for traditional vendors.

The market size is expected to reach xx Million in 2025 and xx Million by 2033. Adoption rates of All-Flash storage are projected to grow at a CAGR of xx%, while Hybrid storage will grow at xx%. The shift towards cloud-based storage is expected to impact the traditional storage market segment.

Dominant Regions, Countries, or Segments in Africa Data Center Storage Market

South Africa currently holds the largest market share in the Africa Data Center Storage Market, driven by its relatively advanced IT infrastructure and strong economic base. Nigeria is experiencing rapid growth, fueled by a burgeoning population and expanding digital economy. Within the segmentation, the All-Flash storage type is experiencing the fastest growth rate, driven by its performance and efficiency advantages. The IT & Telecommunication sector constitutes the largest end-user segment due to their high data storage requirements. Network Attached Storage (NAS) remains a dominant storage technology, though SAN and hybrid solutions are gaining traction.

- Key Drivers in South Africa: Advanced IT infrastructure, strong economic growth, and government initiatives.

- Key Drivers in Nigeria: Rapid population growth, expanding digital economy, and increasing mobile penetration.

- Growth Drivers in All-Flash Storage: Performance advantages, efficiency gains, and decreasing costs.

- Dominant End-User Segment: IT & Telecommunications sector.

- Dominant Storage Technology: Network Attached Storage (NAS).

Africa Data Center Storage Market Product Landscape

The Africa Data Center Storage market showcases a diverse range of products, encompassing high-capacity hard disk drives (HDDs), solid-state drives (SSDs), and various storage arrays offering diverse capabilities. Innovation focuses on increasing storage density, improving performance metrics (IOPS, latency), and enhancing data security features. Vendors are emphasizing energy efficiency and scalability to meet the evolving needs of African data centers. Unique selling propositions include advanced data management software, integrated security features, and flexible deployment options (on-premises, cloud).

Key Drivers, Barriers & Challenges in Africa Data Center Storage Market

Key Drivers: The increasing adoption of cloud computing, the growth of digital services, government initiatives promoting digital transformation, and the rising demand for big data analytics are significant drivers for market growth.

Challenges: High initial investment costs, limited skilled workforce, unreliable power supply in certain regions, and a lack of robust network infrastructure in some areas create significant barriers. Furthermore, stringent data privacy regulations and security concerns can affect adoption rates. The total impact of these challenges is estimated to reduce the market growth by approximately xx% annually.

Emerging Opportunities in Africa Data Center Storage Market

Significant opportunities exist in expanding cloud storage services to underserved regions, developing tailored storage solutions for specific industry needs (e.g., healthcare, agriculture), and investing in robust data center infrastructure. The growth of mobile money and fintech presents a significant opportunity for specialized data storage solutions. Moreover, the adoption of edge computing and the Internet of Things (IoT) will drive demand for distributed storage solutions.

Growth Accelerators in the Africa Data Center Storage Market Industry

Technological advancements, such as the development of higher-capacity and more energy-efficient storage devices, will propel market growth. Strategic partnerships between technology vendors and local service providers are crucial to expand market reach and address infrastructure gaps. Government initiatives promoting digitalization and investments in digital infrastructure will create a favorable environment for further growth.

Key Players Shaping the Africa Data Center Storage Market Market

- Infinidat Ltd

- Lenovo Group Limited

- SMART Modular Technologies Inc

- Nutanix Inc

- Hewlett Packard Enterprise

- ADATA Technology Co Ltd

- Fujitsu Limited

- Dell Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

- Oracle Corporation

- Pure Storage Inc

- QSAN Technology Inc

Notable Milestones in Africa Data Center Storage Market Sector

- March 2024: Western Digital launched a 24 TB WD Red Pro hard drive for NAS applications, expanding its product portfolio and addressing the growing demand for high-capacity storage in the data center market. This signifies a commitment to expanding storage solutions catering to the specific needs of the NAS segment within the Africa data center landscape.

- March 2024: Pure Storage launched advanced data storage technologies and services, enhancing its Pure1 platform with self-service capabilities and expanding its Evergreen portfolio. This innovation enhances the user experience and provides software-based solutions, improving efficiency and ease of access to storage management. This enhances the company's competitiveness in the African market.

In-Depth Africa Data Center Storage Market Market Outlook

The Africa Data Center Storage Market is poised for significant growth in the coming years, driven by the factors outlined above. Strategic investments in infrastructure development, coupled with technological advancements and increasing digitalization across various sectors, will create a favorable environment for continued expansion. Companies that strategically focus on addressing the unique challenges and opportunities presented by the African market, such as focusing on energy-efficient solutions and providing reliable support, will be best positioned to capitalize on the market's growth potential. The focus on providing tailored solutions and leveraging strategic partnerships will be key to success.

Africa Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End Users

Africa Data Center Storage Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Digitalization and Emergence of Data-centric Applications; Demand of Flash Arrays in End Users

- 3.3. Market Restrains

- 3.3.1. Compatibility and Optimum Storage Performance Issues

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. South Africa Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Infinidat Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Lenovo Group Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SMART Modular Technologies Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nutanix Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hewlett Packard Enterprise

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 ADATA Technology Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fujitsu Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dell Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kingston Technology Company Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Huawei Technologies Co Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Oracle Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Pure Storage Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 QSAN Technology Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Infinidat Ltd

List of Figures

- Figure 1: Africa Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: Africa Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: Africa Data Center Storage Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Africa Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 14: Africa Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 15: Africa Data Center Storage Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Africa Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Nigeria Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Egypt Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ethiopia Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Algeria Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Tanzania Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Ivory Coast Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Data Center Storage Market?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the Africa Data Center Storage Market?

Key companies in the market include Infinidat Ltd, Lenovo Group Limited, SMART Modular Technologies Inc , Nutanix Inc, Hewlett Packard Enterprise, ADATA Technology Co Ltd, Fujitsu Limited, Dell Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, Pure Storage Inc, QSAN Technology Inc.

3. What are the main segments of the Africa Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Digitalization and Emergence of Data-centric Applications; Demand of Flash Arrays in End Users.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Compatibility and Optimum Storage Performance Issues.

8. Can you provide examples of recent developments in the market?

March 2024: Western Digital expanded its product lineup with the introduction of a 24 TB WD Red Pro mechanical hard drive designed specifically for NAS (network attached storage) applications. The company launched a 24 TB model earlier, targeted at enterprise and data center use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Africa Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence