Key Insights

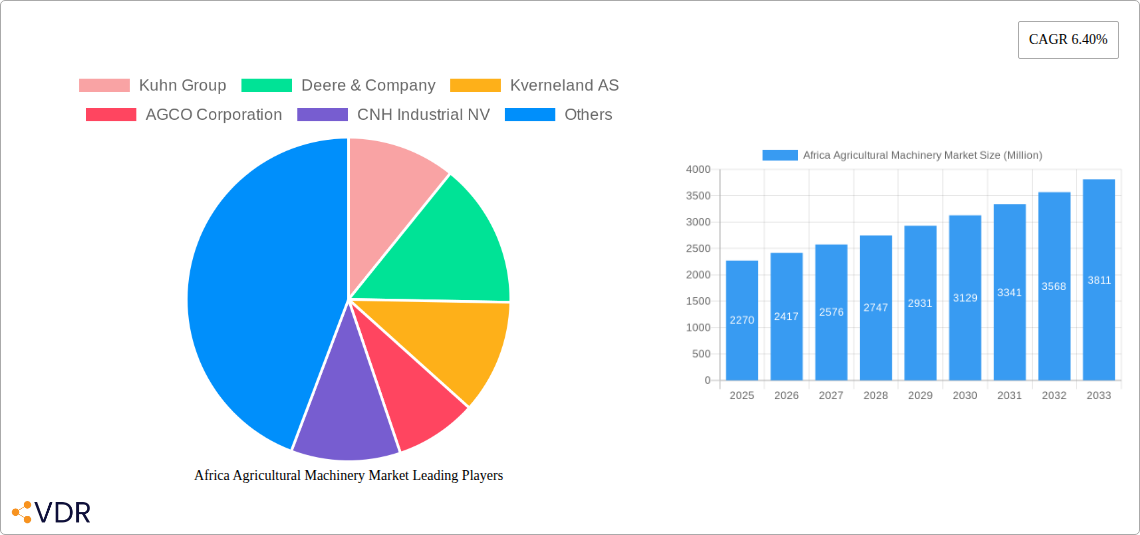

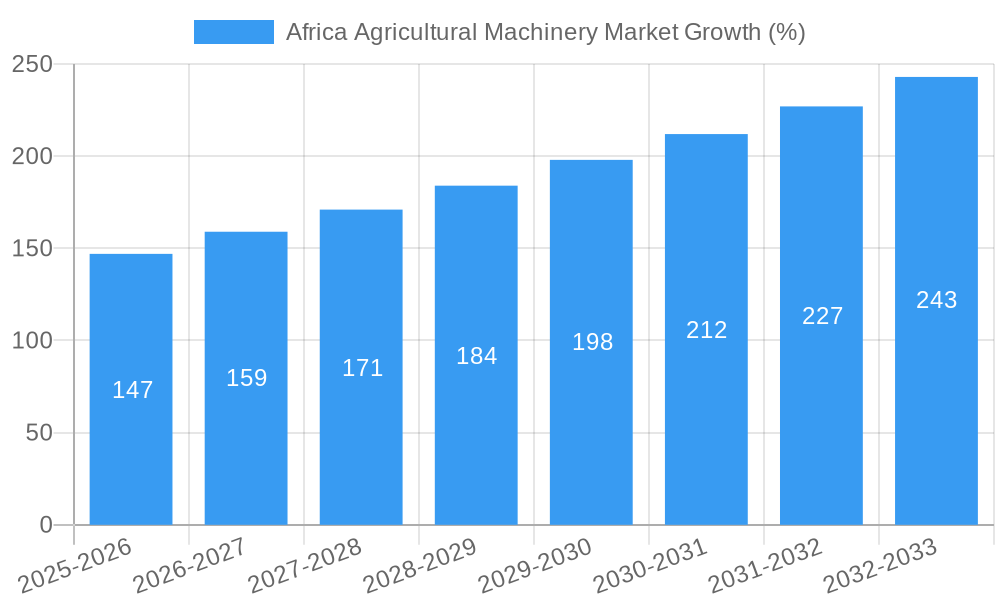

The Africa Agricultural Machinery Market is experiencing robust growth, projected to reach $2.27 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.40% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives across the continent aimed at boosting agricultural productivity and food security are fueling demand for modern agricultural machinery. Secondly, rising arable land under cultivation and the growing adoption of improved farming techniques are creating a significant need for efficient machinery such as tractors, planting and fertilizing equipment, and harvesting machinery. Furthermore, the expanding population and increasing urbanization are placing pressure on food production, further stimulating investment in agricultural mechanization. While challenges remain, such as limited access to finance and infrastructure gaps in certain regions, these hurdles are being addressed through public-private partnerships and investments in rural infrastructure development. The market is segmented by product type, encompassing tractors, plowing and cultivating machinery, planting and fertilizing machinery, harvesting machinery, haying and forage machinery, irrigation machinery, and other types. Key players like John Deere, Mahindra & Mahindra, and AGCO are actively expanding their presence in the region to capitalize on this growth opportunity. The sub-Saharan African region, particularly countries like South Africa, Kenya, and Tanzania, shows promising potential due to their substantial agricultural sectors and growing investments in agricultural modernization.

The market's growth trajectory is projected to remain positive throughout the forecast period (2025-2033). Continued investment in agricultural infrastructure, coupled with technological advancements in machinery design and efficiency, will further accelerate market expansion. However, factors like the volatility of agricultural commodity prices and the dependence on rainfall in some areas will continue to present challenges. Successful market penetration will require manufacturers to adapt their machinery to suit the varied terrains and specific agricultural practices prevalent across different African countries. A focus on providing affordable financing options and robust after-sales services will be crucial to drive wider adoption and market penetration among smallholder farmers, who constitute a substantial portion of the agricultural sector in Africa.

Africa Agricultural Machinery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa Agricultural Machinery market, encompassing market dynamics, growth trends, regional insights, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and base year 2025. Market values are presented in million units.

Africa Agricultural Machinery Market Dynamics & Structure

The African agricultural machinery market is characterized by a fragmented structure with both global and regional players vying for market share. Market concentration is relatively low, with no single dominant player holding a significant majority. Technological innovation, while crucial, faces barriers such as limited access to financing, inadequate infrastructure, and a lack of skilled technicians. Regulatory frameworks vary across countries, impacting market access and operations. Substitute products, such as manual labor and outdated machinery, still compete, but the demand for efficiency is driving a shift towards mechanization. End-user demographics include smallholder farmers, large-scale commercial farms, and government entities. Mergers and acquisitions (M&A) activity remains relatively low, though strategic partnerships and joint ventures are on the rise.

- Market Concentration: Low, with a large number of small and medium-sized enterprises (SMEs) alongside multinational corporations.

- Technological Innovation Drivers: Increasing demand for higher productivity, government initiatives promoting mechanization, and technological advancements in machinery design.

- Regulatory Frameworks: Vary across African countries, influencing import regulations, safety standards, and market access for foreign players.

- Competitive Product Substitutes: Manual labor and older, less efficient machinery pose a competitive challenge.

- End-User Demographics: Diverse, comprising smallholder farmers (majority), large-scale commercial farms, and government agricultural programs.

- M&A Trends: Low M&A activity currently; however, strategic alliances and joint ventures are increasing. Estimated deal volume in 2024: xx million USD.

Africa Agricultural Machinery Market Growth Trends & Insights

The Africa Agricultural Machinery market is experiencing significant growth, driven by increasing agricultural production needs, rising farmer incomes, and supportive government policies. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx million units by 2033. Adoption rates are increasing, particularly among commercial farms, but remain relatively low among smallholder farmers due to financial constraints. Technological disruptions, such as precision agriculture technologies and automation, are gaining traction, further accelerating market growth. Consumer behavior is shifting towards a preference for more efficient, fuel-efficient, and technologically advanced machinery. Market penetration of modern agricultural machinery remains relatively low, offering considerable potential for future growth.

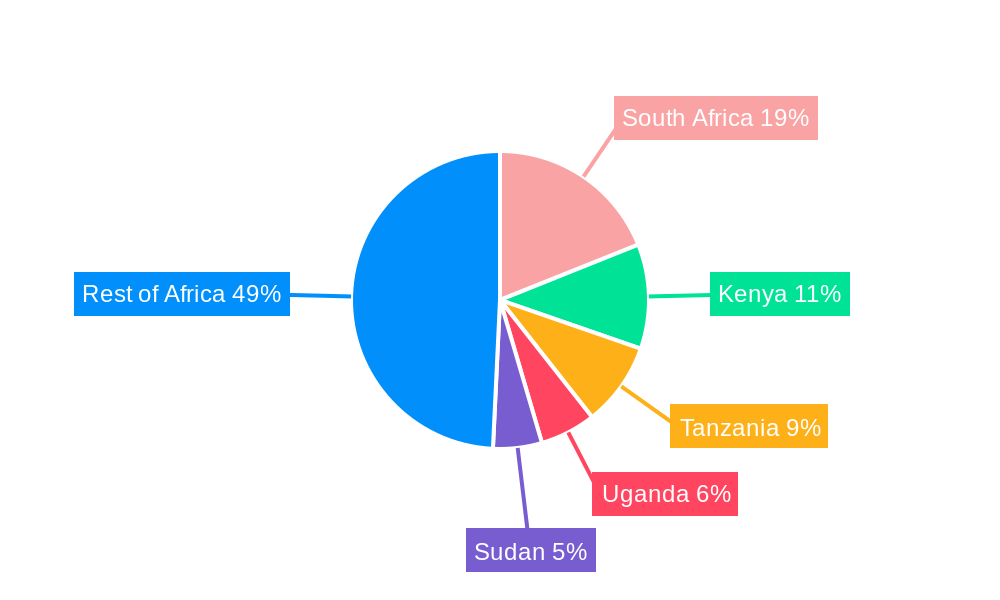

Dominant Regions, Countries, or Segments in Africa Agricultural Machinery Market

The South Africa agricultural machinery market dominates the region, followed by Kenya, Egypt, and Nigeria. The tractor segment holds the largest market share, followed by planting and fertilizing machinery. Growth is driven by factors like increasing land under cultivation, government support for agricultural modernization, and rising demand for higher crop yields.

Key Drivers:

- Government agricultural development programs and incentives.

- Rising demand for food security and improved agricultural productivity.

- Growing adoption of modern farming practices.

- Development of irrigation infrastructure in certain areas.

Dominant Segments: Tractors (xx million units market share in 2024), Planting and Fertilizing Machinery (xx million units).

Growth Potential: Highest in regions with favorable climatic conditions and expanding agricultural land, such as Ethiopia and Tanzania.

Africa Agricultural Machinery Market Product Landscape

The market features a wide range of agricultural machinery, including tractors, planting and fertilizing equipment, harvesting machinery, and irrigation systems. Recent innovations focus on improved efficiency, fuel economy, and user-friendliness. Tractors are evolving towards higher horsepower, greater precision, and enhanced automation. Planting and fertilizing machinery incorporates GPS technology and variable rate application. Harvesting machinery features improved cutting and threshing capabilities. Unique selling propositions include advanced technology integration, robust construction, and after-sales support tailored to African conditions.

Key Drivers, Barriers & Challenges in Africa Agricultural Machinery Market

Key Drivers:

- Rising food demand and population growth necessitate increased agricultural production.

- Government initiatives and funding towards agricultural modernization.

- Technological advancements leading to enhanced productivity and efficiency.

- Growing awareness of the benefits of mechanization among farmers.

Key Challenges:

- High initial investment costs for machinery pose a significant barrier, especially for smallholder farmers.

- Lack of access to credit and financing limits machinery adoption.

- Inadequate infrastructure (e.g., poor road networks) hampers distribution and maintenance.

- Skills gap in operating and maintaining modern machinery. This affects efficient machinery usage by approximately xx% of farmers.

Emerging Opportunities in Africa Agricultural Machinery Market

- Expansion into underserved regions with high agricultural potential.

- Development of affordable and adaptable machinery tailored to the needs of smallholder farmers.

- Growing demand for precision agriculture technologies and data-driven solutions.

- Increased focus on sustainable and environmentally friendly agricultural practices.

Growth Accelerators in the Africa Agricultural Machinery Market Industry

Technological advancements such as automation, precision agriculture, and data analytics are crucial drivers. Strategic partnerships between manufacturers, distributors, and financial institutions are essential for expanding market access. Government policies promoting mechanization and investment in agricultural infrastructure are key. Market expansion strategies focusing on providing financing options and training for farmers are needed to drive adoption, especially amongst smaller farmers.

Key Players Shaping the Africa Agricultural Machinery Market Market

- Kuhn Group

- Deere & Company

- Kverneland AS

- AGCO Corporation

- CNH Industrial NV

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

- Claas KGaA mbH

- Kubota Agricultural Machinery

- Lindsay Corporation

- Escorts Group

- J C Bamford Excavators Limited

Notable Milestones in Africa Agricultural Machinery Sector

- August 2022: The Department of Science and Innovation (DSI) and Technology Innovation Agency (TIA) in South Africa supplied two cotton baler machines to farmers, replacing manual baling.

- May 2022: AGCO launched new Fendt One tractor models (1000 and 200 series) and the Fendt Ideal Combine 10T at the NAMPO agricultural trade show in South Africa.

- May 2022: Bridgestone entered the South African agricultural market with ultra-high-performance tires for tractors and combine harvesters.

In-Depth Africa Agricultural Machinery Market Outlook

The future of the Africa Agricultural Machinery market is bright, with strong growth potential driven by ongoing technological advancements, supportive government policies, and increasing farmer demand for higher yields. Strategic partnerships, investments in infrastructure, and the development of financing schemes for smallholder farmers will be crucial for unlocking the market's full potential. The continued focus on sustainable and climate-resilient agricultural practices will also drive demand for specialized machinery. The market is poised for significant expansion, offering attractive opportunities for both established players and new entrants.

Africa Agricultural Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Agricultural Machinery Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Agricultural Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Increasing Focus on Sustainable Mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Kuhn Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Deere & Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kverneland AS

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AGCO Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 CNH Industrial NV

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Mahindra & Mahindra Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Tractors and Farm Equipment Limited (TAFE)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Claas KGaA mbH

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kubota Agricultural Machinery

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Lindsay Corporatio

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Escorts Group

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 J C Bamford Excavators Limited

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Kuhn Group

List of Figures

- Figure 1: Africa Agricultural Machinery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Agricultural Machinery Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Agricultural Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Africa Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: Africa Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Africa Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Africa Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Africa Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Africa Agricultural Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: Africa Agricultural Machinery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: South Africa Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Sudan Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sudan Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Uganda Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Uganda Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Tanzania Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Tanzania Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Kenya Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Kenya Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Rest of Africa Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Africa Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 29: Africa Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 30: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 31: Africa Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 32: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 33: Africa Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 34: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 35: Africa Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Africa Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 38: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 39: Africa Agricultural Machinery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 41: Nigeria Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Nigeria Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 43: South Africa Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Egypt Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Egypt Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: Kenya Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Kenya Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: Ethiopia Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Ethiopia Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Morocco Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Morocco Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: Ghana Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Ghana Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 55: Algeria Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Algeria Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 57: Tanzania Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Tanzania Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 59: Ivory Coast Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Ivory Coast Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Agricultural Machinery Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Africa Agricultural Machinery Market?

Key companies in the market include Kuhn Group, Deere & Company, Kverneland AS, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), Claas KGaA mbH, Kubota Agricultural Machinery, Lindsay Corporatio, Escorts Group, J C Bamford Excavators Limited.

3. What are the main segments of the Africa Agricultural Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Increasing Focus on Sustainable Mechanization.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

August 2022: As part of plans to support and boost the cotton industry in South Africa, the Department of Science and Innovation (DSI) and its entity, the Technology Innovation Agency(TIA), have together supplied farmers with two cotton baler machines to put an end to manual cotton baling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Agricultural Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Agricultural Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Agricultural Machinery Market?

To stay informed about further developments, trends, and reports in the Africa Agricultural Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence